KEYTAKEAWAYS

- Web3 airdrops have distributed over $26.6 billion, evolving from fixed rewards to complex point systems, reflecting the industry's adaptation to user acquisition challenges.

- Post-airdrop bubble effects pose significant challenges, with many projects experiencing sharp declines in usage metrics after snapshot periods end.

- Effective evaluation of airdrop success requires diverse metrics, including user retention, feature usage, and community engagement, to gauge long-term project viability.

CONTENT

Explore the impact of Web3 airdrops, from Uniswap’s historic $UNI drop to current challenges. Learn about innovative strategies, bubble effects, and key metrics for assessing post-airdrop performance.

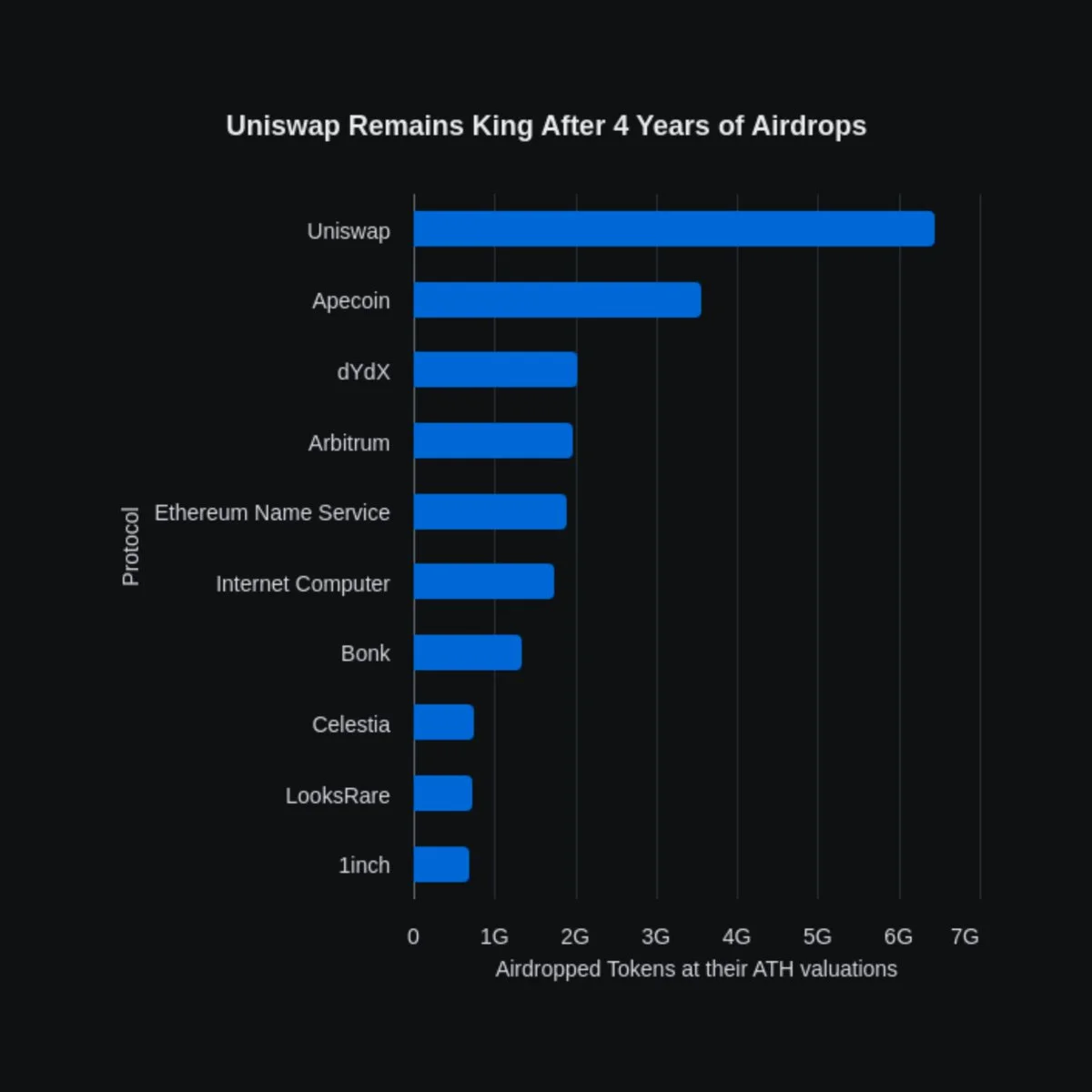

