KEYTAKEAWAYS

- Sui's recent 218% price surge has raised concerns about potential sell-offs, especially with upcoming token unlocks and alleged insider selling.

- While Sui shows promise in technology and team strength, it lags behind SOL in ecosystem development and market penetration.

- Investors must weigh short-term correction risks against Sui's long-term potential in the fourth halving market cycle.

CONTENT

Analysis of Sui’s recent price surge, market concerns, and comparison with SOL. Explores short-term risks, long-term potential, and whether to hold or sell Sui tokens in the current market climate.

SUI’S ROLLERCOASTER: CASH OUT OR HOLD ON?

The popular L1 project Sui, after six consecutive weeks of growth, has turned downward this week, almost erasing last week’s gains. As a result, two different opinions have emerged in the market:

One view is that after Sui’s rise, it’s time for a “harvest.” On the 23rd of this month, Sui will unlock tokens worth about $114 million. The market is very concerned about the possibility of large-scale selling by the project team and early major investors. If the rise was to sell tokens to retail investors, then Sui might be short-lived, and it’s time to get off the train and run.

Another view is that while Sui does face short-term correction risks, this is normal price fluctuation. “A drop makes it healthier.” Sui’s fundamentals haven’t changed; it’s still the most promising L1 in the fourth halving market and might even replicate the success of the previously hot L1, SOL.

So which view is correct? Let’s analyze in detail.

IS A SHORT-TERM CORRECTION INEVITABLE AFTER SUI’S SURGE?

Sui started to rise from its downtrend in early September, beginning a impressive six-week streak of weekly gains, rising from a low of $0.74 to a high of $2.36 (Bitget data), a 218% increase. This continuous rise over an extended period has further heightened Sui’s already high popularity, attracting attention from many in the circle, with many considering it the most worthwhile L1 to buy in this halving market.

Looking at a longer timeframe, Sui has formed a “W” bottom pattern on the weekly chart. Following the overall Bitcoin market trend, it hit its first bottom last October, then rose to a peak in March this year like most coins, followed by a continuous downward correction. It confirmed its second bottom in August and then began a strong upward trend, successfully breaking through March’s highest point. It can be said that its recent performance has not only been better than other similar coins but also better than Bitcoin.

Sui Price Performance

(Source: Bitget)

However, as Sui’s price has skyrocketed, some negative news has recently emerged in the market. On one hand, Sui has been accused of internal selling, with ICO-related wallets reportedly selling about $400 million worth of tokens during Sui’s recent price surge. Project insiders have been exposed not only for starting to sell tokens at the beginning of the price rise but also for accelerating sales as it reached recent highs. This has greatly displeased many investors who planned to hold Sui long-term, questioning whether Sui is truly committed to doing good work, increasing value, and long-term holding.

On the other hand, on the 23rd of this month, tokens equivalent to 2.3% of the circulating supply will be unlocked. This has led some investors to question whether Sui’s recent rise was to allow major players and early profiteers to cash out at high prices. In our previous article, “Will the Public Blockchain Sui Increase 100 Times in the 2025 Halving Bull Market?“, we mentioned that currently, only 28% of Sui tokens are in circulation, with a large number of tokens yet to enter the secondary market in various ways.

Many projects unlocking tokens while pumping and washing the market, or even just unlocking without the token price changing, are common in this halving market. This undoubtedly makes Sui investors very concerned about future value appreciation.

From a technical indicator perspective, Sui’s RSI is above 70 in time frames from 1 hour to 1 week, indicating overbought market conditions. The weekly chart has been breaking above the upper Bollinger Band since mid-September, consistently rising above it. Purely from a technical standpoint, Sui has a strong need for correction in the future.

