KEYTAKEAWAYS

- Privacy vs. Regulation: No KYC exchanges offer enhanced anonymity and quick setup, but users must navigate potential legal risks and reduced protections.

- Diverse Platform Options: The market offers various no KYC exchanges with unique features, allowing users to choose platforms tailored to their specific trading needs.

- Increased User Responsibility: These exchanges provide easier access to crypto trading, but users must be more diligent about understanding regulations and managing their own risk.

CONTENT

A no KYC crypto exchange offers faster trading and privacy. Explore 15 top platforms, but understand the risks before jumping into this exciting world.

Imagine trading crypto without worrying about your ID being leaked. That’s where a no KYC crypto exchange comes in. They let you buy and sell crypto without revealing who you are. It’s faster, more private, and for some, just easier.

We all know blockchain is about privacy, but most exchanges still ask for your personal info. What if you don’t want to share that? Or what if you just want to start trading right away?

That’s why we’ve put together this list of 15 no KYC crypto exchange. Whether you’re big on privacy or just want to skip the paperwork, these platforms might be what you’re looking for.

WHY CHOOSE A NO KYC CRYPTO EXCHANGE?

If you’ve already begun trading, you’ve probably heard about the no KYC crypto exchange. But why are they becoming so popular?

First off, privacy. No KYC means you can trade without sharing your personal info. For many crypto enthusiasts, this aligns perfectly with the whole idea behind blockchain technology – keeping things decentralized and private.

Then there’s the speed factor. With no KYC exchanges, traders can jump in almost instantly. No waiting around for your documents to be verified.

These exchanges also tend to have fewer restrictions. This can mean more freedom in how you trade and manage your crypto.

Of course, like anything in crypto, there are pros and cons to consider. But for those who prioritize privacy and quick access, no KYC exchanges are definitely worth a look.

What is KYC?

KYC stands for “Know Your Customer.” It’s a standard process in the financial world, including crypto exchanges, where users are required to prove their identity before trading.

Typically, KYC involves providing personal information like your full name, address, and sometimes even your source of funds. You might need to submit a government-issued ID, proof of address, or even complete a biometric verification.

Exchanges use KYC to verify user identities, prevent fraud, and comply with anti-money laundering (AML) regulations. While it adds a layer of security, it also means sharing personal data – something not everyone is comfortable with.

A REVIEW OF TOP EXCHANGES WITHOUT KYC PROCESS

#1 No KYC Crypto Exchange | PancakeSwap

(source: PancakeSwap)

PancakeSwap is a decentralized exchange on the BNB Smart Chain (BSC), offering a no KYC trading experience. Users can swap tokens, provide liquidity, and engage in yield farming by simply connecting a BSC-compatible wallet.

As the leading Automated Market Maker (AMM) on BSC, PancakeSwap boasts low fees and high liquidity. The platform supports a wide range of BEP-20 tokens and even features an NFT marketplace.

While it offers great privacy and earning opportunities, users should be aware of potential risks like smart contract vulnerabilities and impermanent loss.

- KYC Policy: No KYC required

- Available Cryptocurrencies: 2000+

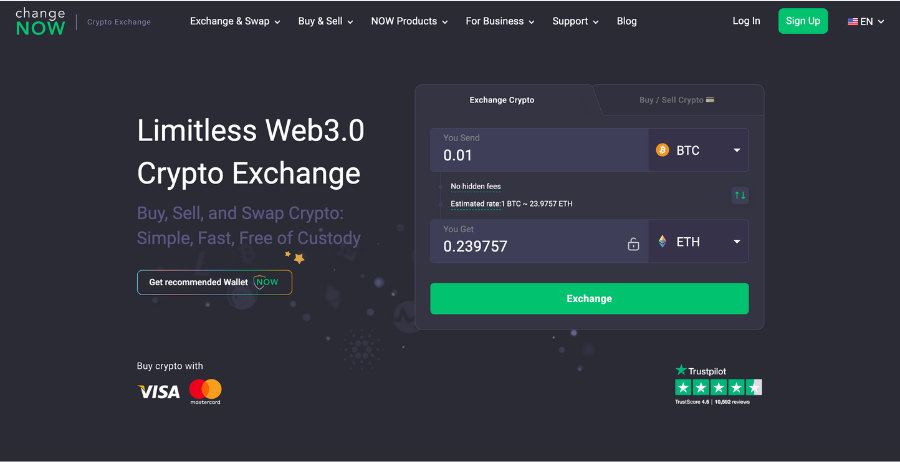

#2 No KYC Crypto Exchange | ChangeNOW

(source: ChangeNOW)

ChangeNOW is a DEX offering quick and easy crypto trades without mandatory KYC. This no KYC crypto exchange integrates with top exchanges like Binance, allowing users to buy, swap, and stake a wide range of cryptocurrencies across multiple networks.