The $UNI airdrop by Uniswap marked a historic moment in Web3, remaining the largest airdrop event to date with a peak value of $6.4 billion even four years later. Since then, the Web3 industry has undergone significant changes, with new protocols typically using airdrop strategies to acquire early users and impressive metrics. However, this has also led to the emergence of numerous airdrop hunters.

To date, the 50 largest airdrops in Web3 have distributed over $26.6 billion in total value. This “free money” opportunity hasn’t gone unnoticed, with each quality project launch now attracting a large number of users eager to exchange minimal costs (time, attention, and gas) for initial airdrop tokens.

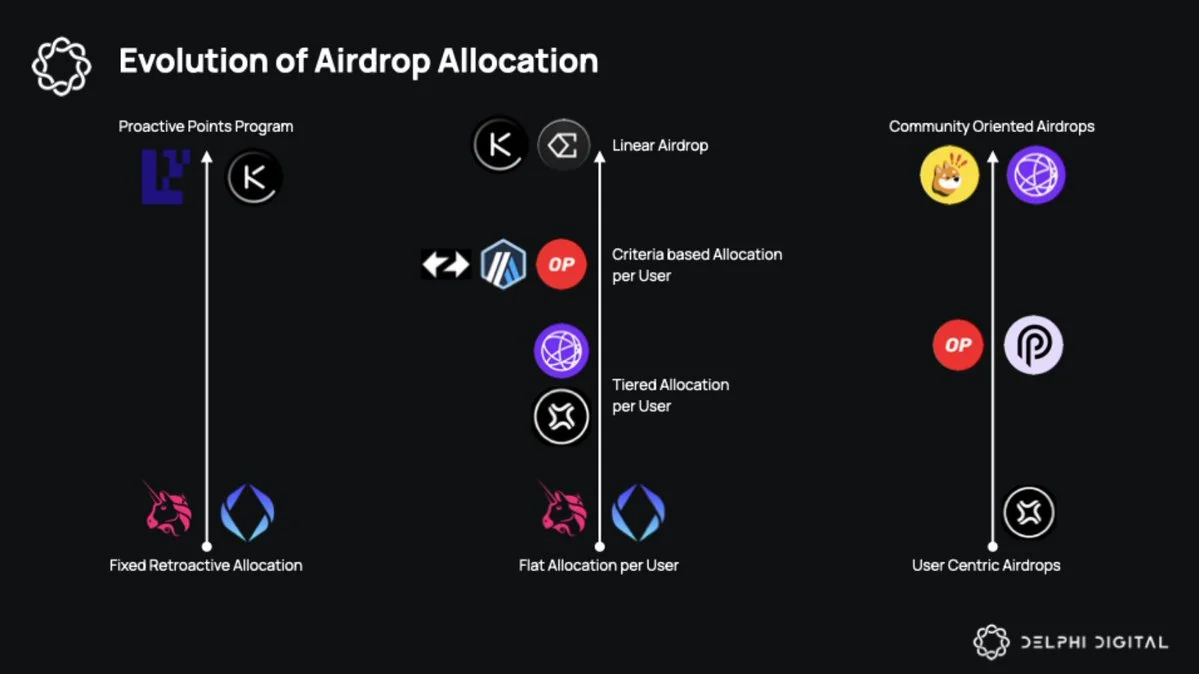

In response, new protocols have developed innovative airdrop standards and anti-Sybil measures:

- Fixed reward systems (e.g., Uniswap)

