KEYTAKEAWAYS

- HyperEVM: The Financial Infrastructure of Hyperliquid Ecosystem

- 9 Core Opportunities in the HyperEVM Ecosystem

- HyperEVM Ecosystem May Still Be Undervalued, Early Participation Is Key

CONTENT

In recent years, the crypto industry has witnessed the rise of multiple ecosystems, and Hyperliquid has quickly become a market focus with its high-performance perpetual contract trading and innovative HyperEVM (Hyper Ethereum Virtual Machine) ecosystem. In November 2024, Hyperliquid conducted one of the largest airdrops in crypto history, distributing 31% of the token supply to over 90,000 users, valued at over $10.5 billion at its peak.

Today, the HyperEVM mainnet has officially launched, and DeFi protocols within the ecosystem are emerging rapidly, offering lucrative opportunities for early participants. This article will delve into Hyperliquid ecosystem’s core protocols, mining strategies, and future potential, helping investors catch this wave of wealth.

HYPEREVM: THE FINANCIAL INFRASTRUCTURE OF HYPERLIQUID ECOSYSTEM

In February 2025, HyperEVM mainnet officially launched, marking Hyperliquid’s transition from a single perpetual contract trading platform to a comprehensive DeFi ecosystem. The core advantages of HyperEVM include:

- High-performance execution: Based on HyperBFT consensus, ensuring low latency and high security.

- Seamless asset interoperability: Supports instant transfers of HYPE tokens between L1 (native chain) and HyperEVM.

- DeFi native support: WHYPE (Wrapped HYPE) system contracts have been deployed, providing a liquidity foundation for ecosystem protocols.

Currently, HyperEVM is still in its early stages with low TVL (Total Value Locked), meaning early participants can obtain higher returns at lower costs. Additionally, Hyperliquid still has 39% of tokens unallocated, which at current valuation could mean nearly $4 billion worth of $HYPE airdrops waiting to be distributed.

9 CORE OPPORTUNITIES IN THE HYPEREVM ECOSYSTEM

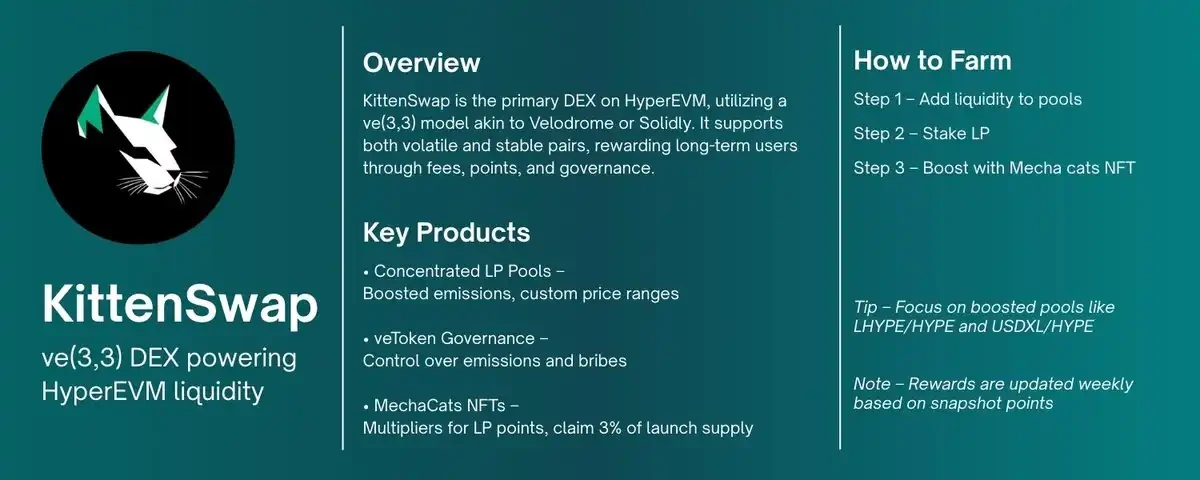

KittenSwap: Core Ecosystem DEX, High-Yield Mining with ve(3,3) Model

KittenSwap is the leading decentralized exchange (DEX) on HyperEVM, adopting a ve(3,3) model similar to Velodrome, supporting both stablecoin and volatile token pairs.

