KEYTAKEAWAYS

- RWA Total Market Cap Doubles to $19 Billion

- RWA Sector TVL Breaks Through $10 Billion

- Maker RWA, BlackRock BUIDL, and Ethena USDtb all have TVLs exceeding $1 Billion

CONTENT

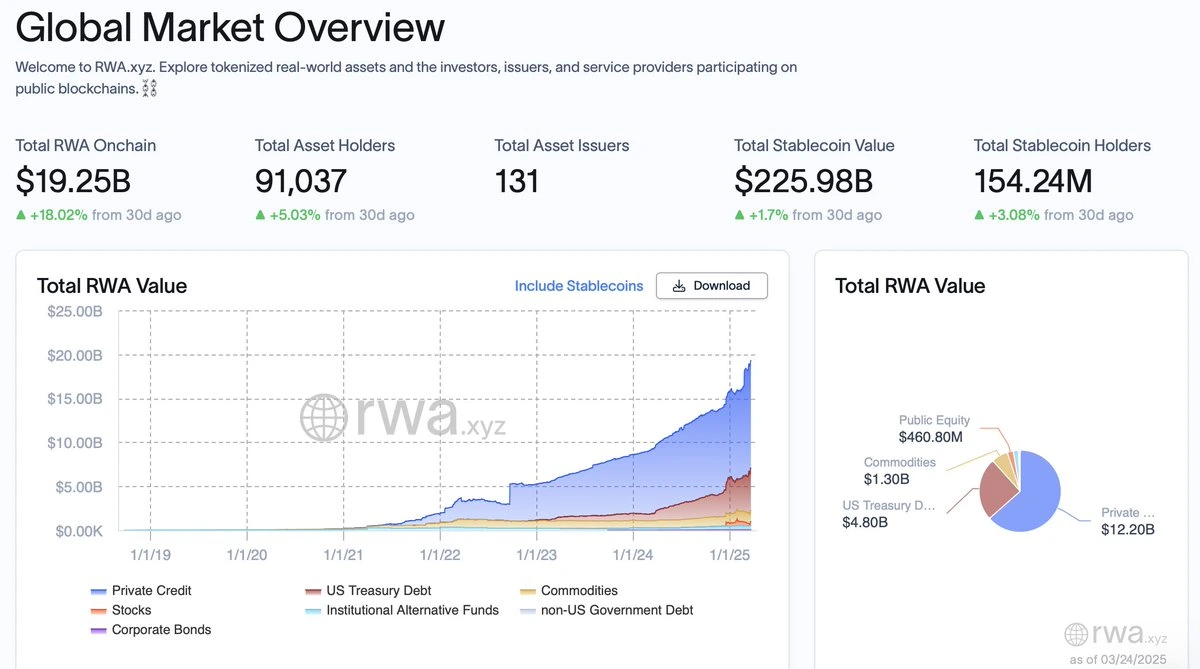

In 2025, the tokenization of Real World Assets (RWA) has experienced explosive growth. According to the latest data, the Total Value Locked (TVL) in the RWA sector has exceeded $10 billion, becoming the seventh track in the DeFi space to reach the $10 billion scale. Meanwhile, the RWA sector has grown by 237% year-to-date, with its total market value doubling to $19 billion, demonstrating strong development momentum. This article will deeply analyze RWA’s growth logic, the performance of major projects, and future development trends.

RWA TOTAL MARKET CAP DOUBLES TO $19 BILLION

In 2025, the RWA sector’s performance has far exceeded market expectations. According to Velo Protocol’s analysis, the RWA sector has grown 237% year-to-date, with total market capitalization soaring from about $8 billion at the beginning of the year to $19 billion. This growth has been primarily driven by the private credit market, while the expansion of stablecoins has also played a key role. Currently, the total value of stablecoins has reached $225 billion, becoming an important infrastructure for the RWA ecosystem.

