KEYTAKEAWAYS

-

MiCA will prompt exchanges like Binance to restrict unauthorized stablecoins in Europe, guiding users to regulated options.

-

Member states are aligning regulations with MiCA standards, including training regulators and setting up technical infrastructure for enforcement.

-

MiCA introduces transparency, compliance, and investor protection requirements, significantly impacting crypto-assets, stablecoin issuers, and service providers.

- KEY TAKEAWAYS

- INTRO

- Ⅰ. DEFINITIONS AND SCOPE OF THE ACT

- Ⅱ. TRANSPARENCY AND DISCLOSURE REQUIREMENTS FOR CRYPTOCURRENCY PROJECT ISSUANCE

- Ⅲ. LICENSING APPLICATION AND OBLIGATIONS

- Ⅳ. MEASURES TO PROTECT INVESTOR AND CUSTOMER RIGHTS

- Ⅴ. REQUIREMENTS TO PREVENT INSIDER TRADING AND MARKET MANIPULATION

- Ⅵ. PENALTIES FOR VIOLATIONS

- VII. INTERNATIONAL COOPERATION AND COORDINATED REGULATION

- Ⅷ. POTENTIAL IMPACTS OF THE MiCA ACT

- Ⅸ. CAN THE MiCA ACT BECOME A GLOBAL STANDARD?

- Buy Bitcoin at Binance

- DISCLAIMER

- WRITER’S INTRO

CONTENT

With the “Markets in Crypto-assets” Regulation (MiCA) set for June 30, 2024, major exchanges like Binance and Kraken will adjust policies, impacting stablecoins and regulatory practices. Find more about the regulation details with CoinRank !

INTRO

As the “Markets in Crypto-assets” Regulation (MiCA) is set to take effect on June 30, 2024, major cryptocurrency exchanges such as Binance, Kraken, and OKX are considering delisting Tether’s USDT from their European platforms. Binance has announced that after MiCA comes into effect, it will restrict the use of unauthorized stablecoins for users in the European Economic Area, gradually guiding users towards regulated stablecoins. Although existing unauthorized stablecoins will not be delisted, they will be set to “sell-only” mode to allow users to convert them into Bitcoin, regulated stablecoins, or fiat currencies.

Meanwhile, member states are adjusting their regulations and supervisory frameworks to align with MiCA standards. Some countries have begun training regulatory personnel for MiCA implementation and establishing the technical infrastructure to support the enforcement of the new regulations.

