KEYTAKEAWAYS

- SUI emerges as a top Layer-1 in 2025, driven by strong price gains, ecosystem growth, and rising institutional support.

- DeFi, NFTs, gaming, and community momentum push SUI into the crypto spotlight this bull market.

- With Move-based tech and major partnerships, SUI is attracting developers, users, and investors alike.

CONTENT

In the 2025 crypto bull market, SUI has emerged as a standout Layer-1 blockchain, showing impressive growth in token price, ecosystem development, and community engagement.

PRICE PERFORMANCE: STRONG UPWARD MOMENTUM

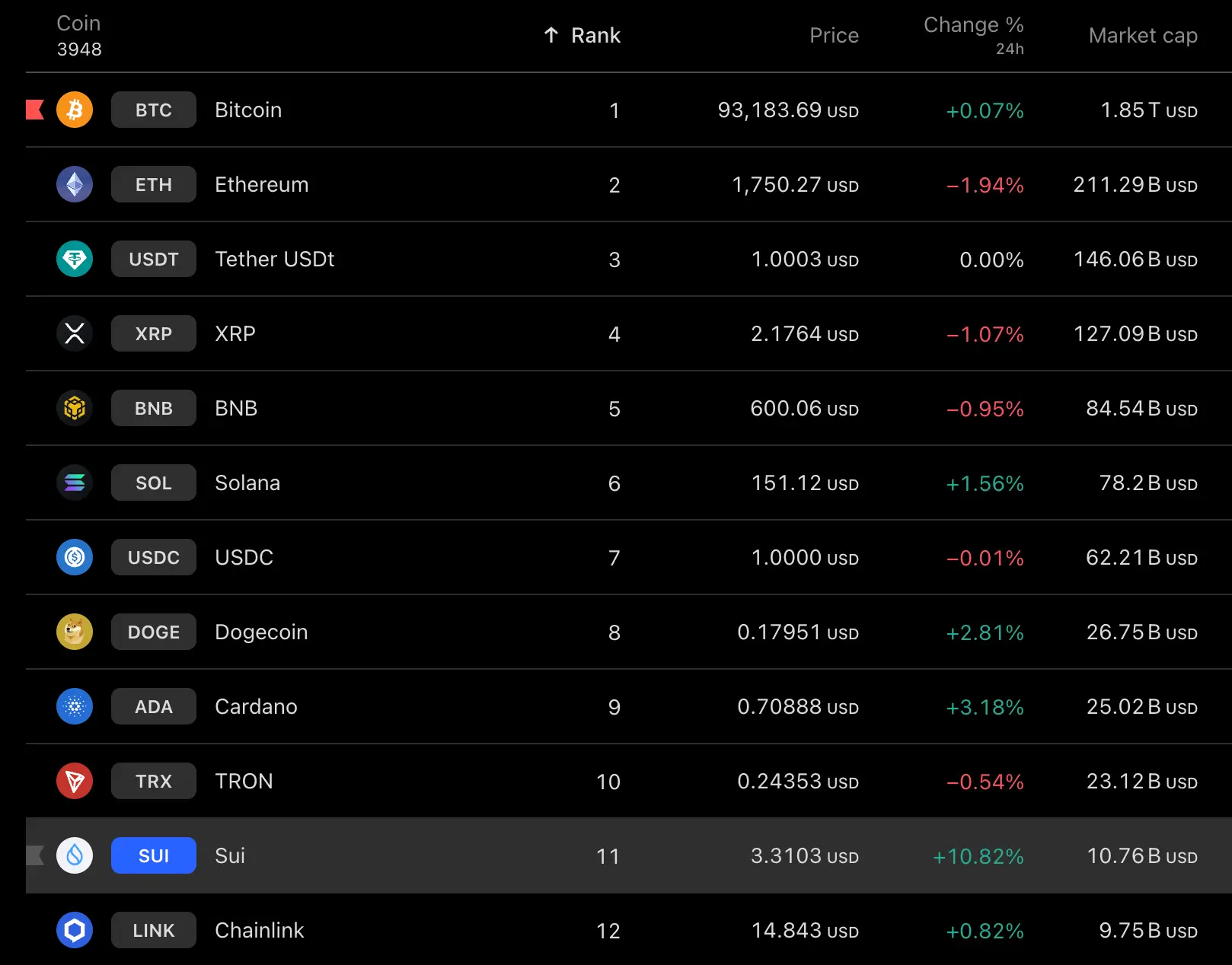

As of April 25, 2025, the SUI token is trading at $3.36, rising 12.94% in the past 24 hours and 57.10% over the past week.