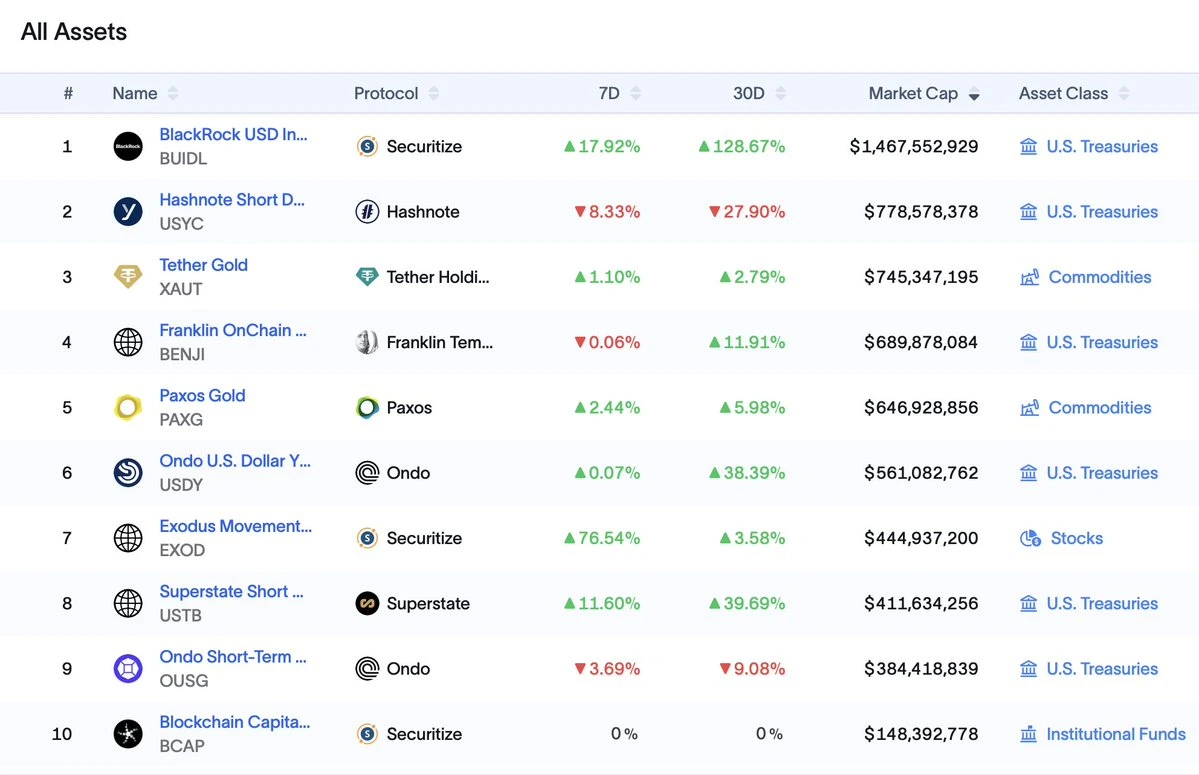

The top five RWA projects by market capitalization include:

- BlackRock’s BUIDL ($1.5 billion)

- Hashnote’s USYC ($800 million, acquired by Circle in 2025)

- Tether Gold’s XAUT ($750 million)

- Franklin OnChain’s BENJI ($700 million)

- Paxos Gold’s PAXG ($650 million)

This explosive growth is closely related to the macroeconomic environment. Under the Federal Reserve’s interest rate hike cycle, the tokenization of low-risk assets such as US Treasury bonds has become a tool for institutional arbitrage, while private credit has filled the financing needs of small and medium-sized enterprises not covered by traditional finance. In addition, the cash-attracting effect of Bitcoin spot ETFs (exceeding $110 billion in scale) has further driven traditional funds into the crypto market, indirectly accelerating RWA expansion.