While account creation isn’t required, it unlocks perks like fee discounts and cashback. ChangeNOW stands out with its flexible exchange rates, offering both floating and fixed options.

The platform also provides additional features such as cold-storage custody for assets and NFTs, portfolio tracking, and instant loans, all while maintaining a strong focus on user privacy.

- KYC Policy: No KYC for most transactions; only required for large sums or flagged trades

- Available Cryptocurrencies: 560+

#3 No KYC Crypto Exchange | Exodus

(source: Exodus)

Exodus is a cryptocurrency wallet that doubles as a no KYC crypto exchange. It supports over 300 cryptocurrencies, allowing users to manage, transact, and swap tokens without identity verification.

The platform offers a user-friendly interface for both beginners and experienced traders, with features like in-wallet crypto swaps, staking options, and an NFT gallery.

Exodus stands out for its strong focus on user privacy and self-custody, enabling peer-to-peer transactions without compromising personal information. While it provides a comprehensive solution for crypto management and trading, users should be aware that fees may be higher compared to some centralized exchanges.

- KYC Policy: No KYC required

- Available Cryptocurrencies: 16+ networks

#4 No KYC Crypto Exchange | ByBit

(source: ByBit)

ByBit is a Singapore-based crypto exchange that offers a no KYC option for users, specializing in crypto derivatives trading. This platform allows traders to create accounts and start trading with minimal verification, making it an attractive choice for those prioritizing privacy.

One of ByBit’s standout features is its generous withdrawal limit for unverified accounts, allowing up to 20,000 USDT daily without KYC. However, users should note that ByBit is not available in some jurisdictions, including the USA and UK, and lacks tier-one regulatory licenses.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 400+

#5 No KYC Crypto Exchange | KCEX

(source: KCEX)

This no KYC exchange stands out with its 0% spot trading fees and support for over 300 cryptocurrencies, including both popular coins and low-cap tokens. KCEX also provides advanced trading options like futures trading with up to 100x leverage.

The exchange requires only an email or phone number for account creation, granting a generous 30 BTC daily withdrawal limit without KYC. While KCEX doesn’t support fiat currencies, it offers an attractive sign-up reward package and is licensed in the US and Canada, balancing user privacy with regulatory compliance.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 300+

#6 No KYC Crypto Exchange | Best Wallet

(source: Best Wallet)

Best Wallet offers a unique no KYC trading experience by combining a self-custody wallet with an integrated decentralized exchange. This platform supports tokens on Ethereum, BNB Chain, and Polygon networks, allowing users to trade popular cryptocurrencies and memecoins without identity verification.

Best Wallet’s non-custodial approach ensures users maintain full control over their private keys and assets. While currently available only as a mobile app, it plans to introduce additional features and a browser extension in the future.

- KYC Policy: No KYC required for any transactions

- Available Cryptocurrencies: 60+ Chains

#7 No KYC Crypto Exchange | CoinEx

(source: CoinEx)

CoinEx offers a wide range of trading options without mandatory KYC and stands out for its $10,000 daily withdrawal limit for unverified accounts, making it attractive for users prioritizing privacy.

The exchange uses a maker/taker fee model, with competitive rates that can be further reduced by holding CET tokens. While CoinEx maintains a no KYC policy for crypto-to-crypto transactions, fiat purchases are processed through third-party services that may require verification. Note that CoinEx is not available to users in the USA.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 1100+

#8 No KYC Crypto Exchange | PrimeXBT

(source: PrimeXBT)

PrimeXBT is a versatile no KYC crypto exchange that specializes in futures and CFD trading. This platform offers leveraged trading on a variety of cryptocurrencies and traditional financial instruments, with leverage up to 100x on certain crypto pairs. PrimeXBT stands out for its low trading fees and advanced charting tools powered by TradingView.