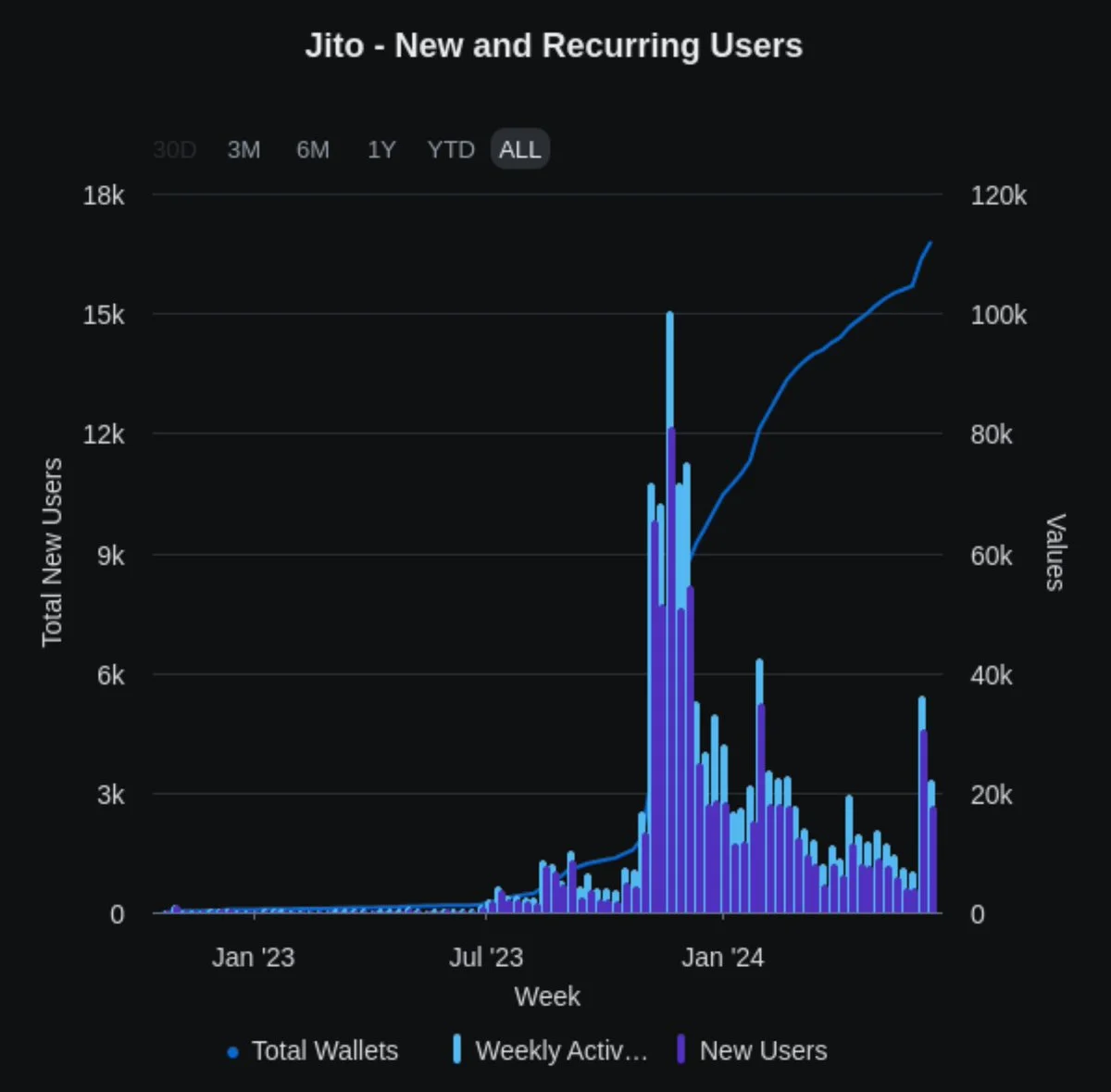

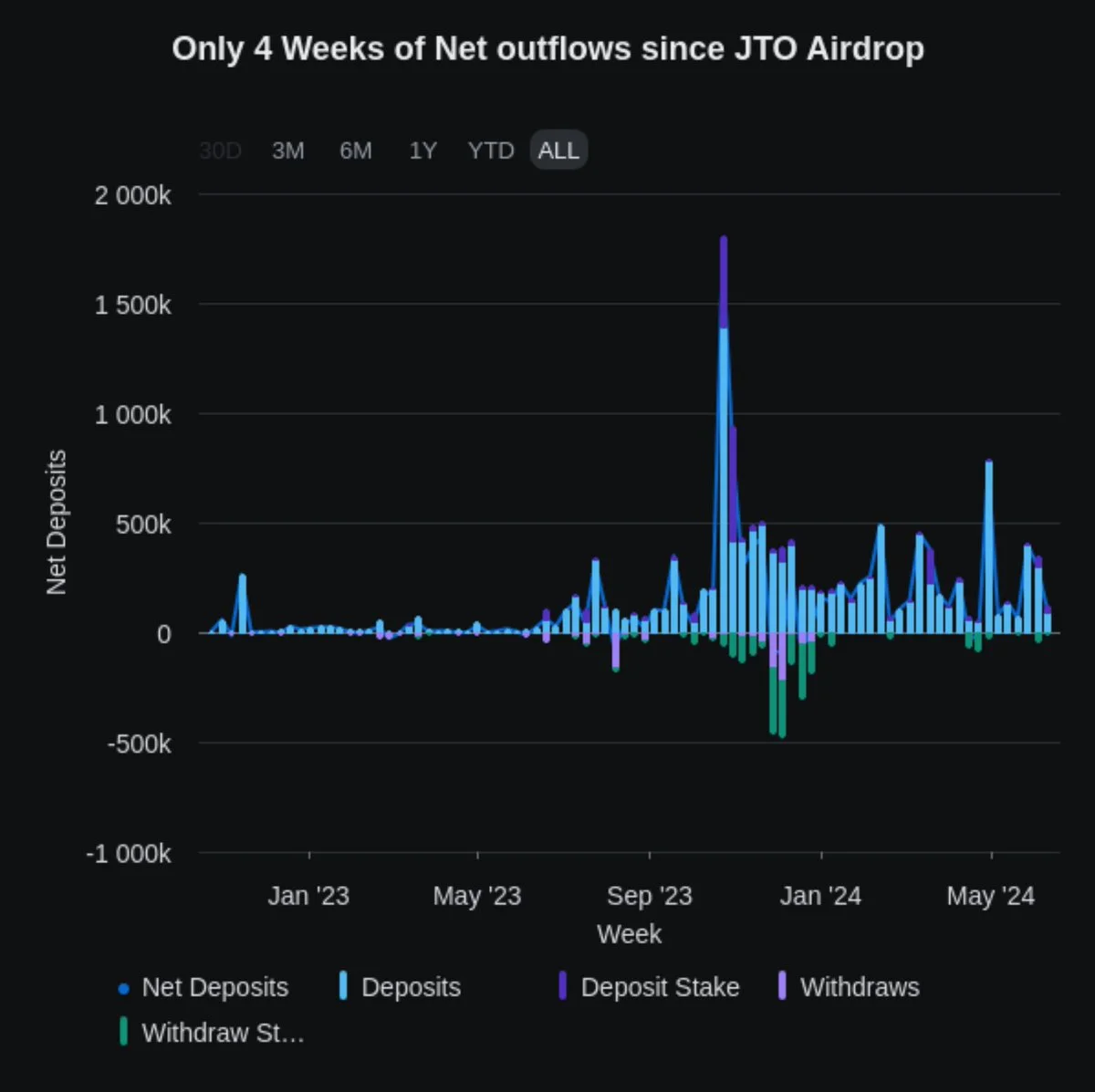