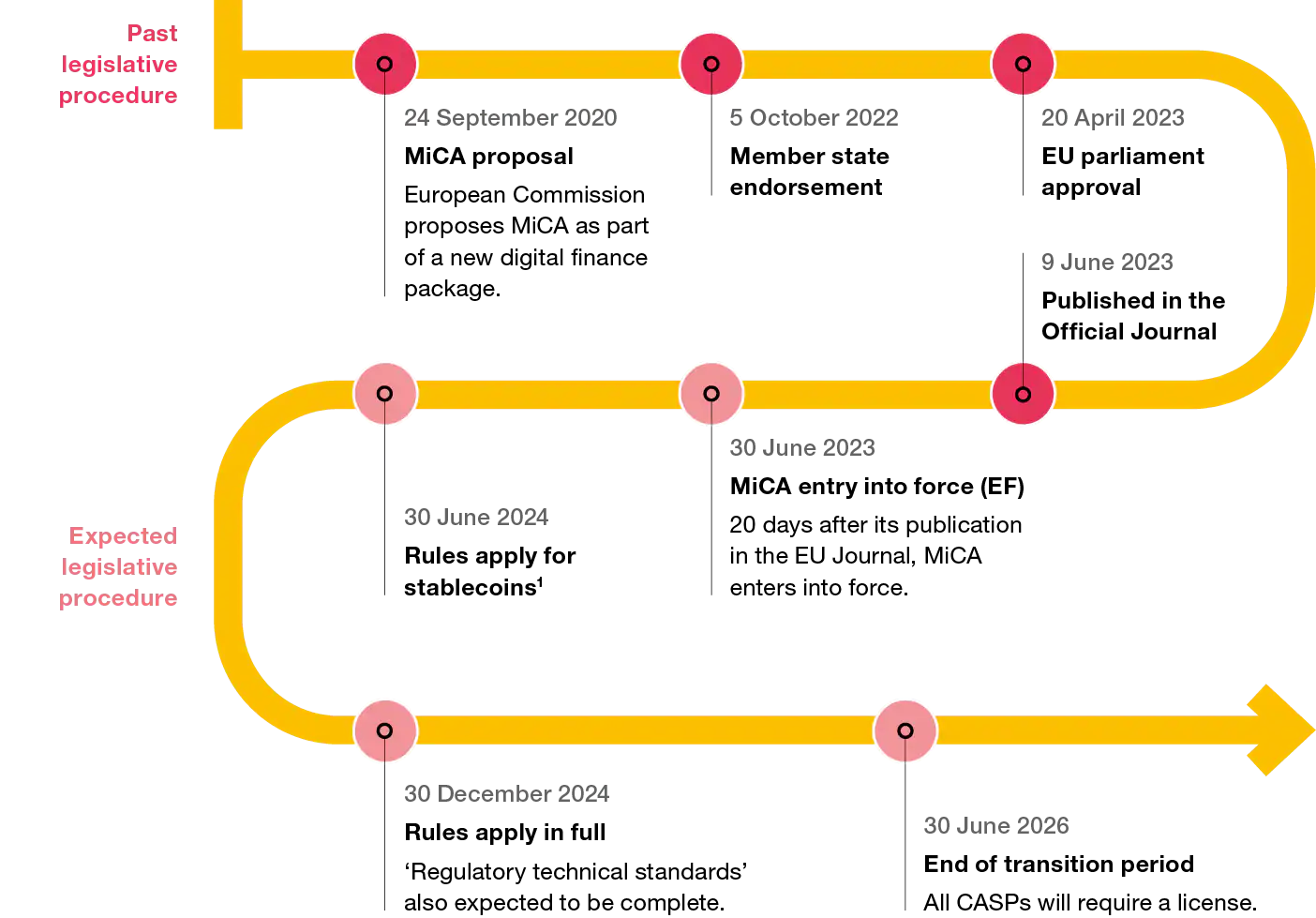

The EU MiCA Act, with most provisions starting from December 30, 2024, some special provisions coming into effect from June 30, 2024, and technical provisions effective from June 29, 2023, aims to ensure the market has sufficient time to prepare and adjust, ensuring a smooth transition and orderly development of the crypto-asset market (staggered implementation over 12 to 18 months). As shown in the figure below:

(Source:PwC)

The main contents of the Act cover the following key areas:

- Transparency and disclosure requirements for the issuance, public offering, and trading of crypto-assets on trading platforms.

- Authorization and supervision requirements for crypto-asset service providers, asset-referenced token issuers, and e-money token issuers, as well as requirements for their operation, organization, and governance.

- Protection requirements for holders of crypto-assets in issuance, public offering, and trading.

- Customer protection requirements for crypto-asset service providers.

- Measures to prevent insider trading, unlawful disclosure of inside information, and market manipulation to ensure the integrity of the crypto-asset market.

In the following content, CoinRank will analyze the MiCA Act through nine sections:

- Definitions and scope of the Act

- Transparency and disclosure requirements for cryptocurrency project issuance

- Licensing application and obligations

- Measures to protect investor and customer rights

- Requirements to prevent insider trading and market manipulation

- Penalties for violations

- International cooperation and coordinated regulation

- Potential impacts of the MiCA Act

- Can the MiCA Act become a global standard?

