KEYTAKEAWAYS

- Solana’s on-chain fee revenue has exceeded Ethereum’s by twofold, with TVL maintaining above $7.5 billion

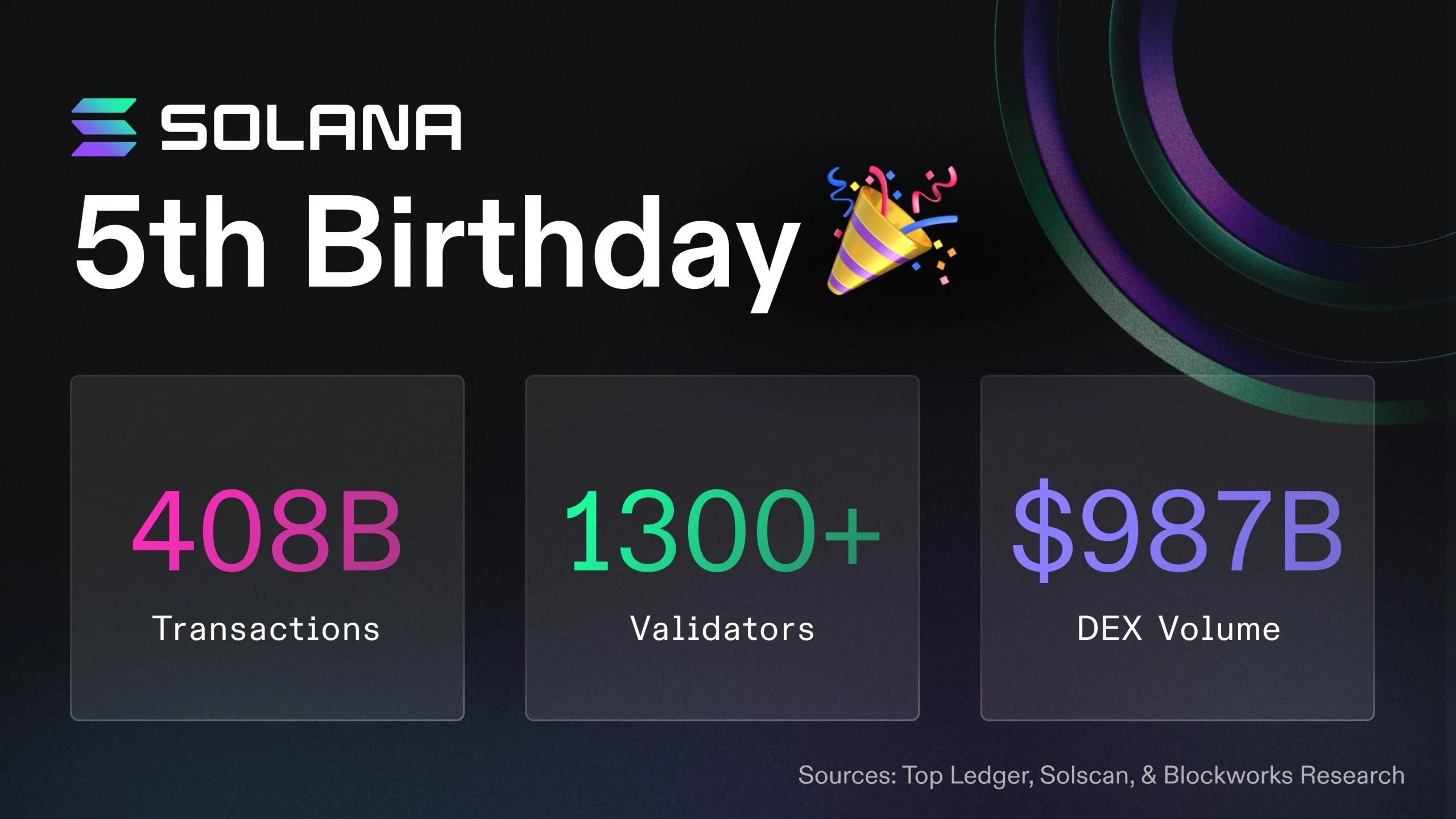

- A total of 408 billion transactions, 1,300 validator nodes, and $987 billion in DEX trading volume on the Solana chain

- The Solana ecosystem, centered on DeFi, Meme coins, NFTs, games, and AI integration applications

CONTENT

On March 16, 2025, when Solana’s official Twitter account posted that futuristic fifth anniversary poster, the blockchain world suddenly realized: this public chain, once mockingly called the “outage chain,” had grown amid controversy to become a top-five cryptocurrency giant by market cap. The statistics on the poster were staggering—408 billion transactions, 1,300 validator nodes, $987 billion in DEX trading volume. Behind these numbers lies an infrastructure that processes tens of thousands of transactions per second, an average transaction cost of $0.00025, and an ecosystem epic written in code by developers worldwide.

At the Solana fifth anniversary celebration in Miami Beach, co-founder Anatoly Yakovenko revealed: “Five years ago, our biggest bet was believing the world needed a public chain with true internet-level performance. Now, that judgment is being proven right.”

