KEYTAKEAWAYS

- Polymarket’s trading volume hits a record $100M in June, fueled by heightened betting on the US presidential election.

- The 'Biden replacement' controversy sparks debate and potential shifts in the Democratic campaign strategy.

- Vitalik Buterin, Ethereum co-founder, emphasizes the transformative potential of prediction markets in shaping future cryptocurrency trends.

CONTENT

Polymarket’s trading surge as presidential betting heats up, with Trump leading at 63% and Biden at 18%, amid controversies and the influence of crypto on the campaign trail.

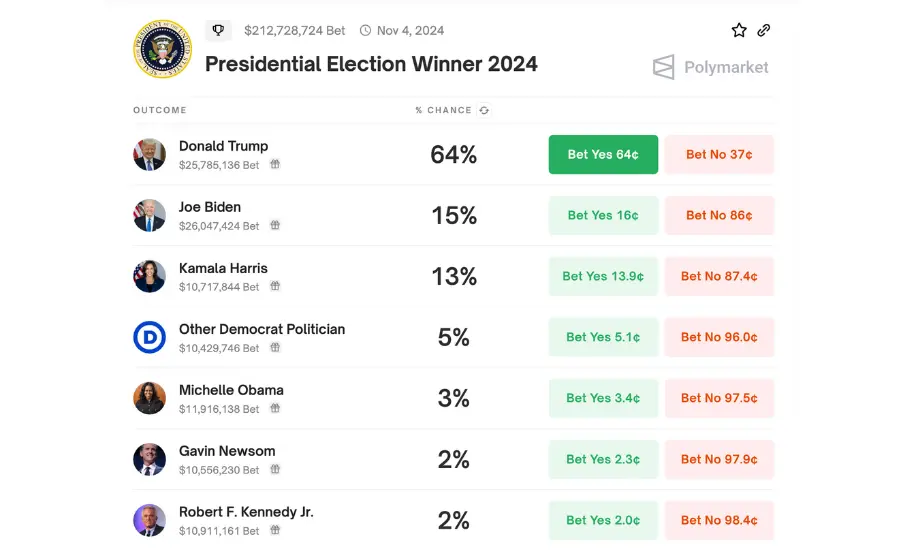

Amid the fervor of the US presidential elections, the decentralized betting platform Polymarket saw its monthly trading volume exceed $100 million for the first time. According to real-time predictions from Polymarket, Trump is currently leading with a 63% chance of victory, followed by Biden at 18%. Additionally, due to the “Biden replacement” controversy, the odds for three other presidential candidates have also increased.

(source: Polymarket)

The US presidential election will officially take place on November 5 this year. Former President Donald Trump, representing the Republican Party, is actively campaigning to challenge the incumbent President Joe Biden for reelection. However, unlike previous elections, both Trump and Biden are courting the crypto community by announcing positive news for the sector.

>>> Read more:

PRESIDENTIAL ELECTION BETTING FRENZY

Polymarket’s trading volume in June surpassed $100 million for the first time, mainly due to investors increasing their bets on the outcome of the US presidential election. According to real-time data from Polymarket, the current betting value for the “Presidential Election Winner 2024” stands at $212 million, encompassing multiple betting options.

Among them:

- Former US President Trump is the most popular candidate, with a 65% chance of winning and a total bet amount of $25.76 million.

- Incumbent President Biden’s chances have dropped from 34% to 15%, with a corresponding total bet amount of $25.97 million. The decline may be related to his lackluster performance in the presidential debate on June 28.

- Several independent candidates also have chances below 5%.

DEMOCRATIC PARTY FACES ‘BIDEN REPLACEMENT’ CONTROVERSY

Moreover, due to concerns that the first debate might lead to a collapse in the election campaign, the traditionally Democratic-leaning New York Times recently published an editorial with the bold headline, “To Serve His Country, President Biden Should Leave the Race.” Several New York Times columnists have also unusually aligned in calling for Biden to withdraw, with Democrats and some major donors discussing the possibility of a leadership change before the election.

POLYMARKET TRADING UP 620% IN FIRST HALF

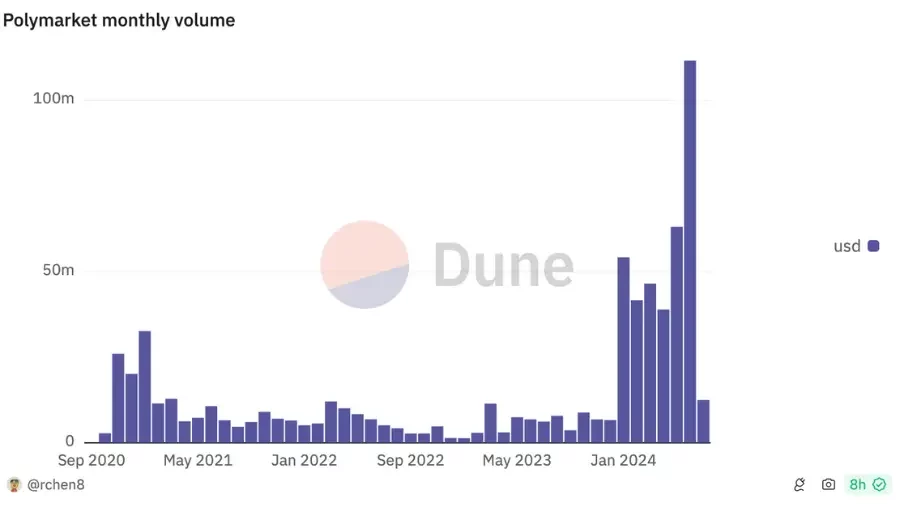

On another note, according to data from Dune Analytics, Polymarket’s trading volume in June on the Ethereum sidechain Polygon was $111 million, surpassing the $100 million mark for the first time.

(source: Dune Analytics)

From January to May, Polymarket’s trading volume fluctuated between $38.9 million and $63 million, marking a 620% growth compared to the previous five months (August to December 2023).

Apart from the US presidential election, predictions on cryptocurrency prices and the UEFA Euro 2024 (June 14 to July 14) also contributed significantly to Polymarket’s trading volume.

HIGH POTENTIAL OF PREDICTION MARKETS

While prediction betting is illegal in most countries, Coinbase’s chief engineering officer stated that decentralized prediction markets serve as a means to eliminate “misleading narratives” and reveal the truth:

.@Polymarket‘s astronomical success is the most important story in crypto right now, but it’s so obvious that we are ignoring it, when we should be screaming it from the rooftops.

Prediction markets are the purest technological manifestation of liberal democracy. They take free… pic.twitter.com/XlubHYDicq

— yuga.eth 🛡 (@yugacohler) June 30, 2024

Notably, Ethereum co-founder Vitalik Buterin, also an investor in Polymarket, published a tweet on June 12 outlining multiple future directions for cryptocurrencies, including prediction markets.

* zk reputation/identity/credentials

* p2p cross-border payments (much lower fees and quickly improving UX this cycle)

* decentralized social

* prediction markets (actually usable this cycle)

* privacy

* enterprise apps via zk validiums

* zk + censorship resistant voting— vitalik.eth (@VitalikButerin) June 12, 2024

>>> Read more: