KEYTAKEAWAYS

- Federal Reserve rate cuts historically correlate with Bitcoin bull markets, with the current cycle potentially accelerating crypto adoption and price growth.

- Bitcoin could reach $100,000 within 3-5 months, driven by rate cuts, ETF approvals, and increasing institutional investment in crypto assets.

- The fourth Bitcoin bull market top is estimated around $190,000-$200,000, potentially positioning Bitcoin as the second-largest asset by market cap after gold.

CONTENT

Analyze Federal Reserve rate cuts’ impact on Bitcoin, exploring historical patterns and future predictions. Discusses potential for Bitcoin to reach $100,000 and the dynamics of the fourth crypto bull market.

Due to an unexpected significant drop in the U.S. Consumer Confidence Index in September, the market’s mainstream expectation is that the Federal Reserve will cut rates by another 50 basis points in November, and possibly by another 25 basis points at the last rate-setting meeting in December this year. Adding to the 50 basis point cut in September, this could result in a 125 basis point reduction in just over three months this year. Looking ahead to 2025, the mainstream expectation is for about four rate cuts. It can be said that in a very short time, the Federal Reserve has put the rate-cutting process on the fast track.

As a product of abundant liquidity, the crypto market will inevitably be driven into a bull market by the ample liquidity following rate cuts. So, as the barometer and foundation of the entire crypto market, whether Bitcoin can break through the $100,000 mark and when it will do so is an important and highly symbolic event.

Let’s trace history, analyze the current situation, and look at the answer to this question.

HOW HAS BITCOIN PERFORMED DURING HISTORICAL FEDERAL RESERVE RATE CUT CYCLES?

Since the first Bitcoin was mined on January 3, 2009, 16 years have passed. During these 16 years, the Federal Reserve has conducted multiple rate hikes and cuts, and Bitcoin has gradually become a global phenomenon through these cycles, becoming the most prominent digital currency and even spawning a “blockchain” world.

As the saying goes, history is a mirror that can reveal the rise and fall. By analyzing Bitcoin’s performance in each Federal Reserve rate cut cycle, we can understand how Bitcoin will perform in this round of rate cuts and prepare investment strategies in advance.

