KEYTAKEAWAYS

- Spot Ethereum ETFs launch Tuesday, but ETH prices remain stagnant. Historical patterns suggest potential price corrections following new crypto product launches.

- Technical analysis shows a high put/call ratio of 1.19, indicating trader anticipation of price declines. ETH's price target is $3,300.

- A put butterfly strategy is recommended for potential downside risk, involving strategic buying and selling of put options at different strike prices.

CONTENT

Analyze Ethereum ETF launch impact on prices. Explore historical patterns, technical indicators, and a put butterfly strategy to navigate potential downside risks in the crypto market.

MARKET OUTLOOK

Spot Ethereum ETFs are set to begin trading on Tuesday. Despite regulatory approval, ETH prices have not seen significant upward movement. The current put/call ratio suggests potential downside risk. Historically, the launch of new crypto products often leads to price corrections.

>> Also read: Spot ETH ETFs: The Ultimate Investor’s Guide for the 2024 Launch

TECHNICAL ANALYSIS

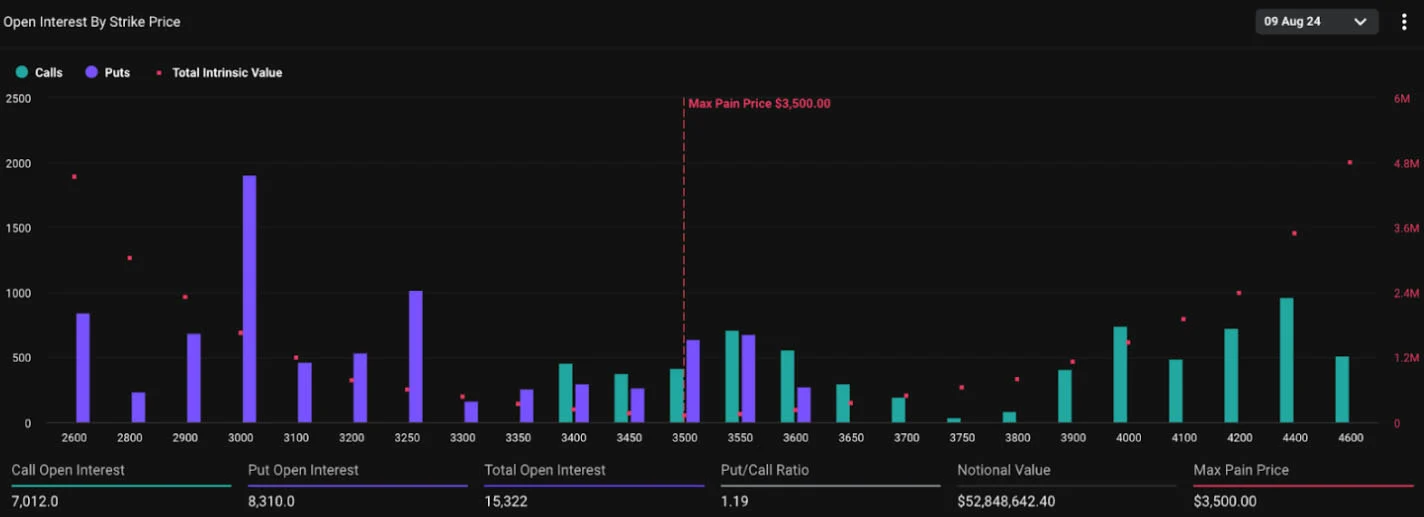

According to Deribit data, the put/call ratio for August 9 expiry has surged to 1.19. This indicates a higher number of put options compared to call options, suggesting traders anticipate an immediate downturn or are seeking to hedge against price declines. Despite approval news, ETH prices have not risen substantially. The crypto market has been anticipating ETF approval since May. However, ETH’s market capitalization has underperformed compared to other cryptocurrencies.

Historical patterns show that the launch of regulated exchange products often results in adjustments. This trend was evident in:

- December 2017: CME Bitcoin futures launch

- April 2021: Coinbase IPO

- October 2021: Futures-based Bitcoin ETF launch

- January 2024: Spot-based Bitcoin ETF launch

ETH’s technical chart indicates increased selling pressure on the underlying asset, despite the approval of spot ETH ETFs for Tuesday trading. The price is expected to fall to $3,300, coinciding with the support level highlighted by the yellow line in the accompanying ETH chart.