Ⅰ. DEFINITIONS AND SCOPE OF THE ACT

1. Relevant definitions of the European MiCA Act:

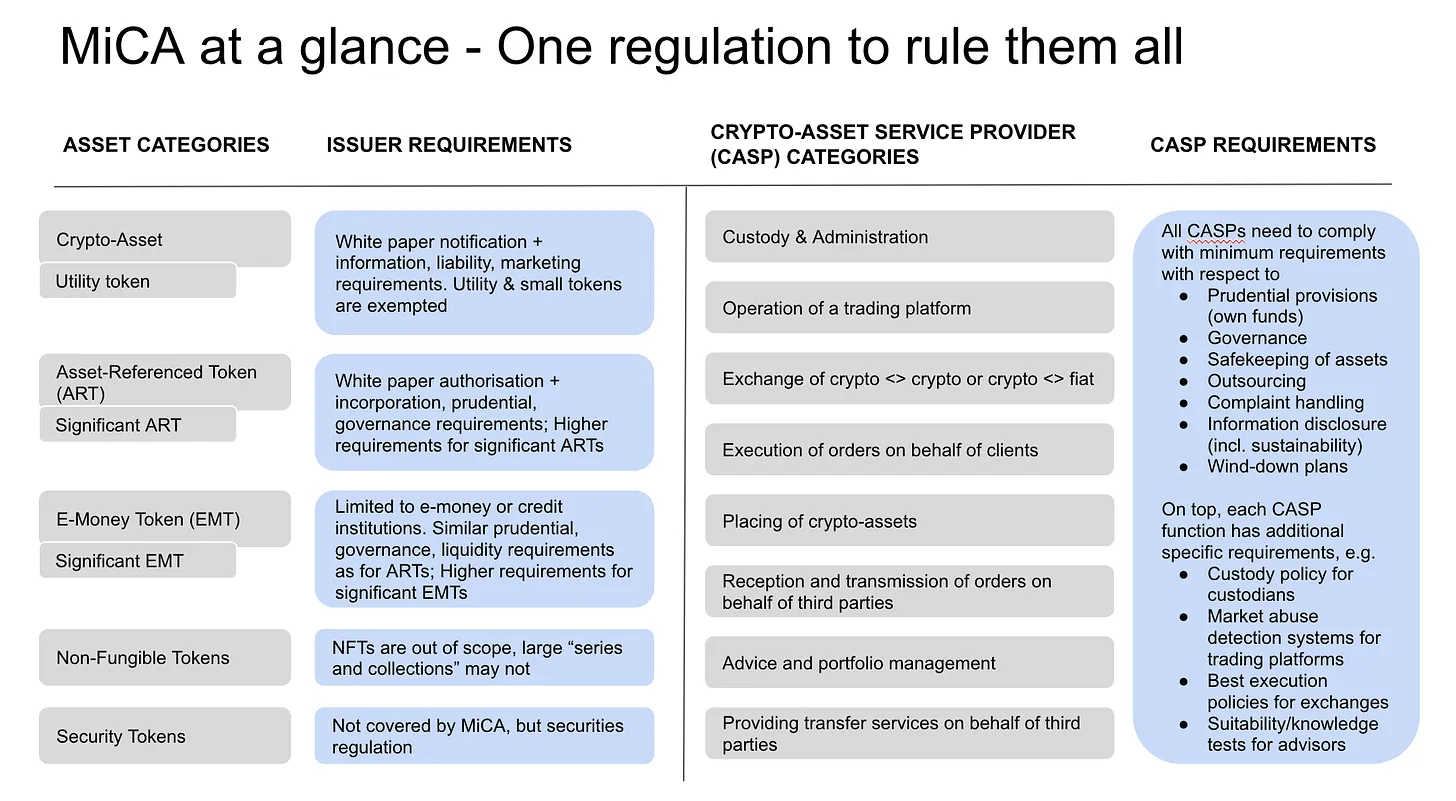

MiCA sets specific amount and other requirements for Asset-Referenced Tokens (ARTs) and Electronic Money Tokens (EMTs), as well as Crypto-asset Service Providers (CASPs):

(1) Asset-Referenced Tokens (ARTs)

ARTs are a type of stablecoin whose value is pegged to multiple currencies, commodities, or other crypto-assets. MiCA’s specific requirements for ARTs include:

- Reserve requirements: Companies issuing ARTs must hold sufficient reserves to ensure the stability of the token. Reserves should be equal to or exceed the total value of the issued tokens.

- Transaction volume limit: A single ART’s daily trading volume should not exceed 5 million euros. If the market value of an ART exceeds 500 million euros, the issuing company must report to the regulatory authority and undertake additional compliance measures.

