KEYTAKEAWAYS

- 74.2% of analyzed airdropped tokens trade below initial listing price, suggesting immediate conversion to USD or Bitcoin is often the most profitable strategy.

- Meme coins like BONK and DEGEN have defied trends, achieving remarkable success, indicating the potential impact of low initial valuations and surprise factors.

- Project teams should reconsider airdrop strategies, as data reveals challenges in designing distributions that don't negatively impact short to medium-term token value.

CONTENT

Explore the performance of airdropped tokens in the cryptocurrency market. Discover key findings on price trends, meme coin anomalies, and strategic implications for investors and project teams.

In the recent cryptocurrency cycle, airdrops have played a pivotal role in token distribution and community building. However, a critical question emerges: How many airdropped tokens maintain a price above their initial listing value? This analysis aims to shed light on the long-term viability of holding airdropped tokens and their potential for positive returns.

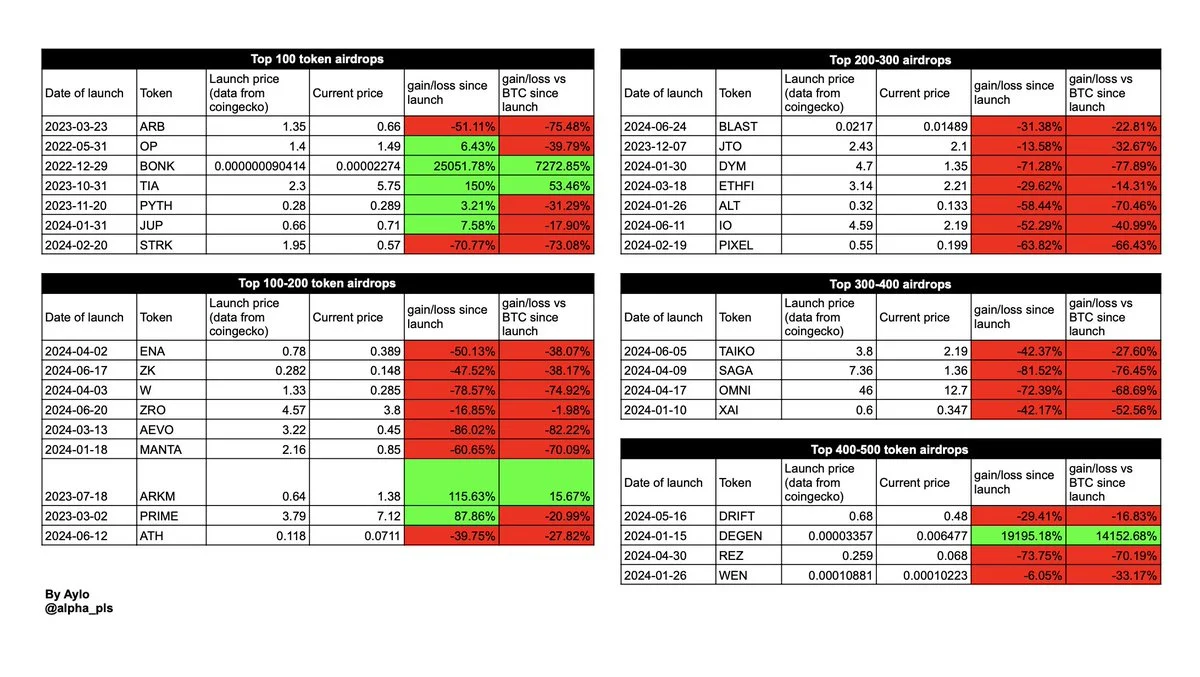

Methodology Our study examined data from the top 500 cryptocurrencies by market capitalization, focusing on tokens distributed via airdrops. The data, while slightly lagged, provides a comprehensive overview of market trends.

KEY FINDINGS

- Price Performance:

-

-

- Out of 31 airdropped tokens analyzed, 23 (74.2%) are currently trading below their initial listing price, with some experiencing significant depreciation.

- Only 4 tokens (12.9%) have outperformed Bitcoin since their launch.

- Among these outperformers, just one was issued in 2024.

-

- Meme Coin Phenomenon:

Two meme-related tokens, BONK and DEGEN, have achieved remarkable success, defying the general trend.

- Notable Exceptions:

TIA, despite current market sentiment, maintains a price significantly above its initial listing and has outperformed Bitcoin.

MARKET IMPLICATIONS

The data suggests that converting airdropped tokens to USD or Bitcoin on the day of listing is generally the most profitable strategy. While short-term price surges post-listing are possible, the overall trend indicates diminishing returns with longer holding periods.

Exceptions exist, but the probability of holding the right airdropped token, especially when compared to Bitcoin, is statistically low. For those bullish on specific projects, opportunities often arise to purchase tokens below their listing price during market downturns.

FACTORS INFLUENCING PRICE DECLINE

Airdrops are not the sole cause of price depreciation. Often, projects and market makers set initial valuations too high. The rapid sell-off of airdropped tokens serves as a market feedback mechanism, quickly exposing overvaluations.

The importance of Fully Diluted Valuation (FDV) has become increasingly apparent. Holding airdropped tokens implies a belief in sustained demand despite token unlocks and potential short-selling pressure.

Yield farmers consistently sell regardless of price, seeking quick profits. Theoretically, token prices should recover post-speculation, but data indicates this is rarely the case.

THE MEME COIN ANOMALY

Interestingly, two unexpected meme coin airdrops with no point systems and low initial valuations yielded the highest returns. These tokens aimed to bolster different ecosystems (Solana and Farcaster). However, historical data shows numerous instances of meme coin airdrops quickly losing value, suggesting that surprise coupled with low initial valuation might be key factors in their success.

FUTURE OF AIRDROPS AND TOKEN DISTRIBUTION

While point systems are likely to persist due to their prevalence in Web2 and ability to create engaging user experiences, the current airdrop model may evolve significantly in the coming years.

CONCLUSION

Based on this analysis, project teams should carefully reconsider their airdrop strategies, or even question the necessity of airdrops altogether. The data underscores the challenges in designing community airdrops that don’t negatively impact token value in the short to medium term, with long-term effects still to be determined.

Original Source: Aylo