KEYTAKEAWAYS

-

Bitcoin's market value has surged from approximately $200,000 to $1.3T, attracting curious investors in the 2023 bull market.

-

Selecting a suitable exchange, funding accounts, and understanding trading methods are crucial initial steps for Bitcoin investment.

-

Investors must research thoroughly and be aware of risks, including fraud and exchange operational issues, due to Bitcoin's relatively immature regulatory framework.

CONTENT

Curious about what is crypto trading? Learn about Bitcoin trading, its basic steps, and essential considerations for new investors, from choosing exchanges to understanding risks and funding methods via CoinRank!

INTRODUCTION

Although cryptocurrencies have only been around for less than 20 years, their market value has surged from approximately $200,000 to $1.3 trillion (looking at Bitcoin’s market cap alone). With the Bitcoin bull market of 2023, many investors are becoming increasingly curious about what is crypto trading and this unfamiliar yet promising market. In this article, CoinRank has compiled essential considerations, basic steps, and preparations for newcomers to the cryptocurrency market.

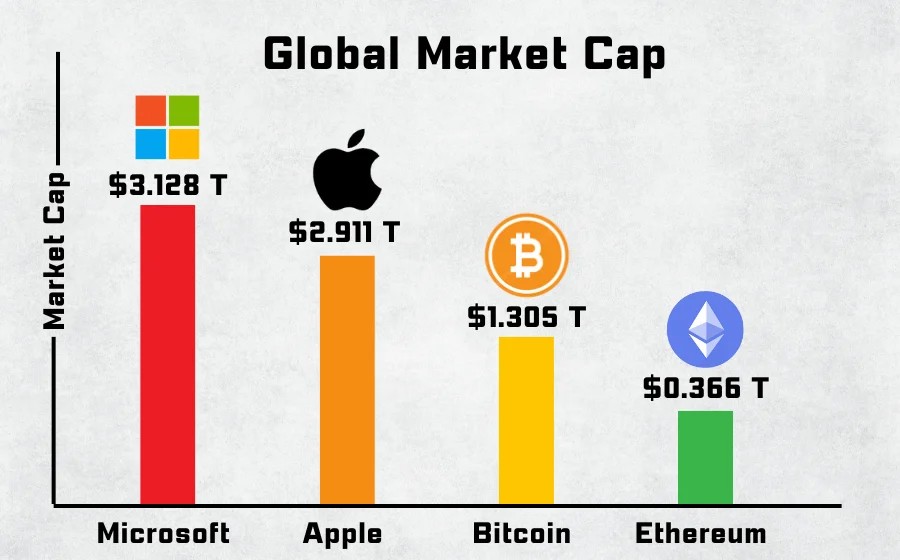

Global Market Cap of Notable Firms and Cryptocurrencies as of May 2024

(Source: CoinRank)

WHAT IS CRYPTO TRADING: HOW TO START IT?

If you are new to cryptocurrency investment, you might not know where to start. Don’t worry; CoinRank has outlined the initial steps and preparations necessary for beginning your journey into cryptocurrency investment:

1. Choosing Your Exchange

Just like investing in stocks requires selecting a brokerage for subsequent trading, investing in cryptocurrencies necessitates choosing a suitable exchange to continue your investments.

Each exchange has its own advantages. For instance, Binance, currently the largest exchange by market share, offers a diverse range of cryptocurrencies and the highest trading volume.

Additionally, the rising exchange – Bitget emphasizes copy trading crypto and diverse products. Secure, user-friendly, and licensed in multiple countries.

>> Also read: Copy Trading Crypto Like a Pro on Bitget | Bitget Review 2024

2. Funding Your Account (Deposit)

When purchasing stocks, the required amount is deducted from your settlement account. Similarly, in cryptocurrency trading, investors need to purchase cryptocurrencies and deposit them into their crypto wallets before proceeding with trades.

