KEYTAKEAWAYS

- US spot bitcoin ETFs experienced $168.4 million in net outflows on Monday during significant market turbulence.

- Spot Ethereum ETFs reported net inflows of $48.73 million, with BlackRock's ETHA leading the gains.

CONTENT

Grayscale’s GBTC and Ark Invest’s ARKB lead outflows as crypto markets experience turbulence; Spot Ethereum ETFs show resilience with net inflows despite market downturn.

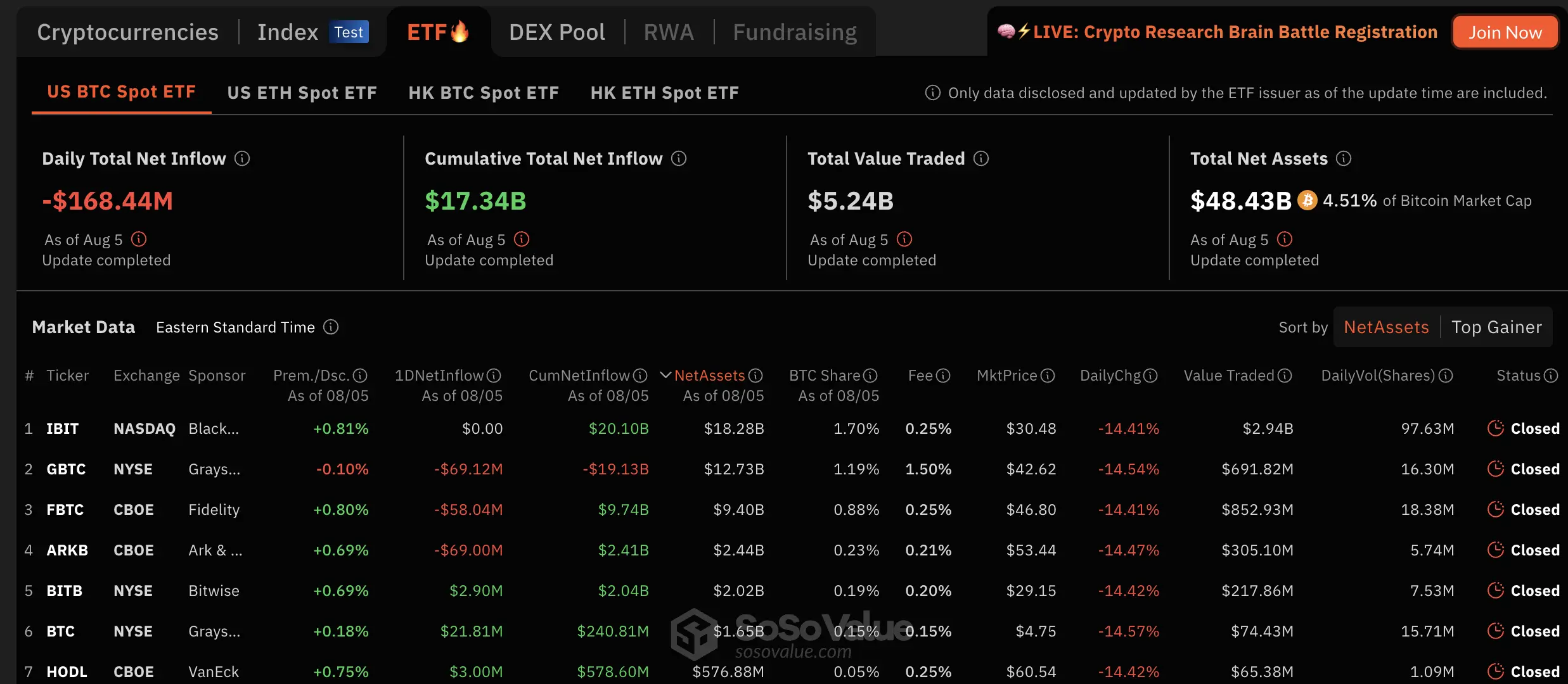

In a day marked by significant market volatility, US spot bitcoin exchange-traded funds (ETFs) witnessed substantial outflows on Monday. Data from SoSoValue revealed that these funds experienced net outflows totaling $168.4 million amid turbulent conditions in the cryptocurrency markets.

Source: SoSo Value

Among the 12 spot bitcoin ETFs, Grayscale’s GBTC led the exodus with $69.12 million in daily net outflows. Close behind was Ark Invest and 21Shares’ ARKB, shedding $69 million, while Fidelity’s bitcoin fund reported $58 million in net outflows.

>> Also read: Grayscale’s GBTC: The Potential Spot Bitcoin ETF – Pros, Cons, and What to Watch Next

However, not all funds saw negative flows. Grayscale’s latest bitcoin trust, launched just last week, bucked the trend with $21.81 million in net inflows. ETFs from VanEck and Bitwise also attracted approximately $3 million each on Monday.

Notably, BlackRock’s IBIT, the largest spot bitcoin ETF by net asset value, recorded zero flows, along with funds from Valkyrie, Invesco, and three others. Since their inception in January, these 12 funds have accumulated a total net inflow of $17.34 billion.

Monday’s market turbulence led to a surge in trading activity, with $5.24 billion worth of funds traded in spot bitcoin ETFs – the highest volume since March 25. This spike in activity coincided with a major downturn in both cryptocurrency and global stock markets.

The market decline was attributed to various factors, including escalating tensions in the Middle East, weak US economic data, and crypto-specific events such as Jump Crypto’s asset movements and uncertainties surrounding the upcoming US election.

Bitcoin’s value briefly dipped below $50,000 but has since rebounded to $55,524. Similarly, Ether’s price, which had plunged to around $2,200, has recovered to $2,500.

In contrast to the bitcoin ETF outflows, spot Ethereum ETFs demonstrated resilience by reporting a net inflow of $48.73 million on Monday. BlackRock’s ETHA led the pack with $47 million in inflows, followed by VanEck and Fidelity’s ether ETFs with approximately $16 million each. Grayscale’s Ethereum Mini Trust also saw $7.59 million in inflows.

The only Ethereum ETF to report outflows was Grayscale’s ETHE fund, with $46.84 million exiting. Invesco and 21Shares’ funds saw no movement. The total value traded in spot ether ETFs on Monday reached $715.61 million.

Despite their recent launch last month, spot ether ETFs have accumulated a total net outflow of $461.98 million to date.

>> Also read:

- Bitcoin Spot ETFs: Risks You Need to Know Beyond the Hype

- ETH Spot ETFs Nearing Approval: Impact on ETH Price and Ecosystem Projects to Keep an Eye On