- Stablecoins’ market cap exceeds $190 billion, led by USDT with 69.86%, serving as key low-volatility payment tools in crypto.

- Unlike fiat, stablecoins are issued by private or decentralized entities, leveraging blockchain for transparent, efficient transactions.

- As blockchain evolves, stablecoins may revolutionize global payments and investments, bridging real and digital economies and reshaping finance.

TABLE OF CONTENTS

Stablecoins are a vital asset in the cryptocurrency space, with their market size and application scope rapidly expanding. Backed by efficient and transparent technology, stablecoins play a crucial role in scenarios such as cross-border payments, DeFi, and value storage. In the future, they are expected to further reshape the global financial system and drive the growth of the digital economy.

STABLECOINS: THE FUTURE OF DIGITAL CURRENCY AND ITS ROLE IN THE CRYPTO ECOSYSTEM

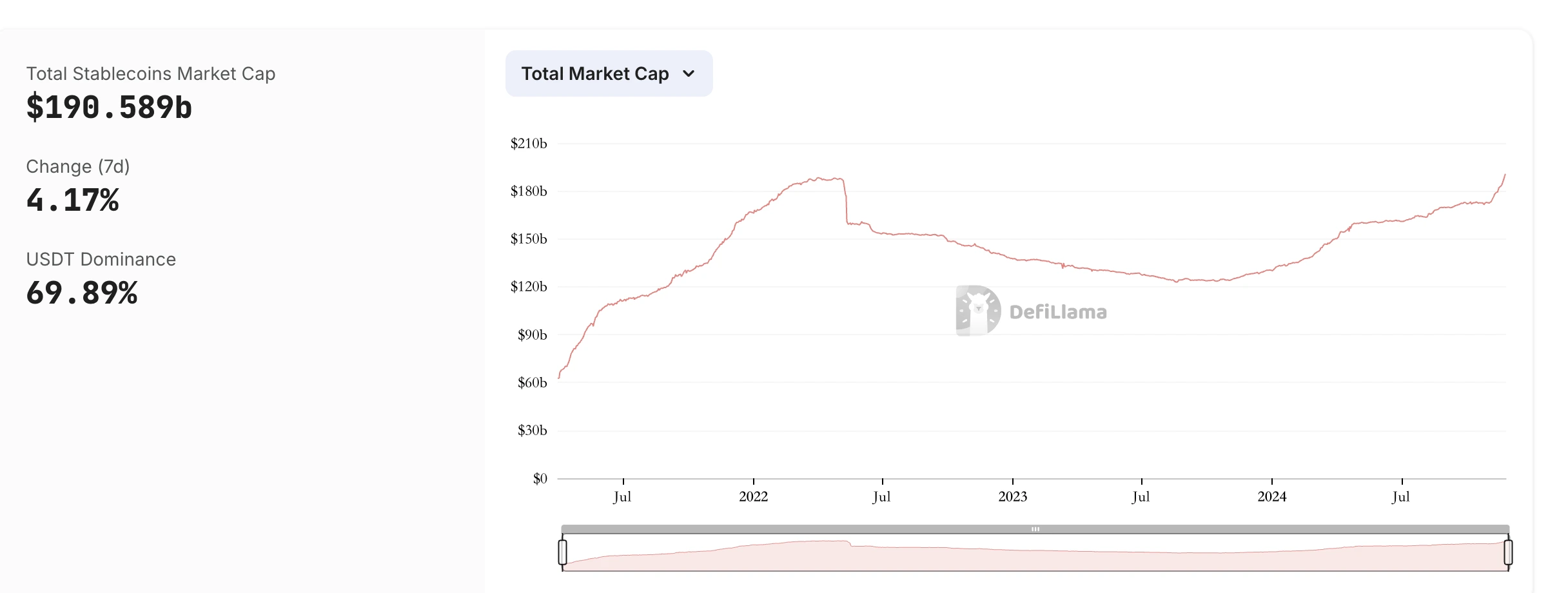

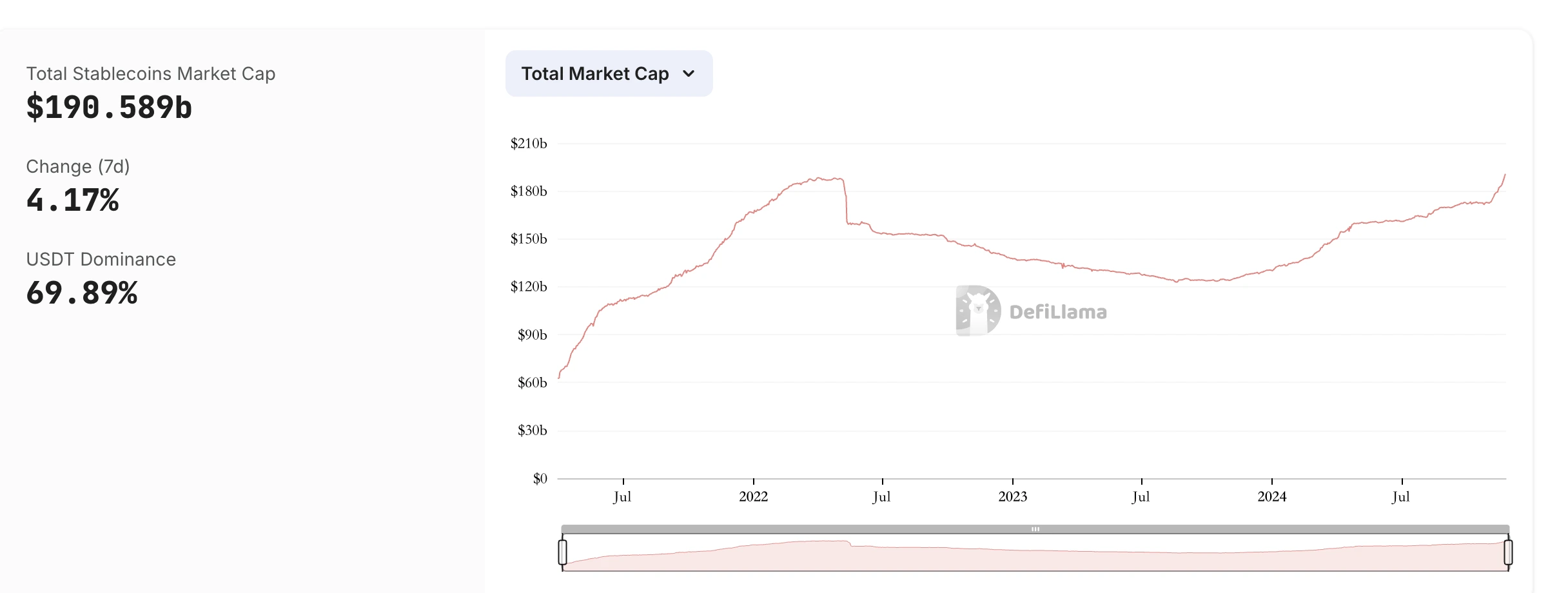

On January 25, DefiLlama reported that the total market capitalization of stablecoins had surpassed $190.29 billion, setting a new all-time high. Among them, USDT led the market with a 69.86% share, and its circulating market cap reached $133.2 billion, marking a 4.13% growth within the week. This data once again confirms the pivotal role stablecoins play in the cryptocurrency market and sparks further interest and thought about their potential.

(Source: DeFiLlama)

Have you ever wondered why cryptocurrency prices fluctuate so wildly? Bitcoin might soar to the moon today, only to crash to the bottom tomorrow. Stablecoins, however, act as a beacon in this volatile cryptocurrency market, with prices that remain relatively stable, much like the paper currencies we use in our daily lives.

A stablecoin is a cryptocurrency pegged to a fiat currency, commodity (like gold), or an algorithm, with the goal of maintaining a stable price. Its design aims to offer the price stability of currencies like the US dollar or euro while retaining the decentralization and efficient trading advantages of cryptocurrencies.