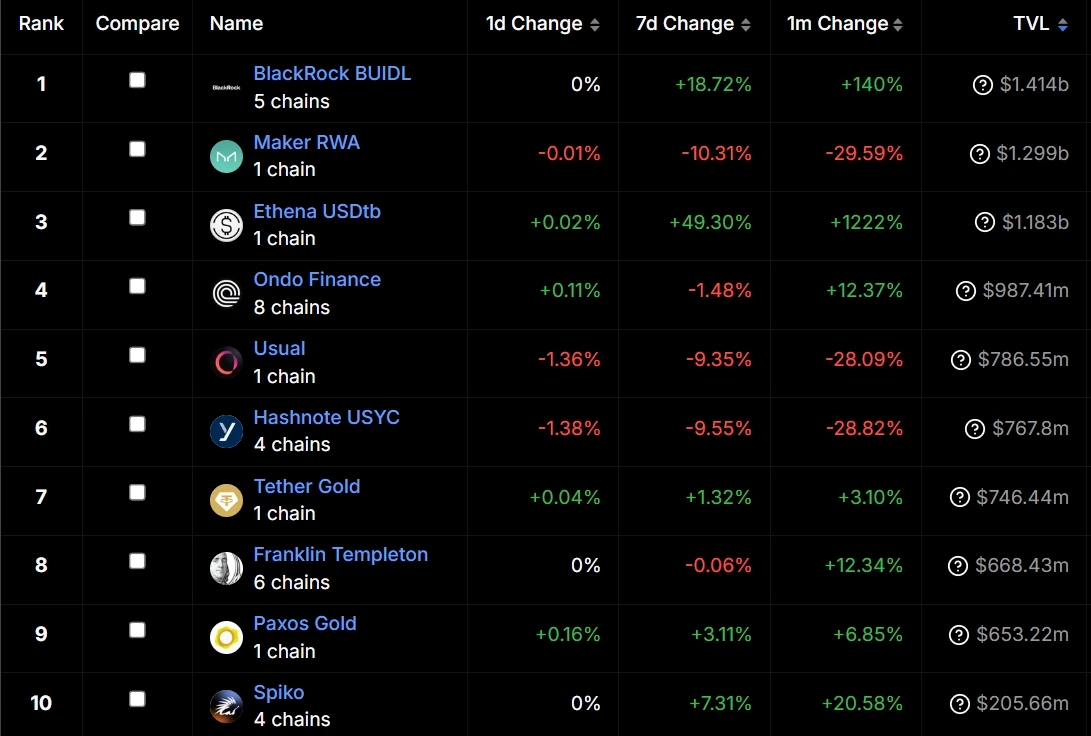

RWA Sector TVL Breaks Through $10 Billion

According to DefiLlama data, the TVL of the RWA sector broke through $10 billion on March 21, 2025, with a 7-day increase of 6.16%, becoming the seventh sector to reach the $10 billion scale after traditional DeFi tracks such as lending, DEX, and stablecoins. Among them, Maker RWA, BlackRock BUIDL, and Ethena USDtb all have TVLs exceeding $1 billion, becoming the main drivers of the market.

Top Five RWA Projects by TVL

- BlackRock’s $BUIDL: $1.4 billion

- Maker RWA: $1.299 billion

- Ethena USDtb: $1.183 billion

- Ondo Finance: $987 million

- Usual: $786 million

WHAT ARE THE NOTABLE RWA PROJECTS?

BlackRock $BUIDL: Institutional-Grade RWA Benchmark

BlackRock’s BUIDL fund is currently the largest RWA project, with deployed funds exceeding $1 billion. The fund primarily invests in US Treasury bonds and institutional-grade liquidity instruments, with deployments across multiple chains including Ethereum, Avalanche, and Polygon. BUIDL’s success marks the recognition of RWA by traditional financial giants and has paved the way for more institutional funds to enter the crypto market.

Maker RWA: Perfect Combination of DeFi and RWA

MakerDAO is one of the earliest DeFi protocols to incorporate RWA as collateral, with approximately 46% of DAI currently backed by RWA. Maker purchases Treasury bonds and private credit through custodians such as Monetalis Clydesdale and BlockTower, with 48% of its annualized income coming from RWA. This strategy not only enhances DAI’s stability but also optimizes the protocol’s income structure.

Ondo Finance: Leader in Tokenized Treasury Bonds

Ondo Finance’s USDY (Ondo Dollar Yield Token) is a yield-based stablecoin anchored to US Treasury bonds, growing 641% in 2023, with a current market cap of $130 million. Ondo’s success proves the strong market demand for low-risk, high-liquidity RWA products.

Tether Gold (XAUT) and PAX Gold (PAXG): The Dual Powers of Gold Tokenization

Gold has always been one of the most popular commodities in RWA, with XAUT and PAXG together accounting for 83% of the market cap of commodity-backed tokens. These tokens allow investors to hold physical gold with a lower threshold while enjoying the convenience of on-chain transactions.

FUTURE TRENDS OF RWA

Institutions such as BlackRock, JPMorgan, and Citigroup have clearly identified RWA as an important strategic direction for the next 5-10 years. JPMorgan predicts that the tokenization market for private securities and funds could reach $5 trillion by 2030. As more traditional assets come on-chain, the market size of RWA will continue to expand.

Ethereum has become the dominant ecosystem for RWA. 1confirmation founder Nick Tomaino points out that Ethereum has become the dominant ecosystem for RWA tokenization. Its security, smart contract flexibility, and the maturity of Layer 2 solutions (such as Arbitrum, Optimism) make it the preferred platform for institutional-grade RWA.

Private credit and real estate will become new growth points. Currently, private credit accounts for 42% of RWA loans, with auto loans being the main source of demand. In the future, the tokenization of illiquid assets such as real estate and artwork will become new growth engines, further lowering investment thresholds and improving market efficiency.

Technological innovation and cross-chain integration are accelerating RWA growth. Ondo Nexus enhances liquidity by enabling real-time redemption of tokenized Treasury bonds, boosting asset utility and capital efficiency. Ethereum dominates RWA with its mature smart contract ecosystem, while Solana and Polygon attract niche markets through low fees and scalability. AI optimizes asset pricing models, and Oracle advancements improve data transparency and reliability, reducing default risk and paving the way for large-scale RWA adoption.

As US stablecoin legislation and global RWA compliance standards advance, regulatory uncertainty will significantly decrease. The Trump administration’s “Strategic Bitcoin Reserve” policy may also indirectly promote the RWA legalization process.

The explosion of RWA is not only an internal narrative of the crypto industry but also a milestone in the integration of traditional finance and DeFi. By improving asset liquidity, lowering thresholds, and enhancing transparency, it is reshaping the trillion-dollar financial market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!