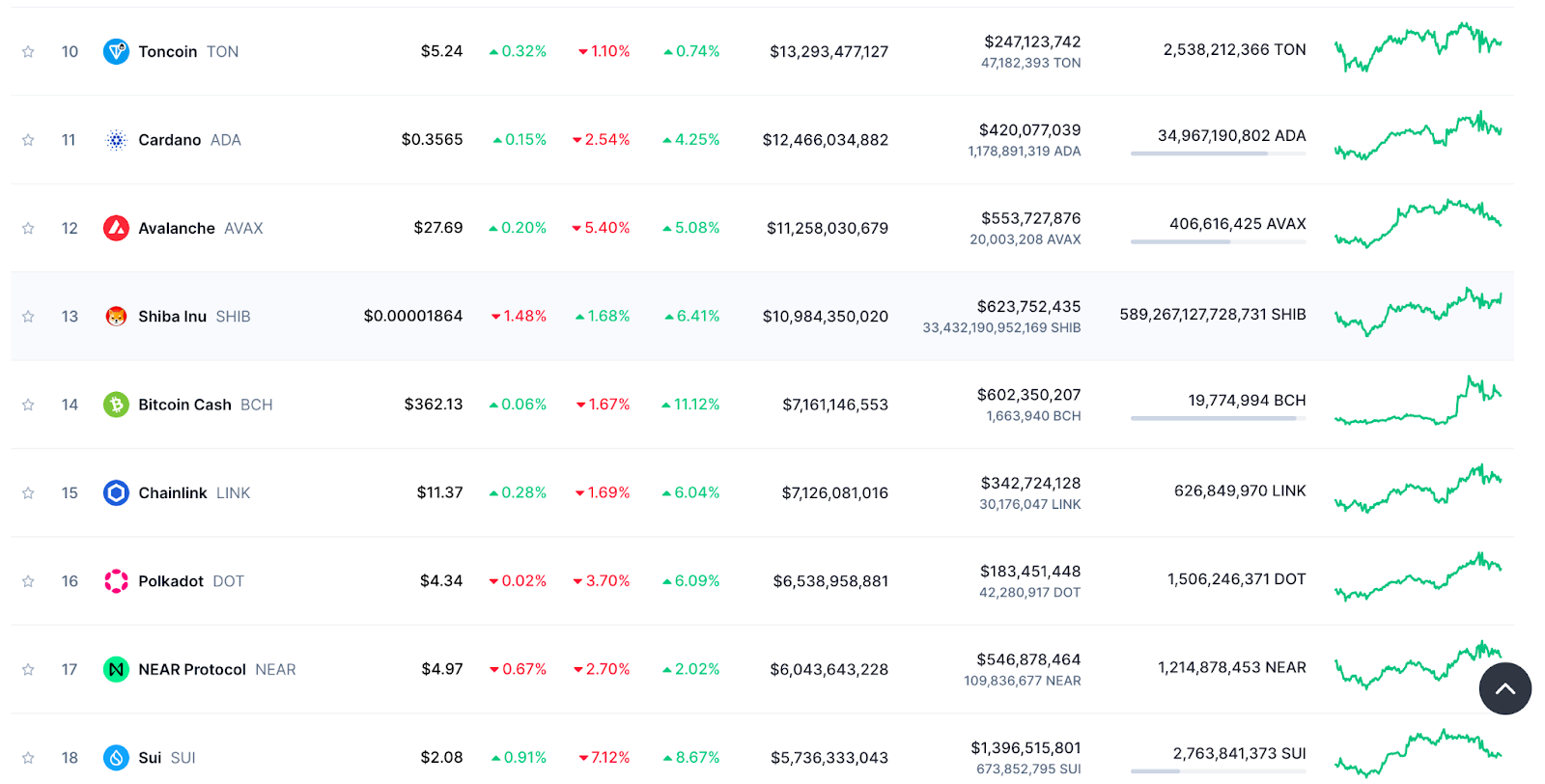

In terms of global market cap ranking, after more than a month of strong growth, Sui’s market cap has reached 18th place. Except for TON, all the coins ranked above it are established strong coins. Before the market liquidity fully recovers and a major bull market arrives, the pressure for Sui to continue rising is increasing.