This growth beats the overall crypto market’s 9.70% gain and the 10.30% increase among smart contract platforms. SUI’s market cap is now about $10.86 billion, ranking it #11 overall.

Technical analysis shows SUI has broken through major resistance and is approaching the $3.60 psychological barrier.

Futures market data is also bullish, with high open interest and positive funding rates. The strong momentum is backed by both market recovery and solid ecosystem progress.

ECOSYSTEM EXPANSION: DRIVING GROWTH ACROSS MULTIPLE SECTORS

SUI’s rapid ecosystem development has played a key role in its strong market performance. It is growing in users, DeFi, NFTs, gaming, and infrastructure.

SUI now has over 150 million total accounts, growing 7.05% in the past week. Thanks to its low-latency, high-speed design, users enjoy smooth and fast transaction experiences, ideal for DeFi and gaming.

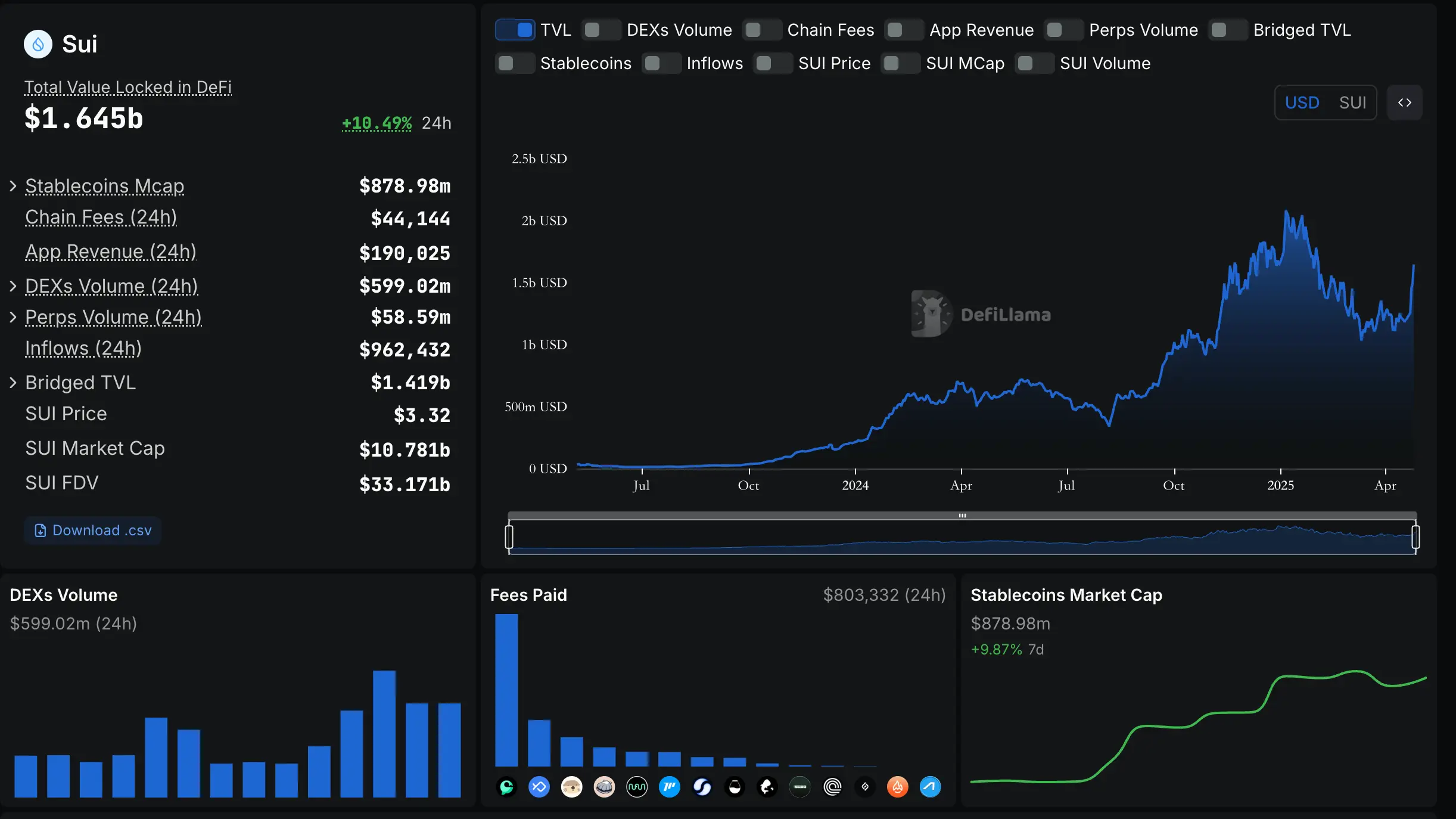

The DeFi sector on SUI is growing fast. TVL has reached $2 billion, with leading protocols like Cetus, Navi Protocol, Suilend, and Scallop Lend standing out.

Navi Protocol alone holds $261 million in TVL. Stablecoin supply on the SUI network has grown 15.01% this week to $824 million, fueling DeFi activity.

NFTs and gaming are also booming. SUI has partnered with MoviePass, Lucky Kat Studios, and Gameplay Galaxy, bringing more real use cases to the network.

NFT trading and developer activity are growing, with unique NFT features powered by the Move language.

Meme coins are also hot, reaching a total market cap of $296 million, up 170%, showing high community activity.

SUI is expanding in decentralized storage, with recent funding rounds totaling $140 million. These infrastructure projects are expected to boost the overall performance and technical foundation of the SUI network.

KEY GROWTH DRIVERS: TECHNOLOGY, INSTITUTIONAL SUPPORT, AND COMMUNITY ENGAGEMENT

SUI uses the Move programming language, which allows parallel execution and object-based data models. This makes it ideal for high-frequency apps like DeFi, gaming, and social platforms.