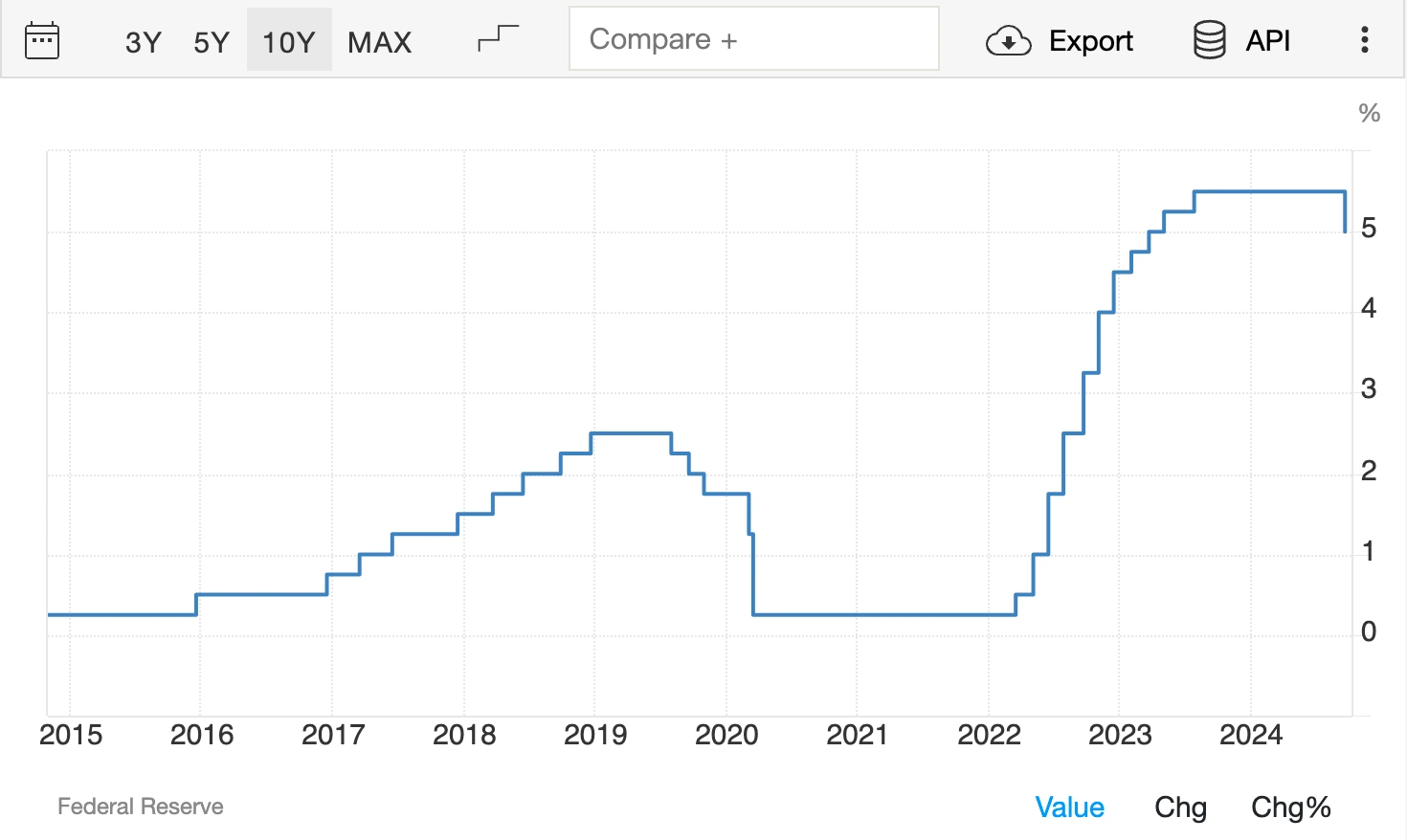

Federal Reserve Interest Rate Changes in the Last 10 Years

(Source: tradingeconomics)

2008-2009 Rate Cut Cycle, Birth Stage: To respond to the 2008 global financial crisis, the Federal Reserve began a series of significant rate cuts, lowering the federal funds rate to near 0%, injecting massive liquidity into the market. However, as Bitcoin was still in its early conceptual stage and the market was extremely small, it was not directly affected by Federal Reserve policies, but Bitcoin’s birth was closely related to the global financial crisis. The crisis led to dissatisfaction with the existing financial system, stimulating the development and promotion of Bitcoin.

2011-2015 Rate Cut Cycle, Emerging Stage: After the shock of the 2008 financial crisis, the global economic recovery was slow, and the Federal Reserve continued to implement loose monetary policies and maintain a low interest rate environment. In 2012, Bitcoin completed its first halving, and the price gradually rose after the first halving, from about $5 at the beginning of the year to $13 at the end of the year. In 2013, Bitcoin entered its first major bull market, with prices rising to a high of $1,200.

The main reason for Bitcoin’s rise during this round of rate cuts was that the Federal Reserve’s loose policy injected a large amount of liquidity into the global market, causing investors to start looking for high-return assets. Bitcoin, as an emerging digital asset, gradually gained more investor attention.

2019-2020 Rate Cut Cycle, Global Recognition: The Federal Reserve began a new round of rate cuts in July 2019 to address slowing global economic growth and trade tensions. Bitcoin performed strongly during the July 2019 rate cut period, with prices rising from about $3,700 at the beginning of the year to about $12,000 in July, creating a small bull market in the halving interval.

In early 2020, the outbreak of the pandemic caused significant market volatility. In March, the Federal Reserve made emergency rate cuts and launched large-scale quantitative easing policies. Bitcoin quickly rebounded and broke through $20,000 at the end of the year, then hit the highest point of the third halving bull market at $69,000 (Bitget data) in 2021.

