KEYTAKEAWAYS

- Solana's price and institutional interest surge, with a 31.1% increase in value and significant growth in daily trading volumes.

- ETF applications by VanEck and 21Shares spotlight Solana's potential, fueled by U.S. political dynamics and regulatory shifts.

- Predicted growth scenarios for Solana range up to 8.9x, contingent on successful U.S. ETF approvals and market conditions.

CONTENT

Solana’s ETF buzz grows with 31.1% price gains and increased institutional interest. Potential 8.9x growth if U.S. approvals align with bullish market trends.

>>> Read more:

With Bitcoin and Ethereum spot ETF hype cooling off, Solana has emerged as the new favorite for capital inflows and ETF speculation. Strong fundamentals, institutional accumulation, and the U.S. election further fueled bullish sentiment for Solana. CoinRank will break down the main reasons for SOL’s recent outperformance in this article.

SOLANA’S METRICS SURGE ATTRACTS INSTITUTIONS

Price Action and Market Outperformance

According to CoinGecko data, SOL price recently hit a three-month high, outperforming Bitcoin, Ethereum, and other major cryptos with about 31.1% gains over the past 30 days.

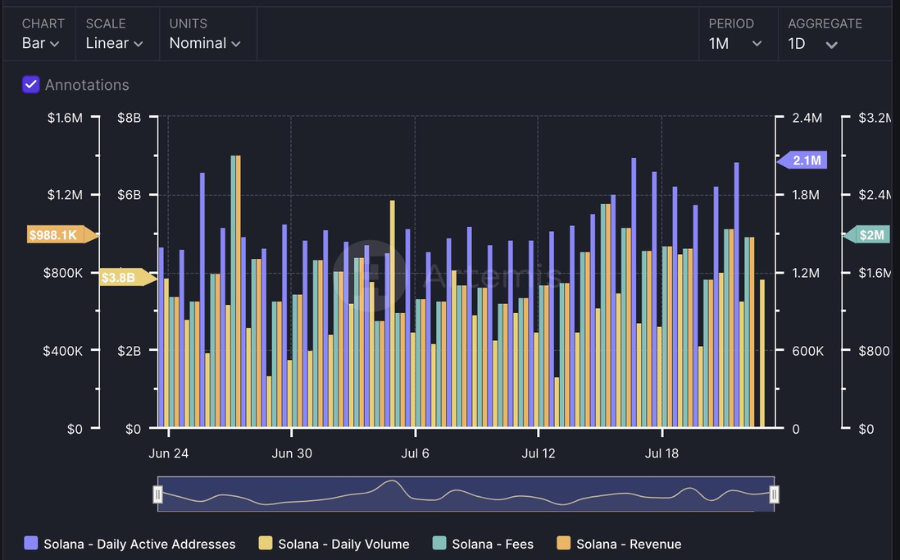

(source: Artemis)

Meanwhile, Artemis data shows that over the past month, Solana’s daily trading volume grew 40.5% to $43.7 million; daily active addresses surged 75% to 2.1 million, mainly from wallet, meme, and cross-chain bridge sectors, with a higher proportion of new user addresses; TVL rose to $5.2 billion, up 26.9%; daily fees increased over 33.3% to $2 million, and daily revenue jumped over 33.1%, with wallets, DeFi, and MEV as the main contributors.

Additionally, Blockworks Research analyst Ryan Connor recently tweeted that Solana has overtaken Ethereum in DEX trading volume over the past 30 days, making it the most used chain by this metric.

The case for the SOLETH relative value trade is only strengthening

ETH’s mcap and P/S ratio sit near cycle highs, SOL’s P/S is at ATLs

ETH’s revenue is in secular decline, SOL’s is at ATHs & growing

ETH continues to bleed market share of total DEX volume, SOL’s is at ATHs and… pic.twitter.com/hjeukmLqML— Ryan Connor | BWR 🟪 (@_ryanrconnor) July 1, 2024

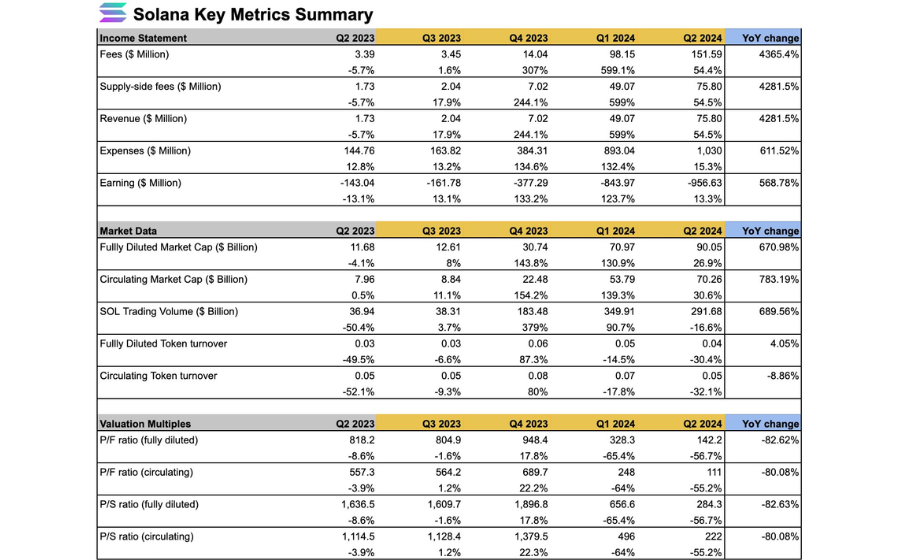

According to a Coin98 Analytics report, Solana’s fees and revenue saw massive growth in Q2 this year, generating over $26 million in revenue, up 42x year-over-year; SOL’s total trading volume reached $292 billion, nearly 7x higher than the same period last year. Dune data shows Solana’s liquid staking rate rose to 6.58%, up 1.76% QoQ in Q2, with the top three providers’ dominance dropping from 93% to 68.7%, indicating a healthier and more diverse market.

