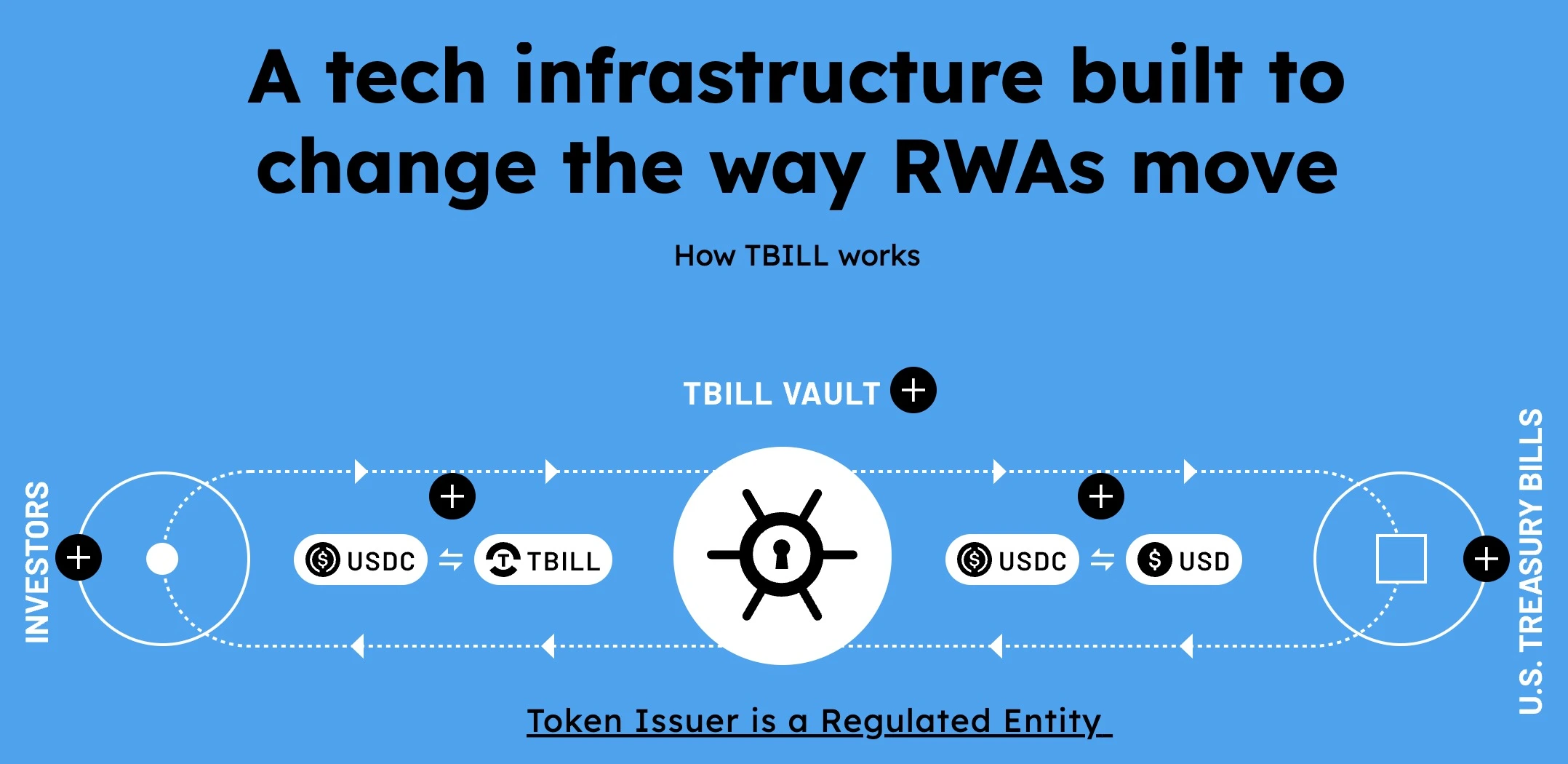

- OpenEden tokenizes U.S. Treasury Bills through T-Bill Vault, providing stable returns and bridging traditional finance with blockchain technology.