- Transparency and reporting: Issuing companies need to regularly disclose detailed information about reserves and financial statements to ensure transparency. Monthly reports on token issuance and reserves must be submitted to the regulatory authorities.

(2) Electronic Money Tokens (EMTs)

EMTs are a type of stablecoin whose value is pegged to a single fiat currency. MiCA’s specific requirements for EMTs include:

- Reserve requirements: Companies issuing EMTs must hold reserves equivalent to the value of the issued tokens in fiat currency to ensure stability. Reserves should equal or exceed the total value of the issued tokens.

- Transaction volume limit: A single EMT’s daily trading volume should not exceed 5 million euros. If the market value of an EMT exceeds 500 million euros, the issuing company must report to the regulatory authority and undertake additional compliance measures.

(3) Crypto-asset Service Providers (CASPs)

CASPs must comply with minimum requirements concerning governance, asset custody, complaint handling, outsourcing, wind-down plans, information disclosure, and prudential requirements. CASPs need to maintain permanent minimum capital (“own funds”):

- Trading platforms need to maintain a minimum permanent capital of 150,000 euros.

- Custodians and exchanges (brokers) need 125,000 euros.

- All other CASPs need 50,000 euros.

(Source:Paddi’s Substack)

Ⅱ. TRANSPARENCY AND DISCLOSURE REQUIREMENTS FOR CRYPTOCURRENCY PROJECT ISSUANCE

EU MiCA Regulation (EU) 2023/1114 sets forth transparency and disclosure requirements through detailed whitepaper drafting and publication processes, stringent information update requirements, and standardized marketing materials to ensure market transparency in project issuance and protect investor rights. The details of the project issuance requirements are as follows:

The details of the project issuance requirements are as follows:

Ⅲ. LICENSING APPLICATION AND OBLIGATIONS

1. Licensing Application

(1) Application eligibility:

Only companies meeting specific conditions can apply for and obtain a license for crypto-asset services. This includes having a sound legal structure, good financial standing, and a reliable management team.

For instance, the company must be a legal entity or other legally recognized form of enterprise.

(2) Application documents:

Companies need to submit a series of documents when applying for a license, including:

- Company name, legal entity identifier, website, contact information, and actual address.

- Legal form and articles of association of the company.

- Detailed operational plan describing the types of crypto-asset services to be provided and their marketing methods and locations.

- Documents proving the applicant meets prudential safeguard requirements.

- Description of the company’s governance structure, including background checks on management members to ensure their credibility and ability to manage the company.

- Identity information and shareholding of major shareholders or members, ensuring their credibility.

- Description of internal control mechanisms, risk management procedures, anti-money laundering and anti-terrorism financing measures, and business continuity plans.

- Technical documentation of information and communication technology (ICT) systems and security arrangements.

- Description of client asset and fund segregation procedures.

- Description of client complaint handling procedures.

(3) Review process:

- Upon receiving the complete application materials, the competent authority must review and make a decision within the specified period.

- Once authorized, the types of crypto-asset services the service provider is authorized to offer must be clearly defined.

- Authorization information must be notified to the European Securities and Markets Authority (ESMA) and recorded in a public register.

2. Obligations of License Holders

(1) Compliance operation:

- Licensed companies must continuously meet authorization conditions and regularly report operational conditions to the competent authority.

- Companies must maintain sound internal control mechanisms and risk management procedures to ensure compliance and safety in their operations.

(2) Cross-border services:

Licensed companies can provide services within the EU without establishing a physical office in each member state but must notify and provide relevant information to the competent authority of the destination member state.

(3) Management changes and business expansion:

- If the company’s management changes, it must immediately notify the competent authority and provide all necessary information to assess compliance.

- If a company wishes to add new service types, it must apply to the competent authority to extend the license and update relevant information.

(4) Regular supervision and inspection:

- The competent authority has the right to conduct on-site inspections and request any information related to operations to ensure the company remains compliant.

- Companies must cooperate with the inspections and provide all necessary operational information and data.

(5) Handling violations:

The competent authority may revoke the company’s license under specific circumstances, including but not limited to:

- Not used within 12 months of authorization.

- Failure to provide crypto-asset services for nine consecutive months.

- Obtaining authorization through improper means.