Mining Strategy:

- Provide liquidity: Focus on high-multiplier pools such as LHYPE/HYPE, USDXL/HYPE, with some pools offering up to 20x point rewards.

- Stake LP tokens: Earn points that can be exchanged for future token airdrops.

- Hold MechaCats NFT: Can boost point multipliers (up to 1.5x) and ensure receiving future 3% allocation of $KITTEN tokens.

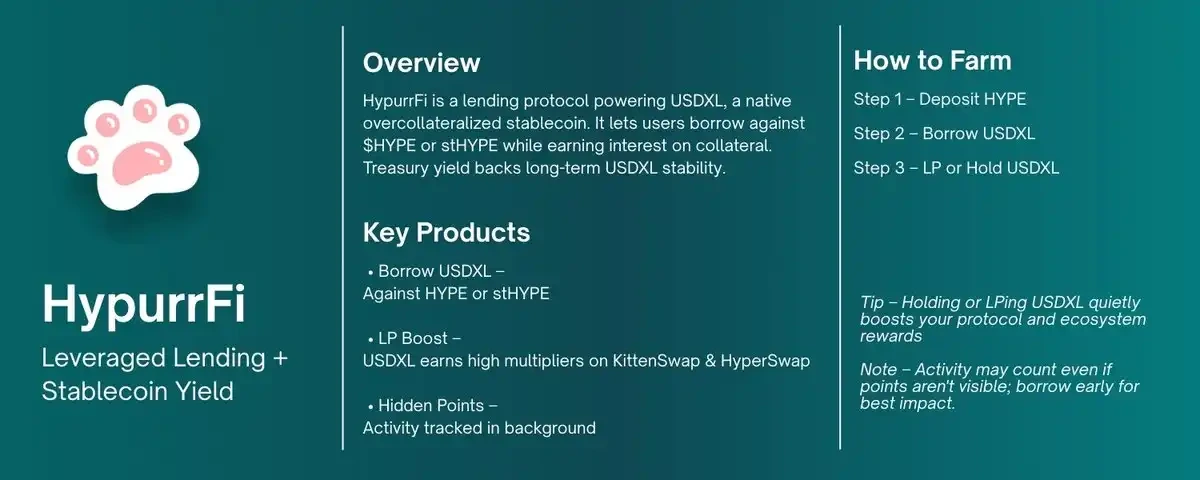

HypurrFi: Leveraged Lending + Stablecoin USDXL Yields

HypurrFi is a lending protocol on HyperEVM that allows users to collateralize $HYPE to borrow the stablecoin USDXL while still earning interest on the collateralized assets.

Mining Strategy:

- Collateralize HYPE → Borrow USDXL: Maintain HYPE exposure while using USDXL for other mining activities.

- USDXL liquidity mining: Provide USDXL liquidity on KittenSwap or HyperSwap to earn multiple points.

- Long-term USDXL holdings: May receive additional protocol rewards.

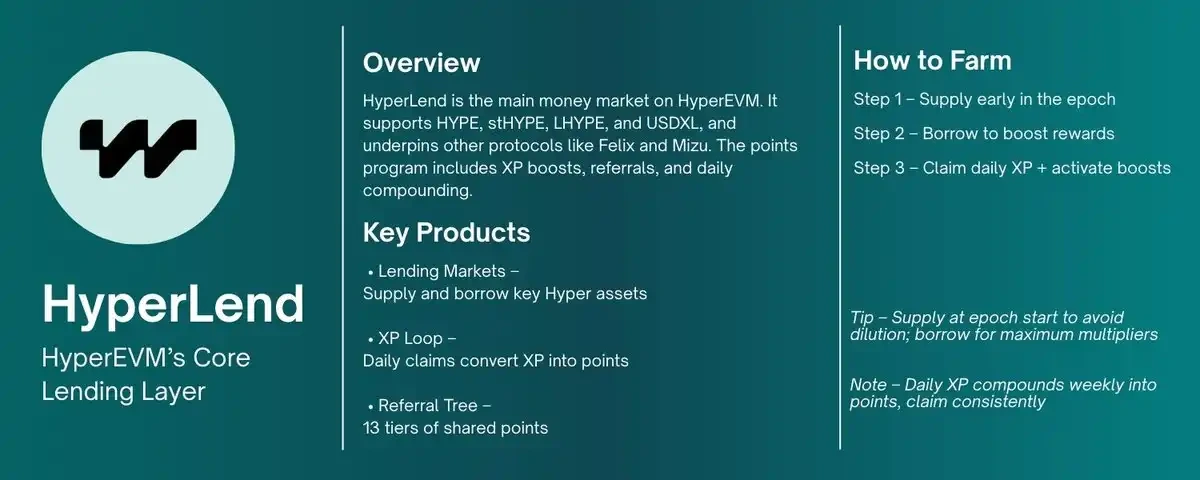

HyperLend: Lending Protocol + Stacked Points

HyperLend is the core lending market on HyperEVM, supporting assets like LHYPE, $USDXL, and deeply integrating with other protocols (such as Harmonix, Mizu Labs).

Mining Strategy:

- Early asset deposits: The earlier you participate, the higher the point rewards (returns will dilute as TVL increases).

- Lending operations: Borrowing stablecoins can increase point weights.

- Daily XP collection: Compound growth of points.

- Hold Hypio NFT: Can enhance point bonuses.

Felix Protocol: Stablecoin feUSD + Liquidation Mining

Felix Protocol allows users to collateralize $HYPE to mint the stablecoin feUSD and participate in liquidation mining.

Mining Strategy:

- Mint feUSD: Over-collateralize $HYPE to generate stablecoins.

- Stake to stability pool: Earn liquidation discounts and protocol dividends.

- Liquidity mining: Provide feUSD/USDXL liquidity on KittenSwap for stacked returns.

Mizu Labs: Automated Yield Aggregator

Mizu Labs is the “lazy mining tool” on HyperEVM, automatically deploying funds to high-yield protocols (such as HyperLend, HypurrFi).

Deposit ETH/BTC → Receive hypeETH/hypeBTC, automatically earning multi-protocol yields. Passive mining, no frequent operations needed, Mizu automatically optimizes strategies.

Drip.Trade: NFT Marketplace + Potential Airdrops

Drip.Trade is the main NFT trading platform on HyperEVM, hosting key NFT series such as MechaCats, HypioHL, whose holders may receive future airdrops.

Purchase key NFTs: Such as MechaCats (KittenSwap bonus), Hypios (HyperLend bonus). Stay active in trading: May influence airdrop eligibility.

Hyperbeat: Staking + Multi-Protocol Vaults

Hyperbeat offers $HYPE staking and vault services, allowing users one-click exposure to multiple ecosystem protocols.

Mining Strategy: Stake $HYPE: Earn Hearts points, potentially qualifying for airdrops. Deposit into vaults: Such as HyperETH vault (exposure to 15+ protocol tokens).

HyperSwap: Low Slippage DEX, Ecosystem Integration Rewards

HyperSwap is a lightweight alternative to KittenSwap, offering low slippage trading and liquidity mining rewards. Mining Strategy: Provide liquidity by focusing on ecosystem pools like USDXL, feUSD, LHYPE, and engage in trade mining to earn points through weekly trading.

Looped HYPE: Passive Leverage + Early User Rewards

Looped HYPE wraps $HYPE into LHYPE, providing rebasing yields and supporting DeFi mining. Mining Strategy: Mint LHYPE to directly participate in the early user program (7% of total supply) and provide liquidity to earn 20x points on KittenSwap.

HYPEREVM ECOSYSTEM MAY STILL BE UNDERVALUED, EARLY PARTICIPATION IS KEY

Hyperliquid’s airdrop history proves that early participants often receive the greatest returns. Currently, the TVL of the HyperEVM ecosystem is still low, but the number of protocols is growing rapidly, potentially leading to explosive growth in the future.

For investors, the current best strategies include: Participating in high-yield mining (such as KittenSwap, HyperLend). Positioning in key NFTs, such as MechaCats, Hypios. Utilizing automated tools like Mizu Labs to reduce operational costs. Watching for future airdrops, as ecosystem protocol token distributions are still ongoing.

If you missed the first wave of Hyperliquid airdrops, the HyperEVM ecosystem is offering a “second chance.” Entering now, you can still enjoy early benefits and potentially reap substantial returns in the future.

(This article merely states facts and opinions and does not constitute any investment advice. Non-professional investors please participate with caution.)

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!