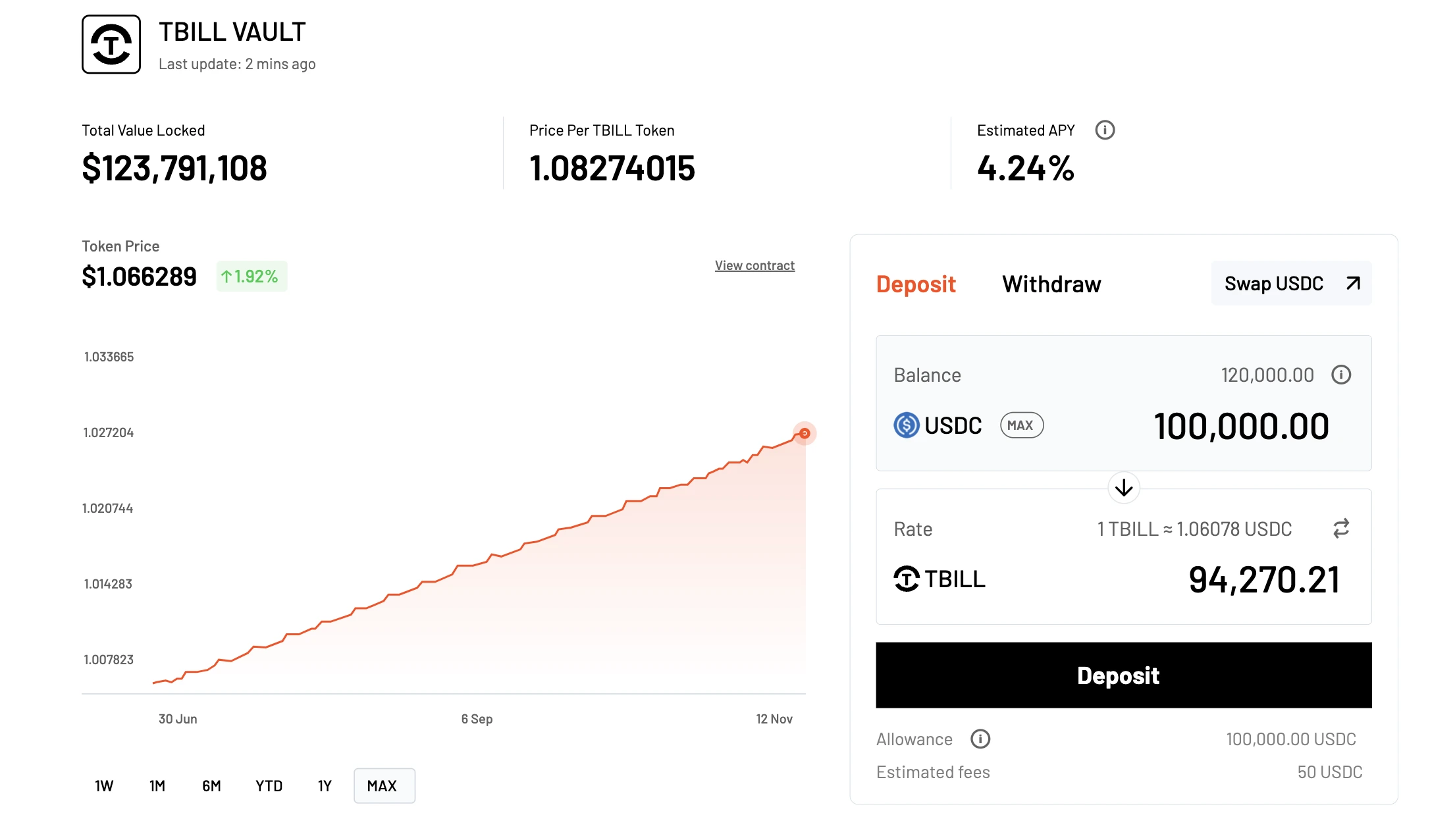

- Since its establishment in 2022, OpenEden’s total value locked (TVL) has exceeded $100 million, attracting over 150 institutional clients and strategic investments.

- OpenEden’s rise is not only a success story in RWA tokenization but also a demonstration of blockchain technology’s potential in traditional finance.

