KEYTAKEAWAYS

- Uniswap Labs surpasses $50 million in cumulative front-end fees.

- The company maintains its position as the largest DEX platform by trading volume.

CONTENT

The leading decentralized exchange platform sees a thirteenfold increase in fee collection since January, bolstered by a strategic fee hike and continued market dominance in the DEX landscape.

Uniswap Labs, the company behind the popular Uniswap decentralized exchange (DEX) protocol, has reached a significant milestone by surpassing $50 million in cumulative front-end fees. This achievement marks a remarkable thirteenfold increase from $3.7 million at the start of the year to over $50.6 million currently.

The surge in revenue can be attributed to the implementation of a 0.15% fee on user transactions through the Uniswap web interface and wallet app in October last year. In April, the company strategically increased this fee to 0.25%, further contributing to the dramatic rise in collected fees.

Uniswap continues to dominate the DEX landscape, maintaining its position as the largest platform by trading volume. In July alone, Uniswap facilitated $54 billion out of a total $154 billion in swap volume across all DEXs, accounting for nearly one-third of the market.

Despite the availability of alternatives that allow users to bypass these fees, such as DEX aggregators like 1inch, Cowswap, and Paraswap, Uniswap’s front-end remains the most popular choice. It represented 25.7% of DEX activity in July, compared to 19.8% for 1inch, the leading aggregator.

