KEYTAKEAWAYS

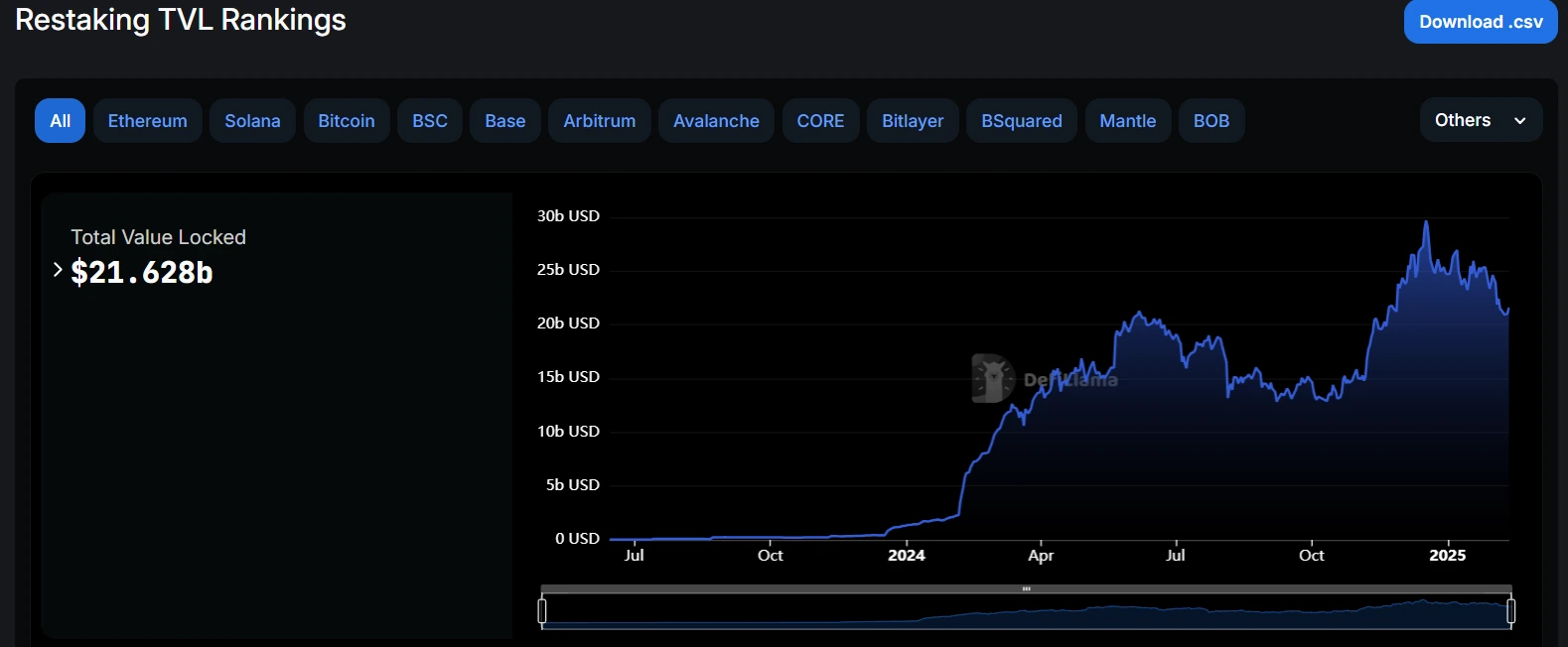

- Total Restaking TVL has reached $21.628 billion.

- Restaking TVL is primarily concentrated on Ethereum.

- The Restaking TVL in the Solana ecosystem is $321.69 million.

- The largest Restaking protocol in the Solana ecosystem is Solayer.

CONTENT

Total Restaking TVL has reached $21.628 billion. Restaking TVL is primarily concentrated on Ethereum. The Restaking TVL in the Solana ecosystem is $321.69 million. The largest Restaking protocol in the Solana ecosystem is Solayer.

Restaking is a simple yet influential concept in the blockchain space. It allows staked assets to be reused across multiple decentralized services, thereby enhancing the security and integrity of these services. Currently, Ethereum is the main battleground for restaking, but with Solana’s rapid development in this bull market, its low cost, high throughput, and strong network effects make it a potential hot track for restaking. This article will explore the market opportunities for Solana restaking, including its ecosystem maturity, innovation potential, network scalability, and optimization of DeFi capital efficiency.

THE CONCEPT AND ADVANTAGES OF RESTAKING

The core idea of restaking is to allow staked assets to be reused across multiple decentralized services. This approach brings several advantages:

- Enhanced Security: Restaking allows decentralized services to leverage L1’s economic security without spending significant resources designing their own security models.

- Improved Capital Efficiency: A single asset can provide security guarantees for multiple decentralized services simultaneously, potentially yielding higher capital returns.

CURRENT STATE OF THE RESTAKING MARKET

According to DeFiLlama data, the total Restaking TVL is $21.628 billion. Restaking TVL is primarily concentrated on Ethereum, as it is considered the PoS blockchain with the highest economic security and widest adoption currently. The Ethereum mainnet has 34.3 million ETH staked (worth approximately $14.17 billion), 4,701 block validators, six consensus clients, and as one of the most historically established and reliable public chains for application development, it enjoys an extremely high industry reputation. EigenLayer is the protocol with the largest restaking TVL at $12.18B.