TABLE OF CONTENTS

OpenEden uses U.S. Treasury Bill tokenization through its T-Bill Vault to offer stable, blockchain-based returns. Since its 2022 launch, it has surpassed $100 million in TVL and attracted over 150 institutional clients, with strategic investments like Binance Labs boosting its growth.

As competition in RWA tokenization increases, OpenEden focuses on improving compliance, user experience, and transparency through on-chain reporting. This positions the platform as a bridge between traditional finance and blockchain, offering a secure, efficient alternative for investing in traditional assets.

In an era where blockchain technology is flourishing, the tokenization of real-world assets (RWA) has become a focal point in the industry. As a trailblazer in this field, OpenEden has quickly gained prominence with its innovative tokenized investment model centered on U.S. Treasury Bills (T-Bills).

Since its establishment in 2022, OpenEden’s trajectory—from gaining market attention to receiving strategic investment from Binance Labs—has demonstrated significant growth potential.

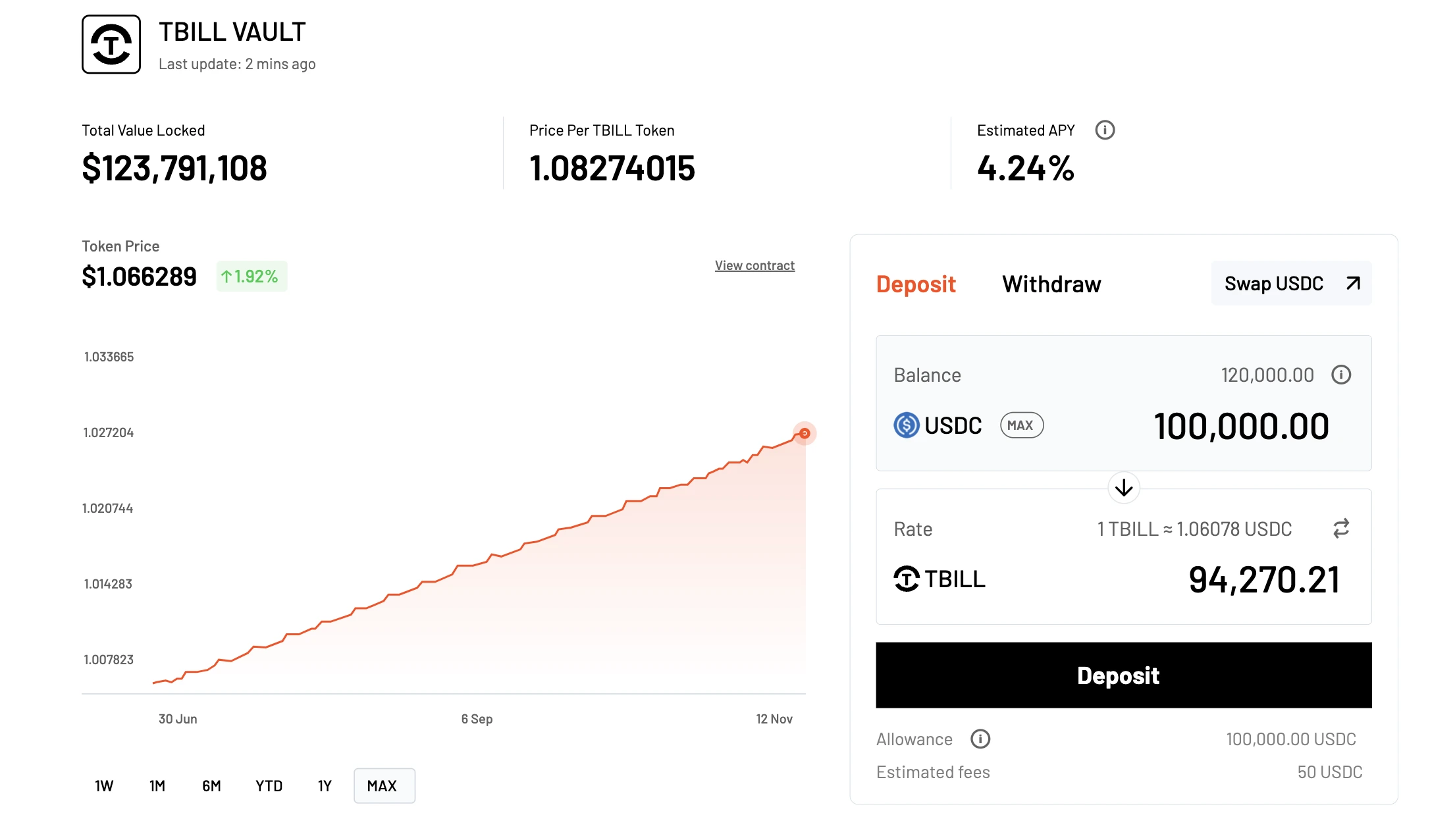

(Source:OpenEden Official Website)

