KEYTAKEAWAYS

- Learn easy and effective ways to earn passive income with crypto.

- From staking and yield farming to NFTs and masternodes, start building your wealth today.

- KEY TAKEAWAYS

- INTRODUCTION

- #1. STAKING CRYPTO: A BEGINNER’S GUIDE TO PASSIVE INCOME

- #2. EARN HIGH RETURNS WITH CRYPTO SAVINGS ACCOUNTS

- #3. YIELD FARMING EXPLAINED: EARN PASSIVE INCOME WITH CRYPTO

- #4. LIQUIDITY MINING: A STEP-BY-STEP GUIDE TO EARNING CRYPTO

- #5. MASTERNODES: THE ULTIMATE GUIDE TO EARNING PASSIVE CRYPTO INCOME

- #6. CLOUD MINING: HOW TO EARN CRYPTO WITHOUT HARDWARE

- #7. LEND CRYPTO AND EARN INTEREST ON YOUR ASSETS

- #8. MAKE MONEY WITH PLAY-TO-EARN (P2E) GAMES

- #9. CRYPTO MINING: IS IT STILL WORTH IT FOR PASSIVE INCOME?

- #10. DIVIDEND-PAYING TOKENS: A SMART WAY TO EARN PASSIVE CRYPTO INCOME

- #11. EARN FREE CRYPTO WITH AIRDROPS

- #12. STABLECOINS THAT PAY DIVIDENDS: PASSIVE INCOME WITHOUT VOLATILITY

- #13. NFT STAKING: HOW TO EARN INCOME FROM YOUR DIGITAL ASSETS

- #14. RUN A BITCOIN LIGHTNING NODE AND EARN FEES

- CONCLUSION

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Discover proven ways to earn passive income with cryptocurrency in 2024. Learn about staking, lending, yield farming, and more methods to grow your wealth with minimal effort in the ever-evolving crypto market.

INTRODUCTION

Cryptocurrency has opened up numerous ways to generate passive income, providing opportunities for both beginners and seasoned investors. In 2024, as decentralized finance (DeFi) and blockchain technology continue to evolve, earning passive income through crypto has become more accessible than ever. This article outlines distinct ways to generate passive income with cryptocurrency, ranging from staking and lending to more advanced methods like running a Lightning Node. Whether you are looking for low-risk options or higher returns with increased risk, these methods offer something for everyone.

| Method | Description |

|---|---|

| Staking | Lock crypto to support a network and earn rewards. |

| Crypto Savings Accounts | Deposit crypto or stablecoins to earn interest. |

| Yield Farming | Provide liquidity to DeFi pools and earn tokens. |

| Liquidity Mining | Earn tokens by supplying liquidity to exchanges. |

| Masternodes | Run specialized nodes and get rewards. |

| Cloud Mining | Rent hardware to mine crypto remotely. |

| Lending Cryptocurrency | Lend crypto to others and earn interest. |

| Play-to-Earn Games | Play blockchain games and earn crypto or NFTs. |

| Mining | Use hardware to mine cryptocurrencies. |

| Dividend-Paying Tokens | Hold tokens that pay out dividends from profits. |

| Airdrops | Receive free tokens through airdrop promotions. |

| Holding Dividend-Yielding Stablecoins | Hold stablecoins and earn yields via savings programs. |

| NFT Staking | Stake NFTs and earn rewards for locking them up. |

| Running a Lightning Node | Run nodes on the Lightning Network to earn fees. |

#1. STAKING CRYPTO: A BEGINNER’S GUIDE TO PASSIVE INCOME

What Is Staking?

Staking is the process of locking up your cryptocurrency to support the operations of a blockchain network. In return, you earn rewards, usually in the form of additional tokens. Proof-of-Stake (PoS) networks like Ethereum 2.0, Solana, and Cardano enable users to stake their coins to help validate transactions and secure the network.

