KEYTAKEAWAYS

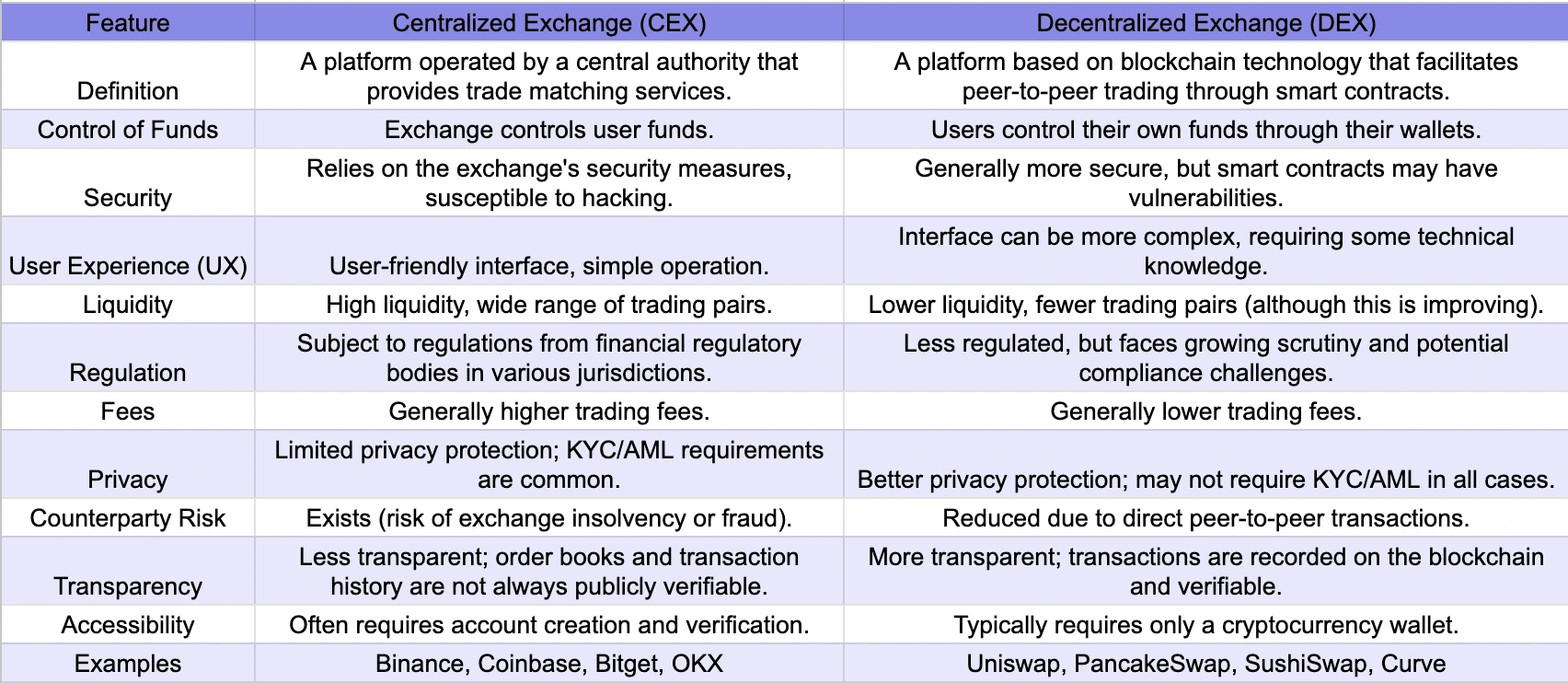

- Decentralized exchanges (DEX) enable trustless, transparent trading and offer key advantages over centralized exchanges (CEX).

- Platforms like Uniswap and PancakeSwap use smart contracts and liquidity pools to ensure secure trading while giving users full control of their assets.

- The comparison highlights differences in user control, privacy, and the technology behind platforms such as Uniswap, Curve, and Raydium.