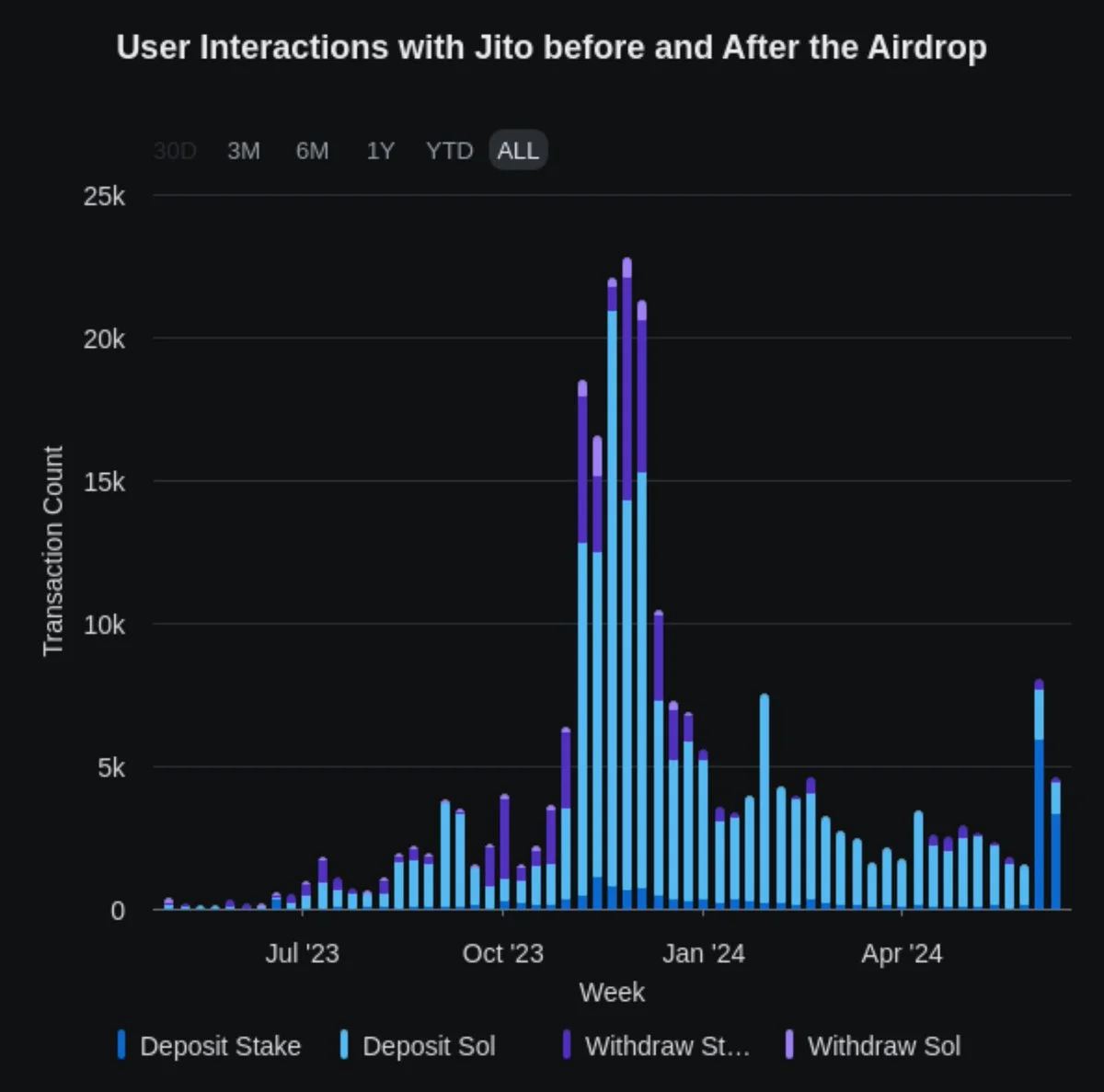

- Tiered airdrops (e.g., Jito)

- Multi-criteria airdrop standards (e.g., Optimism)

- Point systems (currently popular)

