KEYTAKEAWAYS

- Bitcoin's October crash, despite historical positive performance, was influenced by technical resistance, geopolitical events, and upcoming economic data releases.

- Fed rate cuts don't guarantee immediate bull markets; liquidity takes time to enter the market, and sharp corrections are common in crypto bull cycles.

- The fourth halving bull market is anticipated, but investors should expect volatility, influenced by factors like derivatives trading and global economic uncertainties.

CONTENT

Analyze Bitcoin’s recent sharp decline despite Fed rate cuts. Explore technical, news-driven, and macroeconomic factors behind the crash. Discuss historical patterns and future outlook for the fourth halving bull market.

Barely a day into October, Bitcoin led the market into a sharp decline. From a high of $66,404 (according to Bitget data), Bitcoin dropped all the way down, and at the time of writing, it has reached a low of $61,087, a decline of 8%. Under Bitcoin’s lead, the entire market followed suit. ETH fell from a high of $2,726 to a low of $2,432, a drop of 10.7%. Many other altcoins saw drops of 20%, 30%, or even more, essentially wiping out the entire market in an instant. It’s a far cry from the feeling that the fourth halving bull market is on the horizon after the Fed’s rate cuts.

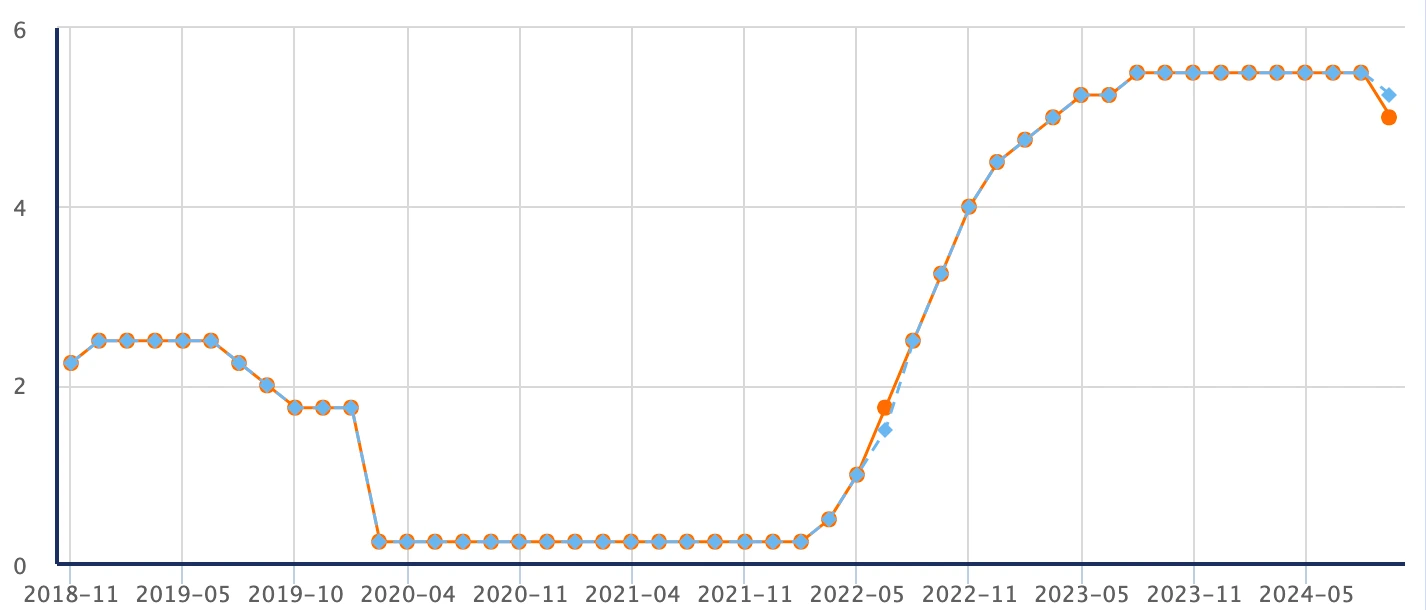

Bitcoin Price Volatility

(Source: Bitget)

Historically, October has predominantly been a positive month for Bitcoin. In the past 13 years, the ratio of Bitcoin’s price increases to decreases has been 9:4, with the last five years (2019-2023) seeing a five-year consecutive rise (tradingview). So why did Bitcoin, which is often seen as a “harvest month,” start off with a sharp drop? Does a bull market automatically follow after the Fed cuts rates? What’s behind Bitcoin’s recent crash?

WHAT CAUSED BITCOIN’S SHARP DECLINE?

Bitcoin’s crashes can usually be attributed to three factors: technical reasons, news-driven events, and the macroeconomic and financial environment. Let’s analyze these three factors in detail.

-

Technical Reasons

Since early August, Bitcoin had been fluctuating within a range, dropping to a low of around $49,000. The market was relatively weak until around September 19th, when, due to expectations of a Fed rate cut and the subsequent rate cut announcement, Bitcoin saw a significant rebound, briefly breaking the $66,000 resistance level. However, once it surpassed $66,000, it quickly retreated, and the breakout lacked strong trading volume.

Technically, this was Bitcoin’s first attempt to break through a key resistance level, but it failed. Historically, Bitcoin usually attempts to break major resistance levels around three times. Over time, as more investors and capital enter this asset, its price movement becomes less influenced by any single individual or entity.

-

News-Driven Events

Black swan events and significant macroeconomic calendar events often drive market volatility. Three key events can be highlighted in this case: Fed Chair Powell’s speech, Iran’s strike on Israel, and the release of U.S. non-farm payroll data on October 4th.