(source: Coin98 Analytics)

Institutional Accumulation Accelerates

With Solana’s strong fundamentals, several institutions have recently begun publicly accumulating Solana.

For example, Canadian fintech company DeFi Technologies announced adding Solana to its digital asset reserves, now holding 12,775 SOL (about $2.03 million); Canadian listed investment firm Cypherpunk significantly increased its SOL holdings to over 63,000 tokens and announced it will run its own Solana validator, staking 49,917 tokens (worth about $11 million) using its own Solana node.

“We are now addressing the increasing investor interest in Solana—the third most actively traded cryptocurrency after Bitcoin and Ether,” Cboe’s Global Head of ETP Listings commented on the Solana ETF 19b-4 filing. Rennick Palley, founding partner of crypto VC fund Stratos, also stated that the easing of U.S. regulatory policies is increasing SOL’s appeal among professional investors.

SOLANA ETF RACE HEATS UP AMID POLITICAL UNCERTAINTY

Solana’s impressive market performance has made Solana spot ETF applications one of the key catalysts, and it’s considered one of the most likely and highly anticipated ETF products.

On June 27, VanEck announced it had filed with the SEC for the VanEck Solana Trust, the first Solana ETF application in the U.S. If approved, the ETF would list on Cboe BZX Exchange. 21Shares quickly joined the application frenzy, filing an S-1 for a Solana spot ETF with the SEC, planning to list the 21Shares Core Solana ETF on Cboe BZX Exchange. Digital asset manager 3iQ also recently applied for a Solana ETF in Canada, planning to list under the ticker $QSOL, marking North America’s first Solana ETF application.

Meanwhile, Franklin Templeton recently expressed bullishness on Solana, stating:

Besides Bitcoin and Ethereum, there are other exciting and major developments that we believe will drive the crypto space forward. Solana has shown major adoption and continues to mature, overcoming technological growing pains and highlighting the potential of high-throughput,…

— Franklin Templeton Digital Assets (@FTI_DA) July 23, 2024

Nate Geraci, President of The ETF Store, also recently revealed on X:

Prediction…

An ETF issuer will file for combined spot btc, eth, & sol ETF in next few months.

We’re quickly heading down path towards index-based & actively managed crypto ETFs.

— Nate Geraci (@NateGeraci) July 22, 2024

VanEck, 21Shares, and Franklin Templeton are all U.S. Bitcoin and Ethereum spot ETF issuers, and their involvement and statements have undoubtedly increased external expectations for a Solana spot ETF. Currently, Cboe has submitted 19b-4 forms to the SEC for VanEck and 21Shares’ Solana ETFs.

With market sentiment ignited, political dynamics under the U.S. election further boost the possibility of Solana spot ETF approval. In fact, as Republican candidate Trump’s campaign probability rises, SEC Chair Gary Gensler, an aggressive regulator, is seen as increasingly likely to “step down.” Markus Thielen, founder of 10x Research, even predicts that although Gensler’s term ends on June 5, 2026, he’s likely to resign in January or February 2025 when President Biden’s term ends. Previously, the SEC had repeatedly characterized SOL as an unregistered security, making its approval path more difficult.

Mattew Sigel, Head of Digital Assets Research at VanEck stated on X:

“VanEck Solana ETF filing May Be Bet on Trump Win”

Can confirm, @JSeyff ✅ pic.twitter.com/MPPtVAkey9

— matthew sigel, recovering CFA (@matthew_sigel) July 1, 2024

noting that crypto voters could play a crucial role in the election, and Washington’s regulatory environment is evolving to be more crypto-friendly.

The path from futures to spot funds for Bitcoin and Ethereum was merely Gensler’s psychological tactic. Bloomberg ETF analyst James Seyffart also pointed out that the final deadline for a Solana ETF is mid-March 2025. However, the most important date in this period is November. There’s only a chance for launch sometime in 2025 if there’s new leadership in both the White House and SEC.

SOLANA’S POTENTIAL 8X GROWTH

Looking at capital inflows from Bitcoin spot ETF approvals, if Solana officially joins this ETF trend, it will directly stimulate prices. According to predictions from renowned crypto market maker GSR Markets, if the U.S. launches a Solana spot ETF, assuming bear market, baseline, and ideal scenarios with inflows at 2%, 5%, and 14% of Bitcoin inflows respectively, and Solana’s market cap averaging 4% of Bitcoin’s over the past year, SOL could potentially grow 1.4x in a bear market, 3.4x in the baseline scenario, and 8.9x in the ideal scenario.

>>> Read more:

▶ Buy Solana at BingX

Sign up to claim 5,000+ USDT in rewards & 20% off trading fees!