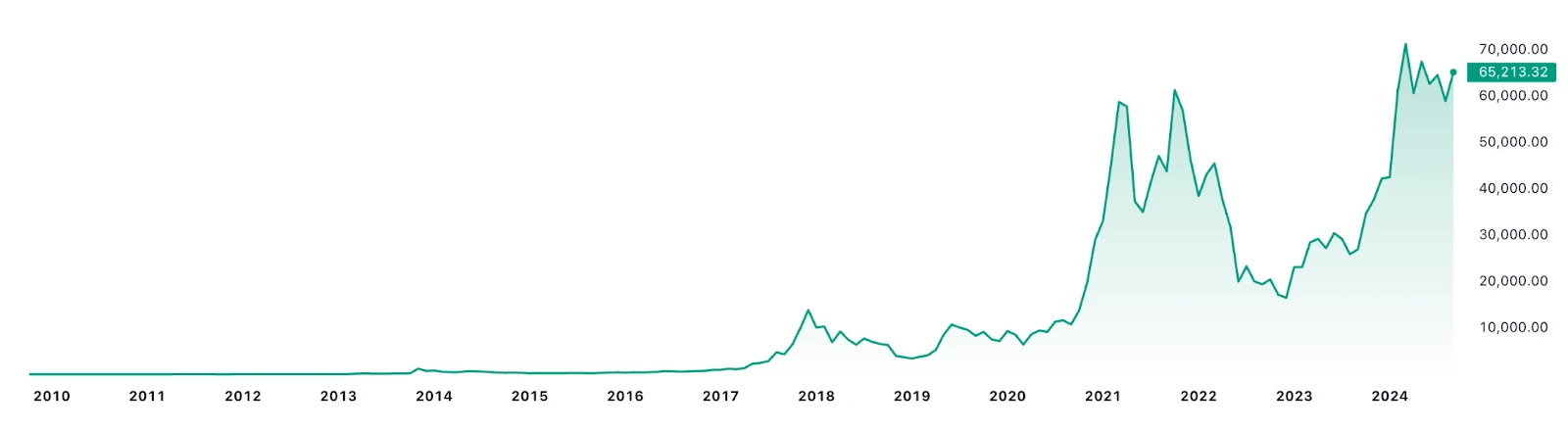

Bitcoin Price Changes 2010-2024

(Source: TradingView)

The rate cuts in 2019 and 2020 greatly increased market liquidity, prompting investors to seek higher-return assets. Bitcoin, as a high-risk, high-return asset, attracted a large influx of funds. During the pandemic, investors worried about global economic prospects and the risk of fiat currency depreciation, and Bitcoin began to be viewed as a “safe-haven asset” similar to gold, further boosting demand.

From the above, it can be seen that since Bitcoin’s first halving in 2012, the impact of the Federal Reserve’s rate cut cycles on the Bitcoin market has been significant. Bitcoin typically performs well during rate cut cycles, mainly due to increased liquidity from rate cuts, enhanced safe-haven demand, and supply-demand changes. Moreover, as Bitcoin gradually becomes mainstream, especially with the participation of institutional investors, its performance during rate cut cycles becomes more stable and mature.

THIS ROUND OF RATE CUTS MAY EXCEED EXPECTATIONS, HOW WILL IT AFFECT THE CRYPTO MARKET?