Generally, there are 5 main ways to fund your cryptocurrency account:

- Transfer from other wallets: If investors already have cryptocurrencies in other exchanges or wallets, they can transfer them to their personal wallet address for subsequent trading. Care must be taken to choose the correct ‘chain’ during the transfer to avoid losing the cryptocurrencies.

- Credit/Debit card purchase: Investors can also purchase cryptocurrencies directly using credit cards, though the transaction fees are relatively high. This method is quick and suitable for small purchases.

- Digital payments (Apple Pay, Google Pay, etc.): Investors can also use linked digital payment methods to purchase cryptocurrencies.

- P2P purchase: Investors can buy cryptocurrencies directly from online merchants, offering more flexibility and payment methods but requiring caution against potential transaction disputes.

- Third-party platforms: Investors can buy cryptocurrencies through third-party platforms partnered with exchanges. Transaction fees vary depending on the third-party platform (i.e. Wello Ramp).

3. Trading

In stock investments, various trading methods such as spot trading, margin trading, and short selling are available. Cryptocurrencies include these trading methods as well, but the investment targets shift from different stocks to different cryptocurrencies.

However, there are noticeable differences between cryptocurrency and stock trading. Unlike the fixed trading hours of stock markets, cryptocurrency trading is available 24/7. Additionally, price volatility in cryptocurrencies is usually greater than in stock markets. Therefore, understanding the details and relevant information about purchasing cryptocurrencies is absolutely necessary.

4. Withdrawing Funds

At some point, investors might want to convert their cryptocurrencies into fiat currencies (such as USD) and withdraw them. This action is known as withdrawing funds.

At this stage, it is crucial to note that withdrawal fees and the time required to receive the funds may vary between exchanges. Therefore, conducting thorough research to choose the most suitable withdrawal method is essential.

Additionally, the minimum withdrawal amounts stipulated by different exchanges should also be carefully considered.

WHAT IS CRYPTO TRADING: CRYPTO TRADING’S RISKS

Compared to traditional financial products, cryptocurrency trading is relatively immature in various aspects, especially regarding regulations. Therefore, investors need to be aware of the following risks before investing:

-

Fraud Risk

The low barrier to issuing cryptocurrencies means that many people might lure investors into buying worthless cryptocurrencies by promising significant price increases, resulting in losses. Investors must conduct thorough research on any cryptocurrency they plan to invest in, understand the issuing entity and its practical applications, and not be swayed solely by investment rhetoric.

>> Also read: 4 Most Common Crypto Scams And How To Avoid Them

-

Operational Risk of Exchanges

One of the most well-known examples of exchange operational issues is the 2022 bankruptcy of FTX, which occurred within a week due to internal operational problems and opaque fund management. However, the collapse of cryptocurrency exchanges is not new, as evidenced by the 2014 bankruptcy of the Mt.Gox exchange, where investor losses remain unresolved to this day.

>> Also read: FTX Founder Sam Bankman Fried: From Crypto King to 25 Years in Prison

These representative cases highlight the importance of choosing reputable and well-regulated exchanges. Otherwise, the capital invested could vanish overnight or become inaccessible, rendering the investment effort futile.

CONCLUSION

As an emerging investment product, cryptocurrency trading offers investors an alternative investment option. Compared to traditional investment products, cryptocurrencies’ rapid liquidity and flexibility are indeed attractive.

However, due to their short history, the regulatory framework for cryptocurrency trading is still incomplete. This means that investors must approach it with greater caution and conduct thorough research beforehand. This way, they can avoid suffering losses instead of achieving the expected investment returns.

FAQS

- How to start crypto trading?

If you are new to crypto trading, you can start the transaction according to the following steps respectively:

- Choosing Your Exchange

- Funding Your Account (Deposit

- Trading

- Withdrawing Funds

-

What are crypto trading’s risks?

Crypto trading’s risks include 1. Fraud Risk and 2. Operational Risk of Exchanges, which investors should be taking cautiously.

More articles about the crypto trading:

-

Crypto Futures Trading: A Way to Multiply Your Crypto Returns

-

Understanding Automated Crypto Trading at a Glance and How to Optimize Your Investment by It

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!