KEYTAKEAWAYS

Decentralized Venture Capital: Synbo is pioneering the decentralization of venture capital, which we believe is the inevitable direction of the industry's evolution.

Beyond Funding: Synbo offers more than just financial support. By connecting investors with startups, we cultivate loyal communities of consensus user groups, fostering organic growth and collaboration.

Community-Driven: Our protocol promotes a collaborative environment where investors and startups engage directly, creating a dynamic and supportive ecosystem.

CONTENT

Synbo Protocol is an innovative underlying protocol for decentralized venture capital, committed to transforming the investment landscape. By leveraging the principles of decentralization, Synbo ensures a fair, efficient, and transparent investment process that benefits both investors and startups.

***Editorial content in partnership with Synbo. Views expressed do not reflect those of CoinRank. Not financial advice.

THE CENTRALIZATION ISSUE

In the field of crypto currency, decentralization has always been regarded as one of its core values, aiming to achieve the dispersion of power and control through blockchain technology. However, the reality is not always so ideal. Many crypto currency projects, especially those supported by venture capital, have not actually achieved true decentralization. This phenomenon is largely due to the control of these projects by traditional venture capital firms, and this centralization issue is criticized as “traditional investment bullying”.

Firstly, we need to understand the essence of decentralization. Decentralization means the dispersion of power and decision-making, not being controlled by a single entity or a few entities. Ideally, crypto currency projects should be jointly governed by a wide range of community members, rather than being dominated by a few investors or companies. However, the reality is that many crypto projects supported by venture capital still have relatively strong control behind the scenes, which runs counter to the core value of decentralization.