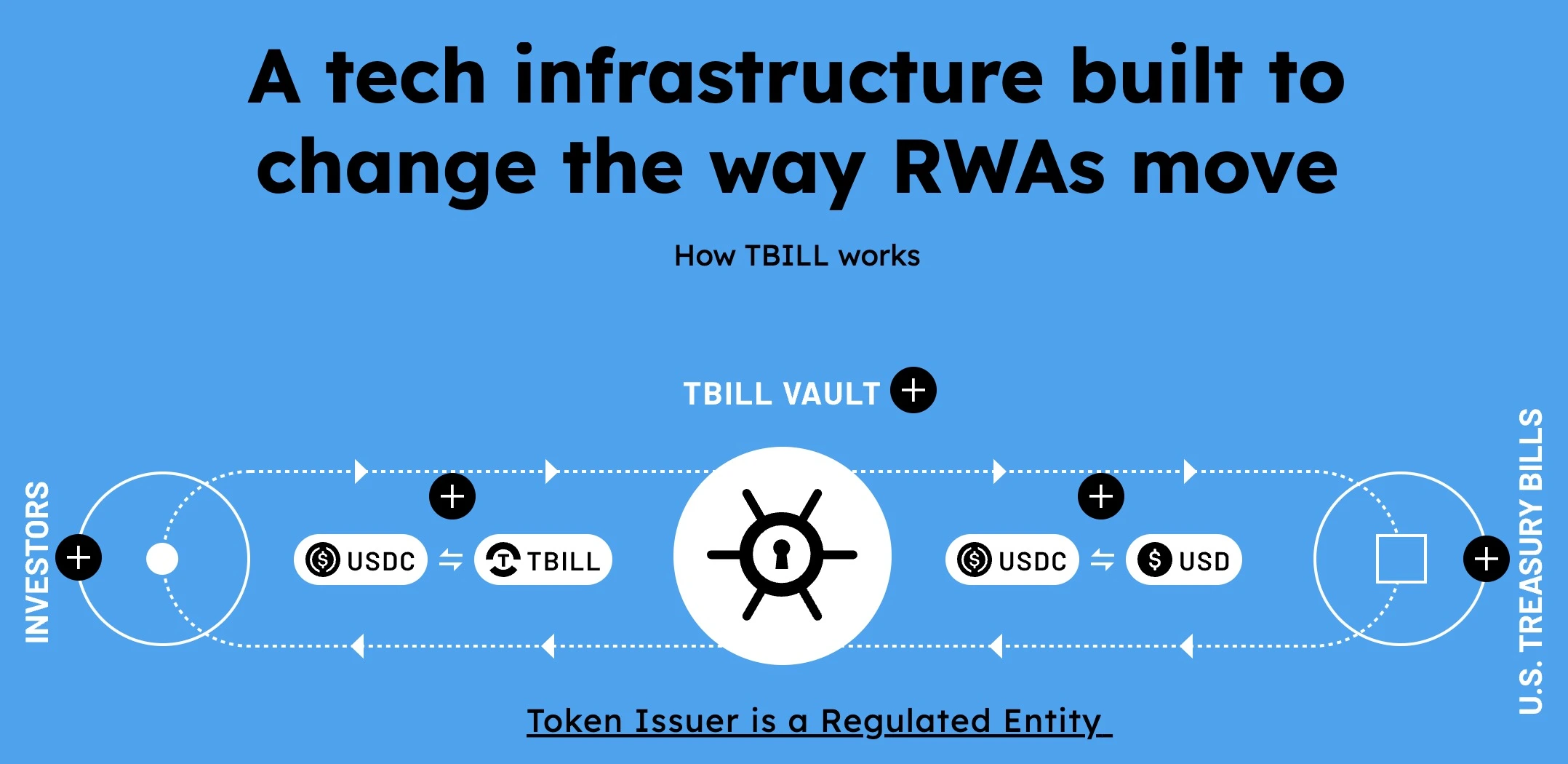

Founded in 2022 by former Gemini executives Jeremy Ng and Eugene Ng, OpenEden aims to bridge the gap between traditional finance and blockchain technology. Its flagship product, T-Bill Vault, leverages tokenization to provide investors with a secure and efficient way to invest in U.S. Treasury Bills.

(Source:OpenEden Official Website)

Verified users can deposit USDC into the platform to mint TBILL tokens equivalent to their investment. These tokens represent the user’s holdings in U.S. Treasury Bills and offer a stable source of returns. By prioritizing transparency and technological innovation, OpenEden seeks to foster trust and encourage more traditional assets to migrate onto the blockchain.

In September 2024, Binance Labs announced a strategic investment in OpenEden, marking a significant endorsement of its business model and solidifying its position in the market. Following this development, OpenEden’s growth accelerated, with the platform recently reporting that the total value locked (TVL) in tokenized T-Bills exceeded $100 million. This milestone has attracted over 150 institutional clients and numerous individual investors.

This achievement not only highlights OpenEden’s market appeal but also sets a benchmark for the RWA sector. Amid market volatility and increased regulation of decentralized finance (DeFi), OpenEden offers a solution that combines stability and profitability.

CORE OPERATIONAL MECHANISM

OpenEden’s operational framework reflects a seamless blend of technology and finance, with innovative mechanisms designed to ensure safety and convenience for investors:

1. Asset Investment

Users’ USDC deposits are used to purchase U.S. Treasury Bills, with equivalent TBILL tokens minted via smart contracts. These tokens represent investors’ asset shares, with returns linked to the performance of the real-world treasury bills.

2. Liquidity Assurance

A dynamic reserve mechanism ensures funds can be redeemed at any time, mitigating liquidity risks while providing flexibility.

3. Transparency and Compliance

OpenEden publishes monthly asset reports and audit results to enhance transparency. Plans are underway to integrate Chainlink’s Proof of Reserve (PoR) system for real-time off-chain data monitoring, further bolstering user confidence.

4. User Experience

Investors can use self-custody wallets to complete KYC, mint TBILL tokens, and earn stable returns. The process is simple and streamlined, appealing to both institutional clients and individual investors.

COMPETITIVE LANDSCAPE: ANALYSIS OF TWO MAJOR RIVALS

OpenEden operates in a competitive RWA tokenization field alongside several notable players. Here’s an analysis of its key competitors and differentiation:

1. Ondo Finance

(Source:Ondo Finance Official Website)

Focused on institutional investors, Ondo offers tokenized funds backed by U.S. Treasury Bills and corporate bonds (e.g., OUSG) with yields of around 4.65%. Its integration with the Flux lending protocol adds to its product line, but its higher participation thresholds cater exclusively to qualified investors with KYC and AML clearance.