In simple terms, stablecoins are like “digital dollars” in the cryptocurrency world. They enable fast global transfers without the massive price volatility that cryptocurrencies like Bitcoin exhibit.

However, stablecoins differ from fiat currencies in many ways.

DIFFERENCES BETWEEN STABLECOINS AND TRADITIONAL CURRENCIES

Stablecoins and traditional currencies (fiat money) differ significantly in various aspects, including issuance, operational mechanisms, value stability, and circulation. Let’s break down these differences in detail.

1. Issuing Authority

• Traditional Currency:

Traditional currencies (like the US dollar, euro, and Chinese yuan) are issued by central banks authorized by governments. The issuance of each currency is strictly controlled by national laws, and central banks stabilize the economy through monetary policies such as interest rate adjustments and money supply control. For instance, the US dollar is issued by the Federal Reserve, and the Chinese yuan is issued by the People’s Bank of China. This power is monopolized by the government and is enforced by law.

• Stablecoins:

Stablecoins are typically issued by private enterprises or decentralized organizations, which are not government entities. For example, USDT is issued by Tether, USDC by Circle and Coinbase, and DAI is governed by the decentralized autonomous organization MakerDAO. Unlike fiat money, the issuance of stablecoins relies more on technical mechanisms (such as smart contracts) or collateral assets than government coercion.

2. Value Foundation

• Traditional Currency:

The value of traditional money is based on national credit. It does not have direct physical assets backing it but is supported by the economic power and policy trust of the issuing government. The value of modern fiat currencies is typically determined by factors such as market supply and demand, the economic stability of the nation, trade, and interest rates.

• Stablecoins:

The value of stablecoins is typically directly pegged to a specific asset (such as a fiat currency or commodity) to maintain price stability.

3. Operational Mechanism

• Traditional Currency:

Traditional currencies are controlled by central banks, which manage the money supply through the banking system. Their operational mechanisms are fully dependent on centralized systems, where central banks take actions like adjusting base interest rates, conducting open market operations, and controlling inflation or deflation through economic policies.

• Stablecoins:

Stablecoins operate on blockchain technology, which provides higher transparency and efficiency compared to traditional currencies. The mechanisms behind stablecoins include:

• Fiat-backed: Fiat-backed stablecoins are usually backed by a 1:1 reserve of fiat currency. Users can redeem stablecoins for an equivalent amount of fiat currency at any time.

• Smart contracts and algorithmic control: Decentralized stablecoins (like DAI) use smart contracts to lock collateral assets and adjust the coin’s value through market actions.

• Automated supply-demand adjustment: Algorithmic stablecoins adjust the supply based on price changes. For example, new coins are issued when the price exceeds the peg, and coins are bought back and burned when the price falls below the peg.

4. Stability vs. Volatility

• Traditional Currency:

The value of traditional currencies tends to fluctuate relatively little. While factors like inflation, economic policy, and international trade can affect their value, changes are generally gradual. For example, exchange rate fluctuations between the US dollar and the euro typically remain under 5%.

• Stablecoins:

Stablecoins are designed to replicate the stability of traditional currencies, but in practice, their stability may be affected by their pegging mechanisms and market conditions. For example:

• If fiat reserves are insufficient or transparency is lacking, a stablecoin might “de-peg” from its intended value (such as controversies surrounding USDT).

• Collateralized stablecoins rely on the market value of their collateral assets, and price crashes in the market may trigger liquidation risks.

5. Transparency and Regulation

• Traditional Currency:

Traditional currencies are strictly regulated by governments, and central banks publish regular reports on monetary policy and economic data. However, the transparency of money supply chains is relatively low. For instance, most people cannot trace the specific journey of a banknote from issuance to circulation.

• Stablecoins:

Stablecoins rely on blockchain technology, which makes their transaction records publicly available for anyone to check. However, the level of transparency depends on the behavior of the issuing entities. For example, USDC provides audit reports to verify the existence of its reserves, while USDT’s reserve transparency has often been questioned.

