KEYTAKEAWAYS

- Bitcoin's correlation with US stocks is increasing due to institutional investors, with Nasdaq having the strongest influence due to tech company crossovers.

- Bitcoin may enter a "slow bull" market pattern, breaking the traditional four-year cycle and creating more sustained, less volatile growth.

- Fed monetary policy remains decisive; 2025's projected two rate cuts and slowing balance sheet reduction will shape Bitcoin's performance.

CONTENT

Explore how Bitcoin is increasingly behaving like US stocks, particularly tech stocks, potentially entering a slow bull market phase with institutional investors driving this shift and how Fed policies will shape crypto markets in 2025.

In the past two months, Bitcoin and the broader cryptocurrency market have continuously declined, following the footsteps of US stocks, leading to jokes in the market that “Bitcoin is the shadow of US stocks.” In fact, as Bitcoin becomes increasingly mainstream and more institutions enter the market, especially after the approval of Bitcoin spot ETFs, voices about Bitcoin behaving like US stocks have already emerged, but now this characteristic is becoming even more apparent.

US Nasdaq Index Monthly K-line

(Source: Investing)

So, with Bitcoin behaving more like US stocks, will it replicate the slow bull market characteristics of US stocks, breaking the four-year cycle of bull and bear markets? If a slow bull market is established, what impact will it have on the crypto sphere? And as Bitcoin becomes more stock-like and mainstream, the Federal Reserve’s monetary policy now has an almost decisive influence on Bitcoin. If 2025 marks the beginning of a slow bull market for Bitcoin, what should we as investors do to capture these market changes?

BITCOIN BEHAVING LIKE US STOCKS: BEGINNING OF A SLOW BULL MARKET?

Bitcoin behaving like US stocks mainly reflects increasing similarities between the two in terms of funding sources, investor demographics, and price movement logic.

Looking at funding sources, US stocks are primarily composed of institutions such as pension funds, hedge funds, insurance companies, and retail investors, creating diverse and stable capital inflows. US stock prices are largely influenced by corporate earnings, macroeconomic data, and policy expectations.

Bitcoin was initially dominated by retail investors and native cryptocurrency investors. In recent years, institutional capital (like MicroStrategy and Bitcoin ETFs) has increased its share, while also attracting global liquidity, including geopolitical safe-haven funds. Therefore, Bitcoin’s funding sources are becoming increasingly diverse, though it still retains high-risk asset characteristics.

Regarding investor demographics, US stocks generally cover traditional investors, long-term value investors, and high-frequency traders who are sensitive to fundamentals. Bitcoin initially attracted geeks and technology enthusiasts but is gradually penetrating hedge funds, family offices, and high-net-worth individuals, with some investors viewing it as “digital gold” to hedge against inflation.

In terms of price movement logic, US stocks are primarily driven by corporate earnings, interest rate policies (such as Fed rate hikes/cuts), and economic cycles (like GDP and employment data). Bitcoin is more influenced by supply and demand relationships (halving cycles), regulatory policies (such as US taxation or ETF approval), technical upgrades, and market sentiment (like leverage liquidations).

US stocks rely more on the real economy, while Bitcoin mainly reflects liquidity expectations and risk appetite, but recently there has been stronger correlation due to Federal Reserve policy synchronization (such as rate cut expectations).

Overall, due to institutional trends and converging capital allocation concepts, Bitcoin is increasingly viewed as an alternative asset, showing high correlation with US stocks, especially tech stocks. The Fed’s easing or tightening policies are highly sensitive for both, causing Bitcoin to “mirror” US stock movements, earning it the nickname “shadow asset.”

Specifically, there are three major US stock indices: Dow Jones, Nasdaq, and S&P 500. Which has the greatest influence?

Comparing the three, the Dow Jones Industrial Average (DJIA) includes only 30 large blue-chip companies, positioned as traditional blue-chip stocks, with a market value of about $10 trillion; Nasdaq is mainly composed of tech stocks, positioned as technology growth stocks, with a market value of about $25 trillion; S&P 500 consists of 500 large companies, representing the broader market, with a market value of about $40 trillion.

US Total Market Cap/GDP

(Source: MacroMicro)

Overall, the influence of the three indices on the crypto sphere is: Nasdaq > S&P 500 > Dow Jones.