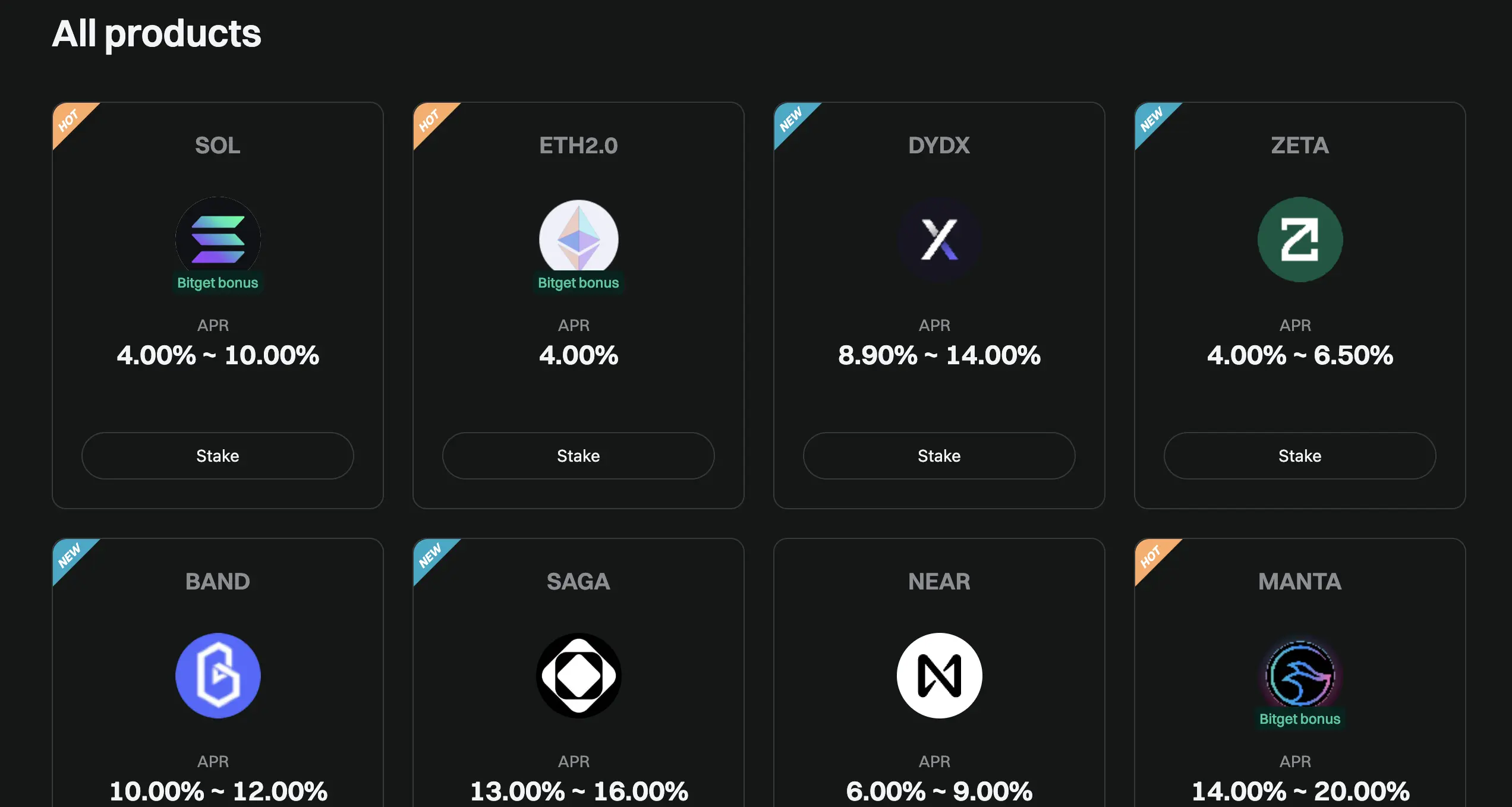

Platforms for Staking

Several platforms, including Binance, Bitget, and BingX, allow users to stake their crypto. Staking rewards typically range between 5% and 15% APY, depending on the network. However, keep in mind that staking involves lock-up periods where your funds are not liquid, so it’s essential to plan accordingly.