The design also reduces the risk of smart contract bugs and scales well as the ecosystem grows. Compared to chains like Solana, SUI offers a better developer experience and stronger security.

Institutional support is another strength. Companies like Franklin Templeton, Grayscale, and Libre Capital back SUI. World Liberty Financial, linked to Donald Trump, plans to launch products on SUI.

Canary Capital also filed for a SUI spot ETF with the SEC, which sparked an 8% price jump. If approved, this ETF could attract more traditional investors to the ecosystem.

Community sentiment is strong. Since late 2024, SUI has had a very active and optimistic online presence. It’s often praised as the most “hardworking” Layer-1 project.

The community has helped boost meme coin and NFT popularity, attracting new users and developers.

POTENTIAL RISKS AND CHALLENGES

While SUI is performing well, there are a few risks to watch:

Token Unlocking: Around 64 to 74 million tokens will be unlocked monthly in 2025 (about 0.64%-0.74% of total supply). If large holders sell, it could pressure prices short-term.

Market Overheating: SUI’s RSI is close to overbought levels. If it fails to break through $3.60, a price correction could follow due to profit-taking.

Competition: SUI faces competition from Layer-1 networks like Solana and Aptos. While SUI has technical advantages, it needs to keep innovating to stay ahead.

CONCLUSION

SUI is one of the brightest performers in the current bull market, showing strength in tech, user growth, ecosystem development, and community momentum.

With major institutional interest and expanding use cases in DeFi, gaming, and NFTs, SUI is well-positioned for long-term growth.

However, challenges like token unlocks and market volatility remain. For those exploring the next wave of Web3 opportunities, SUI is definitely a project worth watching.

Note: All data is based on market information as of April 25, 2025. Crypto investment carries high risk. Please invest carefully.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!