Sui and Other Coins’ Global Market Cap Rankings

(Source: CoinMarketCap)

Overall, from various market indicators, Sui indeed has a strong need for correction in the short term. For investors who require high capital utilization or are risk-averse, now might be a good time to take profits.

COMPARISON BETWEEN SUI AND SOL: CAN THE SUCCESS STORY BE REPLICATED?

Sui’s recent popularity has led to claims like “Sui is the SOL killer” or “Sui is the next SOL” in the market. Let’s compare them in terms of technical architecture, ecosystem, team background, investment institutions, and market demand – the most important aspects of L1 projects – to see if these claims hold water.

In terms of technical architecture, both focus on high-performance L1s, which is the mainstream evolution direction for current L1s. The difference is that Sui provides unique technical innovation through the Move language and concurrent processing model, while SOL adopts the innovative PoH consensus mechanism with its core advantage being ultra-high TPS, although SOL has experienced downtime historically. As a later entrant, Sui has a slight technical advantage over SOL.

As for the ecosystem, which is the foundation for a L1’s value appreciation, Sui’s ecosystem is still in its early stages, currently focusing on GameFi and DeFi. Although projects are continuously increasing, it still lags far behind SOL, whose ecosystem covers multiple areas including DeFi, NFT, marketplaces, games, and payments.