>> Also read: What Is Crypto Staking?: Overview, How It Works, & Future

#2. EARN HIGH RETURNS WITH CRYPTO SAVINGS ACCOUNTS

How Crypto Savings Accounts Work

Crypto savings accounts operate similarly to traditional savings accounts but often offer much higher interest rates. These accounts let you deposit cryptocurrencies or stablecoins, earning interest on your holdings.

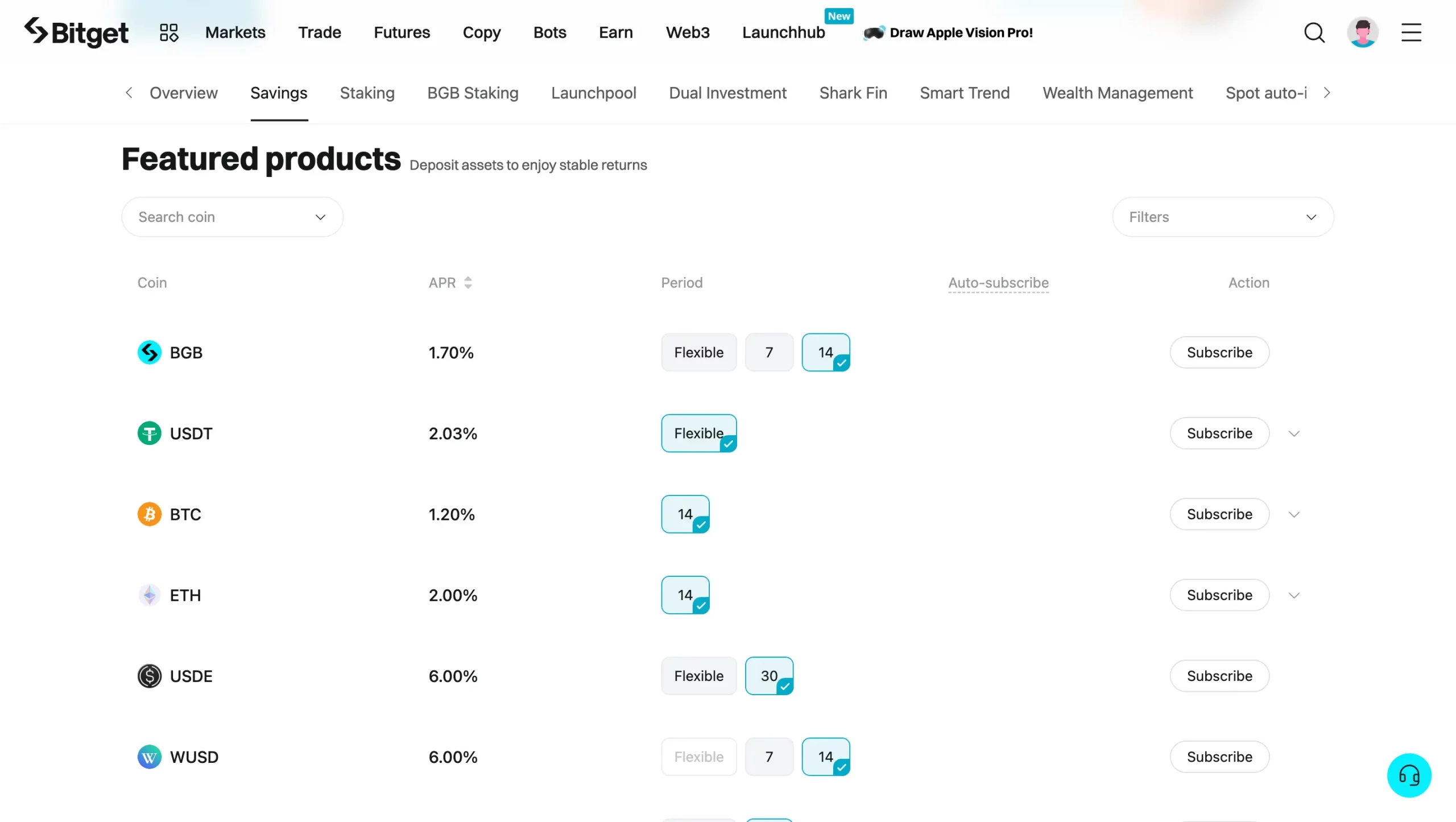

Platforms for Crypto Savings

Platforms such as BlockFi, Nexo, and Bitget offer crypto savings accounts where you can earn interest rates of up to 12% APY. However, unlike traditional bank savings accounts, crypto savings accounts are not insured, which means there’s a level of risk involved, especially in case of platform insolvency.

>> Also read: Bitget Flexible Savings: Grow Your Crypto Safely with Passive Income

#3. YIELD FARMING EXPLAINED: EARN PASSIVE INCOME WITH CRYPTO

What Is Yield Farming?

Yield farming is a DeFi activity where users provide liquidity to decentralized exchanges (DEXs) in return for rewards. Yield farmers can earn tokens by locking up their crypto in liquidity pools that facilitate trades on platforms like Uniswap and PancakeSwap.

>> Also read: What is Yield Farming? Earn Passive Income with Crypto

Popular Platforms

Uniswap, PancakeSwap, and SushiSwap are among the top platforms for yield farming. Rewards can be high, but so are the risks, particularly due to impermanent loss, which can reduce the value of your investment when providing liquidity.

>> Also read: 6 Most Popular Decentralized Crypto Exchanges In 2024

#4. LIQUIDITY MINING: A STEP-BY-STEP GUIDE TO EARNING CRYPTO

How Liquidity Mining Works

Liquidity mining involves contributing your crypto to liquidity pools on decentralized exchanges. In exchange, you earn additional tokens as a reward for providing liquidity, which helps facilitate the trading of crypto assets.

Platforms Offering Liquidity Mining

Platforms like Aave, Compound, and Curve Finance are known for offering liquidity mining opportunities. These protocols reward liquidity providers with both interest and governance tokens. The risks include market volatility and potential smart contract vulnerabilities.

