KEYTAKEAWAYS

- The Fed's rationale for rate cuts significantly influences Bitcoin's price, with inflation-driven cuts potentially bullish and growth-driven cuts bearish.

- Current market conditions show technical oversold conditions for Bitcoin, but seasonal trends and external factors may exert downward pressure.

- Bitcoin's short-term rally has been underwhelming, with the price oscillating between $56,000 and $60,000, suggesting caution for investors.

CONTENT

Fed’s September rate decision could shape Bitcoin’s trajectory. Analysis of historical trends, market conditions, and key price factors guide investors in this volatile period.

With a potential Fed rate cut in September, investors are considering whether now is the time to buy Bitcoin. CoinRank explores the possible effects of the Fed’s rate cut on Bitcoin, considering historical patterns and current market conditions.

>>>Read more: Crypto Market Update in Early July: Ethereum ETFs, Bitcoin Trends, and Future Influences

REASONS BEHIND THE FED’S RATE DECISIONS

Lower interest rates typically stimulate the economy by injecting liquidity into financial markets. However, the reasons behind the Fed’s rate cuts are crucial in determining their impact on Bitcoin. Historically, Bitcoin’s performance has varied significantly depending on whether rate cuts were driven by inflation concerns or economic growth risks.

>>>Read more: H1 2024 Review and Outlook: Us Economy, Inflation, Fed Policy, and Market Impacts on Crypto, Stocks, and Bonds

Scenario 1: Potentially Bullish

When the Fed pauses rate hikes or cuts rates due to inflation concerns, Bitcoin often rallies. For instance, when the Fed paused rate hikes from December 2018 to July 2019, Bitcoin surged by +169%.

Similarly, after the last rate hike on July 26, 2023, Bitcoin rallied by +95%, indicating that a pause or cut driven by inflation concerns can be bullish for Bitcoin.

>>>Read more: Crypto Bull Market 2024: What It is and When to Buy

Scenario 2: Huge Drop

Conversely, when rate cuts are driven by concerns about economic growth, Bitcoin has historically faced selling pressure. For example, after the Fed cut rates on September 19, 2019, due to growth risks, Bitcoin dropped by 20% within a week.

CURRENT MARKET CONDITIONS

Several factors are currently influencing Bitcoin’s market dynamics:

- Technical Oversold Conditions: Bitcoin appears technically oversold, and selling pressure from the German government is easing. Exchange-Traded Funds (ETFs) are also buying the dip, indicating a potential support level for Bitcoin prices.

- Economic Indicators: U.S. GDP has declined from +5% to +1.4%, the ISM Manufacturing PMI has been in contraction since November 2022, and the unemployment rate is above 4.0%. These indicators suggest weak economic growth, which could influence the Fed’s decision.

- Seasonal Trends and External Factors: Historically, August and September are bearish months for Bitcoin. Additionally, the impact of Mt. Gox sell-offs and Bitcoin miners liquidating inventory to fund operations could add downward pressure on Bitcoin prices.

>>>Read more: Is the Least Profitable Bitcoin Bull Run in History Coming to an End?

SEPTEMBER RATE CUT PREDICTIONS

The upcoming September rate cut is a binary event for Bitcoin traders, with the outcome heavily dependent on the Fed’s rationale:

- Inflation-Driven Rate Cut: If the Fed cuts rates solely due to low inflation, Bitcoin could see a short-term bullish response. This scenario aligns with the historical trend where Bitcoin rallies when monetary policy shifts from “awful” (rate hikes) to “less bad” (rate cuts due to inflation concerns).

- Growth-Driven Rate Cut: If the rate cut is driven by concerns about economic growth, Bitcoin might face significant selling pressure. Weak growth and low inflation could lead to a sharp decline in Bitcoin prices, making this scenario bearish for Bitcoin.

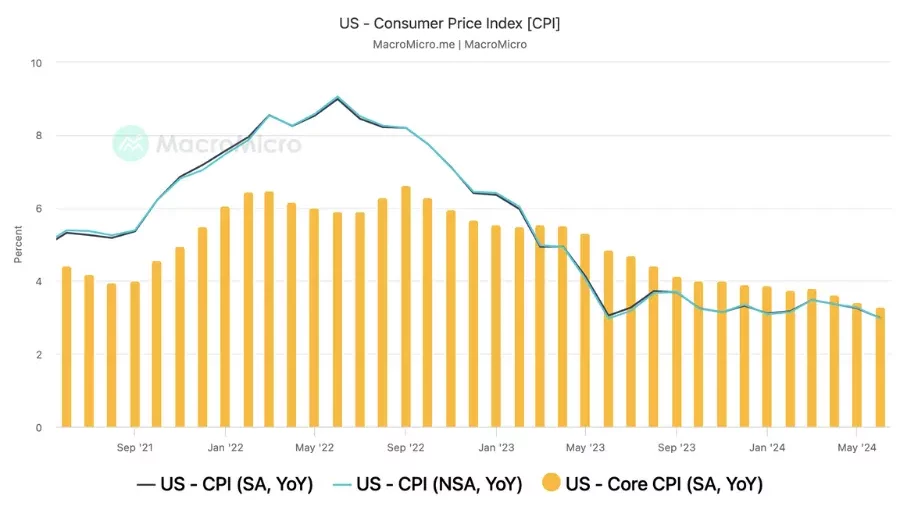

Market expectations for rate cuts have been evolving. Prior to recent CPI releases, derivatives markets were pricing in two rate cuts, more than the Fed’s own projections. A lower CPI reading could push September rate cut expectations to 100%, especially with Fed Chair Powell indicating a live September meeting.

(source: MacroMicro)

BITCOIN TRADING ANALYSIS

(source: TradingView)

Bitcoin’s short-term rally has been underwhelming, failing twice to break through the EMA20 (60-day line). This is a concerning sign. The daily chart shows Bitcoin oscillating within a $56,000-$60,000 range.

A new trend will only emerge if it breaks out of this range. Given the current bearish performance, if the daily close falls below the $56,000 support this week, there’s a risk of dropping to the $53,000 support zone next week.

The existing downtrend line remains crucial. As long as it holds, rallies provide opportunities for short positions at higher levels. Although the upper bound of the channel is rising, each breakthrough attempt has failed, followed by significant pullbacks.

CONCLUSION

Investing in Bitcoin before the Fed’s September rate cut presents a unique opportunity, but not without risks. The market’s reaction will likely depend on the Fed’s rationale: a cut driven by inflation concerns could boost Bitcoin prices, while one driven by growth concerns could lead to losses. Current economic indicators and historical patterns suggest a potential short-term bullish response. However, despite Bitcoin surging close to $60,000, remains vulnerable to a pullback, potentially testing the $50,000 level.

It’s also crucial to remember that Bitcoin’s response to economic data is complex. The magnitude of price movements often depends on how actual figures deviate from expectations, rather than just the raw numbers themselves. Given these factors, a cautious stance may be prudent in the current market environment.

>>> Read more:

▶ Buy Bitcoin at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!