KEYTAKEAWAYS

- Discover the top 5 cross-chain bridges enabling seamless asset flow across blockchains, solving liquidity fragmentation and interoperability challenges.

- This article highlights key cross-chain bridge projects like Circle CCTP, Wormhole, and Stargate, showcasing their unique advantages for blockchain ecosystems.

- Explore how leading cross-chain bridges connect isolated blockchains, boosting asset mobility, capital efficiency, and user experience.

CONTENT

Imagine if your bank card could only be used at ATMs of a single bank, with no ability to use it elsewhere. This would be extremely inconvenient, and your funds would be stuck in one place. In the blockchain world, different chains are like separate banking systems, where assets cannot move freely, and liquidity is restricted.

This is why cross-chain bridges exist—they help enable asset circulation between different blockchains, connecting previously isolated blockchain ecosystems.

WHAT IS A LIQUIDITY BRIDGE?

A liquidity bridge is a tool that transfers assets from one chain to another. It solves the pain point of assets being unable to flow freely within blockchain ecosystems, allowing users to utilize their funds across different chains.

For example, if you have 100 USDT on Ethereum but want to trade on BSC, you can use a bridge to transfer your USDT to BSC.

But bridges don’t just transfer assets; they also enable:

- Shared liquidity: Funds can flow flexibly between different chains, breaking down the “island effect.”

- Improved capital efficiency: Users can deploy their funds on the most suitable chains to obtain better returns.

- Enhanced user experience: Users aren’t limited to a single chain, reducing barriers to entry and making usage more convenient.

The emergence of cross-chain bridges has made cross-chain asset flows simple and quick, solving one of the biggest gaps in the blockchain ecosystem.

Also Read:

- Top Public Blockchain Projects to Watch in the 2024 Crypto Bull Market

- TON Blockchain: Everything You Need to Know

THE IMPORTANCE OF CROSS-CHAIN BRIDGES

In the multi-chain era, the importance of liquidity bridges is mainly reflected in three aspects:

1. Solving Asset Liquidity Fragmentation

With the increasing number of public chains, assets are scattered across various chains. Cross-chain bridges can reaggregate this dispersed liquidity, improving capital utilization efficiency.

2. Promoting DeFi and NFT Development

Many decentralized finance (DeFi) and NFT projects are limited to specific chains, and users cannot use assets across chains. The existence of cross-chain bridges allows users to flexibly participate in projects across multiple chains, further promoting ecosystem development.

3. Connecting Blockchain Ecosystems

Cross-chain bridges are not just “fund transfer stations”; they can also transmit data, NFTs, and even smart contracts. With technological upgrades, cross-chain bridges will gradually become crucial infrastructure connecting the entire blockchain ecosystem.

THE FIVE MOST POPULAR CROSS-CHAIN BRIDGE PROJECTS

Let’s examine five cross-chain bridge projects with the highest current market transaction volumes, each with its unique characteristics:

#1 -Circle CCTP

Circle CCTP’s core functionality lies in providing cross-chain services for the USDC stablecoin. It locks USDC on the source chain through smart contracts and mints equivalent USDC on the target chain. This mechanism ensures USDC’s value stability during cross-chain transfers.

From a technical perspective, CCTP uses Circle’s self-developed cross-chain technology, ensuring cross-chain transaction security and efficiency. Additionally, CCTP is tightly integrated with Circle’s other product lines, providing users with a seamless cross-chain experience.

CCTP’s advantages include:

- Deep integration with USDC: As USDC’s issuer, Circle provides strong support for CCTP, ensuring USDC’s compliance and stability during cross-chain transfers.

- Large user base: USDC is one of the major stablecoins in the market, bringing substantial transaction volume to CCTP.

- High security: Circle has rich experience in the blockchain field, and its cross-chain technology has undergone rigorous testing and auditing.

#2-Wormhole

Wormhole’s core functionality is enabling data transmission between different blockchains, including tokens, NFTs, and smart contracts. It establishes a relay network connecting different blockchains to achieve cross-chain communication.

Wormhole’s technical characteristic lies in its universality. It supports various types of assets and smart contracts, providing developers with high flexibility and scalability.

Wormhole’s advantages include:

- Rich chain support: Wormhole supports multiple mainstream blockchains including Solana, Ethereum, Terra, and Binance Smart Chain, covering most DeFi ecosystems.

- Strong scalability: Wormhole’s architectural design has high scalability, easily supporting new blockchains and assets.

- Active community: Wormhole has an active community continuously driving project innovation and development.