- Failure to meet authorization conditions without taking remedial measures within the prescribed time.

- Serious violations of regulations, including customer protection and market integrity related provisions.

Ⅳ. MEASURES TO PROTECT INVESTOR AND CUSTOMER RIGHTS

- Investor Rights Protection

(1) Information transparency:

- Companies issuing crypto-assets must provide detailed and accurate information, allowing investors to understand what they are buying and the associated risks and returns.

- This information includes detailed information about the company, technical details of the crypto-assets, trading and distribution methods, and potential risks.

(2) Fair treatment:

- Companies must ensure that all investors are treated fairly during transactions, with no form of discrimination.

- If there are special treatments, they must be clearly stated in the whitepaper and marketing materials to ensure transparency and fairness.

(3) Risk disclosure:

Companies must fully disclose all potential risks, including technical, market, and legal risks, ensuring that investors understand the risks involved.

2. Customer Fund Protection

(1) Independent custody:

- Companies must manage customer funds separately from company funds to ensure customer fund safety.

- This is to prevent the company from misappropriating customer funds and to protect customer interests in case of company issues.

(2) Compensation mechanism:

- If the company encounters issues or defaults, there must be a clear compensation mechanism to ensure timely compensation for customers.

- Companies need to have sufficient resources and arrangements to provide compensation.

(3) Transparent pricing:

- Companies must disclose all fee standards and charges, ensuring that customers are aware of the specifics of each charge.

- This information should be prominently displayed on the company’s website to ensure transparency.

3. Investor Suitability Assessment

(1) Customer information collection:

- When providing advice or managing customer assets, service providers need to collect relevant customer information, including investment experience, risk tolerance, and financial status.

- This information is used to assess whether crypto-assets are suitable for customers and to ensure that recommendations align with the customer’s investment goals and risk preferences.

(2) Risk warnings:

- Service providers must clearly inform customers of the associated risks of crypto-assets, including value fluctuation risks, liquidity risks, and potential full loss risks.

- Customers must understand that crypto-assets are not protected by traditional investor compensation schemes and deposit protection plans.

(3) Regular assessment:

Service providers must regularly (at least every two years) review the suitability assessment of customers to ensure that their recommendations and services always meet the customers’ needs and risk tolerance.

4. Customer Complaint Handling

(1) Complaint handling procedures:

- Companies must have effective complaint handling procedures to ensure timely and fair handling of customer complaints.

- Customers can submit complaints free of charge, and companies need to provide complaint templates and record all complaints and their outcomes.

(2) Complaint transparency:

- Companies must disclose detailed information about complaint handling procedures on their websites, allowing customers to understand the complaint process and resolution methods.

- Companies need to investigate all complaints within a reasonable time and notify customers of the results.

Ⅴ. REQUIREMENTS TO PREVENT INSIDER TRADING AND MARKET MANIPULATION

- Prevention of Insider Trading

(1) Definition of insider information:

Insider information refers to non-public information directly or indirectly related to one or more crypto-assets or issuers, which, if made public, could significantly impact the price of these crypto-assets.

(2) Prohibition of insider trading:

- Persons possessing insider information are prohibited from using this information to trade crypto-assets or recommending or inducing others to trade.

- Insider information holders cannot disclose this information to others unless it is disclosed within the normal course of professional duties.

(3) Punitive measures:

If insider trading is detected, relevant authorities have the right to investigate the involved individuals or companies and impose penalties according to regulations, including fines and bans from the industry.

2. Prevention of Market Manipulation

(1) Definition of market manipulation:

Market manipulation includes, but is not limited to, the following behaviors:

- Creating false signals of supply and demand to influence crypto-asset prices.

- Manipulating crypto-asset prices through false transactions or false information dissemination.

- Using market positions to directly or indirectly fix buying and selling prices or create unfair trading conditions.

(2) Typical market manipulation behaviors:

- For instance, disrupting the normal operation of trading platforms through large-scale buying and selling orders to create false market trends.

- Disseminating false or misleading information through media or the internet to influence crypto-asset prices.

- Manipulating buying and selling prices of crypto-assets directly or indirectly using a dominant market position.