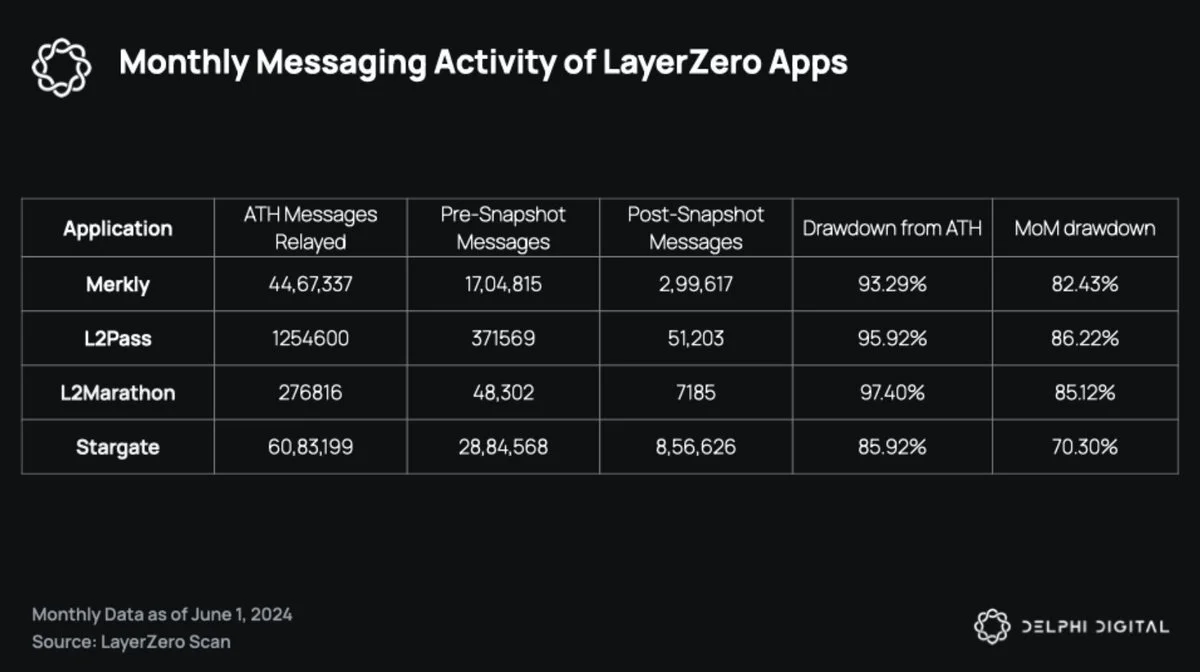

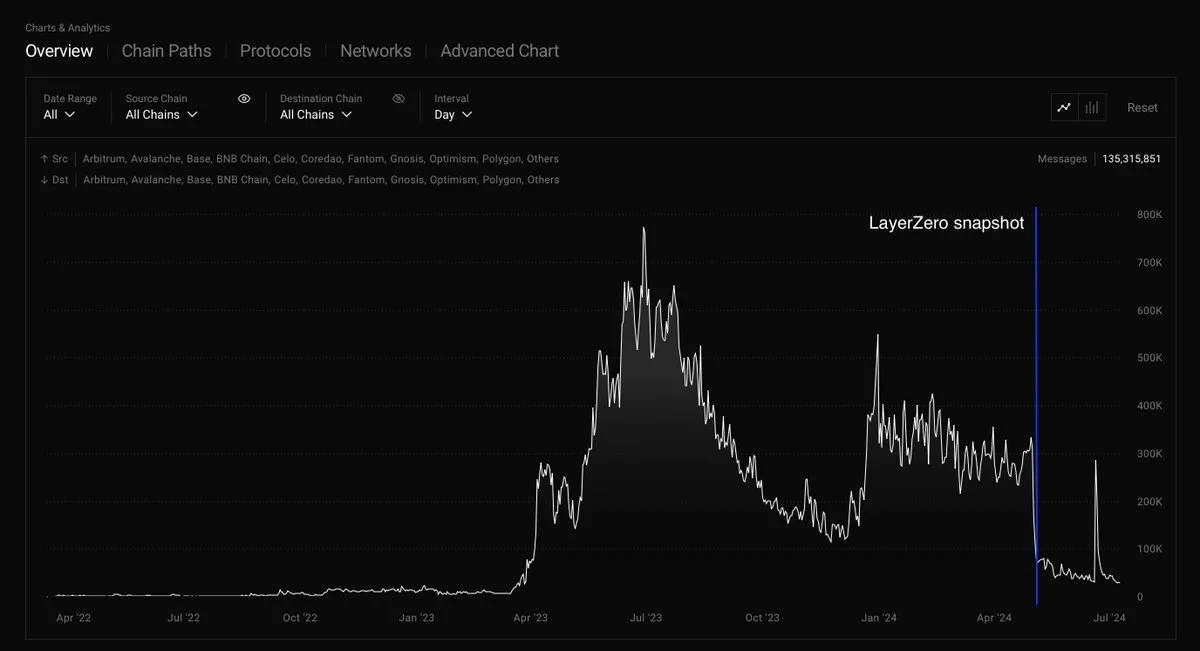

However, the main issue for many protocols favored by airdrop hunters is the bubble effect: usage metrics drop sharply once the snapshot period ends.

