KEYTAKEAWAYS

- Trump's potential victory could lead to loose monetary policies, increasing market liquidity and driving a crypto bull market, particularly benefiting Bitcoin.

- MEME coins, DeFi projects, and decentralized platforms may see significant growth, but investors should exercise caution due to high volatility.

- While potentially positive short-term, a Trump win could pose long-term challenges for crypto due to economic complexity and regulatory concerns.

CONTENT

Explore the potential impact of a Trump victory on the crypto market, including effects on Bitcoin’s fourth halving cycle, specific projects to watch, and long-term industry implications.

Recently, the world’s richest man, Elon Musk, publicly endorsed Donald Trump’s presidential campaign. First, Musk joined Trump at a campaign rally in Butler, Pennsylvania – the site of a previous assassination attempt on Trump. Then, Musk’s newly formed “America PAC” launched a petition-signing campaign in swing states, aiming to secure 1 million voters.

Musk is not only the world’s wealthiest individual but also the biggest influencer in the crypto market. He has propelled Dogecoin to new heights, triggered a MEME coin frenzy, and is a strong supporter of crypto technology. His every word and action significantly impacts the crypto market, even leading to the emergence of Musk-concept cryptocurrencies. Trump, as a former U.S. president and a strong contender for the next presidency, has also made numerous statements about crypto, both positive and negative. The alliance of these two figures could have a massive impact on the future of the crypto market.

If Trump wins the U.S. election in November this year, what changes might occur in the crypto market? How would it affect both long-term and short-term market trends? This article will analyze these questions one by one.

REVIEWING HISTORY: TRUMP’S PAST RELATIONSHIP WITH CRYPTOCURRENCY

To understand the future, we need to look at the past. Before interpreting the potential impact of a Trump victory on the crypto market, let’s review Trump’s previous stance on crypto.

Overall, Trump’s attitude towards cryptocurrency has been contradictory, or rather, initially negative but gradually improving. During his first presidential term (2016-2020), Trump repeatedly expressed opposition to Bitcoin and cryptocurrencies. For instance, in 2019, he stated that “Bitcoin is not real currency, the dollar is the only reliable currency” and expressed “concerns about cryptocurrency facilitating criminal activities.” He also opposed Facebook’s cryptocurrency project, Libra. These statements, coming from a politician, are understandable and may not fully represent his views on cryptocurrency, as he was acting in his official capacity at the time.

Various Countries’ Government Holdings of Bitcoin

(Source: Treasuries)

During Trump’s tenure, he actively promoted the U.S. government’s regulation of the cryptocurrency industry and the introduction of relevant laws. Although the purpose was to guard against the negative impacts of cryptocurrency, in the long run, these regulations and laws are beneficial for the sustainable development of the crypto market. Additionally, Trump held a negative attitude towards the digital dollar (CBDC), preferring to maintain the stability of the traditional financial system during his presidency.

However, after leaving office, Trump’s attitude seemed to shift, mainly due to the influence of those around him and the needs of future elections. First, Trump’s wife, Melania Trump, launched her own NFT project in 2022. Then his son, Donald Trump Jr., mentioned cryptocurrency on social media. Now, collaborating with Musk, the world’s most influential cryptocurrency supporter, for his election campaign could significantly change Trump’s previous negative views on cryptocurrency.

During Trump’s presidency, Bitcoin led the crypto market through a halving bull and bear cycle, including a major bull market following the second halving in 2017 and a smaller bull market in 2019 due to interest rate cuts. Trump’s most significant impact on the crypto market was actually reflected in the monetary policies during his tenure, while his statements mainly affected short-term market fluctuations.

Overall, as a traditional businessman and politician, pragmatism is Trump’s most important principle. Now, with the development of Bitcoin and the crypto market, no country or organization can ignore its role. If Trump is re-elected as U.S. President, his views and policies on Bitcoin and the crypto market may be more positive than before.

HOW WILL THE FOURTH HALVING CYCLE UNFOLD IF TRUMP WINS?

The fourth Bitcoin halving cycle is currently imminent. The most significant external factors affecting this halving cycle are the Federal Reserve’s upcoming monetary policy and potential geopolitical and economic black swan events. If Trump takes office, he would have a major influence on both of these aspects.

Trump and the Republican Party he represents primarily serve the interests of the military-industrial complex and industrial capital. His policies, if elected, would mainly consider the interests of these entities. Therefore, if Trump wins, he would likely use various means to pressure the Federal Reserve to accelerate the process of interest rate cuts to stimulate economic growth.