CONTENT

The article explores the benefits of decentralized exchanges (DEX) over centralized ones, emphasizing trustlessness, transparency, and user control, while examining key platforms and future growth potential.

If you want to swap Bitcoin for Ethereum at a traditional centralized exchange, you’ll first need to register an account, upload your ID for identity verification, and wait for approval before you can start trading.

This process is not only time-consuming but also requires sharing your personal information with the platform. More importantly, since your funds have to go through the exchange, they’re at risk if the exchange gets hacked.

In contrast, on a decentralized exchange (DEX), you only need to store your cryptocurrency in a personal digital wallet (like MetaMask). By connecting to the trading platform, you can directly trade with other users without any third-party intermediaries or identity verification.

All transactions are automatically executed through smart contracts, funds remain under your control, and the entire process is transparent, with transaction records permanently stored on the blockchain.

This comparison clearly demonstrates the core value of decentralized exchanges: trustlessness, disintermediation, and user asset self-management. In DEX, transactions don’t rely on any centralized institutions, trading is faster, and privacy and security are effectively guaranteed.

WHAT IS DEX AND HOW DOES IT DIFFER FROM CEX?

Current State and Advantages of CEX:

Like a large shopping mall – comfortable environment, attentive service, and beginner-friendly. Platforms like Bitget provides comprehensive services, from buying coins to trading and withdrawals in one place. The downside is that you need to trust the platform with your money, just like trusting a bank not to fail.

Current State and Advantages of DEX:

More like a self-service store – no staff, but you’re in complete control. Your money stays in your hands; you can buy and sell as you please without worrying about platform failures. However, there’s currently a learning curve, similar to using a vending machine for the first time.

(Source:Defillama)

Also read:

Cetus on Sui : The Future of DEX

Choosing the Right Cryptocurrency Exchange: CEX vs DEX

MAJOR DECENTRALIZED EXCHANGES

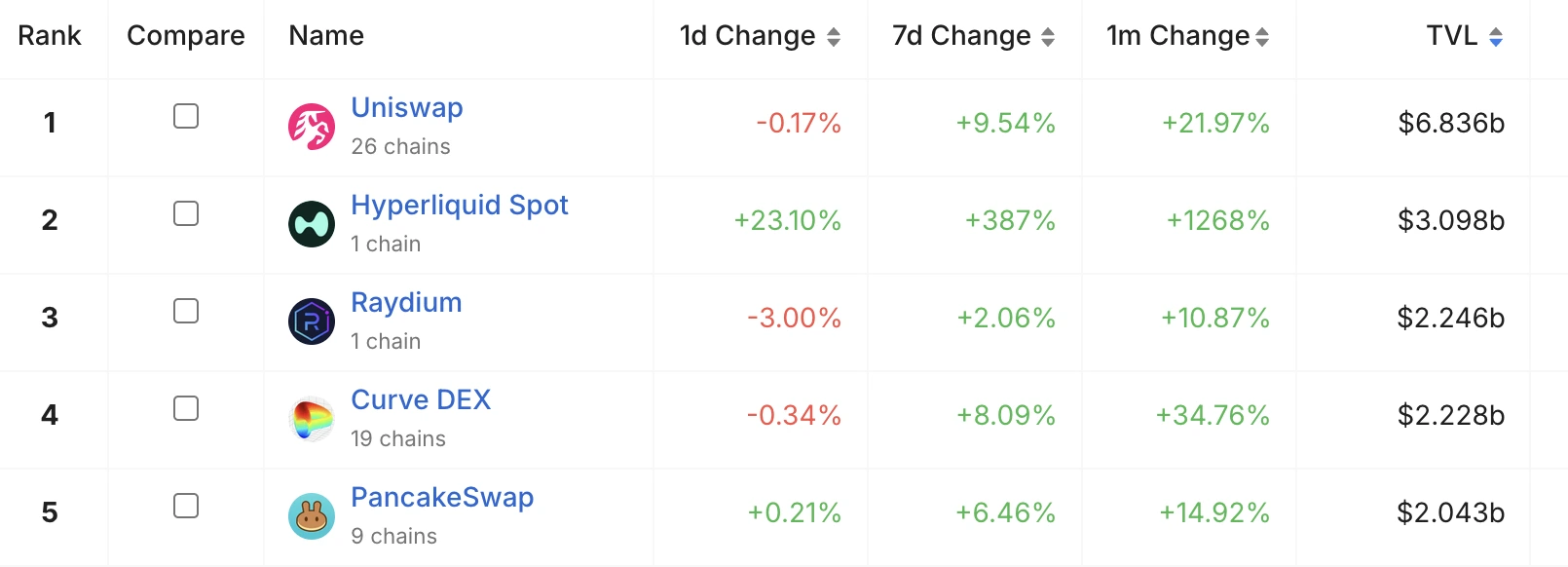

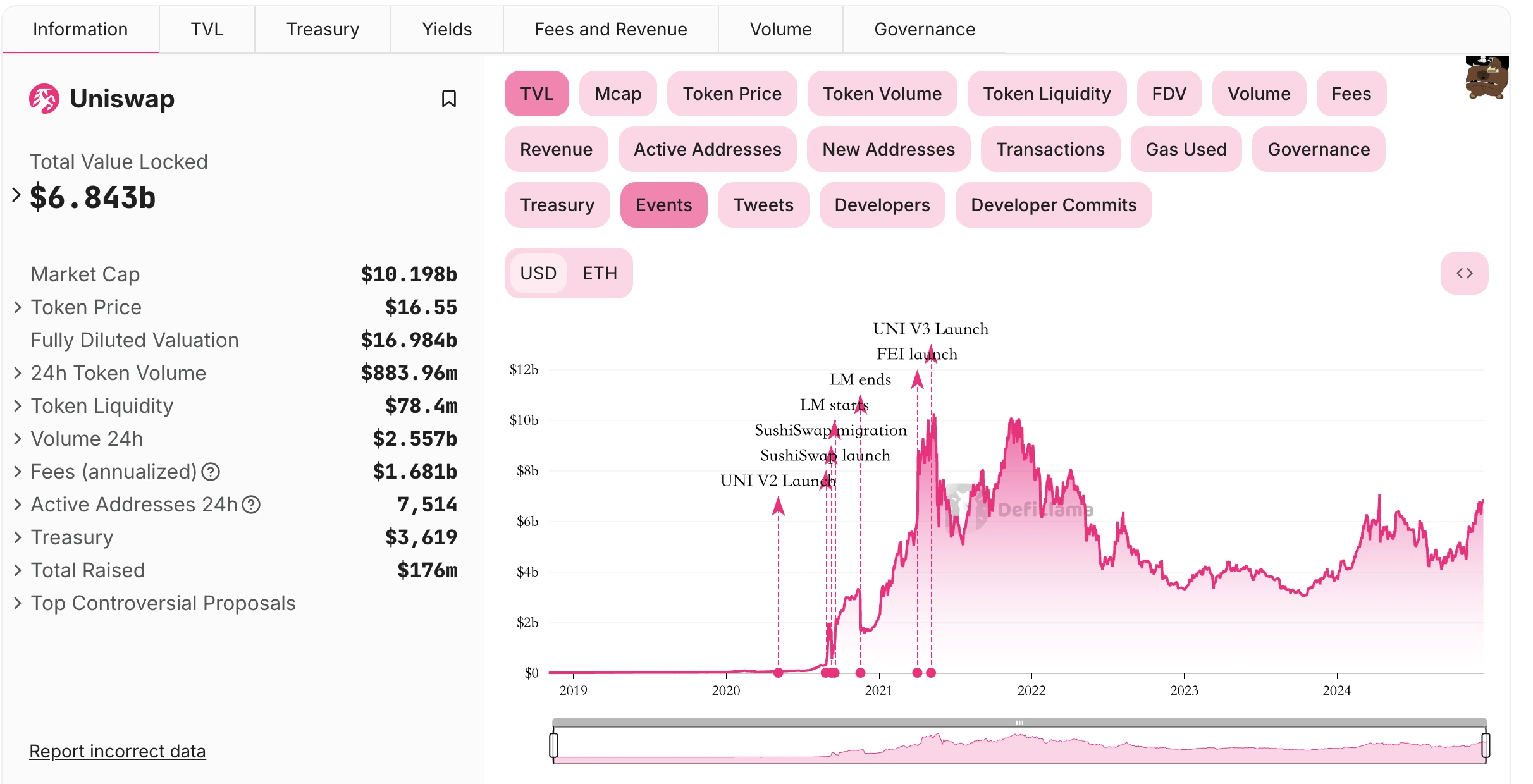

The 5 Most Popular DEXs #1: Uniswap (TVL: $6.836b | 26 chains)

Recent Performance: 1d -0.17% | 7d +9.54% | 30d +21.97%

(Source:Defillama)

Think of it as the “Amazon” of the crypto world. It created a way for anyone to easily trade cryptocurrencies. Instead of matching buyers with sellers, you simply deposit into or withdraw from a “pool.”

For example, if you want to exchange ETH for USDT, you deposit ETH into the pool and automatically receive the corresponding USDT. Its success comes from simplifying complex processes – anyone can trade just by connecting their wallet to the website. It now supports 26 blockchains, like having branches in 26 different markets.