Additionally, stablecoin regulation is still evolving, with different countries adopting varying approaches. Some nations support stablecoin development for its potential to improve financial efficiency, while others are concerned about its impact on monetary sovereignty and may impose strict regulations.

6. Usage Scenarios

• Traditional Currency:

Traditional money is omnipresent in everyday life and is used for purchasing goods, paying wages, investing, and trading. It is the dominant medium of exchange in the current global economy.

• Stablecoins:

Stablecoins primarily serve the digital economy and cryptocurrency sectors, with common applications such as:

1. Cryptocurrency trading: Stablecoins bridge the gap between cryptocurrencies and fiat money, allowing traders to easily move value.

2. Cross-border payments: Using blockchain technology, stablecoins facilitate low-cost and efficient cross-border transactions.

3. Decentralized finance (DeFi): Stablecoins play a critical role in DeFi, where users can borrow, lend, and invest using stablecoins.

7. Monetary Policy and Influence

• Traditional Currency:

Traditional money is directly influenced by national monetary policies. Governments can adjust the money supply to manage the economy. For example, during an economic downturn, central banks might increase the money supply or reduce interest rates to stimulate consumption and investment.

• Stablecoins:

Stablecoins are not affected by traditional monetary policies. Their value is more dependent on market supply and demand, as well as blockchain rules. However, the rapid growth of stablecoins could challenge traditional monetary policies. For instance, if stablecoins were widely adopted for cross-border payments and storage, it might reduce government control over domestic currencies.

• Categories of Stablecoins

Stablecoins can be divided into three main categories based on their operational mechanisms and the assets backing them:

• Fiat-Collateralized Stablecoins: USDT, USDC, TUSD

These stablecoins are backed by sufficient fiat currency reserves, such as the US dollar or euro. Their main advantage is simplicity and ease of understanding, as they maintain a 1:1 peg with fiat money. USDT, being one of the earliest stablecoins, leads the market with a dominant position due to its first-mover advantage, strong brand recognition, and widespread usage in decentralized finance (DeFi).

• Crypto-Collateralized Stablecoins: DAI

These stablecoins are backed by cryptocurrency assets (e.g., Ethereum or Bitcoin) and use smart contracts to ensure their value remains stable. The advantage of crypto-collateralized stablecoins is decentralization, but their stability can be volatile, dependent on the market price of their underlying collateral.

• Algorithmic Stablecoins: Other coins (e.g., USDD, Frax)

These stablecoins are not backed by physical assets but instead use smart contracts and algorithms to control the supply and demand of the coins to maintain price stability. Examples include Ampleforth and Terra (formerly LUNA). The advantages of algorithmic stablecoins are decentralization and lack of asset management costs, but their stability and reliability may face challenges.

THE FUTURE OF STABLECOINS

Imagine this scenario: after finishing a trip abroad, you visit a local market and buy a beautiful handmade craft. Instead of worrying about complicated exchange rates or high cross-border payment fees, you simply open your phone and make a payment with a globally accepted, stable digital currency. That currency could very well be a stablecoin.

With the development of blockchain technology and the rise of the global digital economy, stablecoins are gradually changing our perception of money and the financial system. As a bridge between the physical and digital world, stablecoins offer endless possibilities for the future.

One day, perhaps, your digital wallet will hold not only fiat currency but also the stablecoins you use most frequently. These digital assets will help you pay for coffee, rent, make investments, support charitable causes, and even participate in global economic governance — all with just a tap of your screen.

Stablecoins are not just a rising star in the cryptocurrency field; they are more like a key that is quietly unlocking the doors to the future of finance. In the wave of technological advancement and global collaboration, stablecoins are poised to become an important link between the present and future economic systems, bringing a more efficient and fair digital future to everyone.

Read More:

2024 Top 5 Crypto Market News Websites

Trump Raises Over $4M in Crypto as Campaign Strategy

CoinRank x Bitget – Sign up & Trade to get $20!