SOLANA’S FIVE-YEAR REPORT CARD

Since its birth in 2020, Solana has become a benchmark public chain in the blockchain field thanks to its high throughput and low transaction costs. On its fifth anniversary, the official team released a series of impressive statistics:

- On-chain Transaction Volume: Accumulated over 408 billion transactions, processing millions of transactions daily, far exceeding other public chains combined;

- Validator Nodes: Over 1,300 validators worldwide, continuously increasing network decentralization;

- DEX Trading Volume: Decentralized exchanges (DEXs) reached a total trading volume of $987 billion, occupying a significant market share.

Additionally, Solana’s on-chain fee revenue has exceeded Ethereum’s by twofold, with TVL (Total Value Locked) maintaining above $7.5 billion, and market capitalization steadily ranking in the global top 6.

Notably, stablecoin issuer Circle minted 10 billion new USDC in the first three months of 2025, with 68% flowing to the Solana chain. This is the result of payment giant Visa’s collaboration with Solana—through Solana Pay, users can now settle in real-time with USDC at 56 million merchants worldwide, with each cross-border payment costing only $0.001.

While other public chains were still debating whether to prioritize developers or users, Solana proved with its economic model that both can coexist. Solana’s “triple fee market” design has shown remarkable resilience over five years:

- Fee Revenue totaled $2.37 billion, with $1.24 billion in 2024 alone, exceeding Ethereum’s data for the same period;

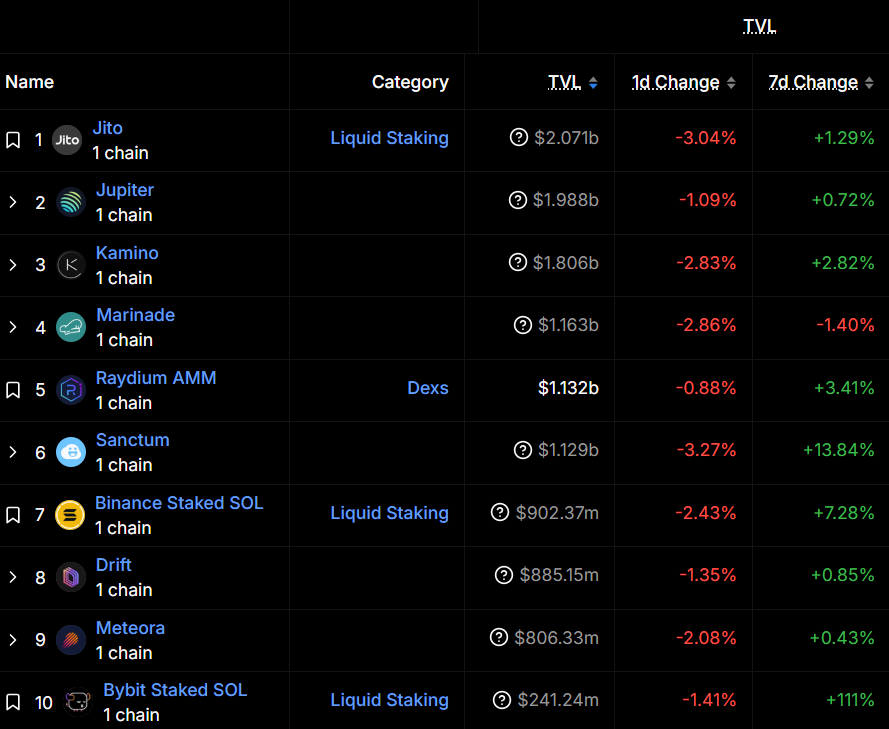

- Staking Economy scale exceeded $30 billion, with protocols like Jito incorporating MEV earnings into staking rewards, stabilizing SOL’s annual yield at 7.2%-9.5%;

- Developer Incentive Pool distributed 120 million SOL, incubating over 2,300 active projects, forming a full-stack ecosystem from DeFi to AI.

FIVE OUTSTANDING PROJECTS IN THE SOLANA ECOSYSTEM

The Solana ecosystem, centered on DeFi, Meme coins, NFTs, games, and AI integration applications, demonstrates powerful diversity and innovation capacity:

- DeFi Sector: Aggregated trading, liquid staking, leverage protocols, and other tracks are thriving, with TVL annual growth rates generally exceeding 200%;

- Meme Wave: In 2024, Meme trading accounted for 74% of total on-chain transactions, becoming a key driver of ecosystem activity;

- Technical Innovation: Firedancer client deployment, Solana Blinks, and other technical upgrades further reduce user barriers and enhance performance;

- Institutional Recognition: VanEck and others submit Solana ETF applications, accelerating traditional capital entry.

Aave (AAVE)

As the first Ethereum-native project to deploy its complete protocol on Solana, Aave’s V4 version fully utilizes Solana’s parallel processing capabilities. Through Solana’s oracle network Pyth, lending rate updates reach millisecond-level frequency, a speed difficult for other chains to achieve.