One of PrimeXBT’s key features is its generous limits for unverified accounts. Users can deposit up to $2,000 with fiat payment methods and withdraw up to $20,000 in crypto daily without KYC. However, the platform doesn’t offer spot trading and supports a limited number of tokens compared to some other exchanges.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 100+

#9 No KYC Crypto Exchange | BloFin

(source: BloFin)

BloFin is a comprehensive crypto exchange offering no KYC trading for a wide range of cryptocurrencies. The platform supports over 300 USDT-margined pairs and provides users with up to 150x leverage on futures trading.

One of BloFin’s key attractions is its generous withdrawal limit of up to $20,000 daily without KYC. The exchange also offers competitive fees and a lucrative welcome bonus for new users. While BloFin provides a robust trading experience, please note that higher withdrawal limits require KYC verification.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 300+ trading pairs

#10 No KYC Crypto Exchange | Margex

(source: Margex)

Margex is a popular no KYC crypto exchange specializing in futures trading with high leverage options. It is also known for its user-friendly interface, robust security measures like the MP Shield System, and educational resources for market analysis.

One of Margex’s key features is its low trading fees and minimum deposit requirements, making it accessible to a wide range of users. The exchange also offers copy trading and staking options for passive income.

- KYC Policy: No KYC required

- Available Cryptocurrencies: 45+ trading pairs

#11 No KYC Crypto Exchange | Uniswap

(source: Uniswap)

Uniswap is a leading DEX operating primarily on the Ethereum blockchain, offering a true no KYC trading experience. As a pioneer in the DEX space, Uniswap allows users to trade a vast array of ERC-20 tokens without any identity verification, simply by connecting their Ethereum wallet.

This platform stands out for its use of an automated market maker (AMM) model, ensuring liquidity for all listed pairs. Uniswap supports over 1000 cryptocurrencies across 11 blockchain networks, including Arbitrum, Polygon, and Optimism.

While Uniswap offers unparalleled privacy and token selection, users should be aware of potential higher gas fees during network congestion.

- KYC Policy: No KYC required

- Available Cryptocurrencies: 1000+

#12 No KYC Crypto Exchange | BingX

(source: BingX)

BingX is a recommended no KYC crypto exchange for users seeking privacy in their trading activities. This platform stands out for its high daily withdrawal limit of up to 20,000 USDT for unverified accounts, making it attractive for users who prioritize privacy and flexibility.

BingX provides a comprehensive trading experience with spot and futures markets, competitive fees, and innovative features like copy trading. While BingX allows basic trading without KYC, users should note that advanced features and fiat transactions require verification.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 890+

#13 No KYC Crypto Exchange | MEXC

(source: MEXC)

MEXC offers a wide range of trading options with minimal KYC requirements for basic functions, while also providing a competitive trading environment with features like spot trading, futures, and copy trading.

The exchange offers attractive benefits, including no fees for spot trading and high daily withdrawal limits of up to 30 BTC for unverified accounts. While MEXC allows basic trading without KYC, users should note that some advanced features may require verification.

Additionally, the platform is no longer available to users in the USA as of 2023.

- KYC Policy: No KYC required for basic trading

- Available Cryptocurrencies: 2600+

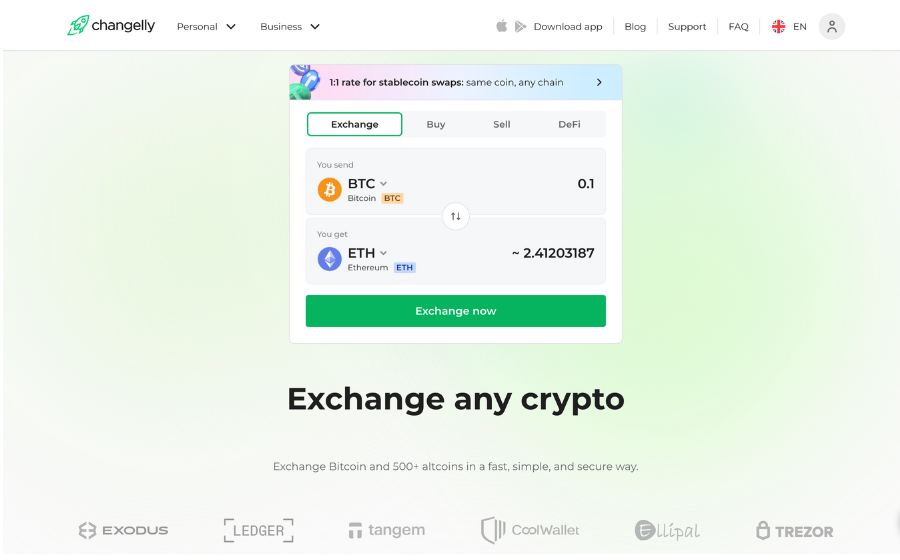

#14 No KYC Crypto Exchange | Changelly

(source: Changelly)

Changelly is a crypto exchange platform with varying levels of KYC requirements. For basic crypto-to-crypto exchanges, users can trade with minimal verification, often just an email address.