3. Prevention and Detection Mechanisms

(1) Preventive measures:

Crypto-asset service providers must establish effective internal control systems to prevent market manipulation behaviors. These systems include monitoring trading activities and detecting abnormal trading behaviors.

(2) Detection and reporting:

- Service providers must report suspicious trading behaviors to the competent authority immediately. These reports should include all relevant information, such as trading orders and the trading platform’s operating conditions.

- The European Securities and Markets Authority (ESMA) will set technical standards to help service providers better fulfill these preventive and detection obligations.

(3) Cross-border cooperation:

For cross-border market manipulation behaviors, relevant national authorities need to coordinate and cooperate to combat market abuse.

Ⅵ. PENALTIES FOR VIOLATIONS

- Administrative Penalties and Other Administrative Measures

(1) Scope of violations:

The regulation clearly lists violations subject to penalties, including failing to publish information as required, not complying with market manipulation and insider trading prohibitions, and not cooperating with investigations.

(2) Punitive measures:

- Public statements: The competent authority can issue statements disclosing the violating company or individual’s actions. This is equivalent to a public reprimand.

- Rectification orders: Requiring violators to cease violations and take measures to prevent recurrence. This is similar to an immediate correction order.

- Fines: Imposing fines on individuals and companies based on the severity of the violation and the illegal benefits gained.

For example:

- Fines for individuals can be up to 700,000 euros.

- Fines for companies can be up to 5 million euros or 5% of annual turnover.

(3) Particularly severe penalties:

For especially severe violations, such as repeated violations or those severely impacting market stability, the competent authority can:

- Temporarily or permanently ban relevant managers from engaging in crypto-asset management.

- Revoke or suspend the company’s operating license.

2. Disclosure of Penalty Decisions

(1) Public transparency:

For each penalty decision, the competent authority must disclose it on its official website. This is similar to a public notification of the violation and resolution.

(2) Privacy protection:

In certain cases, if disclosing the violator’s identity would cause disproportionate harm or affect ongoing investigations, the competent authority can choose to disclose the decision anonymously or delay the disclosure.

3. Implementation of Fines and Other Penalties

(1) Enforcement of fines:

Fines and other penalties need to be enforced according to the legal procedures of the respective country. If the violator does not pay the fine, the competent authority can enforce it through legal means.

(2) Use of fines:

Collected fines will be included in the EU budget for public expenditure.

4. Right to Appeal

Appeal procedures:

- Violators have the right to appeal against penalty decisions. This is akin to a justified appeal, allowing them to challenge the penalty decision through the courts.

- If a license application is denied or the application process exceeds six months without a result, the applicant also has the right to appeal.

VII. INTERNATIONAL COOPERATION AND COORDINATED REGULATION

Through these international cooperation and coordinated regulation measures, the EU aims to ensure regulatory consistency and effectiveness in the global crypto-asset market. By closely collaborating and sharing information with regulatory authorities in other countries, cross-border violations can be better prevented and addressed.

1. Cooperation Among Regulatory Authorities

(1) Cooperation within the EU:

National regulatory authorities need to closely collaborate to ensure consistent regulatory standards for crypto-assets across the EU. This is similar to different countries’ traffic police working together to ensure cross-border drivers adhere to the same traffic rules.

(2) Information sharing:

National regulatory authorities must timely share information, especially when identifying violations or needing investigations. This is like police stations quickly sharing information about suspects to take timely action.

2. Cooperation with Non-EU Countries

(1) Cooperation with regulatory authorities in non-EU countries:

EU member state regulatory authorities need to sign cooperation agreements with non-EU countries’ regulatory authorities to exchange information and jointly enforce regulations. This ensures that cross-border crypto-asset transactions are effectively regulated, similar to international police cooperation to combat cross-border crimes.

(2) Security of information exchange:

These cooperation agreements must ensure the confidentiality and security of information exchange, preventing sensitive information from being leaked or misused. This is like ensuring that shared intelligence between different countries’ police is not accessed by terrorists or criminals.

3. Role of the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA)

(1) Coordination and promotion of cooperation:

ESMA and EBA are responsible for coordinating cooperation among EU member state regulatory authorities, developing standardized cooperation agreements, and information exchange procedures. This is akin to Interpol coordinating actions among different countries’ police forces to ensure everyone follows the same standards and procedures.

