KEYTAKEAWAYS

- Low Market Liquidity: On-chain data shows low liquidity, with investors reluctant to trade, impacting Bitcoin's price stability.

- Federal Reserve's Influence: Market movements are heavily influenced by Federal Reserve decisions and expectations, rather than actual economic data.

- Economic Data Release: The release of core PCE data can cause significant price fluctuations, especially on low liquidity days like Fridays.

CONTENT

Explore the impact of Federal Reserve decisions on the current market, with low liquidity affecting investor actions. Learn how market expectations shape Bitcoin’s price movements.

You can find Lucas’ original content on his site.

The current market is essentially a game against the Federal Reserve.

On-chain data has clearly shown us that liquidity is very low. Whether the price goes up to $72,000 or down to $56,000, the buying and selling intentions are very low. This means that investors, whether they are in profit or loss, are reluctant to release their holdings at these price levels. In such a liquidity-depleted market environment, the on-chain data always looks the same. This situation has persisted for quite some time, which is why there have been fewer updates on the on-chain data recently.

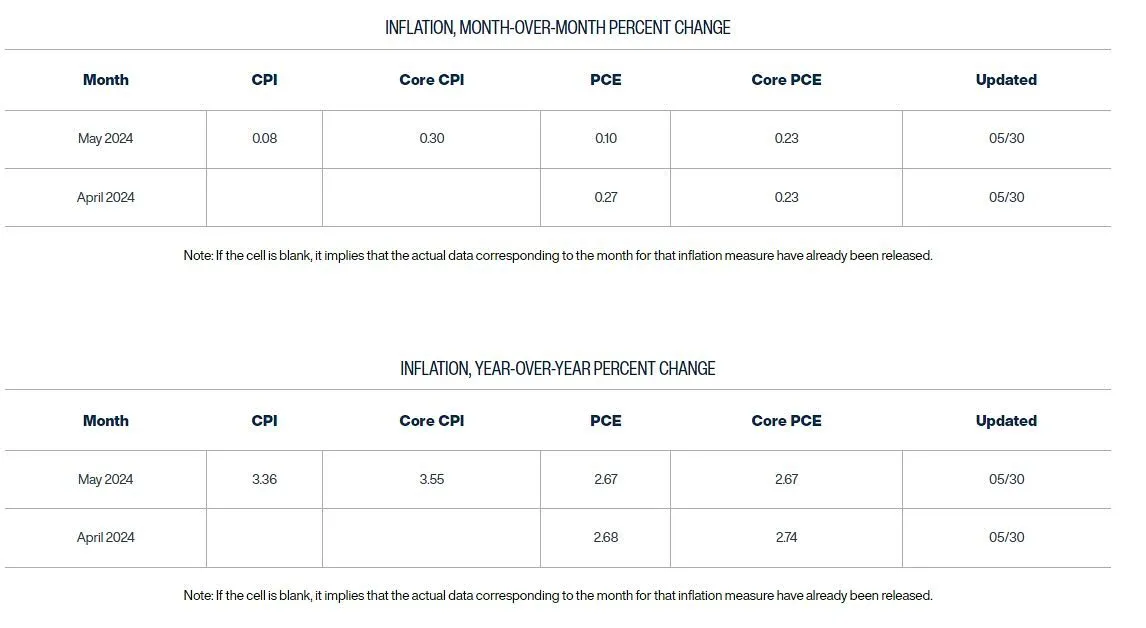

Therefore, the most important thing right now is to watch what the Federal Reserve is going to do next. The actual data is less important; as long as the market expectations are positive, Bitcoin will rise. For instance, tonight, the core PCE data, which is a measure of inflation, will be released. Current data indicates that the market expects April’s data to be the same as March’s. According to the Cleveland Federal Reserve’s forecast, the data might be slightly lower than expected, but the impact is limited.

If the core PCE released tonight at 8:30 A.M. ET is the same as the previous value, meaning it meets expectations, it might be slightly negative because it indicates that inflation has not decreased. If it not only fails to decline but actually increases, meaning it is higher than the previous value and expectations, the market will likely react poorly.

Today is also Friday, the day with the worst liquidity among the weekdays, which will exacerbate the price fluctuations caused by the release of economic data.

(Source: The Federal Reserve Bank of Cleveland)

((Source: Investing.com)