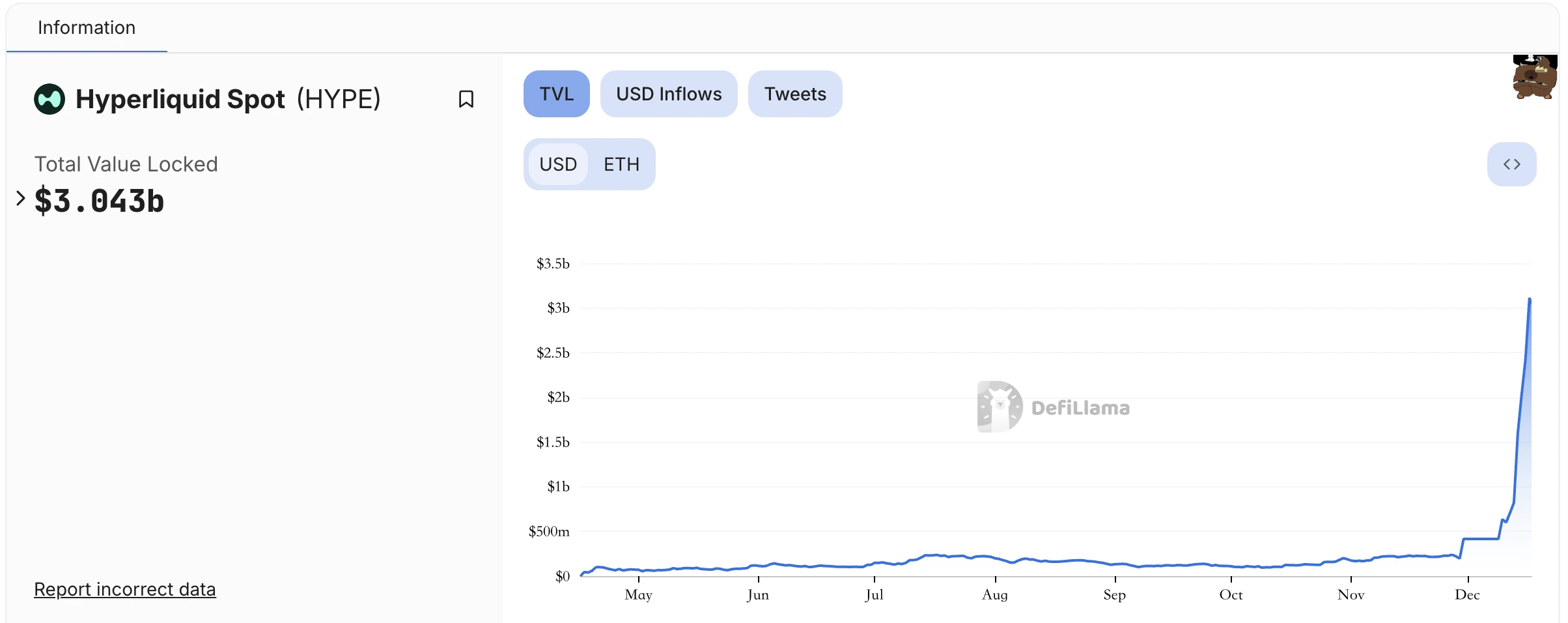

The 5 Most Popular DEXs #2: Hyperliquid Spot (TVL: $3.098b | 1 chain)

Recent Performance: 1d +23.10% | 7d +387% | 30d +1268%

(Source:Defillama)

Think of it as a premium trading venue – while it only operates on the Arbitrum chain, it offers an outstanding trading experience. Rather than a regular store with queues, it’s more like a mall with countless checkout counters, enabling instant trades with precise pricing. It uses an order book system, just like traditional stock exchanges, where all buy and sell orders are matched in real time.