Importantly, Changelly offers the option to buy Bitcoin and other cryptocurrencies with a debit card without KYC verification for transactions below certain limits. However, users should be aware that for larger transactions or more advanced features, a quick verification process may be necessary.

- KYC Policy: No KYC for small purchases

- Available Cryptocurrencies: 500+

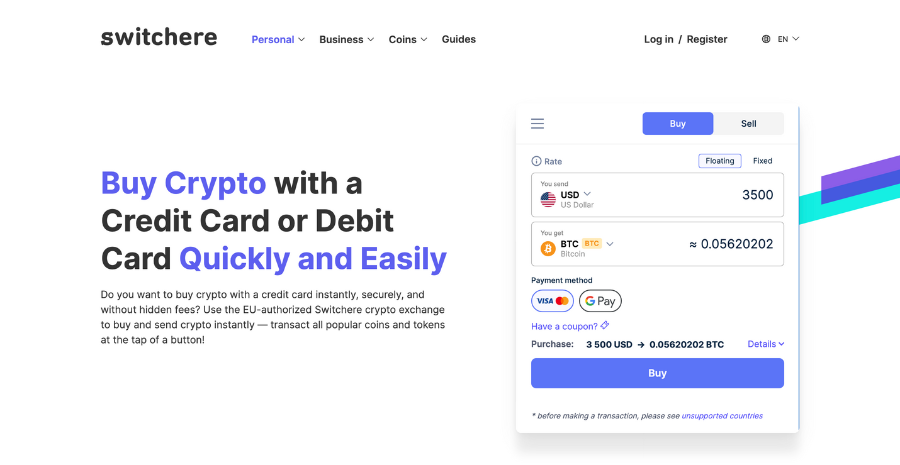

#15 No KYC Crypto Exchange | Switchere

(source: Switchere)

Switchere is a licensed crypto exchange that offers a quick and convenient way to buy, sell, and swap digital assets with minimal verification requirements for small transactions.

One of Switchere’s key features is its tiered verification system. Users can conduct transactions up to $700 daily with only basic information, while higher limits require additional verification. The exchange supports fiat purchases via credit cards, SEPA transfers, and local Asian banks, providing flexibility for users worldwide.

- KYC Policy: Basic info required for low-limit transactions

- Available Cryptocurrencies: 30+

NO KYC CRYPTO EXCHANGE | ADVANTAGES & DRAWBACKS

A no KYC crypto exchange comes with its own set of pros and cons, as listed below:

| Advantages | Disadvantages |

|---|---|

|

Enhanced Privacy Trade cryptocurrencies without sharing personal information, aligning with blockchain’s core principles of anonymity. |

Limited Features Some exchanges may restrict advanced services or higher-tier benefits for unverified users. |

|

Quick Access Start trading almost instantly without lengthy verification processes, capitalizing on market opportunities quickly. |

Higher Risk of Fraud Lack of user screening can potentially attract bad actors, increasing the risk of scams or illicit activities. |

|

Global Accessibility Trade from any location, including regions with strict crypto regulations or where obtaining formal ID is challenging. |

Regulatory Uncertainty These exchanges often operate in a legal grey area, risking sudden closures or asset freezes. |

|

Financial Sovereignty Greater control over assets and trading activities, with less risk of accounts being frozen due to suspicion. |

Lower Trading Limits Stricter caps on transaction amounts for unverified accounts, potentially limiting trading potential. |

|

Reduced Data Breach Risk Less attractive targets for hackers seeking to steal user data, minimizing risk of identity theft. |

Market Manipulation Concerns Easier creation of multiple anonymous accounts could facilitate tactics like wash trading. |

HOW DO I BUY CRYPTO WITHOUT KYC?