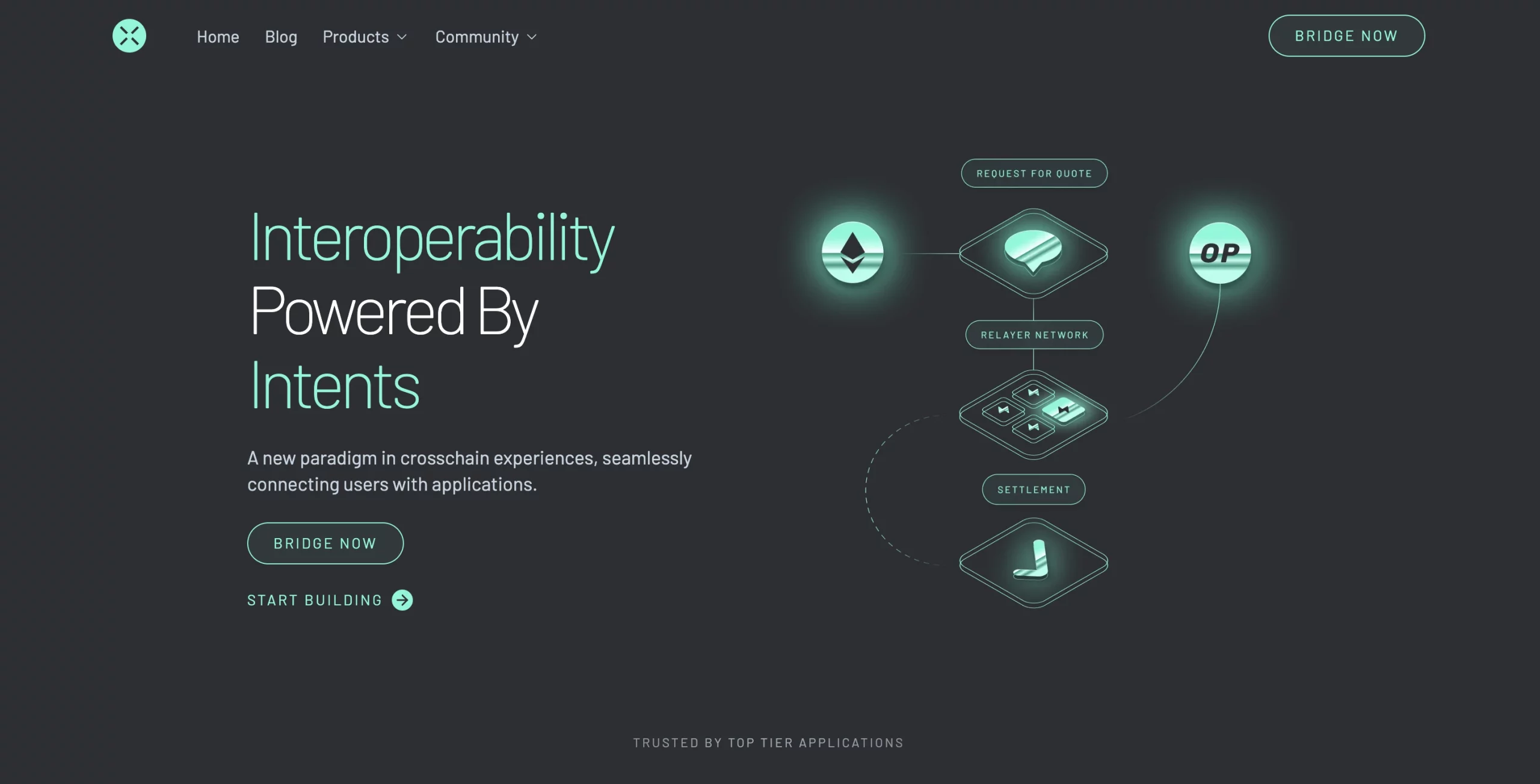

#3-Across

Across’s core functionality is enabling asset transfer between Layer 2 networks. It establishes lightweight cross-chain bridges, reducing cross-chain transaction costs and delays.

Across’s technical characteristic lies in its optimization for Layer 2 networks. It fully utilizes Layer 2 advantages, such as higher transaction throughput and lower transaction fees, providing users with better cross-chain experiences.

Across’s advantages include:

- Layer 2 focus: Across focuses on Layer 2 network cross-chain transfers, providing important support for Layer 2 ecosystem development.

- Low fees: Compared to traditional cross-chain methods, Across has lower transaction fees.

- Fast speed: Across has quick transaction confirmation times and good user experience.

#4-Stargate

Stargate’s core functionality is providing highly flexible cross-chain solutions. It allows users to customize cross-chain paths and supports multiple asset types, meeting different user needs.

Stargate’s technical characteristic lies in its modular design. Through modular design, Stargate can easily expand and upgrade to adapt to changing market demands.

Stargate’s advantages include:

- High flexibility: Stargate can be customized according to user needs.

- High security: Stargate adopts a series of security measures ensuring asset safety.

- Active community: Stargate has an active developer community continuously driving project innovation and development.