For example, Layerzero’s Stargate Finance saw its cross-chain transaction volume plummet from $1.67 billion to $406.7 million since April, a decrease of about 75%. This phenomenon is not unique to L0 but is widespread across the industry.

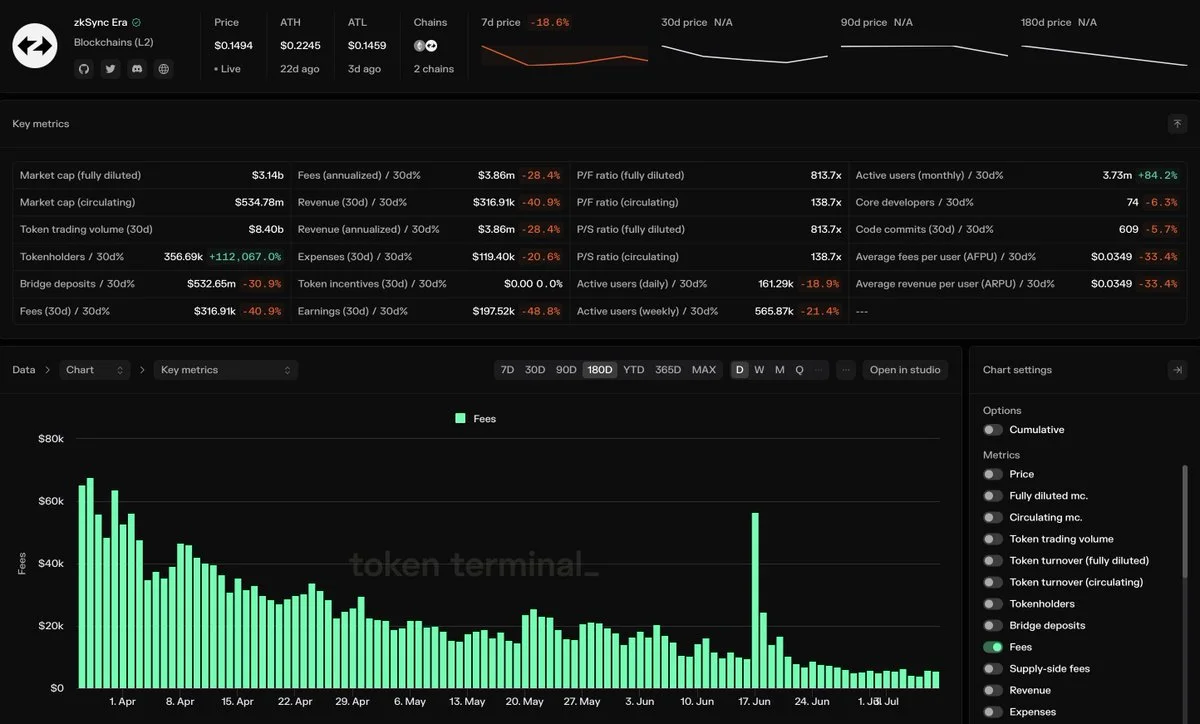

Similarly, zkSync‘s daily fees, which were comparable to Arbitrum‘s before the $ZK airdrop, have been declining since the official announcement of the snapshot and TGE. Recently, this figure fell below $10,000 for the first time.

Other projects like Kamino, Parcl, Manta, and Jito have shown similar patterns: on-chain activity experiences a noticeable decline after the snapshot. From another perspective, this inorganic growth strategy poses a significant problem for the project’s subsequent development, affecting users’ and investors’ evaluations and investment decisions.