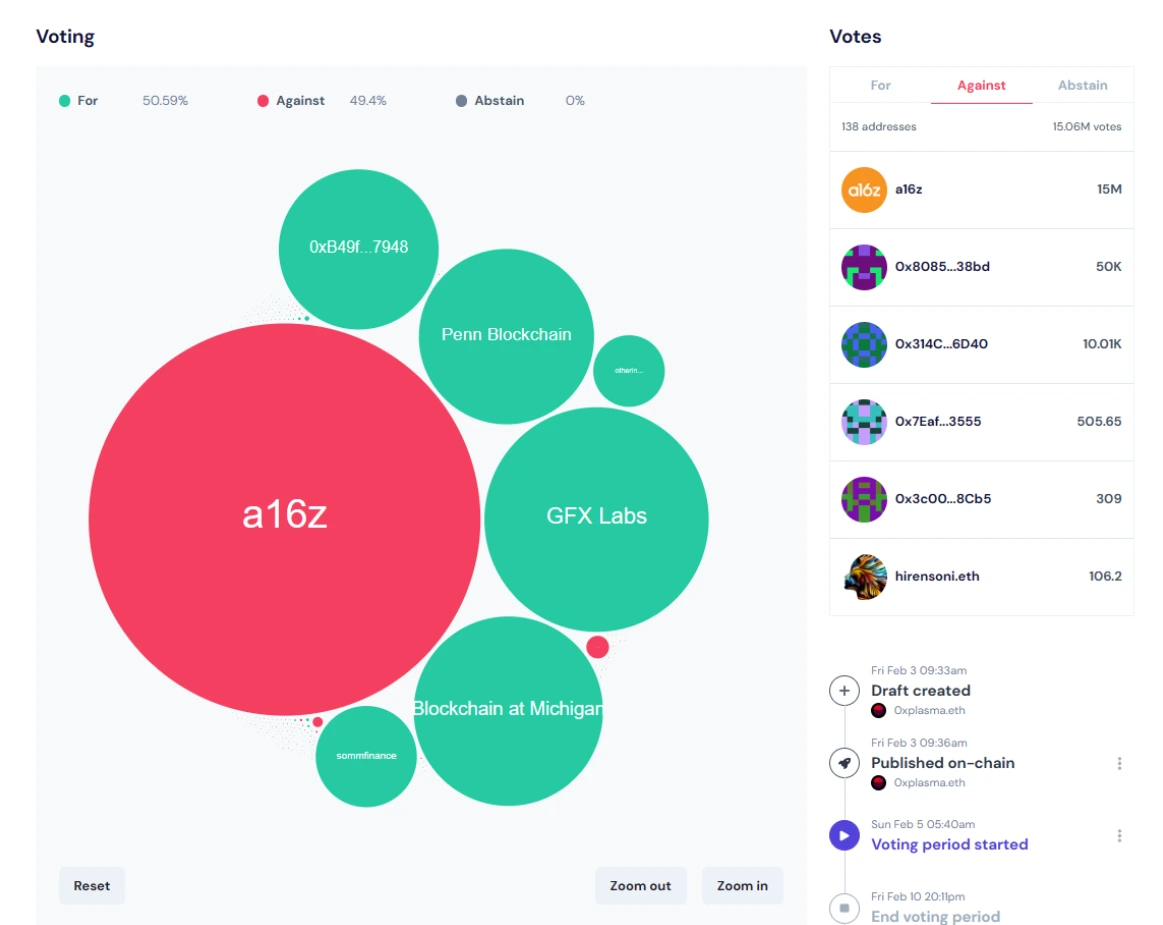

The over-investment and control of large-scale venture capital institutions over projects have undermined the ideal of decentralization. These institutions, through capital injection, have gained significant influence over the development direction of the project, thus effectively controlling the decision-making process of the project. For example, the venture capital firm Andreessen Horowitz (a16z) voted with its 15 million UNI tokens in the vote on the deployment of Uniswap v3 to the BNB Chain. The proportion of support votes (80.28%) with 20 million initially was exceeded by the 15 million votes of a16z, and the proportion of opposition votes was 19.72%. This clearly shows the control that large centralized stakeholders can exert over so-called decentralized projects. This control not only violates the principle of decentralization but may also cause the project to deviate from its original vision and goals.

Edward Snowden emphasized the importance of decentralization at the Redacted conference of Near and criticized the influence of venture capital on blockchain projects, especially taking Solana as an example. Solana, which fell due to FTX and was restructured by capital shuffling, has made a comeback since 2023 and became the third-largest public chain in 2024 due to the rapid development in the Meme field. However, it is well known that Solana was relaunched with heavy capital support. Edward Snowden described Solana as “born in prison” because it received a large amount of venture capital investment, which may hinder the independent operation ability of the blockchain network. Despite its rapid growth, investors have too much ownership, which may affect the decentralization and independence of the project.

THE UNFAIRNESS OF VC COINS TO INDIVIDUAL INVESTORS

Projects dominated by VC often bring greater unfairness to Individual investors. This unfairness is mainly reflected in that venture capital firms acquire a large number of tokens in the early stage of the project and push up their market prices during the project development process, while ordinary investors are often trapped or “cut off”.

Venture capital firms obtain a large number of tokens through early investment, and these tokens are often purchased at a lower price. Many VCs have already invested in projects at a very low price before TGE. This means that when ordinary investors buy these tokens on the open market, the price they pay is actually much higher than the cost price of the venture capital firms. Under such conditions, many venture capital firms will manipulate the market to push up the token price and make huge profits. They buy a large number of tokens in the ICO and then manipulate the market to push up the token price, while ordinary investors face the high risk of being dumped, especially for some tokens with poor liquidity, and the impact of this manipulation is even more exaggerated.

In addition, the influence of venture capital on the crypto currency market is also reflected in controlling the equity of the project to dominate the market development and affect the token price and governance structure. As mentioned above, in the example of a16z’s opposition to the vote on the deployment of Uniswap v3 to the BNB Chain, it also confirms this point. Retail investors simply cannot compete due to this “capital bullying” phenomenon, which also violates the DAO governance of decentralization.

There are also other examples, such as projects like Wormhole, Polyhedra Network, Starknet, LayerZero, Zksync, and Blast. These were highly anticipated Airdrop projects by community users and retail investors. However, the actual price performance after the airdrops did not meet expectations. These projects, largely driven by VC funding, saw increasingly exaggerated Fully Diluted Valuation (FDV), laying the groundwork for early liquidity sell-offs. As a result, ordinary users faced significant risk of losses when purchasing on the secondary market.

AIR TOKENS AND PONZI SCHEMES IN TRADITIONAL CAPITAL SPECULATION

There are also some so-called “garbage projects” that are often supported by venture capital, such as “air tokens” or “Ponzi schemes.” These projects lack significant technological or market value, and are essentially driven by capital speculation and market manipulation. This has led to strong resentment in the community towards both venture capital and the tokens under their control.