This means Nasdaq has the greatest impact on Bitcoin because it’s primarily led by technology companies (like Apple, Microsoft, Tesla) that have more crossover with the crypto world. The liquidity of tech stocks is highly correlated with Bitcoin; when tech stocks rise, Bitcoin is more likely to attract capital. For example, ARK Invest, MicroStrategy, and Tesla holding BTC affects investor sentiment.

The S&P 500 has broad coverage, including many tech companies that hold crypto assets, but is also significantly influenced by financial, industrial, and consumer sectors. The overall rise and fall of US stocks affect market liquidity, which in turn affects Bitcoin capital inflow.

In summary, Bitcoin’s short-term movements are more influenced by Nasdaq, especially tech stock capital flows. Bitcoin’s long-term trend has a higher correlation with the S&P 500 because it reflects overall market liquidity and institutional investor behavior.

If the conclusion that Bitcoin behaves like US stocks holds true, will Bitcoin replicate the past slow bull market trajectory of US stocks, breaking the four-year cycle of bull and bear transitions?

We can analyze whether this replication is possible by examining the driving factors behind Bitcoin’s stock-like behavior. This behavior is mainly due to institutional investors entering the market, with traditional financial institutions like BlackRock and ARK Invest including Bitcoin in asset allocation, pushing it from a “fringe asset” to a “mainstream risk asset.” Additionally, corporate debt purchases of Bitcoin (such as MicroStrategy’s aggressive holding strategy) form an “balance sheet effect” that links with stock prices.

Both are affected by Federal Reserve policy transmission, with Bitcoin and US stocks benefiting from liquidity flooding during easing cycles and facing pressure during tightening cycles.

In terms of market structure evolution, BTC’s compliance process acceleration (such as ETFs and custody services) reduces volatility dominated by retail investors, while increased institutional trading makes the market more dependent on fundamental expectations. Also, the crypto infrastructure (such as custody and clearing) is converging with traditional financial systems, and technical analysis tools are becoming similar to those used for US stocks.

From the driving factors of Bitcoin’s stock-like behavior, Bitcoin has already initially met the conditions to replicate the slow bull market path of US stocks. The core characteristics of US stock slow bull markets are long-term moderate increases, such as the S&P 500 index rising more than 10 times over 30 years and the Nasdaq index rising 45 times, both depending on corporate earnings growth and economic fundamentals, including sector rotation and policy stability, with technology, consumer, and financial sectors taking turns leading the gains, and the government maintaining market stability through policy fine-tuning.

However, there are still obstacles to Bitcoin replicating the US stock slow bull market. Currently, Bitcoin’s volatility remains much higher than US stocks, and market sentiment is easily affected by leverage liquidations and sudden regulatory changes. But in the long term, if institutional holding ratios continue to increase and regulatory frameworks become clearer, Bitcoin may gradually reduce volatility and shift toward a “supply-demand driven slow bull market,” aligning with the past US stock slow bull market.

FEDERAL RESERVE MONETARY POLICY: HOW WILL IT AFFECT THE SLOW BULL MARKET IN THE CRYPTO SPHERE?