Source: DefiLlama

The Solana restaking market has risen to second place network-wide (excluding the Jito protocol). The Bitcoin ecosystem has a total restaking TVL of $6.3B, the Solana ecosystem has a total restaking TVL of $321.69M, and the BSC ecosystem has a total restaking TVL of $318M.

Source: DefiLlama

SOLANA RESTAKING POTENTIAL

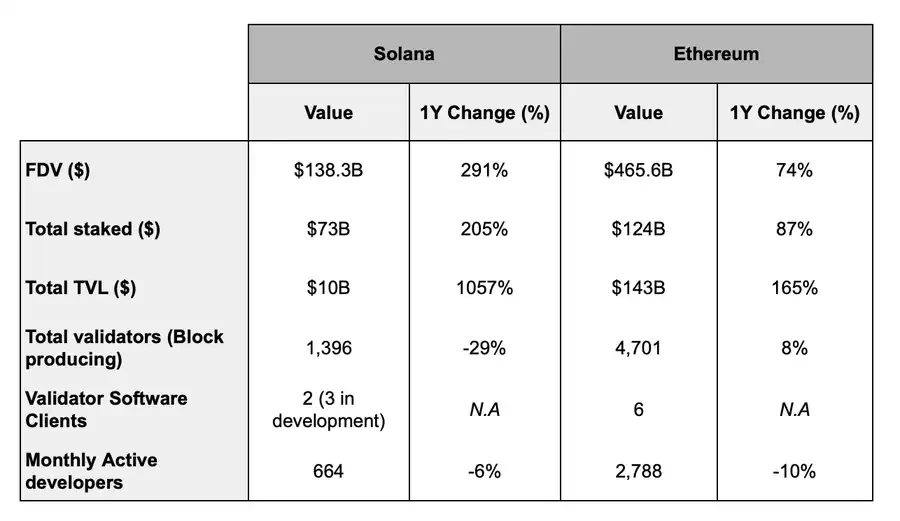

Solana’s Maturity. Solana has reached sufficient maturity to support restaking. Currently, approximately 65% of SOL’s circulating supply is staked, with a total value of about $73 billion (up from $24 billion a year ago). Additionally, Solana has nearly 1,400 block validator nodes and supports two existing client validators, with plans to add new clients including Firedancer, Sig, and Agave in the future.

Solana’s Low Cost and High Throughput. Solana is known for its extremely low transaction costs and fast transaction speeds, with continuously rising adoption rates among users and developers. Solana is currently the public chain with the fastest application development in the crypto industry, not only achieving true organic growth but also successfully overcoming the cold start problem and establishing strong network effects.

Design Space for Solana Restaking. Solana’s architecture allows developers to create richer application forms at the L1 level. Therefore, Solana’s restaking design space is larger than Ethereum’s. First, Solana’s low transaction and computation costs lower the entry barrier for Node Consensus Networks (NCNs). Second, NCNs on Solana can handle more complex operations, and code can be deployed with higher density without affecting on-chain computational capacity.

Source: DefiLlama

Validator Restaking Tokens (VRTs). In terms of Validator Restaking Tokens (VRTs), Solana also has significant advantages over Ethereum. On one hand, Solana’s low costs can substantially reduce the operational costs for VRT providers. On the other hand, liquid restaking on Solana is also more affordable for users, as low transaction costs lower the barrier to participation.

SOLANA RESTAKING’S INNOVATION POTENTIAL

Network Expansion and Innovation. Restaking can bring new design possibilities for Solana network expansion and “network scaling” initiatives. The design space is extremely broad, and while it’s not yet clear how this mechanism will be specifically implemented, it’s likely to evolve into a powerful infrastructure-level scaling tool.

Security Guarantees. The strong security guarantees provided by restaking can effectively enhance Solana network reliability. For example, the Jito TipRouter NCN is under development, aiming to decentralize MEV tip distribution and enhance its security.

SOLANA RESTAKING’S OPTIMIZATION OF DEFI CAPITAL EFFICIENCY

Restaking offers higher annual yields compared to regular staking on Solana. Since one of DeFi users’ core objectives is to optimize capital efficiency, restaking becomes an extremely attractive option. It allows DeFi users to unlock new yield opportunities on Solana without additional capital investment.

Restaking on Solana is still in its early experimental stages, but it has already shown enormous potential, with many interesting use cases gradually emerging. If we assume that, in the long term, Solana could capture a market share comparable to Ethereum’s restaking market, the market opportunity would be considerable.

Currently, Solana’s restaking infrastructure is primarily dominated by two core protocols: Solayer and Jito (Re)staking. As a pioneer, Solayer has built a complete restaking stack and achieved over $350 million in TVL.

We can see that the Solana restaking market not only has huge potential but is also likely to occupy an important position in the future DeFi ecosystem. As technology continues to advance and the ecosystem matures, Solana restaking will bring more opportunities and possibilities for users and developers.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!