Due to the highly speculative nature of the cryptocurrency market, many investors are drawn to capital operations and market manipulation. The early hype and bubbles in the industry are numerous. During the 2017-2018 ICO market bubble, many projects saw their prices surge within a short period, only to crash quickly, causing significant losses for retail investors. These projects often lacked real products or services and relied solely on investor confidence and market hype.

Such venture-backed “air tokens” or “Ponzi schemes” have been criticized for exacerbating market bubbles and exposing ordinary investors to unnecessary risks. A notable example is Finiko, a Russian financial consulting company. From December 2019 to July 2021, it promised monthly returns as high as 30% to lure investors into putting their Bitcoin or USDT into the scheme. Ultimately, it defrauded investors in Russia and Ukraine of more than $1.5 billion worth of Bitcoin.

The concept of decentralization in the cryptocurrency field aims to eliminate the inequalities present in traditional financial systems. However, in reality, capital control—especially the intervention of traditional venture capital—often distorts this ideal. We have summarized the main criticisms of VC-backed coins:

-

Centralized Control:

Despite the core principle of blockchain technology being decentralization, many VC-supported projects fail to implement this in practice. Venture capital firms often hold the majority of shares or voting rights, leading to concentrated control in the hands of a few, which contradicts the decentralized principle.

-

Profit-Driven Behavior:

Venture capital firms and capital moguls often acquire tokens at low prices in the early stages of a project and then drive up the price through market manipulation to realize profits. This causes ordinary investors to feel manipulated, and the practice of “shaving the grass” (a metaphor for exploiting retail investors) is often criticized as bullying.

-

Lack of Transparency in Project Value:

Some VC-supported projects lack technological innovation, market demand, and practical application scenarios. These projects are often seen as “air tokens” or “Ponzi schemes,” which raises doubts and dissatisfaction among investors.

-

Unfair Profit Distribution:

Venture capitalists can obtain huge returns early in a project, while ordinary investors often only get to participate later, further exacerbating wealth inequality. This unfair distribution of profits is one of the main criticisms of VC-backed tokens.

THE RISE OF MEME COINS AND DECENTRALIZED CULTURE

Many VC-backed coins in the cryptocurrency market continue the traditional venture capital model, characterized by highly centralized decision-making power and unequal influence over market resource distribution. In this model, investment decisions are often controlled by a few institutions or individuals, lacking transparency, making it difficult for ordinary investors to participate. At the same time, large amounts of capital are concentrated in a few projects, which crowds out the development space for other innovative projects, raising doubts about fairness in the market.

In response to this situation, some have turned to more decentralized projects or those that focus on community-led and self-governed cryptocurrencies. This shift is one of the key factors behind the rise of decentralized culture and meme coins, which represent the development of a decentralized ethos in the crypto market. Meme coin projects are often driven by community members, emphasizing community consensus and participation. Their development stems from the creativity and spread of network communities, with members actively promoting them through social media, forums, and other channels, thereby forming a strong community force.

Some cryptocurrency projects, such as DOGE, SHIB, and others, may not be particularly innovative in terms of technology, but they have attracted a large number of community participants thanks to meme culture and the principles of decentralization. These projects leverage the power of the community to drive value appreciation, avoiding the traditional market structure dominated by venture capital, and have become a form of rebellion against VC-backed coins. The rise of meme coins is not only a manifestation of the desire for decentralized investment but also an effort by investors to break free from the constraints of traditional investment models, creating a fairer and more transparent investment environment that allows more people to participate in project development and decision-making.

THE CONTRADICTION BETWEEN VC COINS AND MEME COINS

-

Investment Philosophy:

VC-backed coins follow a traditional investment philosophy that emphasizes the long-term development, profitability, and market potential of a project. This usually requires thorough due diligence and professional evaluation. In contrast, meme coins are more reliant on community sentiment, network effects, and short-term speculative demand. Investment decisions are generally faster and more flexible.

-

Profit Distribution:

Venture capital investments in VC coins typically seek to acquire a large equity or token share in a project to secure long-term high returns. Meme coins, on the other hand, tend to focus on widespread community participation, aiming for decentralized token ownership so that more investors can share in the project’s short-term gains. This difference in profit distribution leads to inconsistencies in market behavior and objectives between the two.

