KEYTAKEAWAYS

- Solana’s price fell due to meme coin market crashes and declining investor confidence.

- Large-scale token unlocks could create significant selling pressure on SOL.

- Institutional backing and potential Solana ETF approval offer hope for recovery.

- KEY TAKEAWAYS

- MEME COIN MARKET CRASH: SHAKING INVESTOR CONFIDENCE IN SOLANA

- PRESIDENT-THEMED TOKENS: LIQUIDITY DRAIN FROM SOLANA ECOSYSTEM

- LARGE-SCALE TOKEN UNLOCK: SELLING PRESSURE ON SOLANA (SOL)

- DECLINING ON-CHAIN ACTIVITY AND TECHNICAL CHALLENGES

- INVESTOR SENTIMENT AND FUTURE OUTLOOK: CAN SOLANA RECOVER?

- CONCLUSION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Solana (SOL) has been one of the most popular public blockchains in the recent bull market. Its price surged from $8 to $290, shocking the crypto market with its impressive performance. However, this success didn’t last. In just one month, Solana’s price dropped sharply from $295.83 to $169, losing more than 45% of its value.

This sudden decline has made many investors wonder: is Solana still a good investment, or is it heading for a downfall?

In this article, we will explore the key reasons behind Solana’s price drop, including the meme coin market crash, the impact of president-themed tokens, and the pressure caused by large-scale token unlocks. We will also discuss Solana’s current ecosystem, network activity, and what the future might hold for this leading blockchain.

MEME COIN MARKET CRASH: SHAKING INVESTOR CONFIDENCE IN SOLANA

Solana became popular because of the meme coin boom, earning the title “King of Retail Investors.” However, recent events have damaged the trust investors had in this blockchain. One major issue was the collapse of LIBRA, a meme coin linked to Argentina’s president. Its price dropped by 92%, leaving many investors with heavy losses.

Other meme tokens related to celebrities also performed poorly:

- $TRUMP token fell by 76%, leaving over 800,000 investors stuck at high prices.

- MELANIA token dropped by 90%, nearly becoming worthless.