1. Choose a No KYC Crypto Exchange

- Research and select a reputable exchange that doesn’t require KYC verification.

- Ensure it supports your preferred payment methods and desired cryptocurrencies.

- Consider factors like fees, trading limits, and user reviews.

2. Register an Account

- Sign up on the chosen platform – this usually requires only an email address and password.

- Some decentralized exchanges might just ask you to connect your crypto wallet.

- Verify your email if required.

3. Fund Your Account

- Depending on the no KYC crypto exchange, you may deposit crypto or fiat currency into your account.

- Transfer cryptocurrency from an existing wallet to the exchange.

- Alternatively, use a P2P (peer-to-peer) no KYC crypto exchange to buy crypto first.

4. Navigate to the Trading Section

- Locate the trading area on the exchange’s platform.

- Familiarize yourself with the interface and available trading pairs.

5. Execute Your Trade

- Select your desired trading pair (e.g., BTC/ETH).

- Enter the amount you wish to trade.

- Review the transaction details, including fees and total costs.

- Confirm and complete the transaction.

6. Withdraw Your Crypto

- After purchasing, move your crypto to a personal, non-custodial wallet for enhanced security.

- Be aware of withdrawal limits, which may be lower on no KYC exchanges.

IS A NO KYC CRYPTO EXCHANGE LEGAL?

So, is a no KYC crypto exchange legal? Well, it’s not a simple yes or no answer. The legal status of these exchanges is a bit of a moving target, changing from country to country and sometimes even day to day.

In some places, trading on these platforms is perfectly fine. In others, it might land you in a sticky situation. The tricky part is that governments worldwide are still figuring out how to handle crypto, so the rules are always evolving.

Here’s something to keep in mind: just because an exchange is operating legally in its home country doesn’t mean it’s okay for you to use it where you live. It’s like trying to use a foreign driver’s license – it might work in some places but not others.

Many countries now expect crypto exchanges to verify their users’ identities. Exchanges that skip this step might face some serious consequences, which could spell trouble for you if you’re using them.

If you’re considering using one of these exchanges, it’s worth taking some time to understand your local laws. The crypto world moves fast, and what’s acceptable today might change tomorrow.

A BLEND OF PRIVACY AND CONVENIENCE

At the end of the day, a no KYC crypto exchange offers a unique blend of privacy and convenience, making it a great option for those looking to trade crypto without extensive identity verification.

But remember, these platforms come with their own set of challenges, from potential legal hiccups to limited protections if things go south. Before you jump in, make sure you research thoroughly and consider your local regulations.

Whether you’re a privacy enthusiast or just someone who wants to start trading without the usual paperwork hassle, there’s likely a no KYC option out there for you.

That’s all for this article, happy trading, and may your crypto adventures be both profitable and drama-free!

Read more about our top crypto picks:

- Best Crypto Trading Course for Free in 2024

- 10 Best Technical Indicators for Crypto Trading in 2024

- 4 Best Crypto Trading Tools for Success in 2024

- 4 Best Low Market Cap Crypto to Consider if You’re Bored With Bitcoin

Learn about crypto basics:

- Margin Trading Crypto in 2024: What It is, How It Works & Top 5 Platforms

- What is Sector in Crypto? A Comprehensive Guide

- What Are Decentralized Apps (DApps)?

- Crypto Cold Wallet vs. Hot Wallet: What’s the Difference

Beginner’s guide to buying crypto:

- 14 Ways To Earn Passive Income With Crypto in 2024

- Bitget Futures Trading: A Comprehensive Beginner’s Guide

- Copy Trading Crypto Like a Pro on Bitget | Bitget Review 2024

- Bitget Copy Trading Explained: How It Works and Why You Might Need It

FAQS

- What is a no KYC crypto exchange?

It’s a platform allowing crypto trading without requiring personal identification, prioritizing user privacy and quick access.

- Are no KYC crypto exchanges legal?

Legality varies by country. Always check local regulations before using these exchanges to avoid potential legal issues.

- What are the main advantages of using a no KYC exchange?

Increased privacy, faster trading setup, and fewer restrictions on transactions compared to traditional KYC exchanges.

- What risks should I be aware of when using no KYC exchanges?

Potential legal issues, limited user protections, and possible exposure to fraudulent activities due to reduced oversight.

- How do I buy crypto without KYC?

Choose a no KYC exchange, register with minimal info, fund your account, and execute trades directly.