THE NECESSITY OF DECENTRALIZED CAPITAL DEVELOPMENT

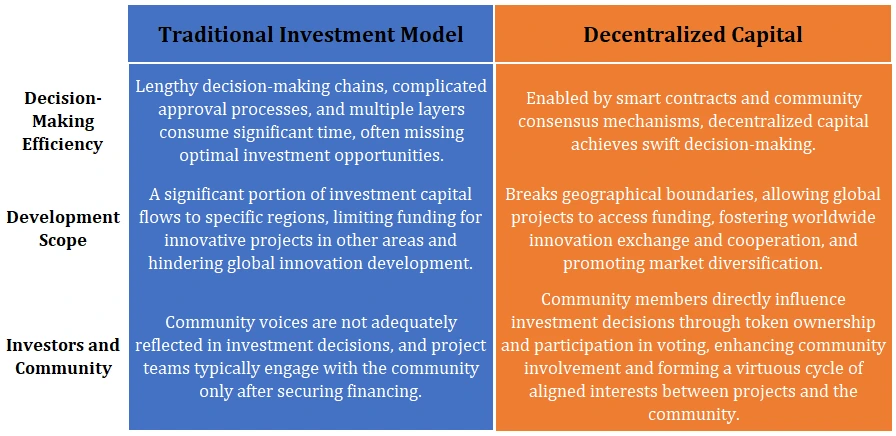

The necessity of developing decentralized capital can be illustrated through the following table, which compares the traditional investment model and decentralized capital across three dimensions: decision-making efficiency, development scope, and the relationship between investors and communities.

SYNBO PROTOCOL’S DECENTRALIZED SOLUTION

Synbo Protocol, established in April 2023, aims to reshape the cryptocurrency capital market and is committed to steadfastly pursuing decentralized investment. Through its innovative “Consensus-Self-Custody” model, Synbo Protocol reconstructs the investment decision-making process to enhance efficiency, ensure decentralization, and foster community participation. Its emergence introduces a new paradigm to the industry, addressing many of the pain points in traditional models and paving the way for a transformative approach in the decentralized capital market.

INNOVATIVE TECHNICAL ARCHITECTURE OF SYNBO PROTOCOL

-

Position-of-Proof (PoP) Mechanism

The PoP mechanism introduces an innovative approach to the investment decision-making process. Unlike traditional decision-making, which relies on closed investment committees, it establishes a dynamic consensus market. Through a 72-hour consensus cycle, Alpha Brokers stake Position Tokens to participate in decisions. Their interests are tied to the outcomes of these decisions, encouraging careful and responsible deliberation. This mechanism ensures efficiency while fostering broad market participation, making the investment process more transparent and democratic, and improving overall decision quality.

-

Community Consensus Offering (CCO) Model

Compared to the traditional Initial Coin Offering (ICO), the CCO model builds a comprehensive consensus system through a carefully designed incentive mechanism. It aligns the interests of early investors and long-term community members. The CCO model emphasizes the long-term development of projects by fostering ongoing community building and consensus formation. This ensures that projects receive support at all stages, rather than being limited to one-off fundraising events.

-

Dual Token Economic Model

The dual token system—Position Tokens and Yield Tokens—serves distinct purposes to meet the needs of different participants while maintaining economic balance within the ecosystem.

Position Tokens act as a medium for voting rights and a value capture tool, granting community members a voice in investment decisions while allowing them to share in the value appreciation of projects.

Yield Tokens provide a stable income channel for liquidity providers, attracting more capital into the ecosystem and sustaining its economic balance.

SYNBO PROTOCOL: EMPHASIZING DECENTRALIZATION AND COMMUNITY POWER

-

Community Capital Pool

The community capital pool of Synbo Protocol introduces an innovative liquidity management mechanism that ensures fund security while significantly enhancing capital efficiency, marking a key highlight of its operational model. The assets provided by Beta Miners remain fully self-custodied and can be redeemed at any time, ensuring the safety of funds. Additionally, through dynamically adjusted reward mechanisms, the community capital pool can adapt flexibly to market demand, ensuring sufficient liquidity while avoiding idle capital waste. This ensures the optimal utilization of funds, fostering the healthy development of the ecosystem.

