KEYTAKEAWAYS

- The upcoming Federal Reserve policy meeting could signal potential interest rate cuts, impacting global markets and Bitcoin.

- Historical data shows varied S&P 500 performance following initial rate cuts, with stocks often rallying after prolonged hiking cycles.

- The Bitcoin mining industry faces challenges due to record-high hash rates and declining profitability, as illustrated by Marathon Digital Holdings' financial outlook.

CONTENT

The Fed’s interest rate decision could reshape Bitcoin’s trajectory amid mining sector challenges and forecasts of potential market rallies.

>>> Read more:

Bitcoin recently made headlines by briefly touching $70,000, but as previously cautioned, it remains constrained within a challenging trading range without significant macroeconomic support. However, recent developments, particularly surrounding the Federal Reserve’s upcoming meeting, could potentially alter this situation.

FED MEETING SPARKS RATE CUT SPECULATION

The Federal Reserve is set to hold its fifth meeting of the year on July 30-31, an event capturing global attention. All eyes are on Federal Reserve Chair Jerome Powell, who is expected to signal the Federal Open Market Committee (FOMC)’s stance on potential rate cuts in upcoming meetings.

Top forecasting institutions, including CNN and the Associated Press, predict a high probability of a rate cut announcement. They base this on three key factors:

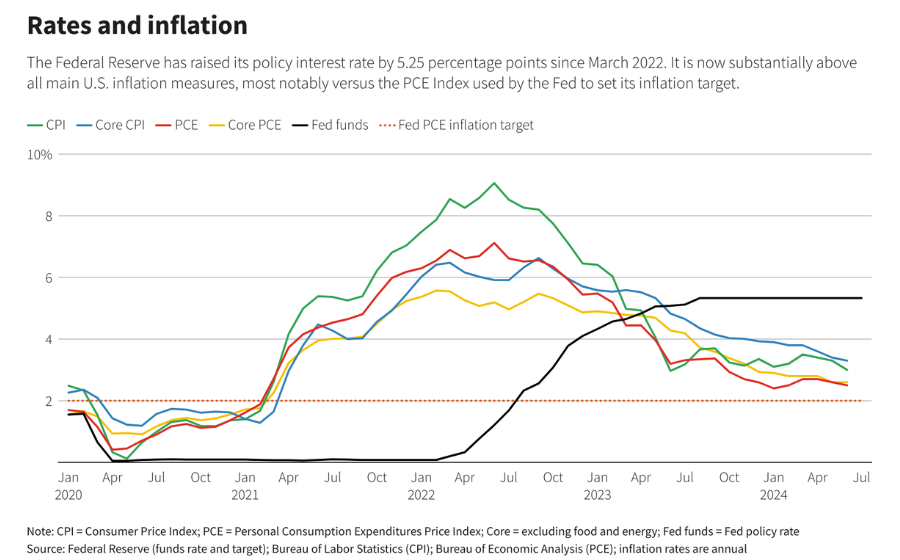

- The US Consumer Price Index (CPI) for June reached a new low of 3%, the lowest since March 2021, indicating controlled inflation.

- The European Central Bank lowered interest rates to 4.25% in June, potentially creating an interest rate differential if the Fed maintains its current rate.

- US economic growth has notably slowed, with Q1 real GDP growing at an annualized rate of just 1.3%.

(source: Reuters)

Most analysts anticipate a total of 50 basis points in cuts this year, likely occurring in September and December, with some predicting up to 75 basis points of reductions in 2024. Some observers suggest that if not immediate, a rate cut could be announced in August or mid-September.

>>> Read more: Fed’s Dilemma: Job Market Trends and Economic Outlook for 2024

HISTORICAL MARKET TRENDS SUGGEST POTENTIAL RALLY FOLLOWING RATE CUTS

The S&P 500’s performance following the first rate cut after a prolonged hiking cycle has varied. Positive outcomes were observed in scenarios like July 1995 and 2019, while negative outcomes occurred after cuts in January 2001 and September 2007, preceding economic downturns.

With inflation declining and the labor market showing signs of weakness, conditions for rate cuts are becoming more favorable. Historically, stocks tend to rally following rate cuts, particularly after periods of decline, suggesting a potential rebound in both stocks and Bitcoin.

Global Impact of Potential Rate Cuts

If the Federal Reserve announces a rate cut, it could have several significant impacts:

- Currency exchange rates: The US dollar may weaken, potentially leading to an appreciation of other currencies.

- Trade dynamics: Imports to the US might become cheaper, while the impact on exports could be mixed.

- Debt relief: For companies holding US dollar-denominated debt, a rate cut could ease repayment pressures.

- Global investment flows: Lower US interest rates could drive capital from US banks into global stock markets.

THE STRUGGLES OF BITCOIN MINING SECTOR

The Bitcoin mining sector faces challenges, with several miners set to report earnings soon. The total hash rate has reached a new all-time high of 660 million terahashes per second (TH/s), leading to higher network difficulty and depressed miner revenues.

Marathon Digital Holdings, a benchmark in the industry, is projected to report a quarterly loss of $0.19 per share on August 1. The company has increased its mining capacity but has also been selling Bitcoin to support operations. Marathon’s realized hashrate declined to 75% in June, and it has missed earnings expectations in the last four quarters.

>>> Read more: Is AI Transformation the Answer to Crypto Mining Companies?

WHAT WE CAN EXPECT FROM THE CRYPTO MARKET

A more accommodative Fed policy, including possible rate cuts, could significantly support Bitcoin prices. This is particularly important for Bitcoin, as increased market liquidity could lead to higher valuations, with Bitcoin prices potentially rising in tandem with the increased liquidity.

While caution is advised with highly volatile assets, potential rate cuts and their economic impacts may create opportunities in the cryptocurrency market. Historically, the fourth quarter (October, November, and December) has typically been the strongest period for Bitcoin, suggesting that opportunities for strategic investment may be on the horizon.

>>> Read more:

-

Trump’s Bitcoin Conference Speech Summary: A Turning Point for Crypto in American Politics

-

Bitcoin Nears ATH: Trump’s Speech to Trigger Parabolic Rise?

▶ Buy Bitcoin at BingX

Sign up to claim 5,000+ USDT in rewards & 20% off trading fees!