KEYTAKEAWAYS

- Trump includes XRP, SOL, and ADA in U.S. crypto reserves, causing major price surges and market volatility.

- White House to host first Cryptocurrency Summit, signaling stronger government support for the crypto industry.

- U.S. regulatory stance softens as SEC drops cases and forms a crypto working group for clearer frameworks.

CONTENT

On the night of March 2, U.S. President Trump announced that Ripple (XRP), Solana (SOL), and Cardano (ADA) would be included in the U.S. cryptocurrency reserves.

A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL,…

— Trump Posts on 𝕏 (@trump_repost) March 2, 2025

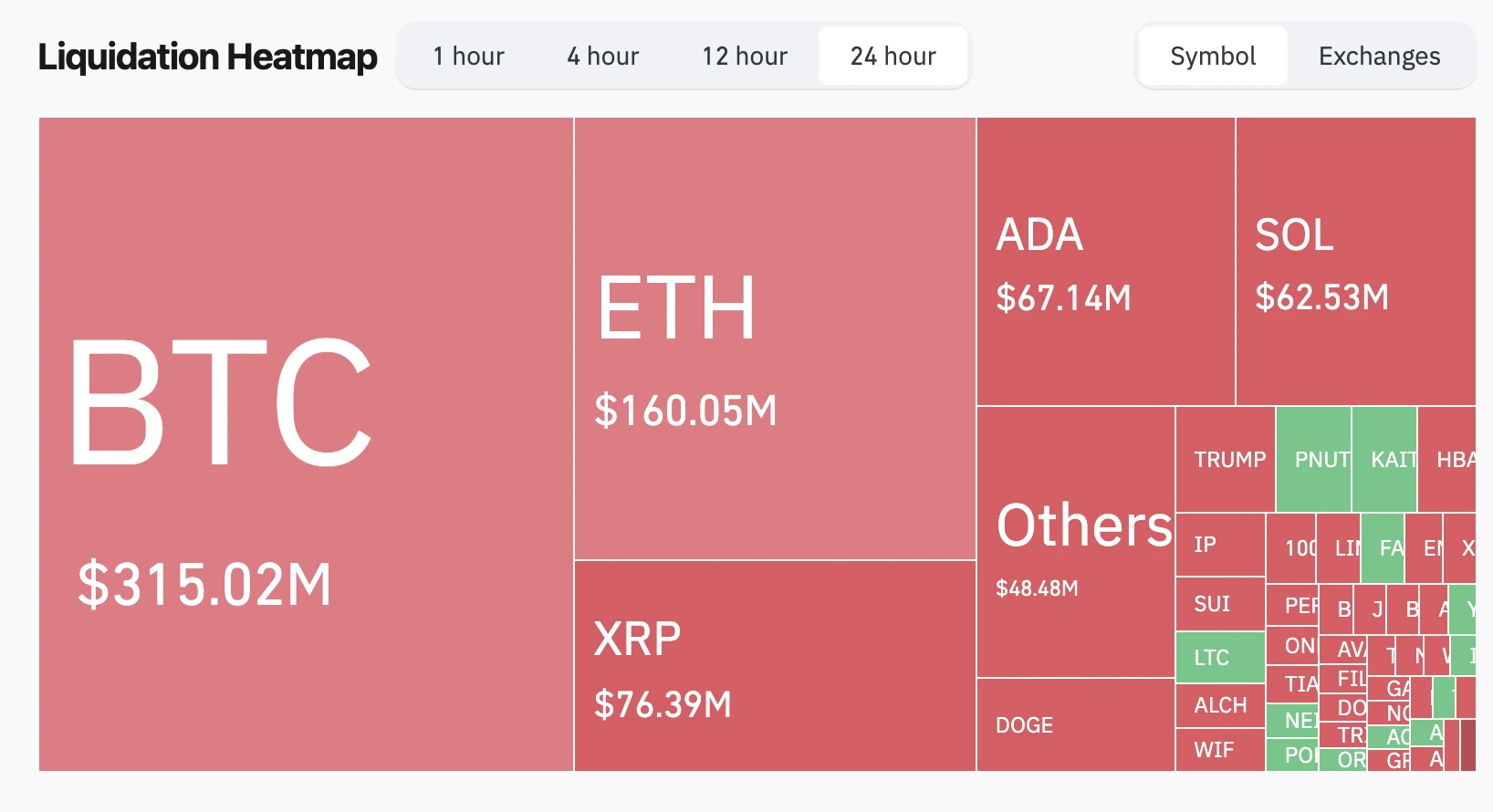

This news caused big changes in the cryptocurrency market. Ripple (XRP) went above $2.93 per coin, up more than 30%. Solana (SOL) passed $178 per coin, up over 24% in one day. Cardano (ADA) rose nearly 72% in a day. Bitcoin also went above $94,000 per coin, up almost 10% in a day.

However, these big changes also caused many investors to lose money. According to Coinglass, in the last 24 hours, over 180,000 people lost their investments, with total losses exceeding $800 million. This shows how risky the cryptocurrency market can be.

TRUMP ADMINISTRATION TO HOLD FIRST WHITE HOUSE CRYPTOCURRENCY SUMMIT

According to Bloomberg, Trump will host the first White House Cryptocurrency Summit on March 7, showing more support for the cryptocurrency industry. The White House said in a statement that Trump will speak at the event. Attendees will include well-known founders, CEOs, and investors from the crypto industry, as well as members of the President’s Digital Asset Working Group.

The summit will be led by David Sacks, the “Crypto Czar” and head of AI and cryptocurrency at the White House, and managed by Bo Hines, Executive Director of the Digital Asset Advisory Committee. The White House added, “The government is committed to providing a clear regulatory framework to promote innovation and protect economic freedom.”

TRUMP’S CHANGE IN CRYPTOCURRENCY POLICY

During the 2024 campaign, Trump once called cryptocurrency a “scam.” But later, he promised to simplify regulations, appoint people friendly to cryptocurrency to oversee the industry, support stablecoin frameworks, and build a Bitcoin reserve. Although he hasn’t fully kept these promises yet, his policies and the upcoming summit show a big change.