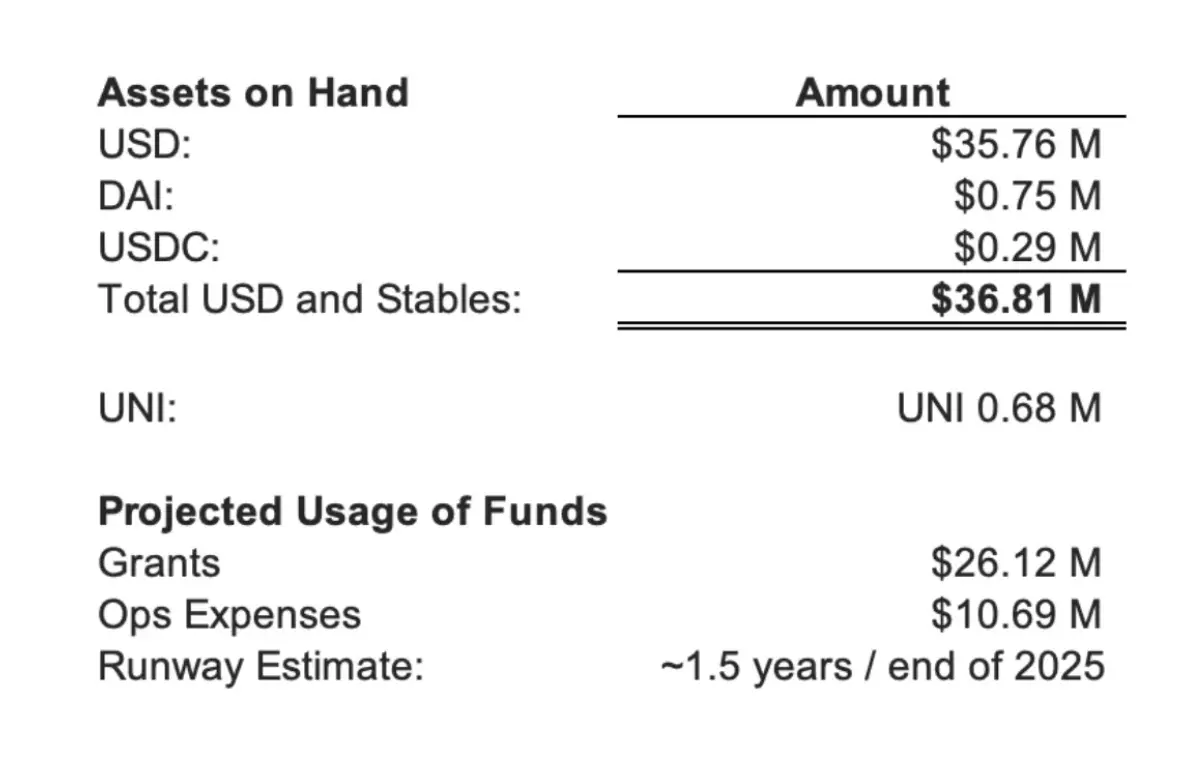

Uniswap Foundation recently unveiled its financial summary for the second quarter, revealing substantial cash and stablecoin holdings of $36.81 million. These reserves are earmarked for grant-making and operational purposes until the end of 2025, with $26.12 million designated for grants and $10.69 million for operational costs.