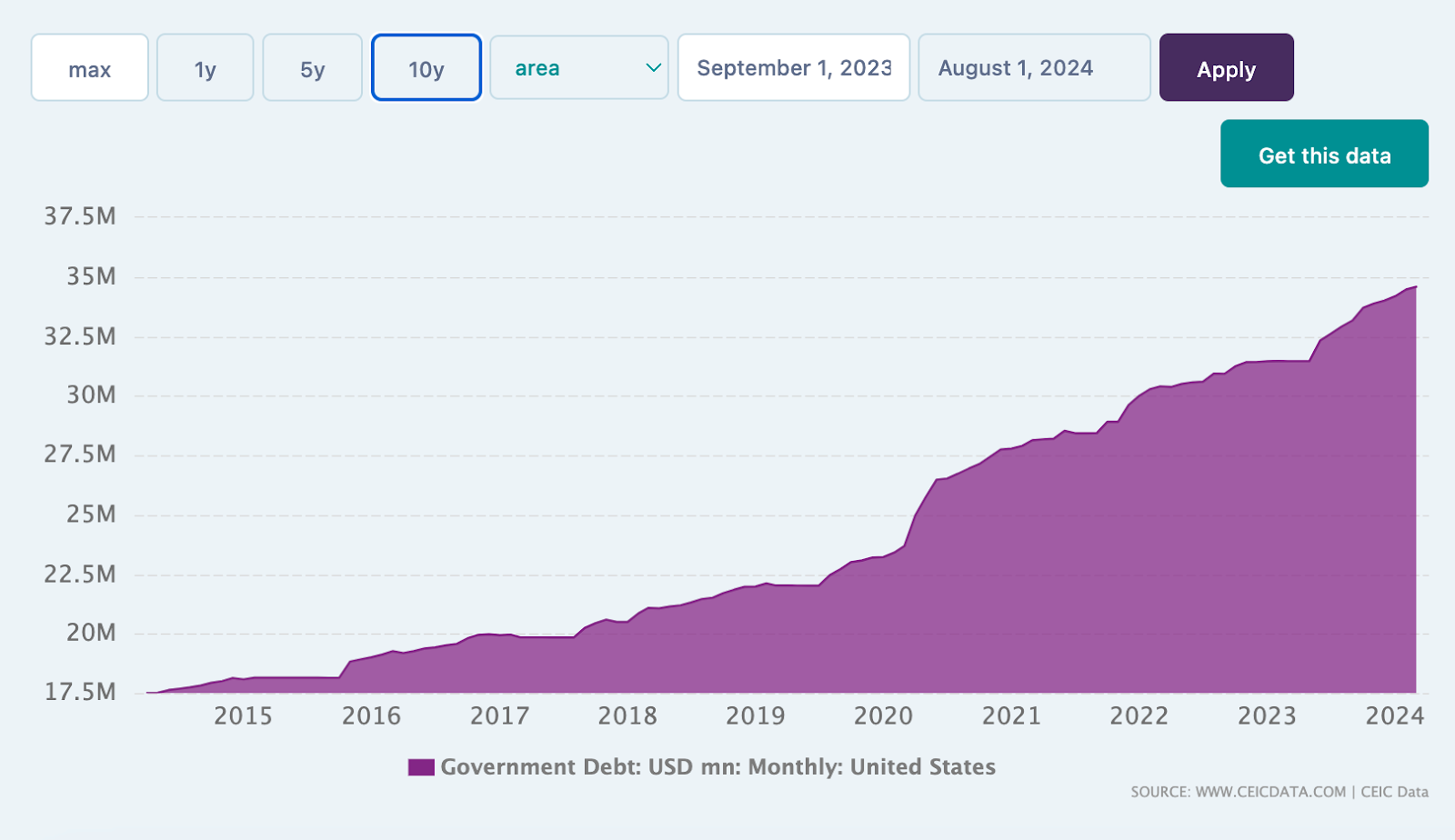

Trump has always advocated for loose monetary policies, tax cuts for businesses, and attracting global industries back to the U.S. These policies require enormous amounts of funding. Given the current U.S. fiscal situation, the only way to raise funds would be through issuing debt – massive debt issuance and unlimited QE. The current $35 trillion national debt is far from sufficient; it could potentially reach $55 trillion or $65 trillion. After all, this would be Trump’s last term, allowing him to act without restraint, following the principle of “After me, the flood.”