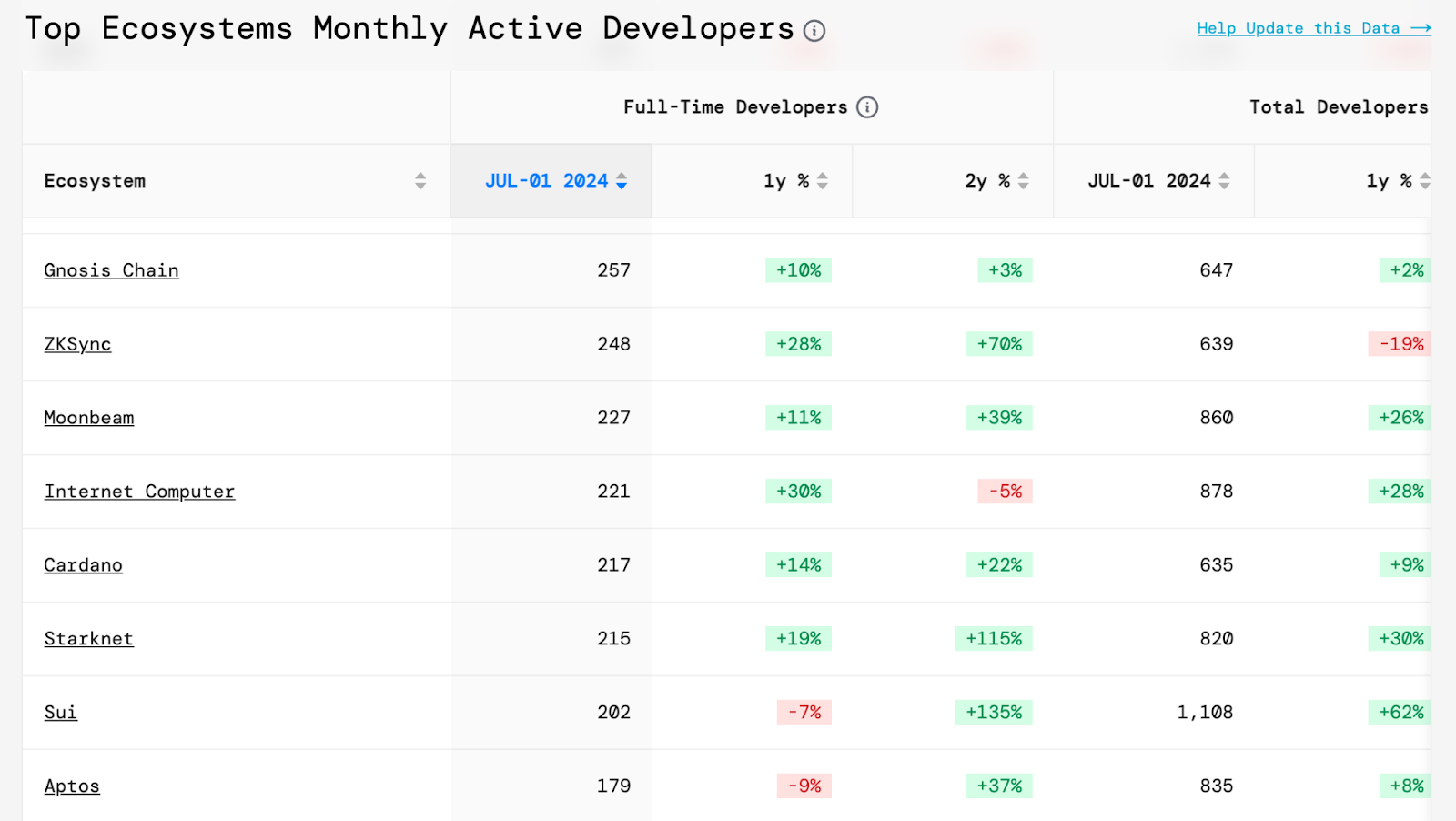

Moreover, SOL’s developer community is extremely active, which is an important reason for its renewed popularity. According to Developer website data, the number of active full-time developers on SOL consistently ranks in the top ten, even top five, among numerous blockchain networks, while Sui hovers around 20th place. As an emerging project, Sui has the potential to attract innovative projects and developers with its unique technical architecture, but it still needs time and resources to expand its ecosystem.

Number of Active Full-Time Developers on Sui and Other L1 Projects

(Source: Developer Report)

Regarding team background, Sui was founded by core members of Meta (Facebook)’s former Libra/Diem project. These members have rich experience in blockchain and payment system design. SOL was founded by Anatoly Yakovenko, a former senior engineer at Qualcomm and Dropbox, with deep experience in network protocol development. Overall, the Sui team has advantages in blockchain language and architecture design, while SOL excels in high-performance, low-latency network optimization. Each has its strengths.

In terms of investment institutions, Sui received early support from well-known institutions like A16Z, FTX Ventures, and Coinbase Ventures. These investment institutions typically bring strategic support, resources, and industry networks. SOL received early investment from institutions like Multicoin Capital and A16Z, and as its ecosystem developed, it attracted a large number of venture capital participants. In terms of future potential, SOL currently has more investment institutions, giving it a clear advantage.

Regarding market demand, Sui focuses on meeting the needs of high-frequency games and decentralized applications (dApps), with resource and technical architecture advantages over SOL in GameFi. However, SOL has a wider range of applications and stronger market penetration.

The difference is clearly visible in the currently popular MEME ecosystem. SOL has more types and quantities of MEME coin projects, while Sui’s MEME ecosystem is just starting, mainly with some innovative MEME projects.

Overall, Sui currently lags significantly behind SOL in terms of ecosystem, market maturity, and community. However, in terms of technical architecture, team, and other hard strengths, it’s not inferior and even slightly superior in some aspects. However, it’s premature to say that Sui will surpass SOL. Whether it can replicate SOL’s success mainly depends on whether a crazy bull market will emerge in this halving cycle.

Returning to the initial question for Sui investors: Should you cash out or continue holding? After reading the above content, there’s a clear answer. If you’re confident in your short-term trading skills or prefer stable investments, taking profits is fine. But we’ve also analyzed Sui’s long-term value in our previous article “Will the Public Blockchain Sui Increase 100 Times in the 2025 Halving Bull Market?“, concluding it’s one of the most noteworthy projects in the fourth halving bull market.

Finally, this article is for reference only and not investment advice. The market carries risks, so invest cautiously.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!