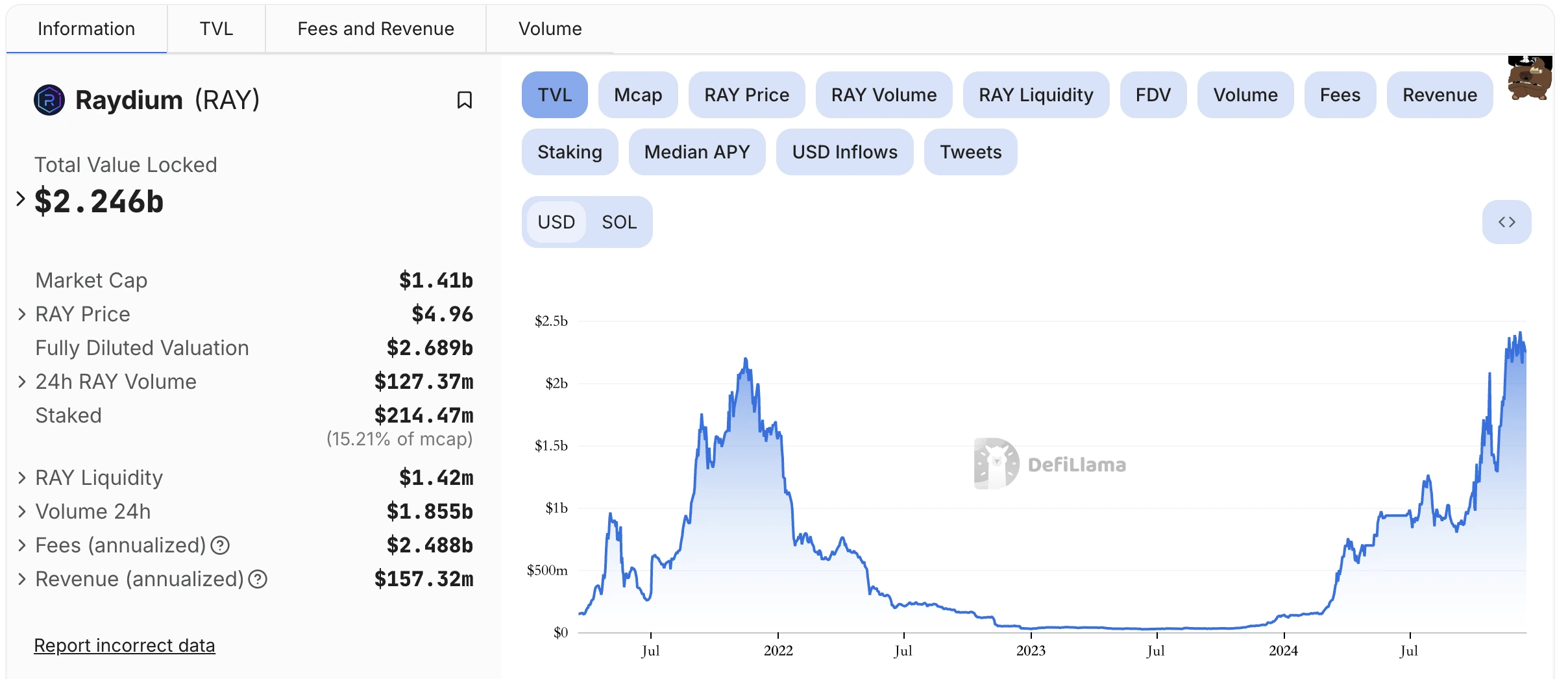

The 5 Most Popular DEXs #3: Raydium (TVL: $2.246b | 1 chain)

Recent Performance: 1d -3.00% | 7d +2.06% | 30d +10.87%

(Source:Defillama)

The leading exchange on the Solana blockchain. Solana’s main features are speed and low fees, which Raydium fully utilizes. It combines the advantages of pool trading and order books, offering users a fast and flexible trading experience. Think of it as a platform that combines both wholesale market (order book) and retail store (liquidity pool) characteristics.

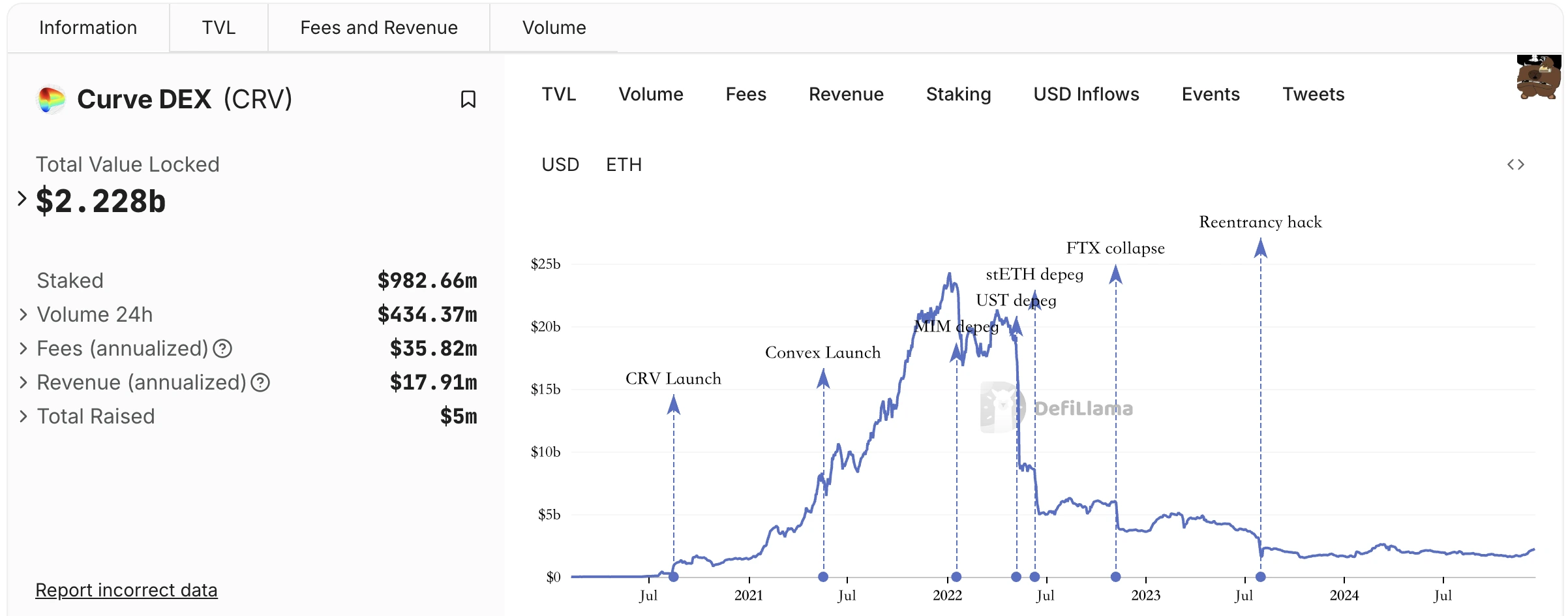

The 5 Most Popular DEXs #4: Curve DEX (TVL: $2.228b | 19 chains)

