KEYTAKEAWAYS

- June CPI expected to drop to 3.1%, potentially influencing Fed's rate cut decisions in late 2023.

- Recent labor market cooling may support a shift towards looser monetary policy.

- Ethereum spot ETF applications could significantly impact cryptocurrency market trends.

CONTENT

U.S. June CPI data release: Impact on Fed rate decisions, market expectations, and cryptocurrency trends. Key insights for investors ahead of the announcement.

>>> Must read: 2024 June Crypto Market Analysis

U.S. JUNE CPI DATA TO BE RELEASED SOON

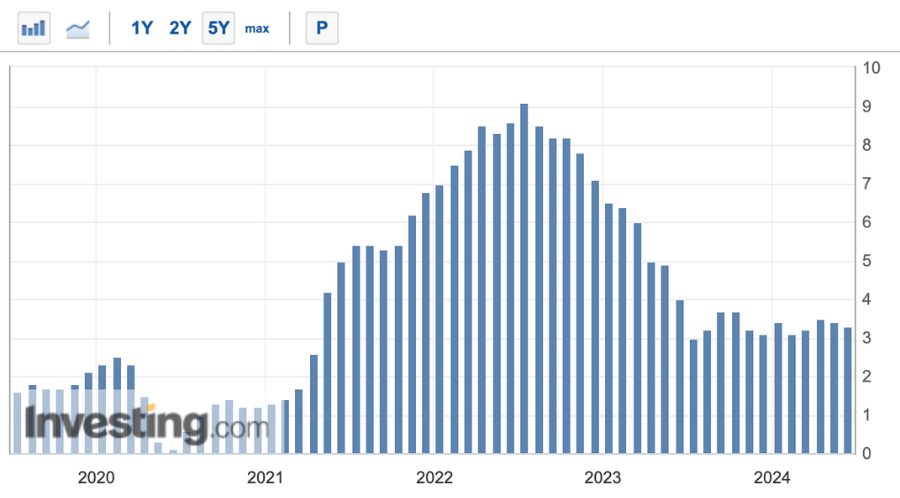

The U.S. June Consumer Price Index (CPI) data is set to be released on July 11 at 8:30 A.M. Eastern Time. According to market expectations, the U.S. June CPI is projected to decrease to 3.1%, lower than May’s 3.3%.

(source: Investing.com)

Additionally, the year-on-year increase in June’s core CPI is expected to remain at 3.4%. These figures suggest a reduction in inflationary pressures, which could significantly influence the Federal Reserve’s decision on potential interest rate cuts in the second half of this year.

>>> Read more: Crypto Market Update in Early July: Ethereum ETFs, Bitcoin Trends, and Future Influences

INCREASED PROBABILITY OF A SEPTEMBER RATE CUT

Prior to this CPI data release, the market recently received last week’s labor report, which indicated a cooling job market with fewer job openings and slowing wage growth, suggesting weakening inflationary pressures.

QCP Capital states that if the upcoming CPI data continues this trend, it could be the final piece confirming the Federal Reserve’s transition towards a looser monetary policy. They predict that weak CPI data will further strengthen the Fed’s inclination to cut rates at its September and December meetings.

Bloomberg economists Anna Wong, Chris Collins, and Stuart Paul forecast that June’s CPI report will present better-than-expected data, laying the groundwork for the Fed to begin rate cuts in September.

MARKET TRENDS AT A GLANCE

The cryptocurrency market is particularly sensitive to U.S. CPI inflation data. Although the market is betting on a potential Fed rate cut in September, if tonight’s U.S. CPI data is higher than expected, it could dampen overall market sentiment and drag down the already sluggish market of recent weeks.

Conversely, if the data matches or beats expectations, it could drive a market rebound. Therefore, investors should be well-prepared before tonight’s data release to prevent losses in high-risk positions.

Besides macroeconomic data, the market is also focusing on numerous S-1 applications for Ethereum spot ETFs. If Ethereum spot ETFs are approved by the U.S. Securities and Exchange Commission (SEC) and begin trading, it could attract substantial capital back into the market, further propelling the cryptocurrency market upward.

In this context, investors should closely monitor the upcoming CPI data as well as policy directions from the Federal Reserve and SEC.

>>> Read more:

▶ Buy Bitcoin & Ethereum at Binance

Enjoy up to 20% off on trading fees! Sign up Now!

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!