#5. MASTERNODES: THE ULTIMATE GUIDE TO EARNING PASSIVE CRYPTO INCOME

What Are Masternodes?

Masternodes are specialized nodes that perform unique roles in a blockchain network, such as transaction validation and governance. Masternodes typically require a large amount of capital but offer consistent returns.

How to Set Up a Masternode

Dash, PIVX, and Horizen are popular cryptocurrencies that support masternodes. Setting up a masternode can be complicated, and it requires locking up a substantial amount of crypto, often in the thousands of dollars. The rewards, however, can be significant, ranging from 5% to 20% annually, depending on the project.

#6. CLOUD MINING: HOW TO EARN CRYPTO WITHOUT HARDWARE

What Is Cloud Mining?

Cloud mining allows users to rent mining hardware to mine cryptocurrencies like Bitcoin without having to manage the equipment themselves. By purchasing a cloud mining contract, you can earn crypto in return.

Popular Cloud Mining Platforms

Genesis Mining, Hashflare, and Bitdeer are popular cloud mining platforms. The profitability of cloud mining depends on the price of the cryptocurrency being mined, the cost of the contract, and the platform’s reliability. Be cautious, as there are many scams in the cloud mining industry.

#7. LEND CRYPTO AND EARN INTEREST ON YOUR ASSETS

What Is Crypto Lending?

Crypto lending allows you to lend your assets to others in exchange for interest. This method is especially popular in DeFi, where decentralized platforms facilitate peer-to-peer lending without intermediaries.

Lending Platforms

Platforms like BlockFi, Aave, and Bitget allow you to lend cryptocurrencies such as Bitcoin, Ethereum, or stablecoins. Interest rates can be as high as 8%-12%, making this a lucrative option for earning passive income. However, lending does come with risks, such as platform failure or default by borrowers.

#8. MAKE MONEY WITH PLAY-TO-EARN (P2E) GAMES

What Are Play-to-Earn (P2E) Games?