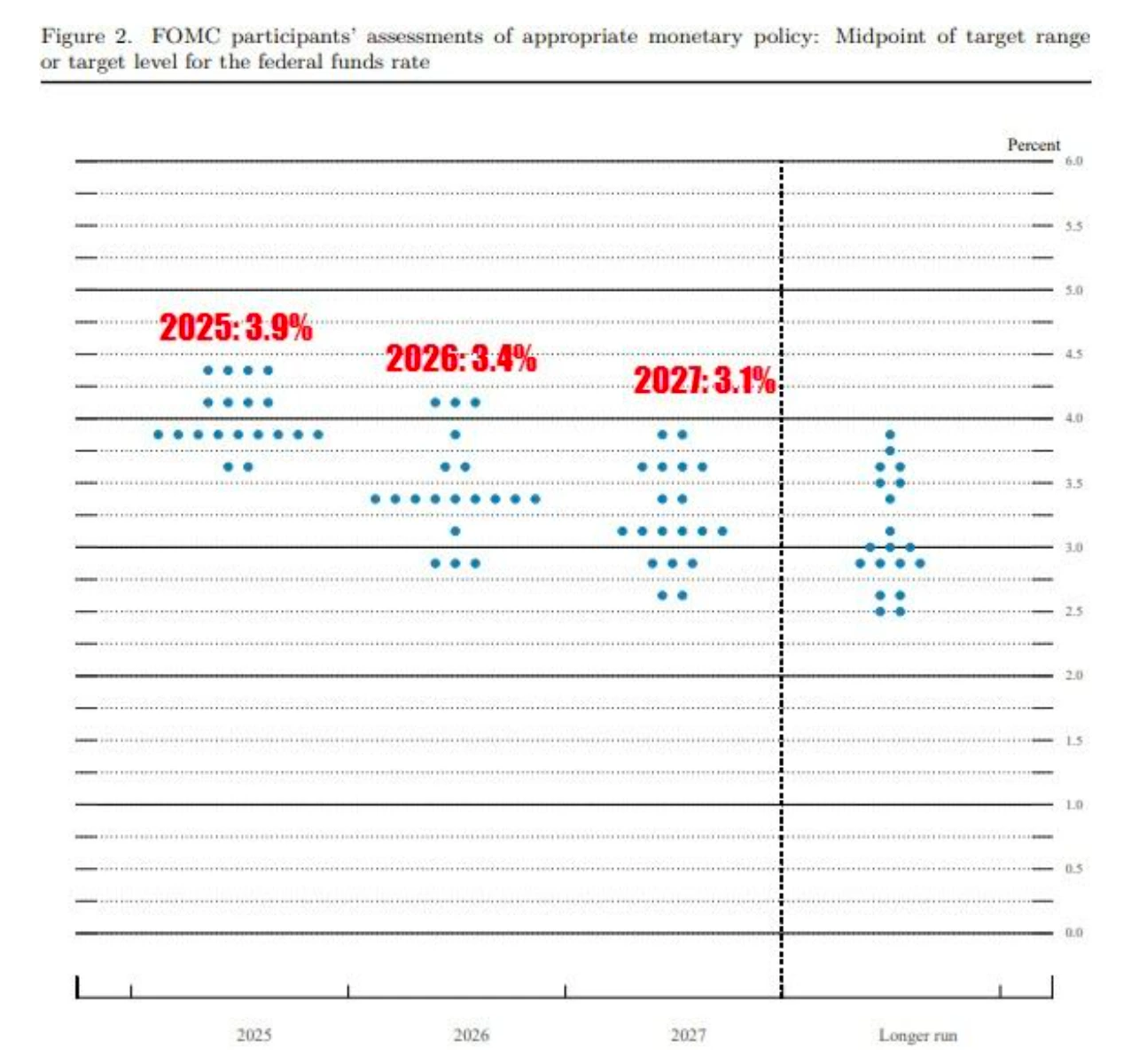

At 2 PM New York time on March 19, the Federal Reserve announced its second interest rate decision of 2025. Here’s a simple summary of the main contents of this Fed meeting:

- Maintaining interest rates unchanged: 4.25%-4.50%, as expected;

- The dot plot shows that two rate cuts are expected in 2025 (the same as predicted in December last year).

- The Federal Reserve will begin slowing down its balance sheet reduction pace on April 1, but not stopping it; Powell later stated that slowing down the balance sheet reduction means proceeding at a slower pace but for a longer duration.

- The Fed survey shows that tariffs are driving inflation expectations, so there’s no need to urgently adjust the monetary policy stance.

Overall, there wasn’t much positive news, with the tone leaning hawkish: no increase in possible rate cuts, and balance sheet reduction only slowing down but still continuing (slightly positive);

Federal Reserve Interest Rate Dot Plot

(Source: MacroMicro)

Although the market expects a potential rate cut in June, it’s a case of distant water not quenching present thirst. Interest rates remain high, and balance sheet reduction continues, so the market still lacks liquidity in the short term.

After the data was released, the market first fell and then rose, with Bitcoin reaching a high of $85,901 at the time of writing. ETH performed strongly, possibly due to the upgrade in late April and the documentary “The Story of Ethereum” being released on Apple TV and Amazon’s Prime Video, but this narrative can only help ETH recover some lost ground. Ultimately, it still depends on BTC’s performance and the current monetary policy and economic data environment.

This Fed meeting essentially continued the previous basic policy: gradually cutting rates depending on circumstances, without rushing to cut rates quickly. This kind of monetary policy also provides the basic conditions for Bitcoin to enter a slow bull market in the coming period.

Based on the current situation, we can make a simple prediction of the Fed’s monetary policy in 2025, to better judge the performance and progress of BTC and the crypto market.

First: When will rates be cut? How many cuts?