PROPOSED TRADING STRATEGY: PUT BUTTERFLY

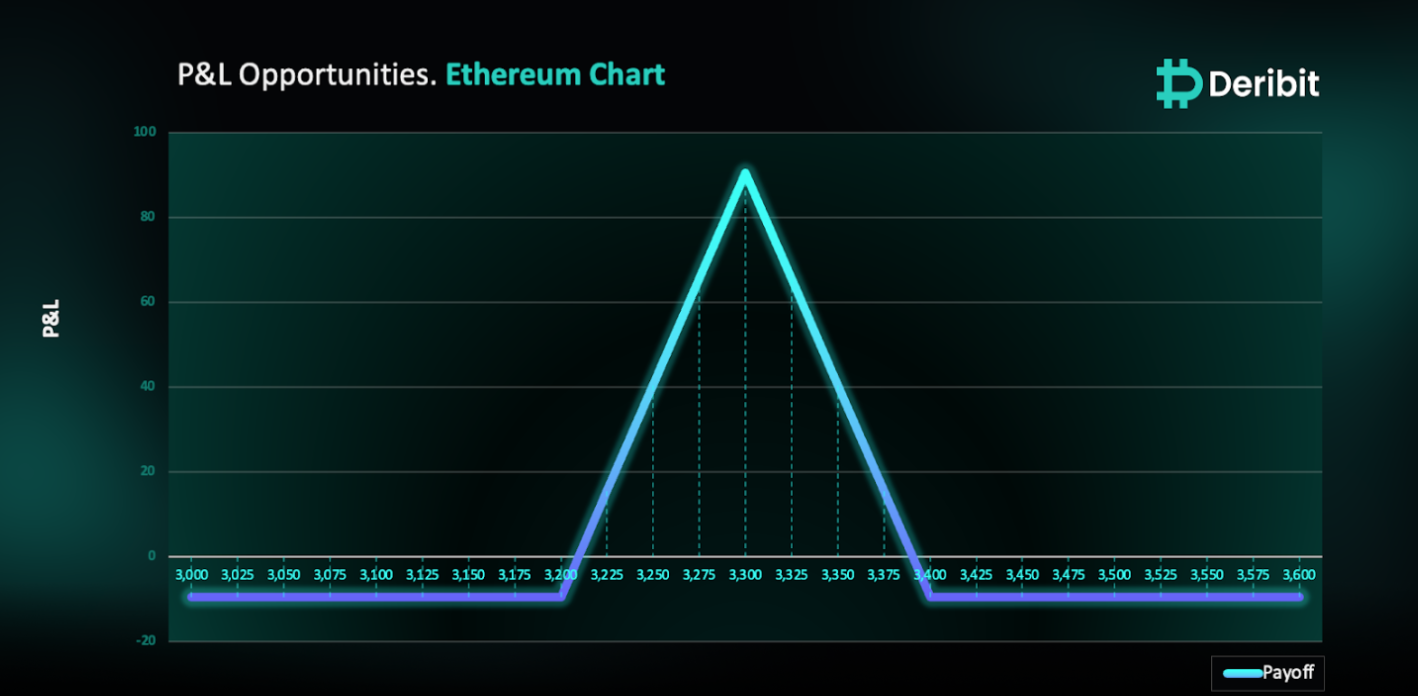

Given the market outlook, the put butterfly strategy is recommended. This three-part strategy involves:

- Buying a put option at a higher strike price

- Selling two put options at a lower strike price

- Buying another put option at an even lower strike price

This strategy is suitable for traders anticipating a downward movement in ETH price.

TRADE STRUCTURE

- Buy 1x ETH-09AUG24-$3,400-P @ $144.5 (OTM put option)

- Sell 2x ETH-09AUG24-$3,300-P @ $105 (OTM put option)

- Buy 1x ETH-09AUG24-$3,200-P @ $75 (OTM put option)

Target: Spot level = $3,300

PAYOFF

- Maximum Profit: $90.5 / ETH

- Strategy Debit: $9.5 / ETH

RATIONALE FOR THE TRADE

This strategy allows traders to capitalize on the expected price movement. By purchasing put options with a higher strike price (e.g., $3,400), selling double the amount of put options at a lower strike price (e.g., $3,300), and buying put options at an even lower strike price (e.g., $3,200), traders can maximize profits if ETH price is at $3,300 at option expiry on August 9.

If the market improves, potential losses are limited to the initial $9.5.

RISK MANAGEMENT

It’s important to note that while this strategy offers potential profits in a specific price range, it also carries risks. Traders should carefully consider their risk tolerance and market expectations before implementing this or any trading strategy.

>> Also read: What Is Ethereum & How Does It Work?

CONCLUSION

The imminent launch of spot Ethereum ETFs presents both opportunities and risks. While regulatory approval is a positive development, historical patterns and current market indicators suggest caution. The proposed put butterfly strategy offers a way to potentially profit from expected price movements while limiting downside risk. As always, thorough research and careful risk management are essential in cryptocurrency trading.

▶ Buy Crypto at BingX

Sign up to claim 5,000+ USDT in rewards & 20% off trading fees!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!