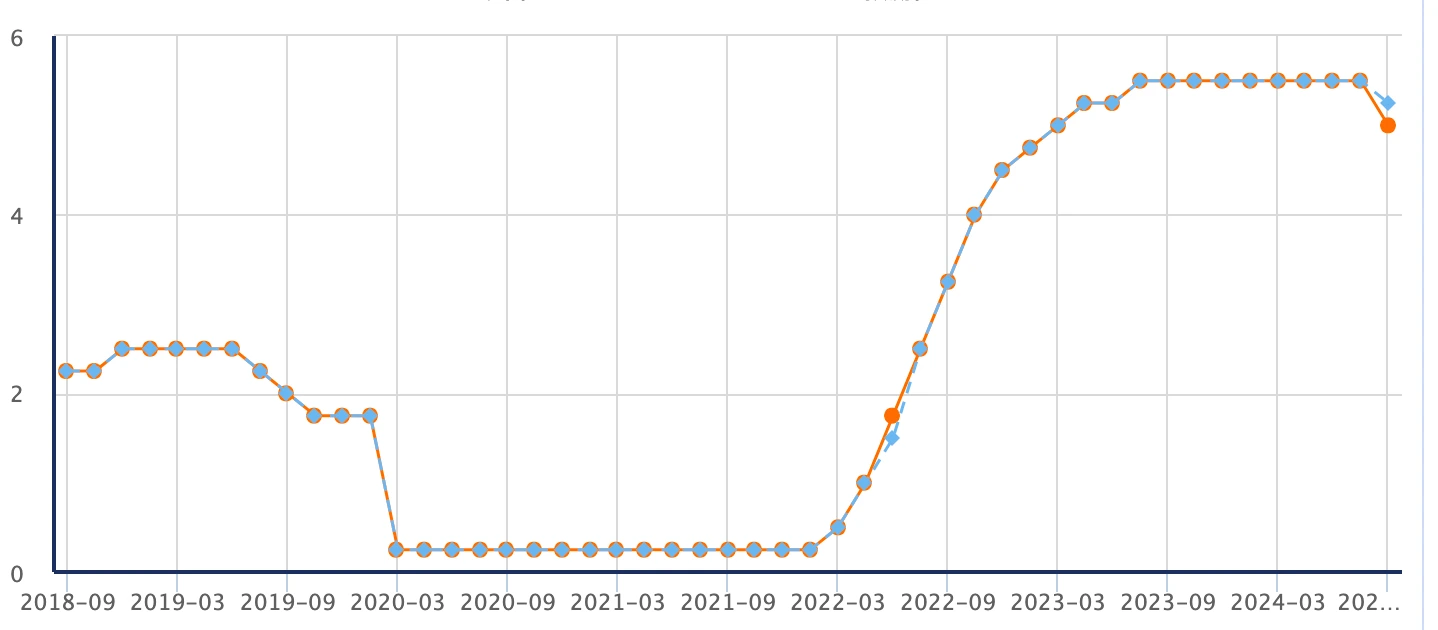

The Federal Reserve’s 50 basis point rate cut in September can be said to be a direct “big move,” and according to the median of the Fed’s dot plot, the Federal Reserve will cumulatively cut rates by 100-125 basis points in 2024, and another 100 basis points in 2025. Goldman Sachs Chief Economist Jan Hatzius predicts that from November this year to June next year, the Federal Reserve will continuously cut rates by 25 basis points, reaching a terminal rate of 3.25%-3.50% by mid-2025.

The expected continuity and intensity of these rate cuts may exceed expectations. Based on the purpose of rate cuts, Federal Reserve rate cuts can be roughly divided into two categories: one is preventive rate cuts, mainly to prevent the risk of economic recession; the other is relief rate cuts, to remedy the economy falling into recession or major crisis.

This round of rate cuts mainly belongs to preventive rate cuts, aimed at extending the resilience of the U.S. economy and labor market. However, starting with a 50 basis point cut has also raised mainstream market concerns about greater risks to the U.S. economy. The U.S. economy may maintain resilience in 2024, but downward pressure is expected to gradually increase in 2025.

Federal Reserve Interest Rate Predictions and Announced Values 2018-2024

(Source: fx678)

If so, the Federal Reserve may adopt faster frequency and larger magnitude rate cuts, which, while injecting huge liquidity into the market to some extent, may also trigger major economic and financial black swan events, and the crypto market may also experience violent fluctuations, triggering market crises.

However, overall, Federal Reserve rate cuts directly lower borrowing costs, making funds more abundant. For Bitcoin and the crypto market, ample liquidity means more funds will flow into high-return, high-risk asset classes. History has already proven that Bitcoin typically performs excellently in a loose monetary policy environment. In a rate-cutting environment, more speculative funds may enter the crypto market, pushing the market into a bull market phase.

Additionally, during rate cut periods, returns on traditional assets (such as bonds, savings, etc.) decline, prompting more institutions and funds to seek higher-return investment opportunities. The crypto market, especially large-cap assets like Bitcoin and Ethereum, has become an increasingly important part of institutional portfolios. The approval of Bitcoin spot ETFs and more crypto asset funds will make it easier for institutional investors to enter the crypto market, driving the market higher. The entry of institutions not only brings capital but also reduces market volatility and enhances the stability of assets like Bitcoin.

Of course, risk and return go hand in hand. While Federal Reserve rate cuts driving a major bull market have been repeatedly proven, this bull market may not be like the previous three halving bull markets where all boats rise with the tide. Mainstream coins, especially sector leaders such as public chains, GameFi, AI, MEME, and other concept leaders, will likely see good returns, but those projects lacking users, stories, and professional team backgrounds will find it difficult to be lifted by the market again.

WHEN WILL BITCOIN REACH $100,000? WHERE IS THE TOP OF THE FOURTH BULL MARKET?

Before answering this question, we need to discuss a fundamental issue: What is the basic logic of a bull market’s rise?

In all investment markets, including so-called mainstream investment markets like real estate, stock markets, and gold, the basic logic of a bull market rise is: continuous inflow of new funds. Other external factors only accelerate or slow down this process.

From the perspective of the Federal Reserve’s rate cut pace, although rate cuts have already begun and future rate cut expectations are optimistic, it takes time for this to transmit to the market. So it’s difficult to reach a unit price of $100,000 in a short time. Considering possible black swan events in the broader economic and financial environment, this time might be even later.

However, the approval of Bitcoin spot ETFs, the overall development of the crypto market ecosystem, retail FOMO sentiment, safe-haven sentiment due to geopolitical risks and economic uncertainties, and even the gradual clarification of legal frameworks for Bitcoin and crypto assets by major economies (such as the U.S., EU, China) could all promote Bitcoin’s rise.

Therefore, comprehensively considering these factors, the probability of Bitcoin reaching $100,000 in the next 3-5 months is high, that is, by the end of December 2024 or the end of February 2025.

We can estimate Bitcoin’s top in the fourth bull market through market capitalization rankings: According to TradingView data, gold’s market cap has reached $20 trillion, while Bitcoin’s market cap is $1.28 trillion, ranking ninth in global asset market capitalization, just behind silver. As digital gold, if compared to gold, Bitcoin still needs to rise 15.6 times to catch up with gold’s market cap, and this is with the precondition that gold’s market cap remains unchanged.