According to the current dot plot and mainstream market expectations, there may be 2 rate cuts in 2025, possibly one in June and one in October or December, with magnitudes of 25-50 basis points. If Trump really artificially creates an economic recession, it might force the Fed to cut rates more times.

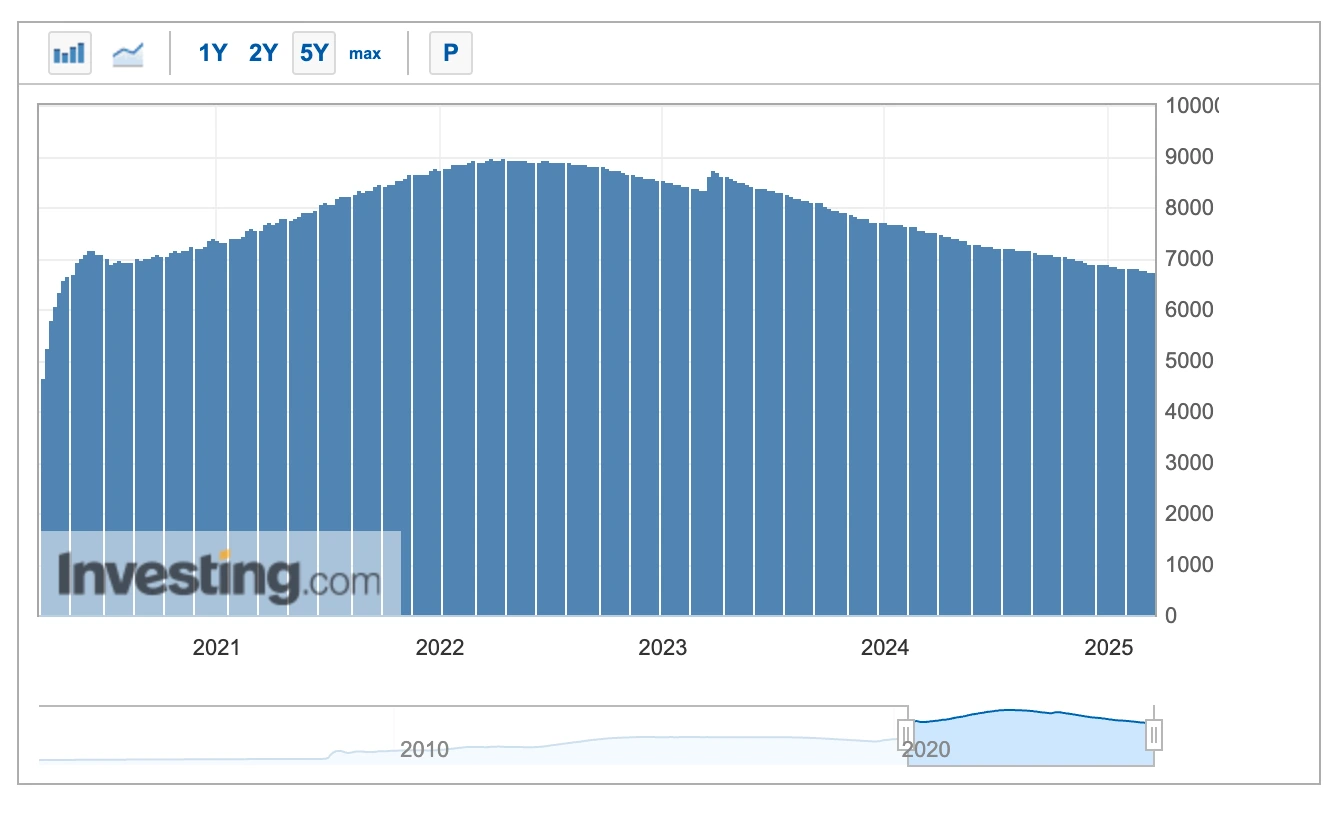

Next, when will balance sheet reduction stop? When will balance sheet expansion begin?

Although this meeting confirmed that the Fed will begin slowing down its balance sheet reduction pace on April 1, it didn’t confirm when the reduction would stop. Powell even indicated that the reduction would continue for a longer period. Therefore, the earliest the balance sheet reduction might stop could be around October, unless economic growth slows down or financial market pressure increases, such as a sustained decline in US stocks, which could lead to an earlier stop to balance sheet reduction or even consideration of expansion. Referring to the QE (quantitative easing) logic of 2008 and 2020: once the market experiences a liquidity crisis, the Fed will restart QE.