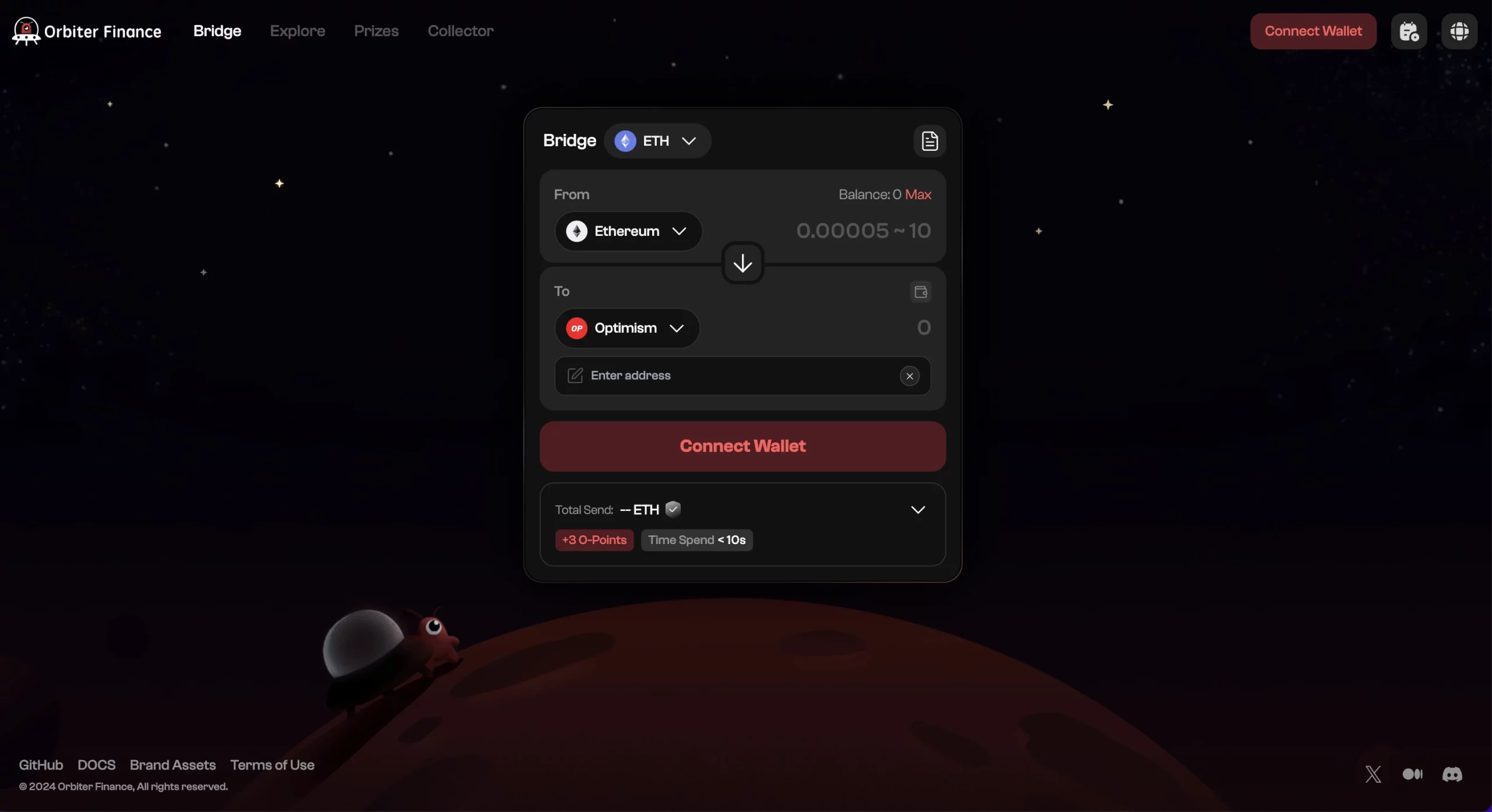

#5-Orbiter Finance

Orbiter Finance’s core functionality is achieving cross-chain transactions through AMM mechanisms. It utilizes Uniswap V3’s efficiency and flexibility to provide users with low-slippage cross-chain trading experiences.

Orbiter Finance’s technical characteristic lies in its deep integration with Uniswap V3. By utilizing

Uniswap V3’s liquidity pools, Orbiter Finance can provide sufficient liquidity, thereby reducing transaction slippage.

Orbiter Finance’s advantages include:

- High transaction efficiency: Due to the AMM mechanism, Orbiter Finance has high transaction efficiency with minimal slippage.

- Sufficient liquidity: Provides abundant liquidity through Uniswap V3 liquidity pools.

- Strong innovation: Orbiter Finance combines AMM and cross-chain advantages, providing users with a new trading experience.

Choosing which cross-chain bridge depends on your specific needs. If you need to bridge USDC, Circle CCTP is a good choice; if you need to cross multiple blockchains, Wormhole and Stargate are good options; if you mainly focus on Layer 2 cross-chain transfers, Across is a great choice; if you want higher transaction efficiency, Orbiter Finance is a good option.

CONCLUSION

Cross-chain bridges free blockchain assets from single-chain limitations, allowing them to flow wherever needed. From Circle CCTP to Wormhole, from Across to Stargate, and to Orbiter Finance, these bridges are gradually breaking down barriers between different blockchains.

In the future, cross-chain bridges will become essential tools connecting the entire blockchain world, leading us toward a new era of multi-chain interconnection and free asset flow.

▶ Buy Crypto at Bitget

ꚰ CoinRank x Bitget – Sign up & Trade to get $20!