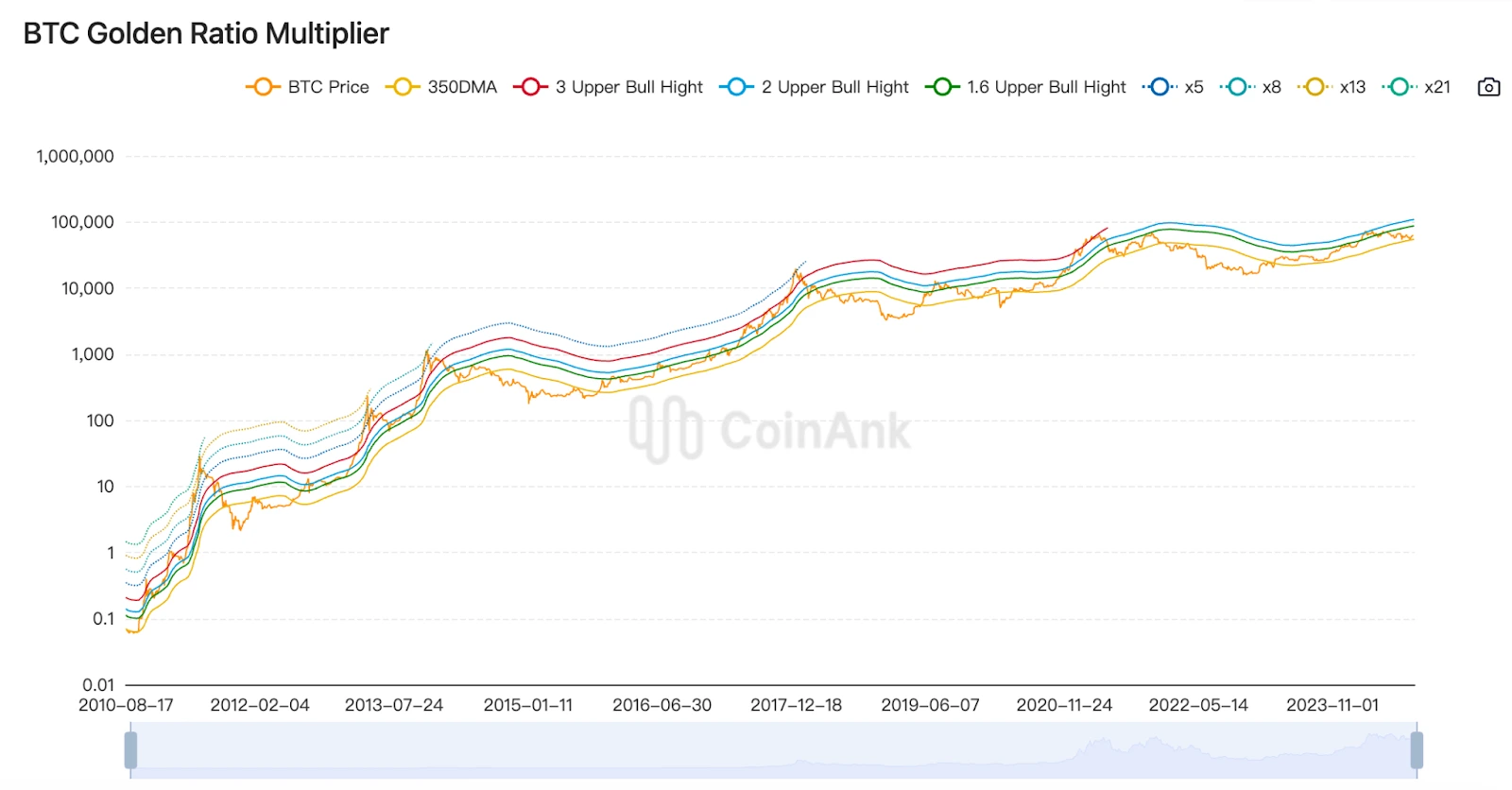

BTC Golden Ratio Multiplier

(Source: Coinank)

So at Bitcoin’s current price of $64,000, 15.6 times would be $998,400, close to $1 million. This price is also the prediction of Bitcoin enthusiasts and some institutional investors like Bernstein and Cathie Wood. Of course, reaching such a high level in this bull market seems difficult at present. However, catching up with or surpassing the market cap of Microsoft, the second-largest asset after gold, is possible, which would require Bitcoin to rise about 3 times from its current price, that is, to $190,000-$200,000, which could be the top of Bitcoin in the fourth bull market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!