KEYTAKEAWAYS

- Long-term Bitcoin holders and miners have sold over $1.2 billion in Bitcoin recently, contributing to the market slump.

- The current economic backdrop and competition from AI and tech stocks are diverting investments away from cryptocurrencies.

- The influx of new altcoins, especially memecoins, is diluting market funds, delaying the anticipated altcoin season.

CONTENT

Bitcoin’s slump is due to sell-offs, economic factors, and competition with AI. Explore the causes behind the crypto market’s poor performance and delayed altcoin season.

The crypto market has been experiencing a pretty notable slump, with Bitcoin and altcoins showing continuous drops. Why? CoinRank has analyzed the current situation and the potential causes, ranging from market cycles to competition with the AI sector. Take a look.

>>> Read more: 2024 June Crypto Market Analysis

RECENT NOT-SO-GOOD MARKET PERFORMANCE

According to a report by CryptoQuant, long-term Bitcoin holders and miners have been the biggest sellers in the past two weeks, offloading over $1.2 billion worth of Bitcoin, likely through over-the-counter (OTC) trades. The U.S. Bitcoin spot ETF has seen over $600 million in outflows in the past few days, marking the worst performance since late April. Since Bitcoin hit $70,000 at the end of May, the number of Bitcoin holders has been gradually decreasing, with retail traders showing little interest in buying the dip.

FOUR-YEAR CYCLE AND POST-HALVING EFFECTS

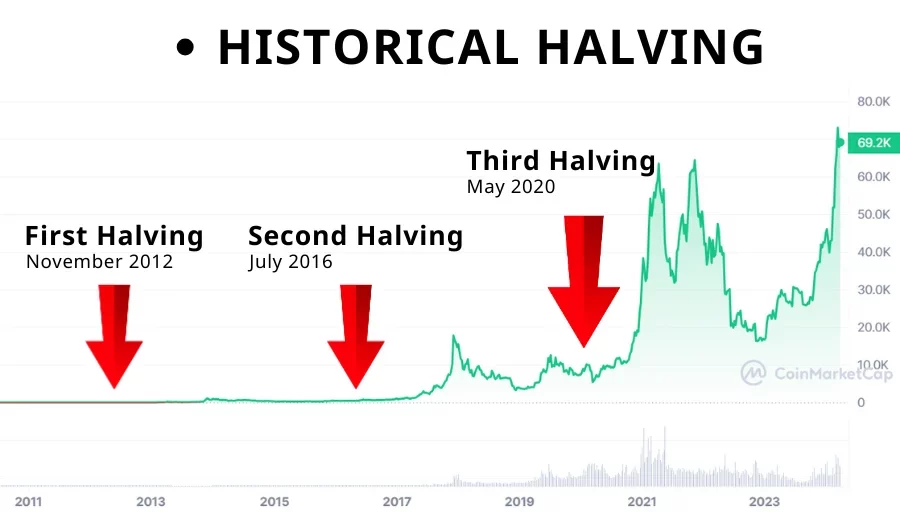

We should also consider the common four-year cycle in the crypto world, which revolves around Bitcoin’s halving events. These events have historically led to price increases followed by periods of decline. Previous halvings occurred in November 2012, July 2016, and May 2020, each resulting in significant price increases within 12 to 18 months.

- The first halving saw a 92-times increase within a year,

- the second a 30-times increase over 17 months,

- and the third an 8-times increase over 18 months.

As Bitcoin’s market cap grows, the price increase after each halving becomes smaller, which is likely inevitable.

The most recent Bitcoin halving occurred just two months ago. Based on historical patterns, it may be too early to expect immediate price surges. This cycle has already seen Bitcoin rise from a 2022 low of around $16,000 to over $60,000, representing a 3-4x increase.

DIFFERENT ECONOMIC BACKDROP AND MARKET COMPETITION

Aspect 1

The current economic backdrop is significantly different from previous bull markets. In early 2020, the COVID-19 pandemic caused the U.S. economy to plunge, leading the Federal Reserve to implement zero interest rates and quantitative easing policies. This injected a large amount of capital into the market, making borrowing easy and causing a surge of hot money.

Currently, we’ve just experienced the strongest interest rate hike cycle in history. Although the Federal Reserve is expected to lower rates soon, it hasn’t started yet, meaning the money in the market remains the same, with no signs of increasing.

Aspect 2

Different markets are now competing for the same pool of money. Recently, AI, NVIDIA, Apple, semiconductor, and tech stocks have become new favorites. The launch of Bitcoin spot ETFs has allowed traditional investors to easily allocate funds to Bitcoin, but they can also quickly withdraw if other investments seem more attractive. This means the crypto market is now competing more directly with traditional markets for the same pool of funds.

>>> Read more:

- Tech Giants’ Q1’24 Performance – How Financial Forecasts Shape Stock Prices

- AI Stocks: 10 AI Companies to Invest In 2024

Aspect 3

Some analysts believe that the AI sector might be competing with cryptocurrencies not just for investment attention but also for resources. After this Bitcoin halving, mining rewards have decreased, and bitcoin miners are reportedly shifting their focus to the AI sector, which has a huge demand for high-performance computers and computing power. Unless Bitcoin’s price rises significantly, many smaller miners might find it unprofitable. This transition might involve gradual selling of Bitcoin holdings.

IS IT ALTCOIN SEASON YET?

Many of us have been anticipating an altcoin season, a period where various altcoins see significant price increases, often surpassing Bitcoin’s gains. However, this hasn’t materialized yet. Analyst Miles Deutscher suggests that the sheer number of new altcoins entering the market might be a contributing factor. The total number of cryptocurrencies has tripled from 2021 to 2023, with over a million new tokens emerging since April, many being memecoins on Solana. This influx creates a daily supply pressure of $150-200 million worth of new coins, diluting market funds and scattering attention.

A MAJOR fundamental flaw in crypto is starting to emerge.

It’s the #1 reason why altcoins are underperforming this cycle.

And currently, there seems to be no fix.

I just dug through all the data (what I found was shocking).

🧵: How altcoin dispersion is killing crypto.👇

— Miles Deutscher (@milesdeutscher) June 18, 2024

IN A PERIOD OF BOREDOM

Before Bitcoin reaches a new clear peak, the market might go through a period of consolidation. True new highs would involve not just breaking $74,000 but staying well above it consistently.

Ultimately, the crypto market’s performance is tied to the overall economic situation. Right now, we can only wait for economic conditions to improve and the total money supply to increase, then perhaps, shall we see the anticipated crypto boom.

>>> Read more:

- Crypto 2024: Predicting When Crypto Market Will Go Up

- Current Market: Playing Against the Federal Reserve – May 31, 2024

- Crypto Bear Market – What Causes It and Investment Advice During Recessions