- The Fed's cautious approach to rate cuts and continued focus on above-target inflation has prompted investors to reduce their cryptocurrency exposure significantly.

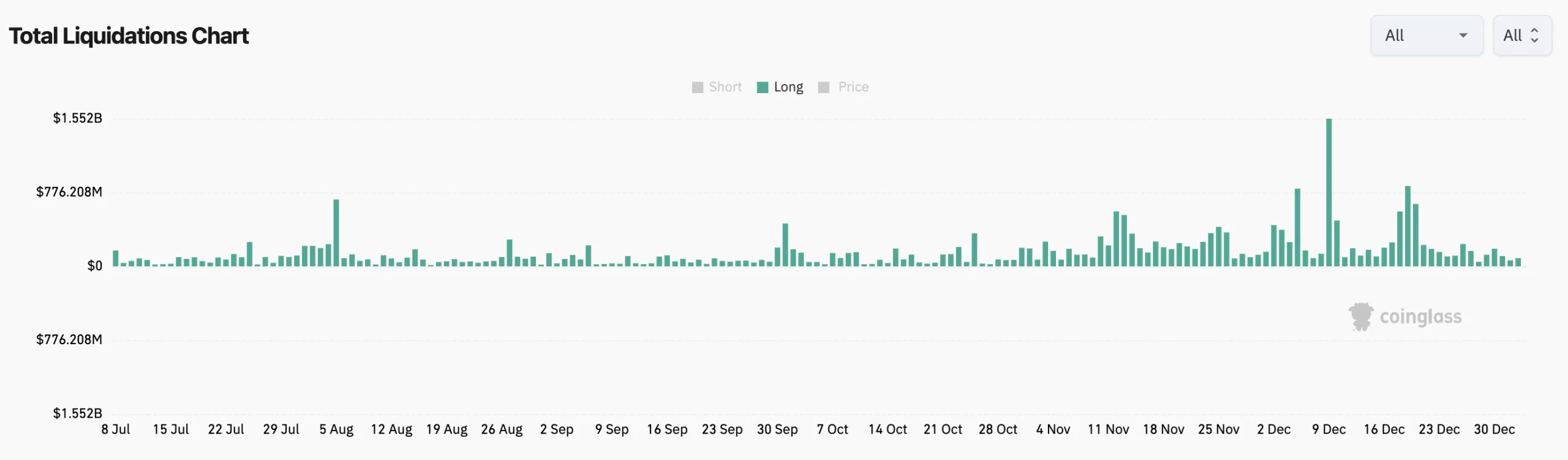

- A cascade of leveraged position liquidations totaling $1.5 billion amplified market decline, demonstrating how high leverage can exacerbate cryptocurrency price movements.

- Major central banks' balance sheet reductions have created a challenging environment for speculative assets, leading to decreased market depth and trading volumes.

TABLE OF CONTENTS

Why is the crypto market down? Explore the late 2024 crypto decline driven by Fed’s cautious rate cuts, $1.5B in forced liquidations, and tight global liquidity conditions pushing Bitcoin below $94,000

As the crypto market down trend emerges in late 2024, investors and traders are seeking to understand the driving forces behind this significant movement. Recent market data shows Bitcoin falling below $94,000, with the total cryptocurrency market capitalization declining to $3.3 trillion.

(Source:CMC)

This comprehensive analysis examines the key factors keeping the crypto market down, including monetary policy changes, market dynamics, and global liquidity conditions. A critical question emerges: why is the crypto market down?

For investors navigating the volatile cryptocurrency landscape, finding the answer is crucial. As the market continues to evolve, both institutional and retail investors are closely monitoring these developments to make informed decisions about their digital asset investments.

WHY IS THE CRYPTO MARKET DOWN? POINT 1: FED’S HAWKISH STANCE

Recent Policy Changes Keep Crypto Market Down

The

Federal Reserve’s latest monetary policy decision may be one of the main reasons driving the market decline. To understand

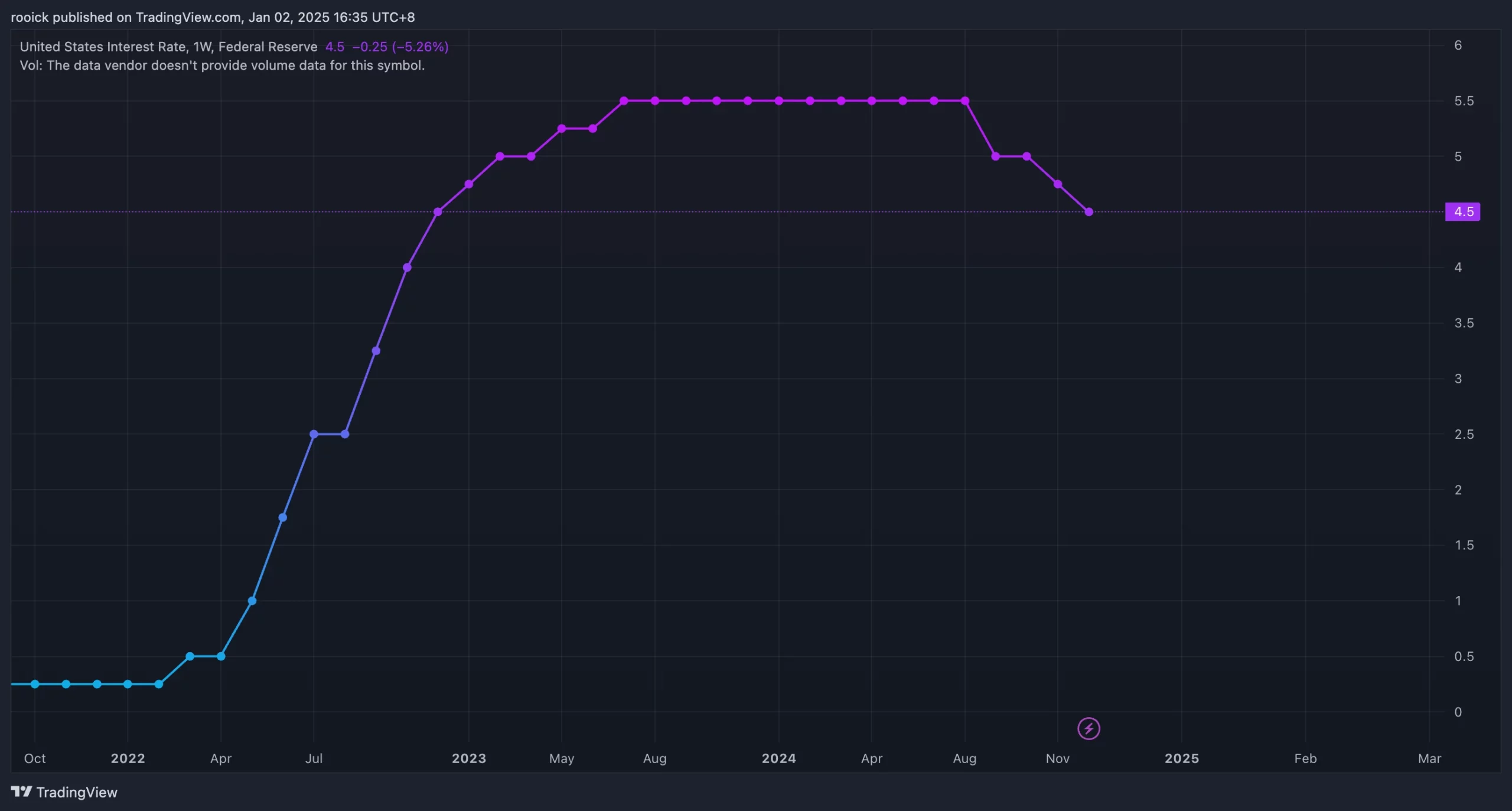

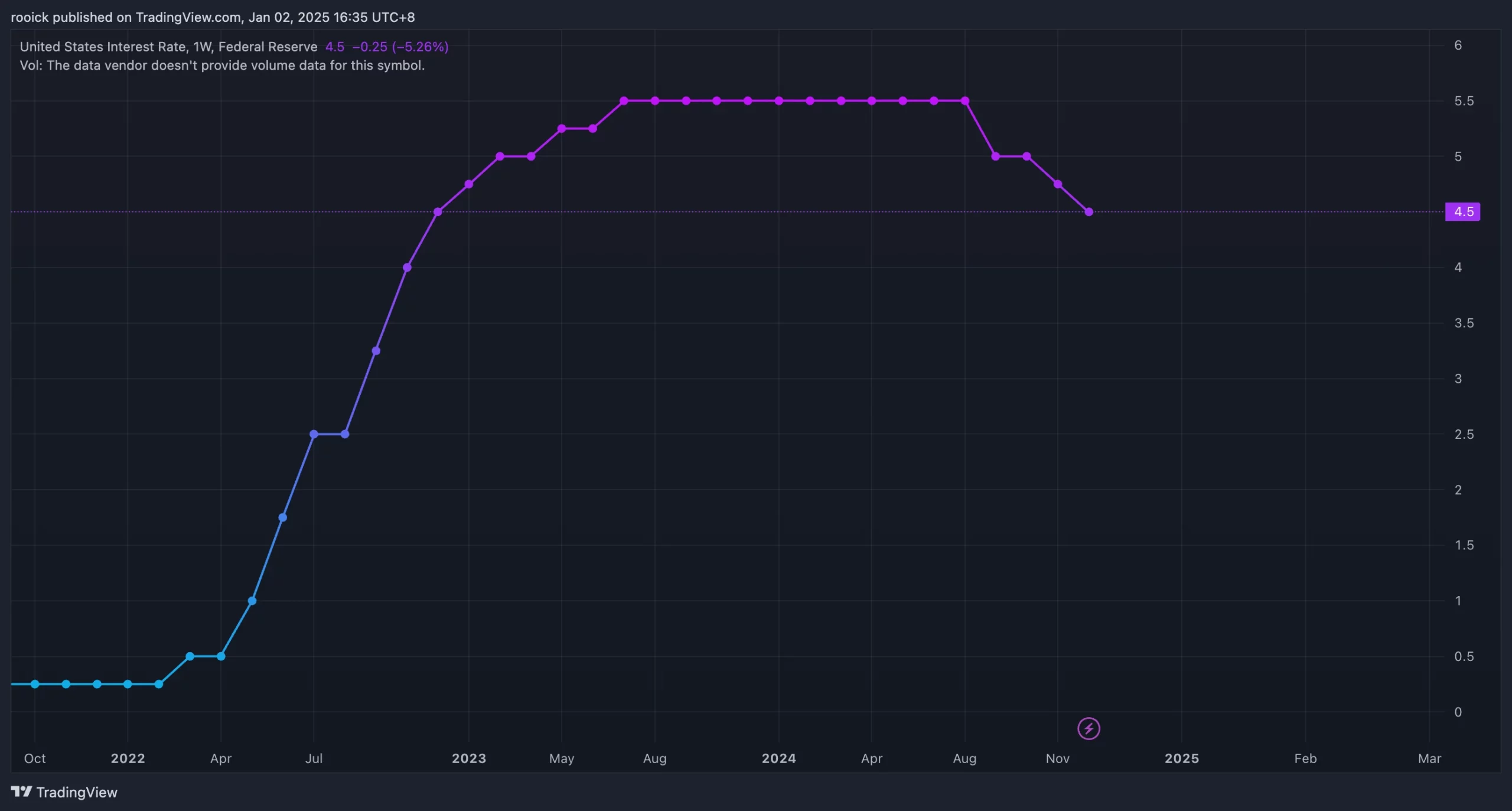

why is the crypto market down, let’s examine the Fed’s policy: while the Fed implemented a 0.25% rate cut, Chairman Jerome Powell’s accompanying statement revealed a more cautious approach than market participants anticipated.

Powell emphasized that while inflation has moderated, it remains above the target rate, suggesting limited scope for future rate reductions.

(Source:Tradingview)

This hawkish stance indicates only two potential rate cuts through 2025, considerably fewer than market expectations. The cautious monetary policy outlook has prompted investors to reassess their risk exposure, contributing to the crypto market down trend that began in late 2024.

Impact on Cryptocurrency Trading Volumes

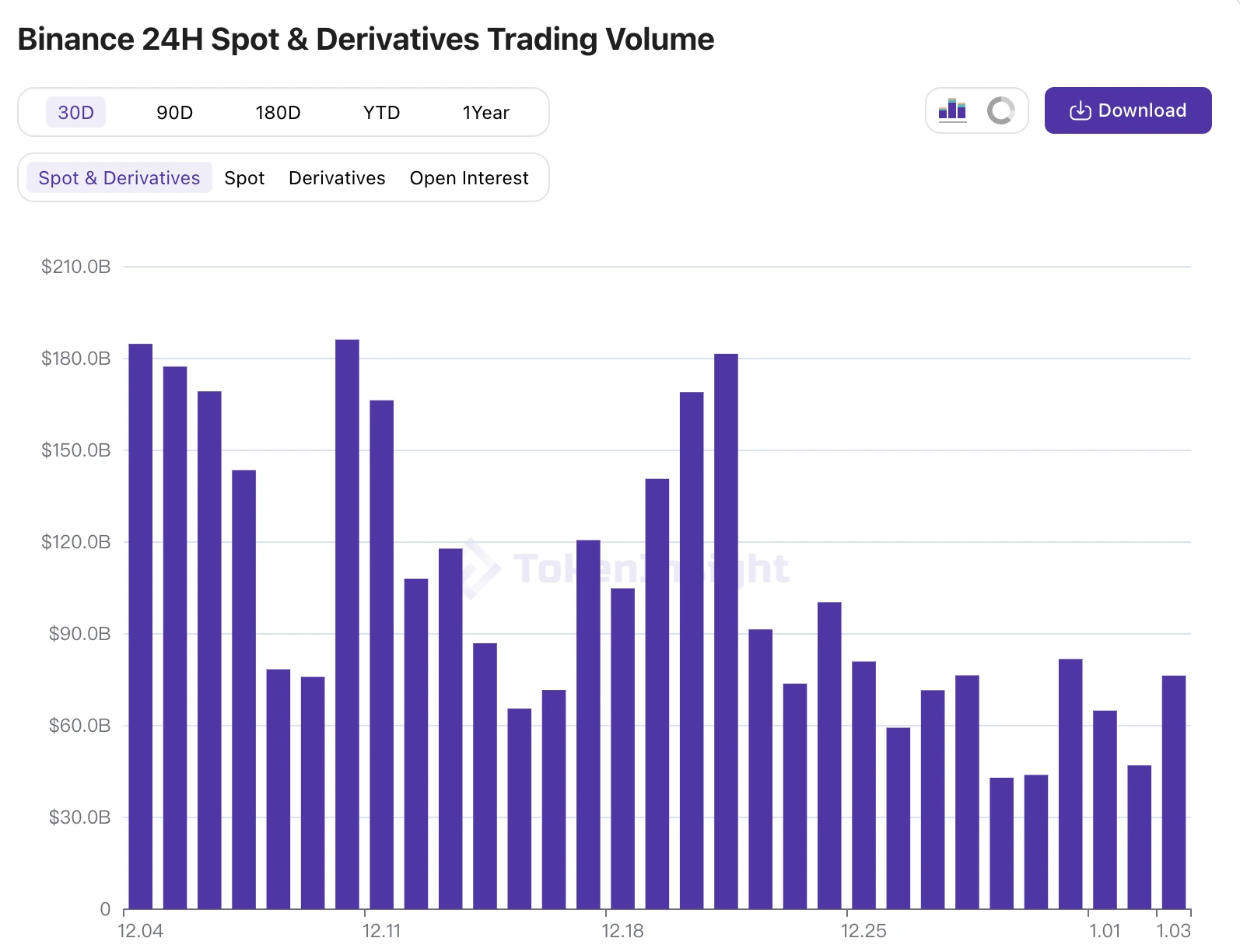

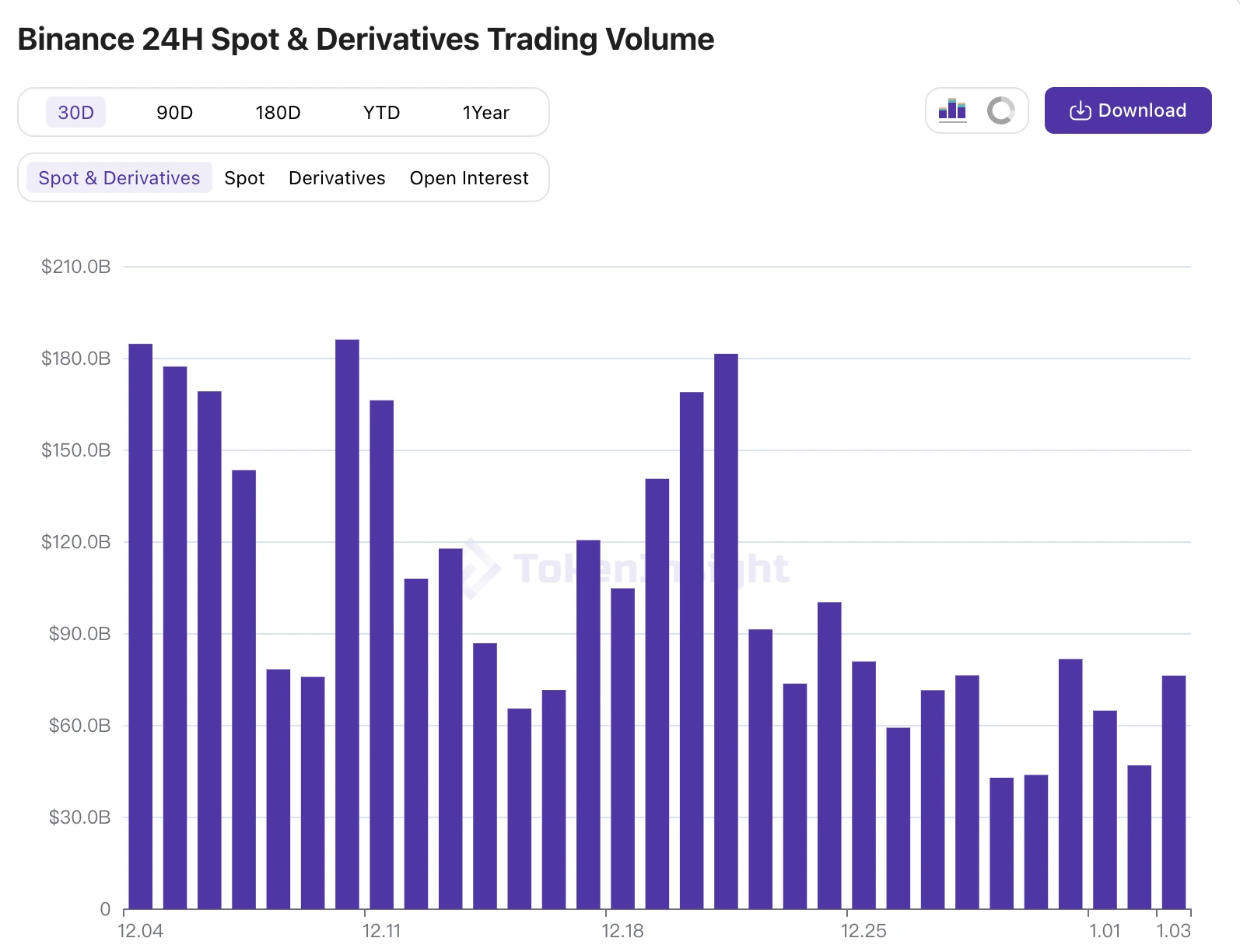

The market’s reaction to the Federal Reserve’s position has been substantial, manifesting in decreased trading volumes and increased selling pressure in recent weeks. Trading data reveals a significant shift in market sentiment, with institutional investors reducing their cryptocurrency exposure in response to the tighter monetary environment.

(Source:TokenInsight)

The Federal Reserve policy announcements raise a crucial question: why is the crypto market down? This relationship has become increasingly pronounced, highlighting the growing integration of digital assets with traditional financial markets.

This interconnectedness suggests that cryptocurrency valuations are increasingly sensitive to macroeconomic policy decisions.

Also Read:

Federal Reserve May Accelerate Rate Cuts: When Will Bitcoin Reach $100,000?

Trump’s Victory and Federal Reserve Rate Cuts: Impact on Bitcoin’s Fourth Halving Bull Run

WHY IS THE CRYPTO MARKET DOWN? POINT 2 :MAJOR MARKET LIQUIDATIONS

$1.5 Billion in Forced Liquidations

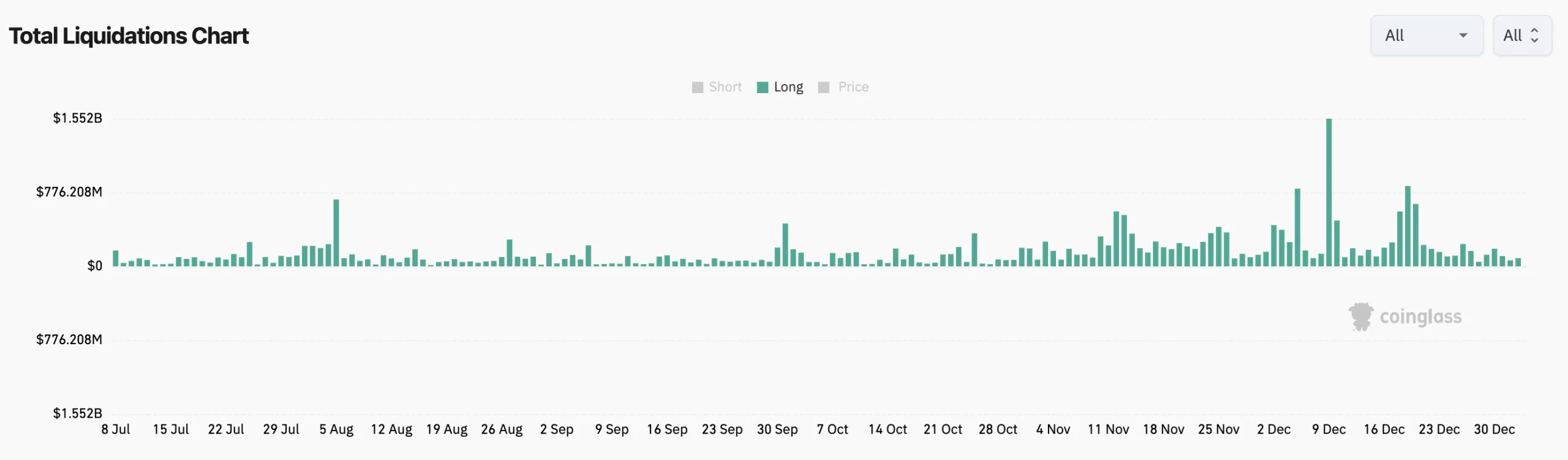

The sudden crypto market down trend triggered a cascade of liquidations, with approximately $1.5 billion worth of leveraged positions being forced to close. This liquidation event significantly amplified the market’s downward momentum.

(Source:Coinglass)

The sequence began with Bitcoin’s price decline below $94,000, which triggered automatic liquidations of leveraged long positions. These forced sales created additional selling pressure, leading to a self-reinforcing cycle of price declines and further liquidations.

The magnitude of these liquidations raises another key question: why is the crypto market down? It comes down to the high leverage levels present in the cryptocurrency market and their potential to exacerbate price movements.

WHY IS THE CRYPTO MARKET DOWN: CROSS-MARKET IMPACTS

The recent crypto market down trend wasn’t limited to Bitcoin, as Ethereum and other major cryptocurrencies experienced synchronized declines. This widespread correlation prompts many to ask: why is the crypto market down during stress periods?

This synchronized downturn across various cryptocurrencies demonstrates the high degree of market correlation during periods of stress.

The collective decline suggests that market participants are reducing exposure across the entire cryptocurrency ecosystem rather than discriminating between individual assets.

Central Bank Balance Sheet Reductions

The latest global liquidity environment has become increasingly challenging for risk assets.This helps explain why is the crypto market down in the current environment.

Major central banks worldwide are actively reducing their balance sheets, marking a significant shift from the expansionary policies that characterized recent years

This reduction in global liquidity has created a less favorable environment for speculative assets, contributing to the cryptocurrency market’s year-end downturn. The tighter liquidity conditions have particularly impacted market depth and trading volumes, making it more difficult for large trades to be executed without significant price impact.

Institutional Investment Patterns

Institutional investors have quickly adjusted their cryptocurrency exposure as the crypto market down trend emerged. Analysis of recent investment flows indicates a more cautious approach from institutional players, with some reducing their positions or postponing planned investments.

This shift in institutional sentiment reflects broader concerns about market valuations and risk assessment in a tightening monetary environment. The changing patterns of institutional investment have implications for market stability and price discovery, as these players often provide significant liquidity and price support.

Also Read:

Understanding Leverage in Crypto Market

WHY IS THE CRYPTO MARKET DOWN? POINT 3: CRITICAL INSIGHTS ON MARKET RECOVERY

Technical Support Levels to Watch

To understand why is the crypto market down?, let’s look at technical analysis, which reveals several key price levels as important indicators for potential market recovery. The breakdown below significant support levels has created new technical resistance points that may influence future price action.

(Source:Tradingview)

Trading volumes and market depth at these levels will be crucial in determining whether the market can establish a sustainable bottom. The interaction between price action and these technical levels provides important insights into market psychology and potential recovery scenarios.

Long-term Outlook as Crypto Market Stays Down

Despite the current market pressures keeping the crypto market down, fundamental factors supporting cryptocurrency adoption remain largely intact. The ongoing development of blockchain technology, increasing institutional acceptance, and growing regulatory clarity continue to provide a foundation for long-term market development. For investors, the question remains: why is the crypto market down? The answer requires balancing these short-term pressures with long-term potential.

However, the near-term market outlook remains challenging as participants adjust to tighter monetary conditions and reduced global liquidity. The balance between these long-term positive fundamentals and short-term market pressures will likely influence the timing and strength of any market recovery.

Also Read:

10 Best Technical Indicators for Crypto Trading in 2024

WHY IS THE CRYPTO MARKET DOWN: KEY UNDERSTANDING AND TAKEAWAYS

Despite current pressures keeping the market down, the growing regulatory clarity and blockchain adoption provide a foundation for recovery. However, why is the crypto market down recently ? Factors such as tighter monetary policies and reduced global liquidity are pivotal.

Understanding these market dynamics requires considering both immediate triggers and broader structural factors affecting market behavior. For investors and traders, this period of market adjustment necessitates careful risk management and a balanced assessment of both short-term challenges and long-term opportunities in the cryptocurrency space.

As the market continues to mature, the interaction between traditional financial factors and crypto-specific dynamics will likely remain a crucial determinant of market behavior.

CoinRank x Bitget – Sign up & Trade to get $20!