Recent Performance: 1d -0.34% | 7d +8.09% | 30d +34.76%

(Source:Defillama)

Unique in its focus on stablecoin trading. Imagine it as a specialized forex exchange window, but only for various types of USD (USDT, USDC, etc.). Its special feature is minimal price slippage when converting between stablecoins, something rarely achieved on other platforms.

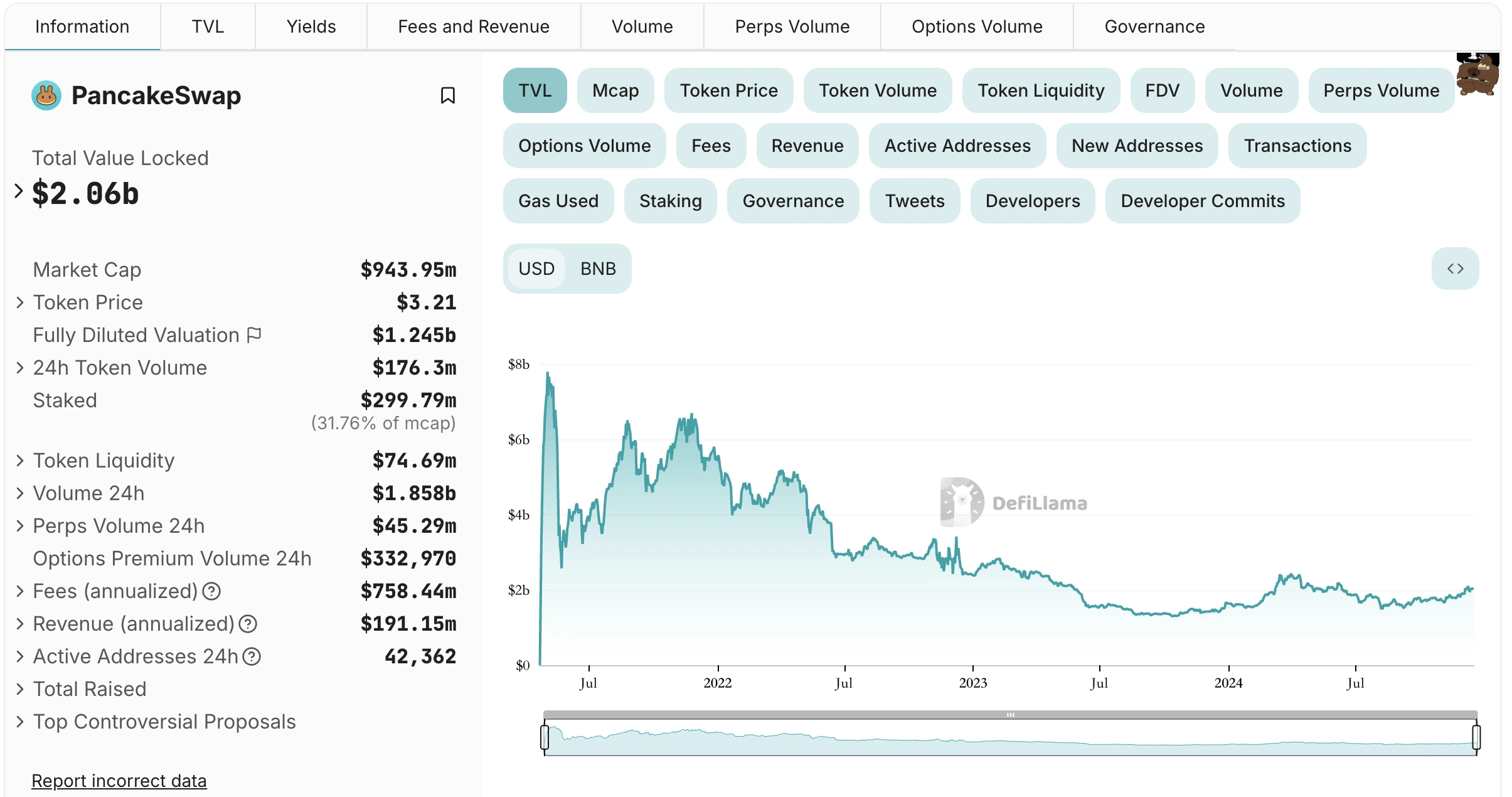

The 5 Most Popular DEXs #5: PancakeSwap (TVL: $2.043b | 9 chains)

Recent Performance: 1d +0.21% | 7d +6.46% | 30d +14.92%

(Source:Defillama)

True to its playful name, it’s the most “down-to-earth” platform. Originally developed on Binance Smart Chain, it attracted many regular users due to low transaction fees. Beyond trading, it includes fun features like lottery and prediction markets, making it a comprehensive platform combining trading and gaming. Now expanded to 9 blockchains while maintaining its user-friendly character.

These exchanges each have their unique characteristics, like different types of trading venues in the real world – malls, specialty stores, wholesale markets, etc., meeting various user needs. Choose based on your specific requirements: Uniswap for stability and security, Hyperliquid for speed, PancakeSwap for low costs, Curve for stablecoin trading, and Raydium for Solana ecosystem trading.

HOW DEX WORKS

Smart Contracts: Automated Rulebooks

Think of a vending machine – you put in $2, and it automatically gives you a cola. Smart contracts work in the same way. When you want to swap ETH for USDT on a DEX, the smart contract acts like a reliable robot, automatically executing the trade based on preset rules, without any possibility of cheating or mistakes.

Liquidity Pools: A Magical “Fund Pool”

Traditional exchanges are like markets where buyers and sellers need to negotiate prices. But DEX liquidity pools are like a buffet – take what you want at marked prices. The “food” (tokens) in this “buffet” is provided by other users who earn fees by providing these “foods,” just like restaurants earn by providing meals.