-

Consensus Matching System

The consensus matching system redefines the relationship between project teams, investors, and the community, serving as a pivotal element in Synbo Protocol’s sustainable ecosystem. Its strength lies in its ability to efficiently connect stakeholders, achieving deep value alignment and strategic synergy. By establishing efficient communication channels, the system can swiftly identify and precisely match high-quality projects with suitable investors, ensuring effective resource allocation. Moreover, the system transforms active participants into project agents and consensus holders. This innovative design creates a sustainable growth environment for projects, enabling them to thrive with the collective support of all parties, thereby driving the prosperity of the entire ecosystem.

MARKET DEMAND ANALYSIS OF SYNBO PROTOCOL

Based on an in-depth analysis of market demand, Synbo Protocol demonstrates its flexibility across various domains:

Traditional Financing: By leveraging its unique PoP mechanism and CCO model, Synbo Protocol ensures that the financing process aligns closely with project development goals. This enables project teams to achieve more reasonable valuations while safeguarding the interests of early investors. As a result, Synbo Protocol significantly enhances the efficiency and fairness of traditional financing processes.

Fair Launch: Synbo Protocol’s innovation lies in its scientific token allocation mechanism and transparent launch rules. This approach not only achieves true decentralization and community-driven token distribution but also ensures fairness in the launch process. It establishes a sustainable value creation and distribution system, allowing more market participants to share in the project’s growth.

Real World Assets (RWA) : Synbo Protocol offers effective solutions in the realm of real-world assets by providing comprehensive services to facilitate the digital transformation of traditional assets. Its transparent valuation framework and efficient price discovery mechanism enable traditional assets to seamlessly integrate into the digital economy. This creates new value for asset holders while expanding the application scope of the crypto capital market.

ANALYSIS OF THE NEEDS OF DIFFERENT MARKET ROLES

-

Project Teams

Efficient Financing Channels: Project teams need quick and convenient access to funding to drive project development. Synbo Protocol’s innovative model shortens financing cycles and offers diverse financing options to meet the capital needs of projects at different stages, helping project teams bring their ideas to life and accelerate growth.

Fair Valuation and Resource Allocation: Project teams hope to receive a fair valuation in the market, avoiding being undervalued or overlooked due to the shortcomings of traditional investment models. Through decentralized investment decisions and a fair issuance mechanism, Synbo Protocol ensures that the value of the project is reasonably assessed and that it receives the necessary resource support for healthy development.

-

Investor Needs

Transparent Decision-Making Process: Investors seek clarity on the basis and process behind investment decisions to make more informed choices. Synbo Protocol’s PoP mechanism and CCO model offer an innovative design that makes the investment decision process more transparent. Investors can clearly see the evaluation standards for projects, the formation of community consensus, and more, which enhances their confidence and sense of security in their investments.

Diversified Investment Opportunities: Investors wish to find a broader range of investment opportunities in the crypto capital market to reduce risks. Synbo Protocol provides extensive application scenarios, covering traditional financing, fair launches, and tokenization of real-world assets, offering a wide range of investment options that allow investors to diversify based on their risk preferences and investment goals.

-

Community Member Needs

Deep Participation in Value Creation: Community members want to be more than just users; they aim to be active participants and creators within the project. Synbo Protocol’s decentralized model allows community members to participate in project decisions and ecosystem development through voting, liquidity provision, and other means, enabling them to share in the project’s success and maximize their own value.

Community Incentives and Rewards: Community members expect to receive appropriate incentives and rewards for their participation in the project. Synbo Protocol’s comprehensive token economic model allocates a significant number of tokens for community incentives, including early-stage ecosystem development and liquidity mining, offering community members opportunities to earn economic benefits and enhancing the cohesion and vitality of the community.

CONCLUSION

In the evolving landscape of the crypto capital market, decentralized investment is gradually emerging, with Synbo Protocol undoubtedly standing out as a shining star. From the early conceptualization of decentralized investment to the continuous innovation in technology and the gradual expansion of application scenarios, this development process reflects the market’s unwavering pursuit of a more fair and efficient investment model. With its innovative technical architecture, operational model, and Alpha Broker consensus decision-making system, Synbo Protocol provides a new paradigm for social innovation in investment and financing, poised to lead decentralized investment to new heights. Looking ahead, with the ongoing advancement of technology and the continuous evolution of market demand, we are excited to foresee the emergence of more projects like Synbo Protocol, collectively building a more open, diverse, and vibrant crypto capital market.

CONNECT WITH SYNBO

➡️ Website

➡️ Telegram

➡️ Discord

➡️ Medium

▶ Buy Crypto at Bitget