KEYTAKEAWAYS

- Historical data shows Bitcoin halving cycles consistently trigger bull markets, with new ETF approval and potential Fed rate cuts creating unprecedented market conditions.

- Trump's victory could accelerate crypto growth through deregulation, pressure for Fed rate cuts, and geopolitical uncertainty driving demand for alternative assets.

- Despite positive sentiment, investors should remain cautious until Trump's inauguration in January 2025, focusing on stability over FOMO-driven leveraged trading.

CONTENT

Analyze how Trump’s presidential victory aligns with Bitcoin’s fourth halving cycle, examining historical patterns, potential policy impacts, and strategic investment approaches in the evolving crypto market landscape

According to multiple media outlets including Fox, CNN, and Associated Press, Trump has secured over 270 electoral votes, winning the 60th presidential election. He will become the 47th U.S. President and the oldest president at inauguration at 78 years old.

With the U.S. presidential election settled, the crypto market, which has been fluctuating around this election for quite some time, saw Bitcoin reaching a new all-time high of $75,381 (Bitget data) today under the anticipation and stimulus of this news. Other altcoins also surged, with many showing gains of 10% or even over 20%.

So after Trump’s election as president, will the crypto market directly enter the fourth halving bull market? What procedures remain after Trump’s election victory? How will the bull market progress?

HISTORICAL PATTERNS: BITCOIN’S HALVING BULL MARKETS EXPLAINED

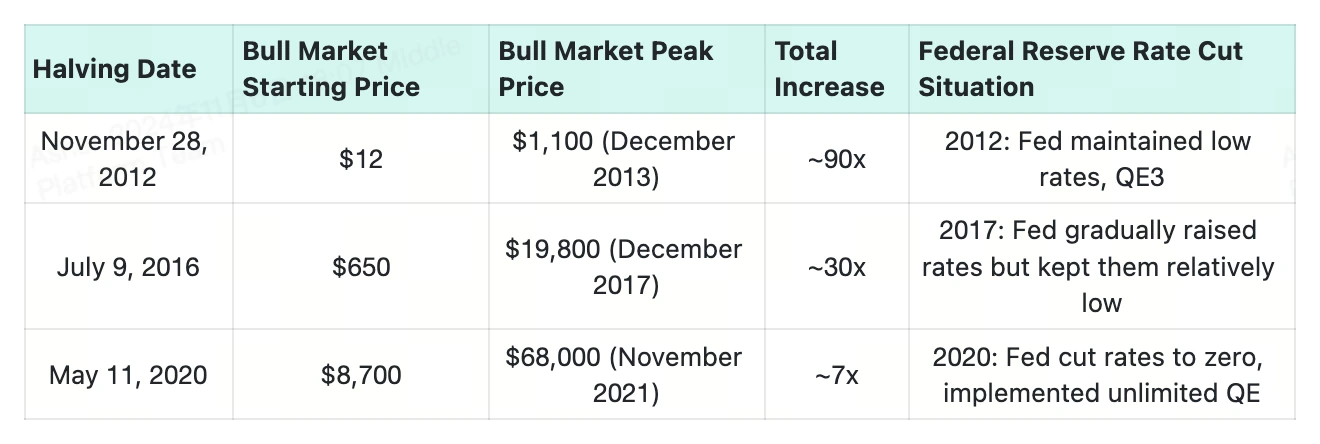

Looking at Bitcoin’s previous three halvings, each bull market was predictable: In 2012, the Fed maintained low interest rates and quantitative easing; 2017’s super bull run was driven by Fed’s low rates and CBOE/CME launching Bitcoin futures trading; 2020-2021’s super bull run was driven by Fed’s 0% interest rate and unlimited QE.

This halving bull market will be driven by Bitcoin spot ETF and Fed rate cut cycle, with ETF as the fuse and rate cuts as the powder keg.

Looking at the data from TradingView regarding Bitcoin’s previous three halving bull markets, the author has compiled a table showing the highest prices, lowest prices, percentage gains, and Fed rate cuts during these periods, as shown in the image below:

Bitcoin’s Previous Three Halving Bull Market Data

(Source: CoinRank)

More specifically:

The first halving bull market was predictable because Bitcoin had just entered public view, and the first halving’s supply reduction directly enhanced its scarcity value, attracting early investors. Meanwhile, the Fed’s low interest rates and quantitative easing policies provided massive liquidity for this bull run.

Relatively speaking, during the first halving bull market, Bitcoin was still very niche. The second halving bull market starting in 2017 marked Bitcoin’s first breakthrough into mainstream visibility.

This wasn’t coincidental – the Fed’s long-term low interest rate environment provided conditions for liquidity, encouraging investors to seek alternative assets for returns when traditional yields were low.

This favorable economic environment created fertile ground for speculation/investment. Bitcoin, as an emerging asset with high growth potential, began gaining attention from both institutional and retail investors.