Trustless Mechanism: A Transparent Glass House

DEX is like a completely transparent glass house where everyone can see everything happening inside. All transactions are recorded on the blockchain, like writing with permanent ink in a public ledger. No one can secretly modify records because everyone can see them. You don’t need to trust anyone because the entire system is transparent and runs automatically through code.

Wallet and Key Management: Your Digital Safe

Digital wallets are like your personal safe, with private keys being the only key to open it. When using DEX, you don’t need to deposit money elsewhere; instead, you interact directly with DEX using your safe (wallet). It’s like shopping online with PayPal – money stays in your account until you confirm payment.

Remember, keeping your private key (the key) safe is crucial because if lost, like losing a safe key, you can never retrieve what’s inside. No one can help you recover this key, so it must be kept secure.

This is how DEX works fundamentally, using smart contracts, liquidity pools, and blockchain technology to enable safe, autonomous cryptocurrency trading without intermediaries.

FUTURE OUTLOOK FOR DEX AND CEX

While decentralized exchanges offer more freedom and flexibility in cryptocurrency trading, they face challenges in liquidity, transaction speed, and user experience. As technology advances, particularly with Layer 2 solutions, DEX will improve efficiency, reduce fees, and overcome current bottlenecks.

Meanwhile, traditional centralized exchanges (CEX) still dominate the market by offering higher liquidity, faster transaction execution, and more user-friendly experiences.

Therefore, DEX and CEX aren’t completely opposing forces; they might complement each other in the future, creating a diverse trading ecosystem.

As decentralized finance (DeFi) and blockchain technology continue to develop, decentralized exchanges are expected to play an increasingly important role in the financial industry, becoming one of the mainstream platforms for crypto asset trading.

▶ Buy Crypto at Bitget