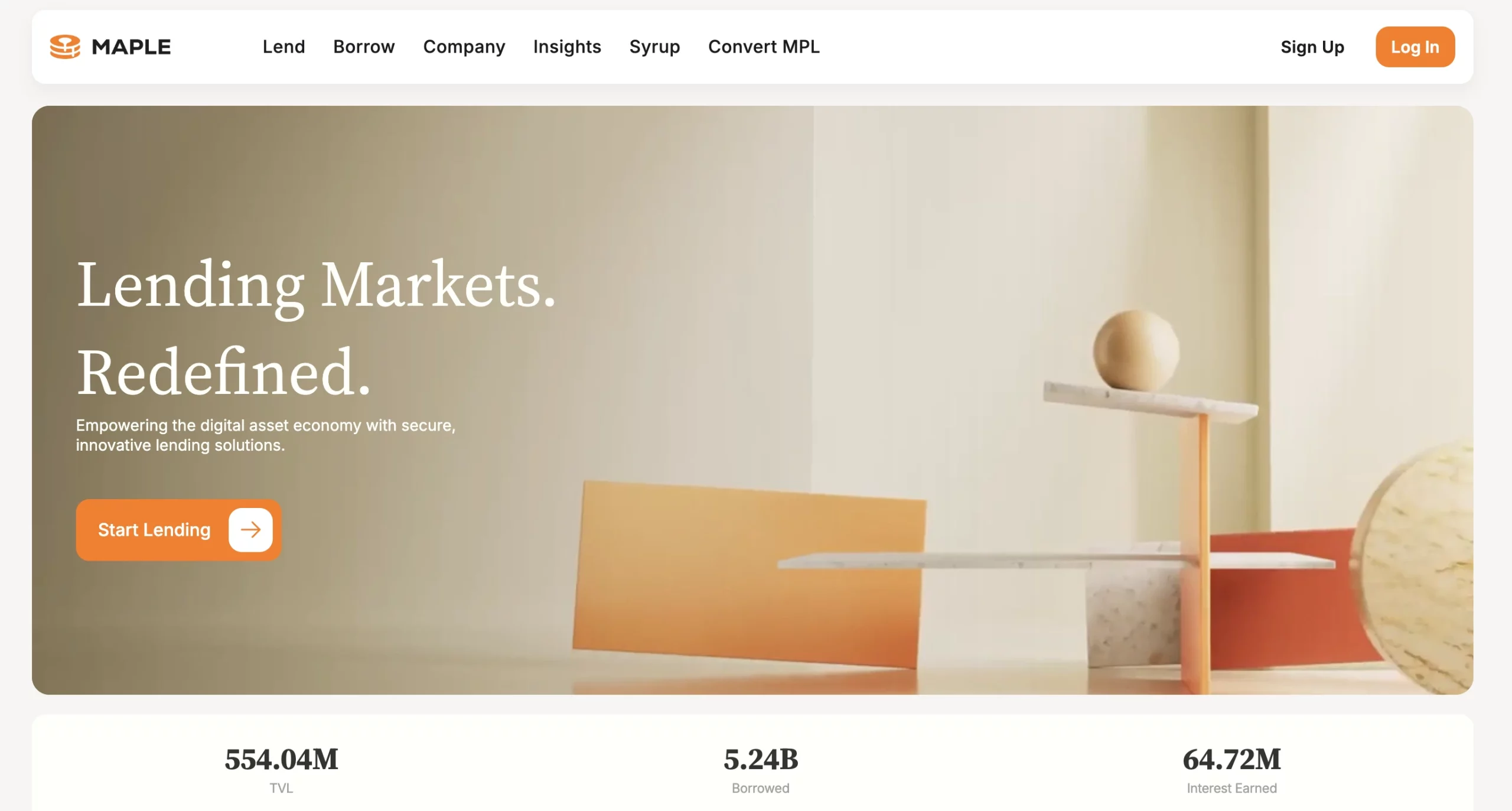

2. Maple Finance

(Source:Maple Finance Official Website)

Known for institutional credit services, Maple Finance’s lending pools support short-term U.S. Treasury Bill investments, with annual yields of approximately 4.7%. While its smart contract management enhances flexibility, its clientele mainly comprises offshore companies and non-U.S. DAOs.

FUTURE OUTLOOK: THE NEXT CROSSROADS FOR ON-CHAIN TREASURY BILLS

OpenEden’s rise is not only a success story in RWA tokenization but also a demonstration of blockchain technology’s potential in traditional finance. However, as competition intensifies and regulatory frameworks remain underdeveloped, OpenEden must further enhance compliance, refine user experience, and expand market reach.

Advancements in blockchain technology provide the infrastructure to make asset tokenization more efficient and transparent. Developments in smart contracts, DeFi protocols, and dedicated oracles will further improve liquidity and tradability in the RWA market. Combining RWA and DeFi can create innovative financial tools and use cases, driving the evolution of the entire financial ecosystem.

CoinRank x Bitget – Sign up & Trade to get $20!