Source: Uniswap Foundation

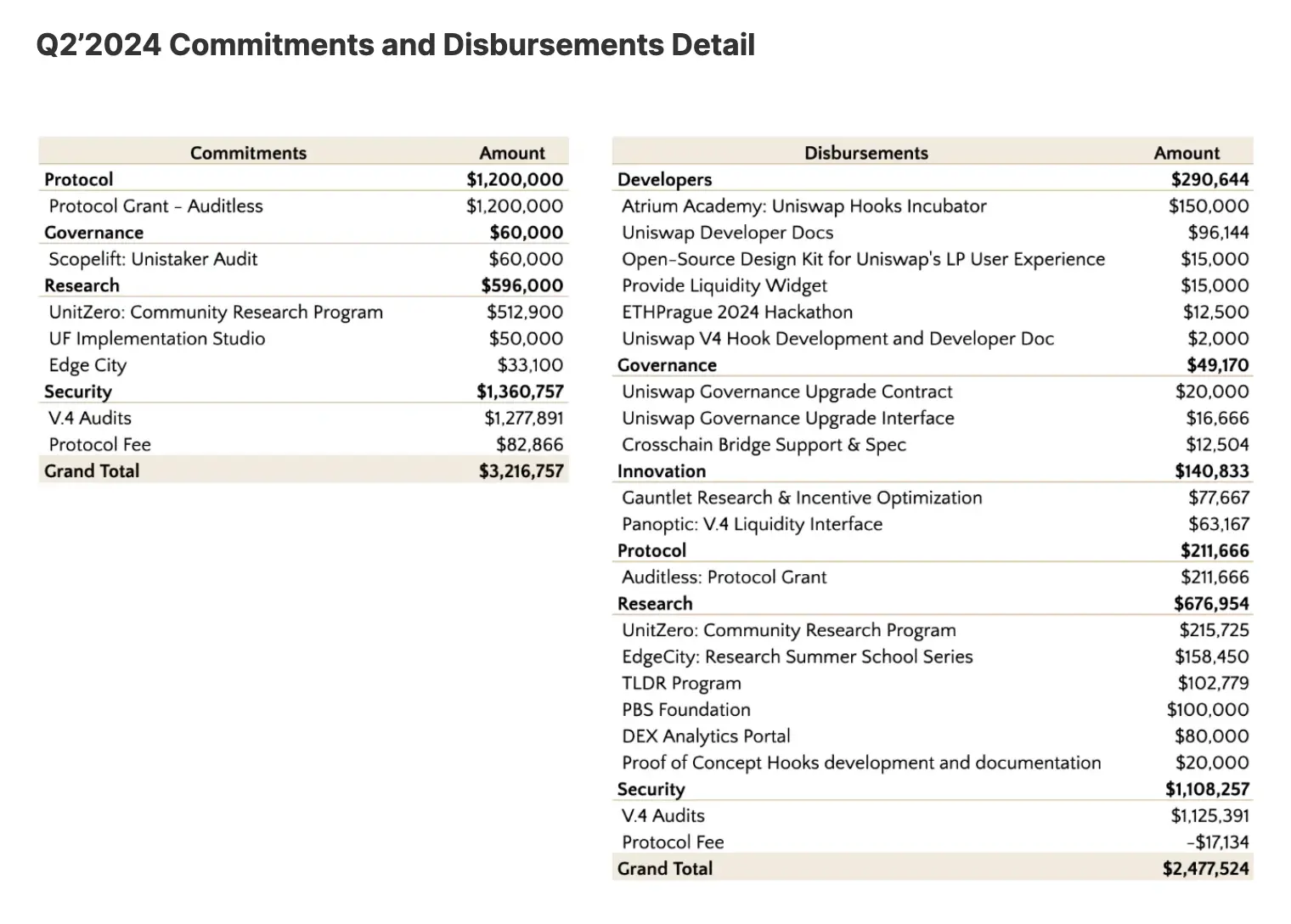

Source: Uniswap Foundation

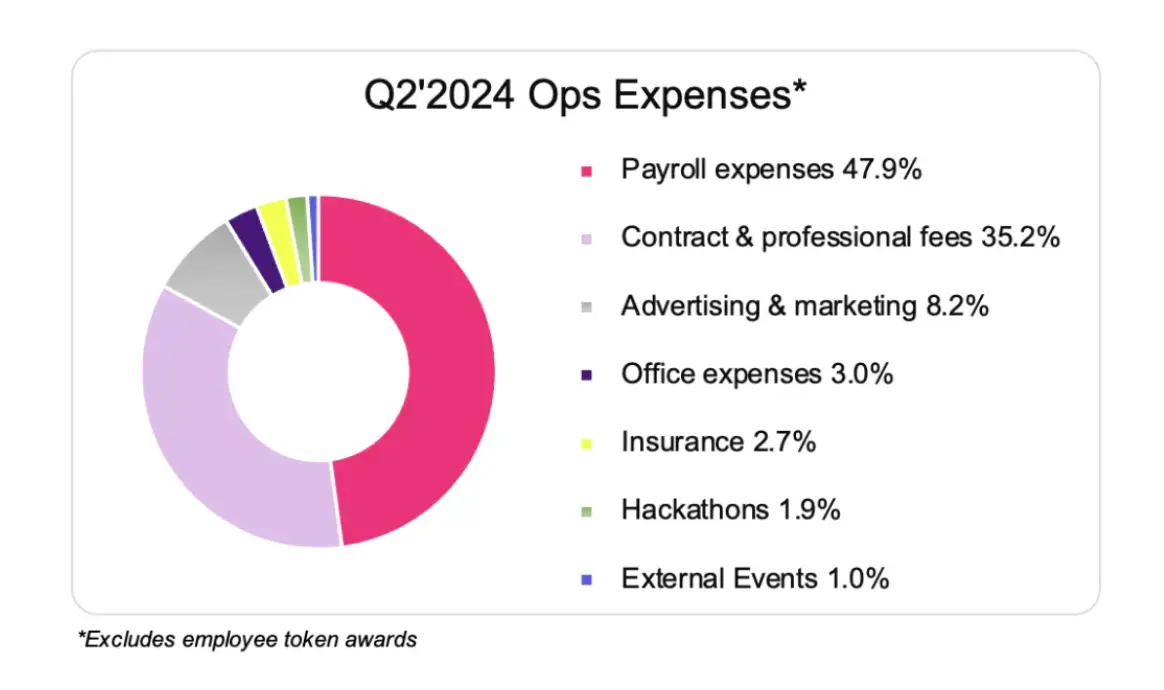

During Q2, the foundation approved over $3.2 million in new grants and distributed nearly $2.5 million from previously committed grants. The foundation’s operating expenses for the quarter reached $1.6 million, with the majority allocated to payroll (47.9%) and professional fees (35.2%).

Source: Uniswap Foundation

As Uniswap Labs continues to grow and evolve, this milestone in front-end fee revenue underscores its strong position in the decentralized finance ecosystem and its ability to generate substantial income while maintaining user engagement.

>> Also read: Choosing the Right Cryptocurrency Exchange: CEX vs DEX