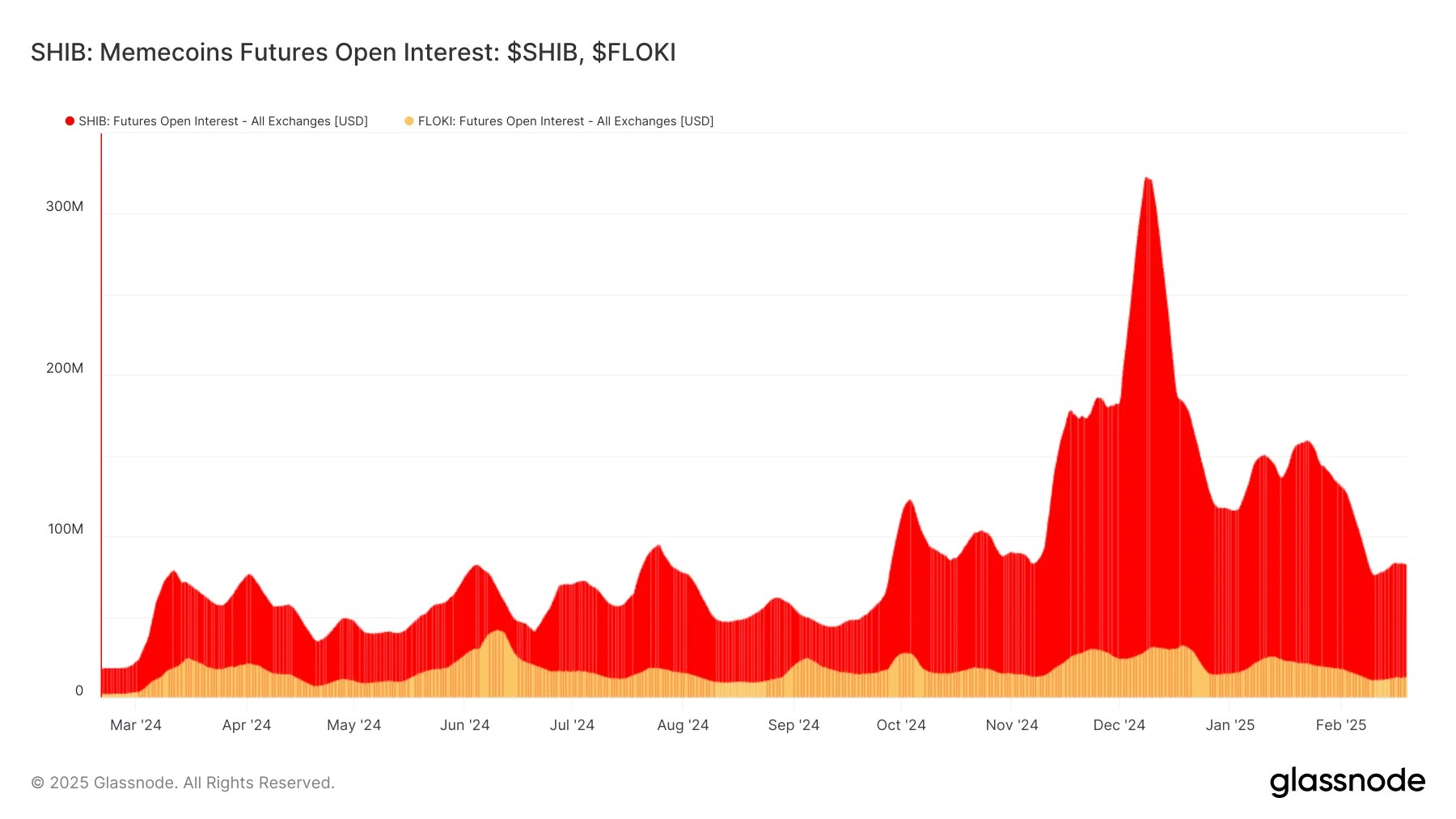

The situation worsened on February 19, when Glassnode reported that meme coin open interest had dropped significantly since mid-December 2023. According to Glassnode:

- DOGE open interest dropped 58.45% (from $3.58 billion to $1.49 billion).

- PEPE: down 71.93% ($1.25 billion → $351 million).

- BONK: down 75.10% ($715 million → $178 million).

- WIF: down 69.83% ($653 million → $197 million).

- SHIB: down 74.41% ($323 million → $83 million).

- FLOKI: down 69.18% ($41.7 million → $12.9 million).

(source:Glassnode)

Glassnode explained that the decline in open interest shows a loss of leverage and a shift in sentiment across the entire meme coin market. Since Solana played a key role in hosting many of these meme projects, it naturally suffered when confidence in this market faded.

The sharp decline in meme coin trading and the negative mood in the market have raised concerns about Solana’s ability to keep attracting active capital. Without new investments, Solana’s ecosystem could struggle to recover in the near term.

PRESIDENT-THEMED TOKENS: LIQUIDITY DRAIN FROM SOLANA ECOSYSTEM

The problems for Solana didn’t stop with the meme coin collapse. The so-called “president coin” effect added more trouble. Former U.S. President Donald Trump launched the official $TRUMP meme token on the Solana blockchain, attracting a lot of attention. However, this hype didn’t last long. After the initial surge, the $TRUMP token price crashed, causing liquidity to drain from the Solana ecosystem.

These types of high-risk, hype-driven tokens brought short-term liquidity to Solana, but they also exposed the network’s reliance on speculative assets. Once the hype died down, investors quickly pulled out their funds, weakening Solana’s ecosystem.

This liquidity drain led many investors to shift their attention to more stable blockchain projects. If this trend continues, Solana might face an uphill battle to retain its position as a leading public blockchain.

LARGE-SCALE TOKEN UNLOCK: SELLING PRESSURE ON SOLANA (SOL)

While market sentiment was already turning negative, Solana faced another major challenge—large-scale token unlocks.

Over the next three months (February to April), more than 15 million SOL tokens (valued at over $7 billion) will be unlocked. The most significant unlock is scheduled for March 1, when 11.2 million SOL tokens, worth approximately $2.06 billion, will enter circulation.

This increase in supply could create significant selling pressure on Solana’s price. Adding to the complexity, these tokens are linked to the FTX bankruptcy proceedings:

- Galaxy Digital purchased 25.52 million SOL at $64 per token.

- Pantera Capital acquired 13.67 million SOL at $95 per token.

If these large holders decide to sell their tokens, the SOL price could face another sharp drop. Although some experts believe that institutional investors are unlikely to dump all their tokens at once, the fear of a potential sell-off is enough to keep retail investors cautious.

This upcoming token unlock event could significantly impact Solana’s price performance, especially if the broader market remains weak.