Play-to-earn games allow players to earn cryptocurrency or NFTs by participating in game activities. These games are built on blockchain technology, and players can exchange their in-game assets for real-world currency or other crypto assets.

Popular Play-to-Earn Games

Popular P2E games include Axie Infinity, The Sandbox, and Decentraland. Earnings from these games can vary widely, but top players can generate significant income. Be mindful that initial investments in NFTs or tokens are often required.

#9. CRYPTO MINING: IS IT STILL WORTH IT FOR PASSIVE INCOME?

Traditional Crypto Mining

Traditional crypto mining involves using specialized hardware to solve complex mathematical puzzles that validate transactions on the blockchain. Mining rewards are given to miners who successfully validate a block of transactions.

Profitability of Mining in 2024

With Bitcoin halving events reducing mining rewards, traditional mining has become less profitable for individual miners. However, those who invest in high-quality mining hardware and cheap electricity sources can still turn a profit.

#10. DIVIDEND-PAYING TOKENS: A SMART WAY TO EARN PASSIVE CRYPTO INCOME

What Are Dividend-Paying Tokens?

Dividend-paying tokens distribute a share of the platform’s profits to token holders. These tokens function similarly to dividend stocks in traditional finance.

Examples of Dividend-Paying Tokens

KuCoin Shares (KCS) and NEXO are examples of tokens that pay dividends to holders. The rewards are typically distributed as a percentage of the platform’s revenue and can provide a consistent stream of passive income for long-term holders.

#11. EARN FREE CRYPTO WITH AIRDROPS

What Are Crypto Airdrops?

Airdrops are free distributions of new tokens to users who hold certain assets or meet specific criteria. Airdrops are often used as a marketing tool to promote new projects or to reward loyal users of a particular blockchain.

How to Participate in Airdrops

To qualify for airdrops, users often need to hold specific tokens or interact with certain platforms. For instance, Uniswap famously airdropped thousands of dollars worth of tokens to early users in 2020.

>> Also read: The Airdrop Farmer’s Guide: What, Why and How

#12. STABLECOINS THAT PAY DIVIDENDS: PASSIVE INCOME WITHOUT VOLATILITY

How Stablecoins Generate Income

Some stablecoins, such as USDC and Dai, offer yield through lending and savings programs. These stablecoins are pegged to fiat currencies, making them less volatile while still generating passive income.

Platforms Offering Stablecoin Yields

Platforms like Gemini Earn and BlockFi offer yield on stablecoins, providing returns of up to 8% APY. These platforms lend out your stablecoins to generate profits, which are then shared with you as interest.

>> Also read: APR vs APY in Crypto: What’s the Difference?

#13. NFT STAKING: HOW TO EARN INCOME FROM YOUR DIGITAL ASSETS

What Is NFT Staking?

NFT staking allows users to lock up their NFTs on specific platforms in exchange for rewards. This concept is relatively new, but it offers a way for NFT holders to earn passive income without selling their assets.

Popular NFT Staking Projects

Platforms like R-Planet allow users to stake their NFTs to earn rewards. The value of these rewards can fluctuate depending on the popularity of the platform and the demand for the staked NFTs.

#14. RUN A BITCOIN LIGHTNING NODE AND EARN FEES

What Is a Lightning Node?

The Bitcoin Lightning Network is a layer-2 solution that facilitates faster and cheaper transactions. Running a Lightning Node allows users to earn fees by processing these microtransactions.

How to Earn from a Lightning Node

Setting up a Lightning Node requires technical expertise and initial investment, but it can generate passive income through transaction fees. The network is still growing, so the long-term potential for earning income through Lightning Nodes is promising.

CONCLUSION

In 2024, there are countless ways to generate passive income with cryptocurrency, whether you’re a seasoned investor or just starting out. From staking and lending to running masternodes and participating in play-to-earn games, the opportunities are vast. While the rewards can be substantial, it’s crucial to understand the risks involved with each method. By carefully selecting the strategies that align with your financial goals and risk tolerance, you can start earning passive income with crypto today.