To better assess a project’s performance post-airdrop, consider the following metrics:

- Changes in DAU and MAU after the airdrop announcement

- User retention rate within a specified period post-airdrop

- Ratio of new to old users in DAU or WAU

- Number of transactions per user

- Usage frequency of core features

- Wallet engagement metrics

- Community discussions and governance activities

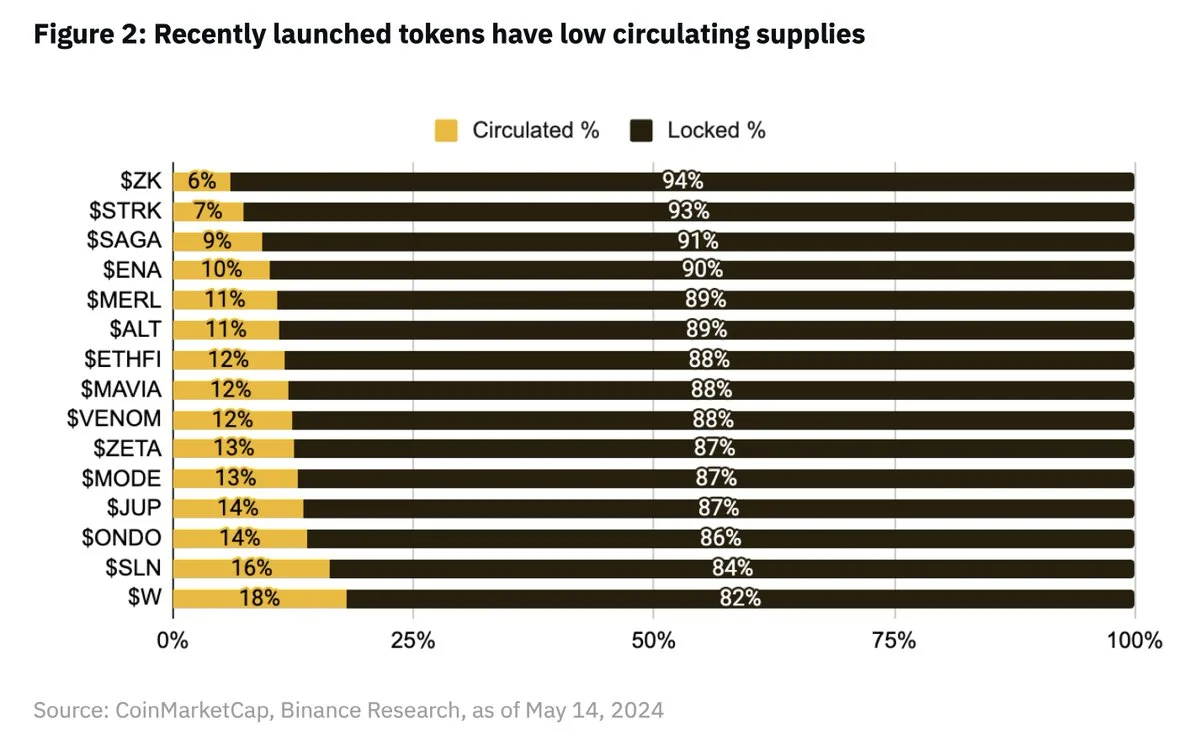

Another issue discussed in the airdrop sphere in 2024 is the widespread adoption of “low circulation, high FDV” token models by many new protocols. This model makes it difficult for buyers to assess growth potential and offset selling pressure from airdrops.

Airdrops remain one of the most effective means for new protocols to attract users, with some potentially becoming loyal or active users. However, this is similar to Twitter giveaways: some users will visit, a few may become active users, but most will disappear.

Summary

- Airdrop Evolution: Strategies have evolved from fixed rewards to point systems, reflecting the continuous optimization of user acquisition tactics.

- Bubble Effect Challenge: Multiple cases show sharp declines in usage post-airdrop, highlighting the limitations of inorganic growth strategies.

- Diversified Evaluation Metrics: It’s recommended to assess post-airdrop project performance through multidimensional indicators, including user retention, feature usage, and community engagement.

- Token Economic Models: Low circulation, high FDV models may hinder accurate project valuation by investors, necessitating more transparent token distribution mechanisms.

- Limited Long-term Impact: While airdrops can attract initial attention, the conversion rate to loyal users remains low, requiring projects to develop more effective user retention strategies.

Original Source: Stacy Muur