DECLINING ON-CHAIN ACTIVITY AND TECHNICAL CHALLENGES

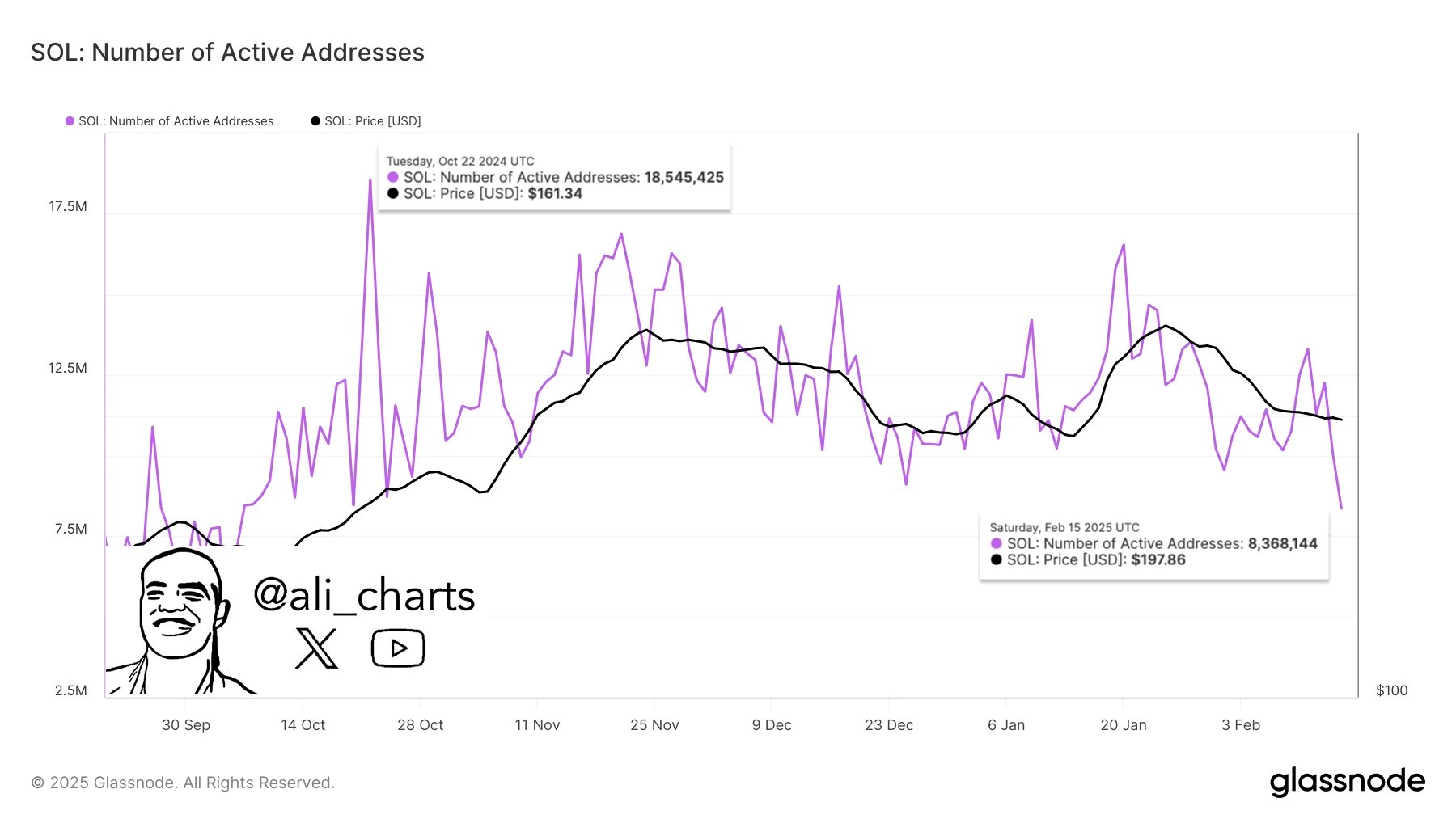

Investor confidence in Solana is also reflected in its on-chain performance. Key network metrics have shown a noticeable decline:

- Active addresses on the Solana blockchain fell from 18.5 million in November 2023 to 8.4 million, marking a 54.6% decrease.

- Daily trading volume dropped from $35.5 billion on January 17 to $3.1 billion on February 17.

(source:X )

Additionally, Solana’s total value locked (TVL) fell by 19% in just two weeks, currently standing at $8.24 billion—significantly lower than Ethereum’s $57.3 billion.

Despite Solana’s reputation for high throughput and low transaction fees, frequent network outages and security concerns have damaged its credibility. With major projects like Jito, Kamino, and Marinade Finance experiencing capital outflows, Solana’s ecosystem looks increasingly fragile.

INVESTOR SENTIMENT AND FUTURE OUTLOOK: CAN SOLANA RECOVER?

Although Solana is currently under pressure, there are still signs of hope. Many big investment firms, such as A16z, Galaxy Digital, and Pantera Capital, continue to support Solana, providing strong financial backing.

One potential positive development is the possible approval of a Solana spot ETF. Five major firms have submitted applications:

- Grayscale

- Bitwise

- VanEck

- 21Shares

- Canary Capital

The U.S. Securities and Exchange Commission (SEC) is reviewing Grayscale’s Solana ETF application, with an initial decision expected by March 30. If approved, the Solana ETF could attract institutional investors, improving SOL’s liquidity and boosting market confidence.

However, there are still risks. Recent data shows that Solana’s application revenue grew by 213% in Q4 2024, from $268 million to $840 million. But this growth came mainly from meme coin trading, especially on the Pump.fun platform, which contributed $235 million. This over-reliance on meme coins could pose long-term risks if market interest continues to fade.

CONCLUSION

The recent decline in Solana (SOL) is the result of multiple factors. The meme coin market collapse weakened investor confidence, while the president-themed tokens drained liquidity from the Solana ecosystem. The upcoming large-scale token unlock adds further uncertainty, and declining on-chain activity combined with technical challenges raises additional concerns.

Despite these issues, Solana remains one of the most active public blockchains in the crypto market. With strong institutional backing and potential positive catalysts like a Solana ETF, it could still recover. However, Solana needs to reduce its dependence on speculative assets like meme coins and ensure its ecosystem remains attractive for developers and investors alike.

For investors, the best approach is to stay cautious, diversify risk, and continue monitoring Solana’s ecosystem and market developments. The future of Solana depends on how well it navigates these challenges and whether it can rebuild trust in its long-term growth potential.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!