- Flash Loan Delay compressed from 13 seconds on Ethereum to 0.8 seconds, with arbitrage bots executing 40 times more strategies daily;

- Multi-chain Asset Bridge allows users to collateralize BTC and ETH to obtain SOL on-chain liquidity, with TVL surging from $700 million to $3 billion in three months;

- Risk Control Module introduces an AI-driven dynamic collateral ratio adjustment system, maintaining bad debt rates at a historical low of 0.03%.

OFFICIAL TRUMP (TRUMP)

This Meme coin using the former U.S. president’s image as a cultural symbol has become a phenomenon in the Solana ecosystem:

- Behind its $2.2 billion market cap are over 500 million daily transactions and 890,000 holder addresses;

- Community Governance adopts a “Twitter governance” model, with each of Trump’s posts on Truth Social triggering 5%-15% price fluctuations;

- Ecosystem Penetration has connected to Drift Protocol’s perpetual contract trading, allowing users to use TRUMP as margin to establish positions with up to 50x leverage.

“Meme coins are the pop culture of the crypto world, and Solana is the best carrier for this culture,” says TRUMP community leader “CryptoPatriot.” While other chains still struggle with Gas fee fluctuations, Solana allows every retail investor to participate in hundreds of Meme transactions with just $0.1, which is true “financial democratization.”

Raydium (RAY)

As the largest decentralized exchange in the Solana ecosystem, Raydium redefines DEXs with two innovations:

- Hybrid Liquidity Pools combine AMM with order books, reducing slippage on large transactions by 80%. One whale once sold $120 million worth of BOME in a single transaction with less than 3% price fluctuation;

- Launchpad Mechanism has listed 327 Meme coin projects, 21 of which achieved 100x gains, forming the “Raydium Effect”;

- Cross-chain Gateway supports direct trading of Ethereum chain assets like SHIB and PEPE, with daily cross-chain transaction volume exceeding $200 million.

Jupiter (JUP)

Its founder Meow revealed in an interview that the platform earns over $9 million monthly by charging a 0.05% routing fee. This all-chain liquidity aggregator is rewriting DEX competition rules:

- Smart Routing algorithm can scan all DEXs on Solana within 0.2 seconds, saving users an average of 15% in transaction costs;

- MEV Protection system has saved users over $47 million in frontrunning losses. One institutional investor completed a single $180 million stablecoin exchange with zero slippage, shocking the industry;

- Governance Token JUP airdrop covered over 190,000 addresses, setting a record for the most extensive token distribution in crypto history.

Jito (JTO)

While traditional staking provides static returns, Jito created a dynamic yield model. Data shows that JitoSOL holders earn on average 1.8 times more than those simply staking SOL. Jito reinvented staking logic:

- MEV Revenue Sharing increases staker annual yields by 2.3%-4.7%, with one validator node capturing $370,000 in MEV in a single day by optimizing block packaging order;

- Liquid Certificate JitoSOL can freely circulate in DeFi protocols, increasing staked asset utilization to 78%;

- Decentralized Governance adopts a dual DAO structure, with technical upgrades and fund allocations decided by different committees.

SOLANA’S THREE STRATEGIC OBJECTIVES

The Firedancer client developed by Jump Crypto will be fully deployed in Q2 2025. Testnet data already shows amazing potential: transaction processing speed jumps from the current 65,000 TPS to 280,000 TPS, bringing it closer to the ultimate goal of one million TPS; network interruption risk reduced by 99.7%, completely washing away the “outage chain” stigma; validator node hardware costs reduced by 60%, further lowering participation barriers and promoting network decentralization. Firedancer is not just a performance improvement but a key step in Solana’s evolution from a “high-performance chain” to an “ultra-high-performance chain.”

With VanEck submitting a Solana spot ETF application, the crypto market is experiencing a new round of shocks. If approved by the SEC, an estimated $24 billion in institutional funds will flow into the Solana ecosystem in the first year, completely changing its capital structure. Galaxy Digital is developing SOL staking yield structured products with a target annual yield of 9.5%, attracting attention from traditional financial institutions.

The integration experiment of AI and on-chain society. The Solana Foundation’s “AI x Crypto” program demonstrates its grand vision for the future. The ASYM41b07 distributed AI training network based on Solana costs only 23% of AWS, providing highly cost-effective infrastructure for AI developers; the Cod3xOrg platform allows users to create DeFi protocols through natural language, with 4,300 automatic strategies already online, greatly lowering development barriers; and the upcoming Solana Mobile Chapter 3 phone will integrate local AI models to achieve semantic recognition of on-chain transactions, further promoting deep integration of blockchain and AI. These experiments are not only explorations of technological boundaries but also redefinitions of on-chain social forms.

Driven by these three strategies, Solana is evolving from a high-performance public chain into a super ecosystem that carries the future digital civilization.

Looking back from this five-year milestone, Solana’s rise trajectory secretly aligns with the evolutionary logic of the crypto world: from the idealism of pursuing absolute decentralization to the engineering mindset of compatibility between performance and practicality, and then to the dual ecosystem that accommodates both Meme culture and institutional capital. In this system, speed is faith, cost is discipline, and ecosystem prosperity is the eternal holy grail.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!