– Fed Chair Powell’s Speech: On September 30th (Eastern Time), Powell delivered a speech at the National Association for Business Economics (NABE) annual meeting, which was seen as somewhat hawkish. The Fed’s baseline expectation is for two more 25-basis-point rate cuts this year, differing from the market’s previous expectation of one 50-basis-point rate cut. This set the stage for the market’s initial decline.

– Iran’s Strike on Israel: This black swan event primarily influenced market sentiment and risk perception. The crypto market, including Bitcoin, is still considered a risk asset by large institutional investors. In times of global uncertainty, these investors prioritize risk control over high returns, leading to a rapid withdrawal from the market. This kind of large-scale exit caused significant drops, as seen during the early days of the Russia-Ukraine war in February 2022.

– U.S. Non-Farm Payroll Data (October 4th): This traditional macroeconomic event could trigger significant market fluctuations. The consensus is that 145,000 jobs will be added in September, slightly higher than the 142,000 in August, with the unemployment rate remaining at 4.2%. While stable, such data could potentially have a negative impact on the crypto market.

- Macroeconomic and Financial Environment

The Fed recently cut rates by 50 basis points, but the liquidity resulting from rate cuts takes time to flow into the market. This recent rise was more driven by FOMO from existing funds after the rate cut rather than an influx of new capital. Without continuous fresh capital inflows, any rise will likely be short-lived, and as the market hits strong resistance levels, a decline becomes inevitable.

Fed Rate Data

(Source: fx678)

BITCOIN’S MARKET WON’T RISE SMOOTHLY AFTER THE FED CUTS RATES.

In a previous article, Has the Fourth Bitcoin Halving Bull Market Begun? Analyzing Market Sentiment After Rate Cuts, we discussed how since Bitcoin’s first halving in 2012, Bitcoin has entered a bull market following the three rate cuts it experienced. Historically, Bitcoin has tended to rise after rate cuts, but the bull markets have not been without volatility. Each rate cut-driven bull market has seen multiple sharp corrections.

In the previous three halving bull markets, the number of significant drops was as follows:

– The first halving bull market saw 25 days where Bitcoin dropped by more than 15% in a single day.

– The second halving bull market saw 17 such days.

– The third halving bull market saw 8 such days.

In each bull market, crashes have been a constant companion. The primary reason is that the inflow of new capital cannot keep up with the market’s rapid rise. When the capital inflows slow down and the market becomes saturated with profits, a wave of selling ensues, turning the market downward and triggering panic selling.

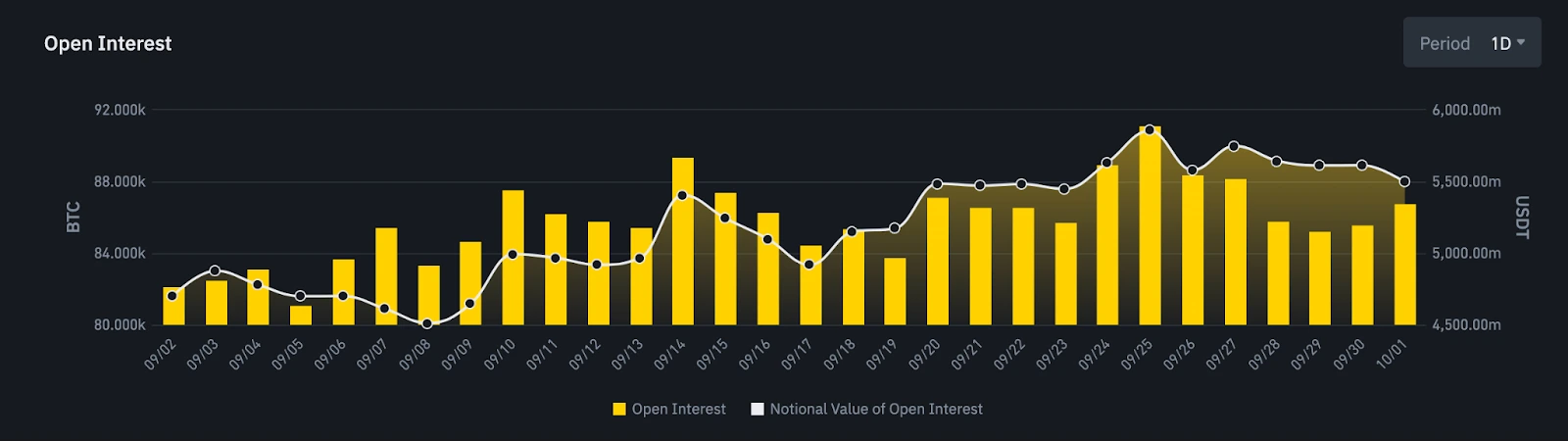

Another factor to consider is the influence of financial tools like contracts and loans on Bitcoin’s price. Today, the volume of derivatives trading far exceeds spot trading, and open interest in contracts continues to hit record highs.

Bitcoin 24-Hour Contract Open Interest

(Source: Binance)

Each time Bitcoin and altcoins rise, many traders leverage up to chase gains. However, when the market reaches a certain point, deleveraging becomes necessary to continue the upward trend. Leveraged positions get liquidated, triggering sales that lead to price drops, which in turn causes further liquidations, creating a cycle of cascading crashes.

From the above analysis, it’s clear that although the Fed has started cutting rates, it takes time for liquidity to reach the market and truly kickstart a bull market. Additionally, the pace and magnitude of future rate cuts remain uncertain and will be influenced by upcoming economic data such as non-farm payrolls, CPI, and PCE. This uncertainty will lead to fluctuations in the crypto market.

Moreover, after rate cuts, black swan events, whether political or economic, could trigger sharp market movements in the short term.

In conclusion, although Bitcoin’s fourth halving bull market is on the way, the path will not be smooth. Patience and perseverance will be key to navigating and capitalizing on this bull market.