(2) Development of technical standards:

ESMA and EBA will develop technical standards to ensure consistent format and content for information exchange, making it easier for national regulatory authorities to use. This is like creating a unified language so that different countries’ police can understand and use shared information.

4. Handling Cross-Border Issues

(1) Cross-border investigations and supervision:

For cross-border crypto-asset violations, relevant national regulatory authorities need to jointly investigate and supervise. This is similar to multiple countries’ police forces conducting joint operations to capture cross-border criminal groups.

(2) Resolving cooperation issues:

If a national regulatory authority refuses to cooperate or does not respond to information requests in a timely manner, other countries can report the issue to ESMA or EBA for coordination and resolution. This is like submitting a problem to Interpol for coordination and resolution.

Ⅷ. POTENTIAL IMPACTS OF THE MiCA ACT

Impact 1: Delisting of Privacy Coins

Crypto-assets with built-in anonymity features (e.g., Monero, Zcash) will only be allowed on trading platforms if CASPs or relevant regulatory authorities can identify token holders and their transaction history. Since this is practically unachievable, EU-regulated crypto exchanges are expected to delist privacy coins.

Impact 2: Easier Access to MiCA Licenses for CASPs with Existing European Licenses

CASPs that have already obtained licenses under national frameworks will benefit from a simplified MiCA authorization process and will have up to 18 months to obtain the final MiCA license. For example, regulated crypto custodians in Germany may benefit from these simplified procedures and transition measures. However, only CASPs with MiCA licenses will have the opportunity to provide services across the EU single market through so-called cross-border licenses. Therefore, it is expected that most crypto companies will seek MiCA authorization as soon as possible.

Impact 3: A Unified Large European Market

MiCA regulations will bring unified regulation, enhance competitiveness, and promote institutional development. So far, EU crypto companies must apply to the regulatory authorities of each country to serve the entire EU market, resulting in high costs and complexity. Under MiCA, the same binding EU requirements will apply to all 27 member states. Once a company obtains a MiCA license in one country, it will be able to provide licensed services across the EU single market through “cross-border licenses.”

Impact 4: Offshore Companies Will Be Restricted, Benefiting EU Enterprises

After MiCA comes into effect, offshore, unregulated companies will be unable to actively attract EU customers. Even the rule allowing foreign companies to accept customers through active EU user contact will become stricter. This means that MiCA-regulated crypto companies will capture more EU market share from these unregulated offshore competitors.

Impact 5: MiCA Promotes Institutional Participation, European Banks Accelerate Deployment

MiCA may lead to increased institutional adoption and activity in the EU crypto market. According to Bloomberg, only 4% of European institutional funds are exposed to crypto-assets. Regulatory uncertainty is one of the main concerns preventing institutions from entering this field. Over the next 48 months, major European banks are expected to launch crypto-asset services, whether for custody, trading, or issuing electronic money tokens or asset-referenced tokens.

Impact 6: MiCA’s Impact on Stablecoin Issuers

MiCA’s new regulatory rules will bring significant compliance challenges for stablecoin issuers such as Tether, especially considering Tether’s history of not fully disclosing its reserve status and composition and not undergoing comprehensive audits by authoritative independent institutions. Tether has also been involved in multiple lawsuits and investigations, including a $18.5 million settlement with the New York State Attorney General’s Office and a rumored investigation by the US Department of Justice for alleged bank fraud, money laundering, and illegal operations. In the future, stablecoin issuers like Tether will face substantial compliance reform costs.

To address these challenges, Tether should actively advance its compliance process and establish good relationships with EU regulators and third-party audit institutions to enhance its market reputation and competitiveness. In response to increasingly stringent regulatory requirements, Tether has taken measures to advance its compliance process. For example, Tether recently announced a partnership with the Italian branch of BDO International, the fifth-largest accounting firm globally, which will be responsible for auditing the company’s reserve guarantees and certification reports, with plans to increase the frequency of audit report releases from quarterly to monthly.