The launch of Bitcoin futures on the Chicago Board Options Exchange (CBOE) and Chicago Mercantile Exchange (CME) pushed Bitcoin’s price to its then-historical high of nearly $20,000. This was mainly because the new financial product significantly expanded Bitcoin’s investor base, injecting more fuel into the already accumulated momentum.

Coming to the 2020-2021 third halving bull market, the macroeconomic environment provided fundamental momentum for Bitcoin’s bull market. At that time, to respond to the COVID-19 pandemic, the Fed reduced interest rates to near zero and implemented unprecedented quantitative easing, injecting trillions of dollars of liquidity into the economy.

This “unlimited QE” environment sparked concerns about currency devaluation, reigniting interest in Bitcoin as a store of value or “digital gold.”

Moreover, with large-scale Bitcoin purchases by institutions/companies like MicroStrategy, Tesla, and Square, Bitcoin’s status as an inflation hedge tool and corporate asset became increasingly recognized.

Improvements in institutional custody and infrastructure also provided secure ways for companies and large investors to hold Bitcoin. Bitcoin’s price soared from around $7,000 in early 2020 to nearly $69,000 at its peak in 2021.

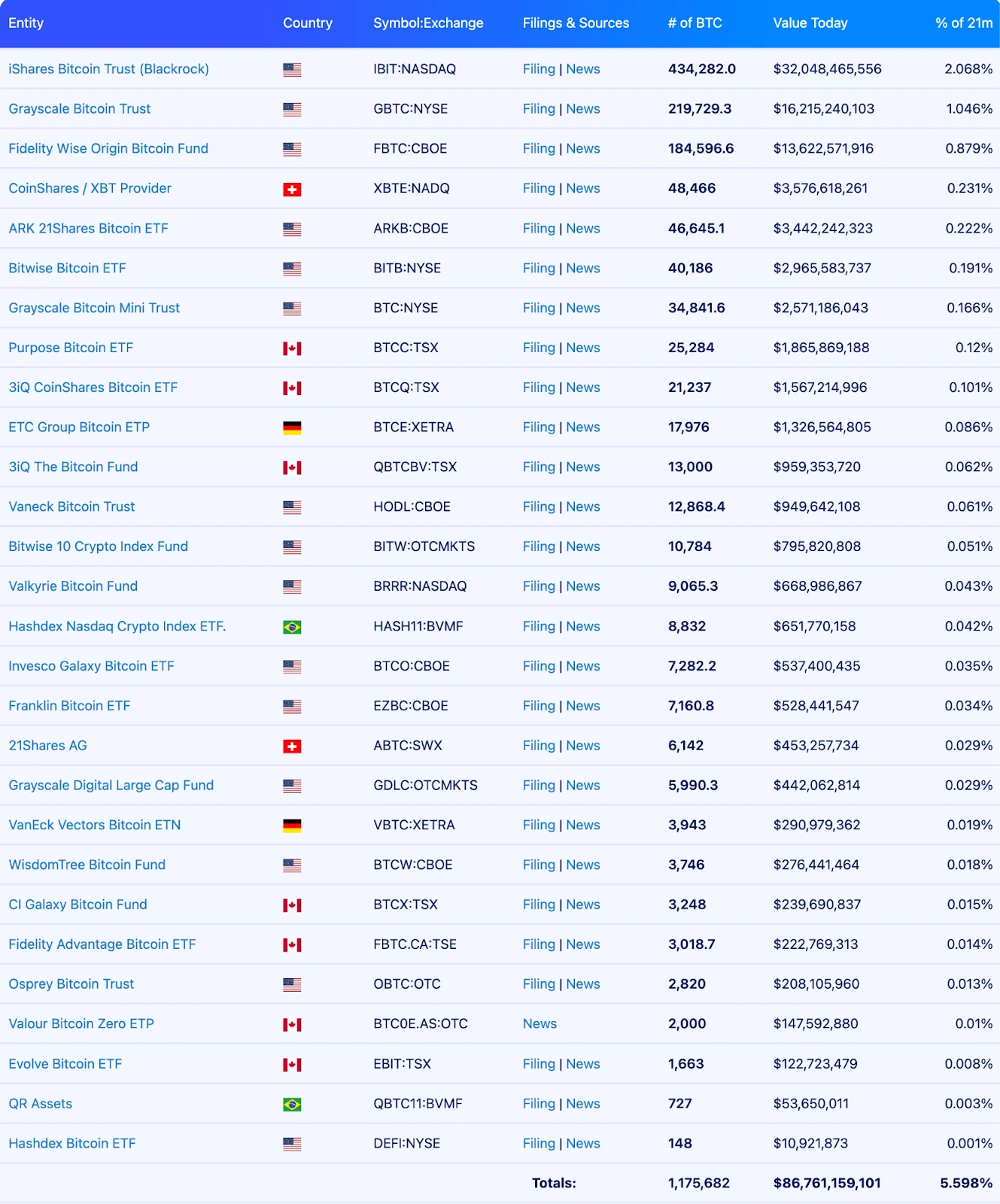

Bitcoin ETF Holdings

(Source: Bitcoin Treasuries)

Analyzing the previous three halving bull markets, we can summarize the triggers in three words: halving, rate cuts (loose monetary policy), and institutional entry (mainstream acceptance).