Changes in Us National Debt over the Last Decade

(Source: CEIC Data)

Therefore, if Trump wins, it would bring massive liquidity to the market. As a product of abundant liquidity, the crypto market would also enter the fast lane of the fourth halving cycle under this enormous liquidity boost. Bitcoin prices would rise rapidly, driving other cryptocurrencies to follow suit, potentially leading to a frenzied bull market similar to those seen in 2021 and 2017. Various coins could experience explosive growth, with different concepts and projects rapidly occupying the market’s hot spots. However, this would also bring a mix of good and bad, with bubbles proliferating, and investors risking significant losses if they’re not careful.

In the short term, accelerated interest rate cuts by the Federal Reserve would reduce borrowing costs for businesses and individuals, rapidly increasing market liquidity. This would make investors more inclined towards high-risk, high-return crypto markets. The overall sentiment in the crypto market would be boosted, causing rapid price increases for Bitcoin and other cryptocurrencies. As funds continue to pour in, Bitcoin’s price could be pushed to unimaginable heights.

In the long term, rapid interest rate cuts, while stimulating economic growth, would also drive inflation. On one hand, this would make Bitcoin a choice for more investors to hedge against inflation, shifting funds from fiat currencies and traditional financial markets to Bitcoin and other crypto assets, pushing up their prices. On the other hand, rapidly rising inflation would also put pressure on the economy, potentially leading to black swan events that could affect the crypto market, causing short-term panic selling and sharp declines.

Of course, Trump’s “America First” foreign policy could also intensify global conflicts, potentially leading to black swan events that could cause violent fluctuations in the crypto market.

Regarding specific crypto market policies, if a massive influx of liquidity drives the crypto market into a frenzied bull market, regulatory policies in various countries would likely accelerate. Previously, countries like China and the U.S. have introduced relevant policies during halving cycle booms, sometimes even targeting specific projects, causing major market fluctuations, mainly sharp declines. Examples include the famous “9/4 and 5/19 crashes” and the SEC’s lawsuit against XRP in 2020.

Overall, if Trump wins, it would generally be positive for Bitcoin and the overall crypto market. In the short term, it could potentially drive the fourth halving bull market to unimaginable heights. However, in the long term, due to the increasing complexity of the global economy and the inherent decentralization and anonymity issues of cryptocurrencies, it could pose significant challenges.

WHICH PROJECTS ARE WORTH WATCHING IF TRUMP WINS?

After discussing the macro perspective, let’s look at some specific details: If Trump wins, which crypto projects and sectors are worth watching?