Under the MiCA framework, stablecoin issuance will become more compliant and transparent. Stablecoin issuers like Tether need to accelerate the compliance process to adapt to the new regulatory environment and maintain competitiveness in the EU market.

Impact 7: MiCA’s Impact on DeFi

MiCA applies to enterprises—natural persons, legal persons, and “certain other enterprises.” “Other enterprises” may include entities not legally established, but the EU has clarified that decentralized DAOs and protocols are not the new targets of this regulation. MiCA Paragraph 22 clarifies, “If crypto-asset services are provided in a fully decentralized manner without any intermediary, they should not fall within the scope of this regulation.” This core statement is supported by multiple public statements from key officials of the European Commission and Parliament.

However, the details are crucial. The Act states that even if some activities or services are executed in a decentralized manner, MiCA may still apply. This means that if certain parts or aspects of a DeFi project are not fully decentralized, they may still need to comply with MiCA regulations.

How much decentralization (technical, governance, legal, etc.) is required to be out of scope? This is a subjective judgment. I expect some enforcement and litigation cases will revolve around this issue. The EU generally does not like to enforce its laws on other countries, but if some DeFi projects claim to be decentralized but are actually centralized and offer services in Europe or to EU users, the EU will pay special attention.

DeFi projects have two choices to be out of scope:

- Prove full decentralization (high threshold)

- Block EU users

Nonetheless, the EU deserves praise for excluding truly decentralized DeFi projects when formulating regulations for traditional financial companies. If some aspects of MiCA become global standards, it would be good news.

Impact 8: Challenges and Uncertainties

However, the actual success of MiCA heavily depends on the implementation standards and enforcement practices developed by EU regulators over the next 12-18 months. Some provisions may impose burdens on industry participants, and their full impact will only become apparent once technical implementation standards provide practical guidance.

Impact 9: High Compliance Costs and Innovation Barriers

Similar to the recent situation in Hong Kong, high compliance costs may lead to companies leaving the market. MiCA’s compliance costs will also cause stablecoin issuers to bypass the EU, and disclosure requirements and responsibilities for exchanges will be too burdensome, failing to benefit consumers, making their products less competitive compared to offshore competitors. EU consumers will either be cut off from innovation or continue to use (and be exposed to) the largest offshore liquidity and utility pools. Additionally, regulators may consider most NFTs and DeFi projects to fall within MiCA’s scope, requiring compliance—this is still an open door for interpretation in MiCA’s preamble. This will inevitably lead to teams and resources migrating out of the EU.

Ⅸ. CAN THE MiCA ACT BECOME A GLOBAL STANDARD?

MiCA is expected to become the GDPR of the cryptocurrency field, a globally adopted regulatory standard, but this is not yet certain.

There is no denying that MiCA will have a significant impact on the crypto-asset frameworks of other jurisdictions, especially those with less experience in financial regulation and supervision. Many concepts in the recent Financial Stability Board (FSB) recommendations for crypto service providers and “global stablecoin arrangements” have already been inspired by MiCA.

The EU market is the world’s largest internal market, with 450 million relatively affluent consumers. With its market size, MiCA will prompt many companies around the world to adopt MiCA’s operational standards, and it may even be adapted globally to maintain consistency in global operations and products. The global impact of EU regulatory standards has been observed in multiple industries, from chemicals to agriculture to technology, a phenomenon Columbia Law School Professor Anu Bradford calls the “Brussels Effect.”

Current US Commodity Futures Trading Commission (CFTC) Commissioner Caroline Pham warned: “As the US struggles to provide regulatory clarity for the domestic crypto industry, global regulatory frameworks like MiCA may fill this void.”

As the regulatory vacuum in the US crypto-asset market persists, MiCA standards are expected to have increasing global influence.

However, the ultimate success of MiCA is crucial, with most practical implementation work still ahead. If MiCA proves feasible for the industry, consumers, and regulators, it will have a global impact. Otherwise, many jurisdictions may choose completely different policy paths. Only time and the market will tell.

After the complete collapse of FTX, even the most ardent crypto extremists have had to admit that some form of reasonable regulation is needed to move the field forward and prevent the most serious frauds.

Buy Bitcoin at Binance

Enjoy up to 20% off on trading fees! Sign up Now!