This halving cycle maximizes these three factors: After the previous three halvings, expectations for the fourth halving bull market are more certain; after the Fed’s extreme rate hikes, the potential and expectations for rate cuts are even greater; the approval of spot ETFs provides stable, legal channels for institutional old money to enter directly.

Combined, these factors have pushed market expectations for this bull run to historical highs.

Therefore, as long as these fundamental factors exist, each Bitcoin halving bull market will arrive as scheduled. Trump’s election as U.S. president and his urging the Fed to accelerate rate cuts will only accelerate the bull market process, serving as icing on the cake.

TRUMP’S IMPACT: ACCELERATING THE CRYPTO BULL RUN

In our previous article “Musk Endorses Trump: What Impact Would Trump’s Victory Have on the Crypto Sphere?” we mentioned that Trump’s election would greatly accelerate the fourth halving bull market.

Now that Trump’s election is confirmed, the herald of a violent bull market has sounded. We can analyze why Trump’s victory will drive a “violent” bull market from aspects of domestic and foreign policy, monetary policy, and global economic conditions.

Regarding domestic policy, Trump tends to favor deregulation and encourage financial innovation. During his first term, Trump emphasized reducing regulations to stimulate economic growth, especially in the financial sector. In this election, Trump received support from Musk and many cryptocurrency enthusiasts.

After taking office, reciprocating this support, he may push to reduce restrictions on cryptocurrency trading and holding, which will help facilitate capital entry into the market and attract more retail and institutional investors.

A relaxed regulatory environment will provide greater freedom for the crypto market, helping innovative projects develop, especially DeFi projects and Web3 applications which could see faster development in this environment, thus driving overall market growth.

From a foreign policy perspective, Trump has always maintained an “America First” strategy, which will lead to geopolitical uncertainty and challenges to the dollar’s status. Escalating trade disputes and geopolitical tensions will cause capital to seek decentralized assets like Bitcoin as “safe-haven assets.”

Meanwhile, this might lead other countries to gradually reduce their reliance on the dollar. Once the dollar’s status as the global reserve currency is challenged, capital will seek other assets as stores of value, and Bitcoin, as digital gold, could become an important tool for capital transfer and value preservation, thus driving up Bitcoin’s price.

Trump Meme

(Source: Internet)

Regarding monetary policy, after taking office, Trump will exert maximum pressure on the Fed to accelerate rate cuts to promote economic growth. Trump has repeatedly criticized the Fed’s rate hike policy in the past and openly expressed preference for low interest rates.

Accelerated rate cuts will bring enormous liquidity to the crypto market, while inflation expectations and the pursuit of higher returns will drive faster and larger increases in cryptocurrency prices, represented by Bitcoin.

Looking at the global economic situation, Trump is relatively unpredictable, which will lead to increased global economic uncertainty, and the crypto market will benefit from this.

For example, Trump’s tough foreign policy and confrontational trade policies will increase global capital’s hedging needs, leading them to seek stable, decentralized assets like Bitcoin as hedging tools.

Under tense global economic conditions, some emerging markets may face higher inflation and local currency depreciation pressures, causing local capital to be more inclined to transfer assets to dollars and Bitcoin to seek safer stores of value.

From the perspective of investor confidence and market sentiment, Trump’s election will not only affect the macroeconomy but also directly impact market sentiment.

Many crypto investors view Trump as a symbol of “anti-establishment,” while Bitcoin itself has anti-traditional finance and decentralization characteristics.

Therefore, Trump’s victory may further boost crypto investors’ confidence, driving more capital into the market.

After Trump’s victory, these factors working together will bring large capital inflows to the crypto market, driving significant price increases in Bitcoin and other crypto assets.

This “violent bull market” may not only set new historical highs but also further consolidate the position of Bitcoin and cryptocurrencies in the global financial market.

TIMELINE AND STRATEGY: NAVIGATING THE COMING BULL MARKET

Currently, Trump has only won the election, with other procedures still to follow, such as:

November 6 – December 11: States certify election results

December 17: Electoral College meets to cast official votes

January 6, 2025: Congress meets to count and certify electoral votes

January 20, 2025: Trump’s official inauguration

After that, he will urge the Fed to accelerate rate cuts, followed by liquidity implementation. Only then will the promised fourth halving bull market turn violent.

Current increases are mainly due to emotional FOMO – don’t be blinded by the current situation, don’t chase rising prices, especially with leverage.

In the current market conditions, stability remains most important; surviving longer is key to capturing the “big gains.”

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!