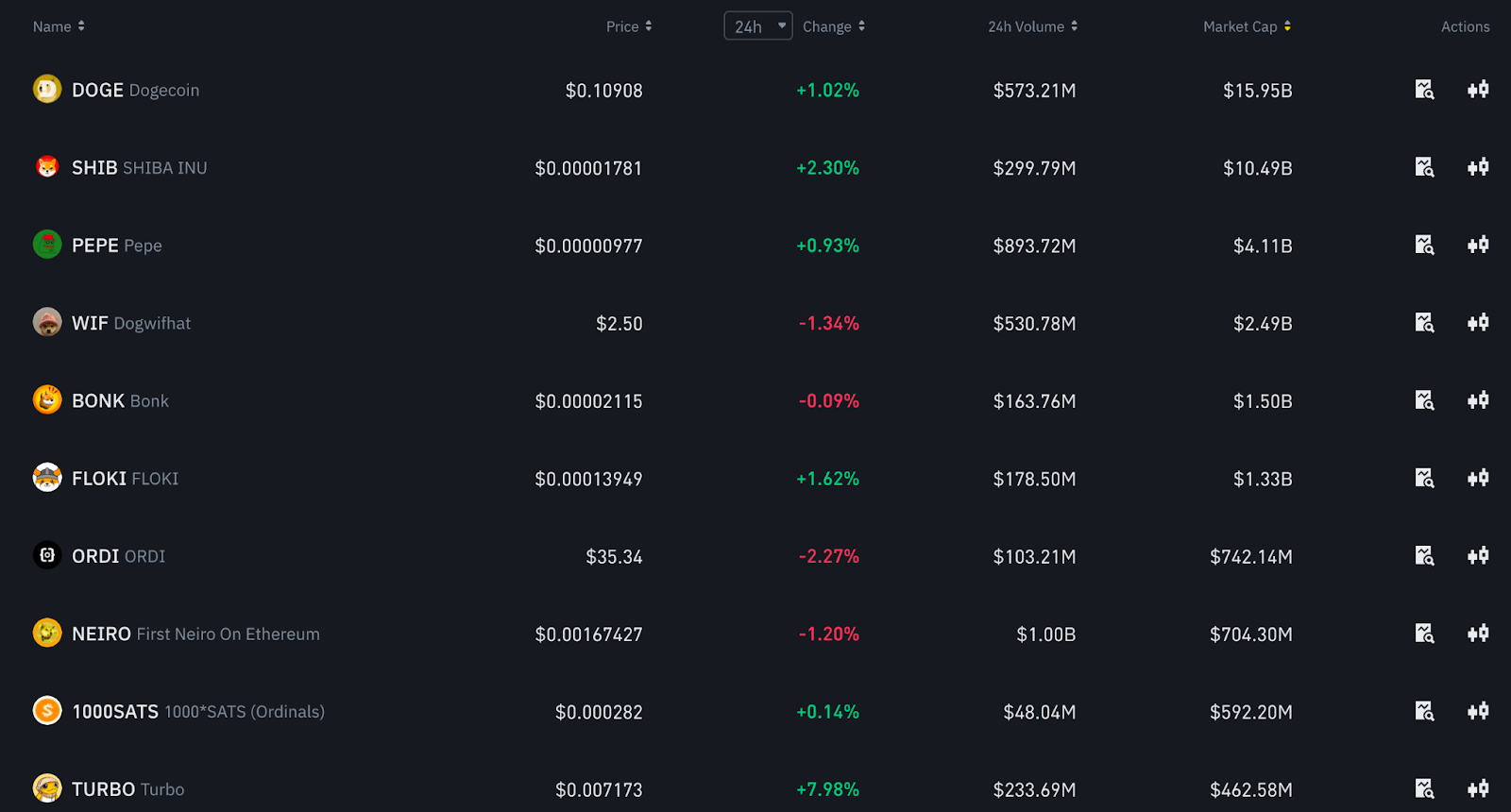

We can see some clues from recent news: On October 7, after Musk’s speech supporting Trump, a trader made a floating profit of $113,000 (+31.5%) in just 17 hours by buying TRUMP and MAGA. In addition to these two larger market cap MEME coins, two smaller market cap MEME coins also saw explosive growth: MABA with a 24-hour increase of 9145.3%, and PAC with a 24-hour increase of 82700%.

Some Meme Concept Coins

(Source: Binance)

Of course, with Musk being the “godfather” of Dogecoin, he directly led MEME concepts to become a mainstream sector in the market. If Trump is elected, some MEME concept coins may see explosive projects. However, MEME tokens are highly volatile and most lack practical applications, being the most concentrated sector for “air coins.” It’s a bit like buying a lottery ticket – extremely low odds of getting rich overnight or losing everything. So don’t FOMO, and prioritize risk control.

Regarding other projects and sectors, Bitcoin, as “digital gold,” has always been viewed as an inflation-resistant asset and would be the biggest beneficiary of Trump’s loose monetary policy. The DeFi sector, as one of the most innovative sectors in the crypto market, would greatly benefit from a free market and loose financial regulatory policies, potentially leading to significant development for its leading projects such as Aave, Uniswap, Compound, and Curve. Additionally, the stablecoin sector and central bank digital currency concepts are worth watching, with specific projects like Chainlink (oracle) and Ripple (cross-border payments).

Trump himself has been banned from mainstream social platforms, making him particularly opposed to tech giants’ monopoly on discourse. Now, decentralized social media and content platforms are becoming a new trend. Therefore, it’s worth paying attention to some decentralized social platforms like Mastodon and Lens Protocol, and decentralized content platforms like Audius and Mirror.

The NFT and metaverse sectors, as the most popular blockchain-related concepts, might continue to develop if Trump wins. NFT marketplaces like OpenSea and Blur, metaverse projects like Decentraland and The Sandbox, as well as NFT assets based on these projects, are all worth watching.

According to a September survey by Fairleigh Dickinson University, about one in seven American voters own cryptocurrency, with 50% of holders supporting Trump and only 38% supporting Harris. It can be said that the current crypto market and Trump are mutually supportive. If Trump successfully becomes the 47th President of the United States, it would generally be positive for the crypto market, greatly increasing the upper limit of Bitcoin’s fourth halving cycle and accelerating the bull market process. However, it might shorten the duration of the bull market, which could be detrimental to the industry’s long-term development. Black swan events potentially triggered by domestic and foreign policies during this period could cause short-term violent fluctuations in the market, resulting in heavy losses for some risk-taking investors in the crypto market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!