In contrast, the previous Biden administration took a tough approach to regulation after the collapse of the FTX exchange and other crypto industry scandals. Trump’s shift in policy seems to appeal to crypto supporters, especially after he launched his own meme coin, TRUMP, and supported a project involving his son called World Freedom Finance.

Also Read:

New Opportunities for the Crypto Industry as Trump Takes Office

SIGNS OF LOOSER CRYPTOCURRENCY REGULATION IN THE U.S

Recently, there have been signs that U.S. government agencies are becoming more lenient toward the cryptocurrency industry. On February 27, the U.S. Securities and Exchange Commission (SEC) announced it had reached an agreement with Coinbase and Coinbase Global to drop ongoing legal actions against them. Earlier, on January 21, the SEC had formed a special cryptocurrency working group to help create a clear and comprehensive regulatory framework for crypto assets.

Since the working group’s job is not yet done, the SEC decided to drop the case. This move is seen as a sign that the U.S. government is becoming more friendly toward the cryptocurrency industry, which could help the market grow further.

THE FUTURE OF THE CRYPTOCURRENCY MARKET

The Trump administration’s policy changes and the U.S. government’s softer approach to cryptocurrency regulation bring new opportunities and challenges to the market. With the White House Cryptocurrency Summit, the industry may get more policy support and clearer regulations, helping it grow.

However, the high volatility and risks in the cryptocurrency market remain a big concern. Investors need to be careful, understand the risks, and avoid big losses caused by sudden market changes.

In summary, the Trump administration’s policy shift and the U.S. government’s softer stance on regulation mark a new phase for the cryptocurrency industry. As policies become clearer and the market matures, cryptocurrency could play a bigger role in the global financial system.

Also Read:

Why Have Nations Been Reluctant to Include Bitcoin in National Reserves?

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!