Federal Reserve Balance Sheet for the Last 5 Years

(Source: Investing)

If expectations are met in the future: rate cuts + liquidity easing, then capital will flow back, liquidity will be sufficient, and Bitcoin and the crypto sphere may enter a bull market. But caution is needed: if rate cuts are forced by economic downturn, the market may first fall and then rise.

The formation and confirmation of Bitcoin’s slow bull pattern will profoundly influence all participants in the crypto sphere, including investors’ choice of investment strategies and project development and operation processes, and will deeply affect the construction of the entire industry ecosystem and development path.

From the project perspective, if Bitcoin’s slow bull pattern is established, the duration of the bull market will correspondingly increase, giving more projects and concepts time to grow, evolve, and mature. It’s like each warm period on Earth: the longer it lasts, the stronger biodiversity becomes, the more prosperous the ecosystem, and the more likely higher forms of life evolve. Conversely, some projects that continue as before, without long-term planning and only aiming for short-term battles, may be “purified” by the market.

For the entire crypto sphere, a slow bull market can win time for institutional construction; it can allow the market to continuously rise, enabling more quality projects to be successfully born; the possibility of bubbles forming is reduced to a minimum in a slow bull market, conducive to the stable development of the entire market; a slow bull market will strengthen investor confidence in the entire industry, thereby attracting more people to join and promoting the development of the entire industry.

“Slow bull” means mainstream coins (BTC, ETH) will be more dominant. Capital flows become stable, no longer experiencing “violent rises and falls” of excessive speculation, while the speculative nature of altcoins and Memecoins decreases in the short term, with quality assets more favored. Additionally, industry institutionalization strengthens, and the crypto industry becomes more compliant. Traditional financial institutions participate in new tracks like DeFi and RWA, driving incremental funds, while GameFi and NFT tracks need to adapt to new investment models, with short-term speculation reducing.

The establishment of a slow bull pattern may make this round of Bitcoin halving market last longer than many people expect. However, during some sustained phases of the slow bull market, the market may appear sluggish, not feeling like a bull market, with most people not believing it is a bull market.

For investors, how to adapt to the slow bull market and seize opportunities?

In asset allocation strategy, BTC and ETH remain mainstream, with mainstream coins as the main focus, concept leader coins as supplementary, and try to avoid small-cap altcoins. Focus on tracks with institutional capital inflow, especially hot tracks: RWA (Real World Asset tokenization), on-chain treasury bonds, compliant stablecoins; DeFi blue chips, liquidity markets (such as Lido, EigenLayer), leading DEXs (such as Uniswap, Curve); GameFi & SocialFi, etc.

For trading strategy, long-term holding (HODL) + dollar-cost averaging, adapting to the “slow bull” trend, reducing short-term trading; appropriately using contract leverage, adding leverage when trends are clear, but controlling risk.

Additionally, pay attention to market signals, such as Federal Reserve policy shifts; ETF capital flows, as ETF subscriptions and redemptions are important indicators for BTC price; monitor on-chain data (such as net outflows from exchanges), and the correlation between the US stock VIX index and Bitcoin volatility.

US Stock VIX Fear Index

(Source: Investing)

With Bitcoin’s slow bull pattern established, investment strategies and mindset need to change with the situation. Bitcoin now finds it difficult to surge like it did in the first three halving markets, so investors need to adjust their expectations for returns, trading strategies, choice of trading methods and targets, capital allocation, and other aspects. Mentally, more patience is needed, as patience is the watershed of wealth.

CONCLUSION

Overall, Bitcoin’s stock-like behavior is due to increased institutional investors, making its price movement logic more similar to US stocks, especially tech stocks. Bitcoin may enter a “slow bull” market next, with ETF capital inflow + institutional dollar-cost averaging + increased market maturity collectively shaping a long-term stable upward trend; afterward, the crypto sphere will undergo differentiation, a significant feature of a slow bull market, with different digital assets differentiating, concept sectors differentiating, and investor behavior differentiating. Of course, differentiation will be a long-term process, not achieved overnight, and this differentiation will create greater fission in the entire market and bring Bitcoin to a new height, becoming a more mature asset.

Finally, let’s recharge our faith: as long as Federal Reserve rate cut expectations persist, the fourth round of halving market continues.

*Friendly reminder: This article is for reference only, not investment advice. The market involves risks, please invest cautiously.*

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!