KEYTAKEAWAYS

- Bitcoin's four 10,000-point drops since December have effectively shaken out retail investors, with Fear & Greed Index reaching 43, suggesting a thorough market reset.

- Trump's crypto policy promises face varying implementation challenges, with Federal Reserve influence being the key long-term factor for market direction.

- Market outlook suggests a slower, more sustainable bull run ahead, unlike previous halvings, requiring greater investor patience for long-term gains.

CONTENT

Analysis of Bitcoin’s recent market shakeout after four major drops and Trump’s potential impact on crypto markets, examining retail investor psychology, policy feasibility, and Federal Reserve implications for 2025.

After Bitcoin broke through $102,700 (Bitget data) on January 7th, it continued to decline and fell below $90,000 on the 13th, reaching a low of $89,268, marking a maximum decline of 13.1%. ETH dropped from $3,743 to $2,925, a maximum decline of 21.8%. Altcoins generally saw declines of over 30%, some even halving in value, falling to new lows since December.

However, Bitcoin found substantial support between $89,000-$90,000. After the sharp drop, the market quickly rebounded and climbed back above $99,000, suggesting that the continuous decline might have ended and Bitcoin could be setting sail for new highs again.

Since Bitcoin first broke the $100,000 mark on December 5th, it has experienced four major drops of over 10,000 points in just over a month. This has dampened market sentiment, with the Fear & Greed Index remaining below 50, something rarely seen since October last year. These consecutive drops have scared many market participants, leading them to either cut losses or get liquidated.

In such a market atmosphere, is it still possible for Bitcoin to break new highs in the next month or two? On January 20th, the highly anticipated Trump presidential inauguration ceremony will be held – will it bring a major market rally?

More to Read:

- 2024 Crypto Market Review (Part 1): Bitcoin’s Journey to $100K

- 2024 Crypto Market Review (Part 2): Will Bitcoin Hit $200,000 in 2025? When Will the Crazy Bull Market Begin and End?

HAVE BITCOIN’S FOUR MAJOR DROPS THOROUGHLY SHAKEN OUT THE MARKET?

As mentioned above, since Bitcoin first broke $100,000 on December 5th, it has experienced four rounds of 10,000-point drops. This suggests Bitcoin’s consensus is indeed stronger, requiring market makers to use every means to shake out retail investors.

Let’s analyze whether this month-long market shakeout has been thorough from a retail investor psychology perspective:

The market makers’ objective during the shakeout phase is to eliminate unstable retail positions while generating panic through market volatility, compelling retail investors to liquidate their holdings to create space for the next upward movement. Looking at this dynamic, when Bitcoin surpassed $100,000 on December 5th and immediately experienced a sharp 10,000-point drop, the market remained calm, with the Fear & Greed Index staying above 80, indicating persistent greed in the market. Not until three days later, when Bitcoin crashed again and triggered an altcoin collapse, resulting in 570,000 positions being liquidated overnight, did the market show initial signs of fear, with the Fear & Greed Index finally breaking below 80.

In subsequent days, Bitcoin staged a quick recovery and reached new highs on December 17th, with market sentiment still showing greed and numerous investors continuing to chase rallies and buy dips. This was followed by the largest decline of this uptrend, as Bitcoin dropped for three consecutive days while many altcoins saw their values cut in half, finally triggering panic among retail investors and causing the Fear & Greed Index to plunge below 70.

Fear & Greed Index Changes

(Source: CoinMarketCap)

However, Bitcoin’s continuous record highs led many to believe the uptrend would resume at any time. Most retail investors were still looking to buy the dip, hoping for quick rebounds like the previous two times. This prompted market makers to initiate a two-week consolidation phase to wear down retail investors’ patience. When quick rebounds failed to materialize, many dip buyers began selling and exiting positions, causing the Fear & Greed Index to drop below 50 for the first time, shifting towards fear.

But due to Bitcoin’s increased consensus after four halvings, a large portion of retail investors still refused to sell at a loss and remained committed to holding. Market makers then initiated a false breakout, pushing above $100,000 again on January 6th. Before the market could celebrate, it fell back below $100,000, with bearish daily candles engulfing bullish ones for three consecutive days. While it didn’t break below $90,000, giving retail investors a glimmer of hope, this hope lasted only three days before a sharp drop pierced through the $90,000 level, breaking many retail investors’ final psychological barrier. This triggered panic selling among retail investors, with the Fear & Greed Index falling to its lowest point of 43.

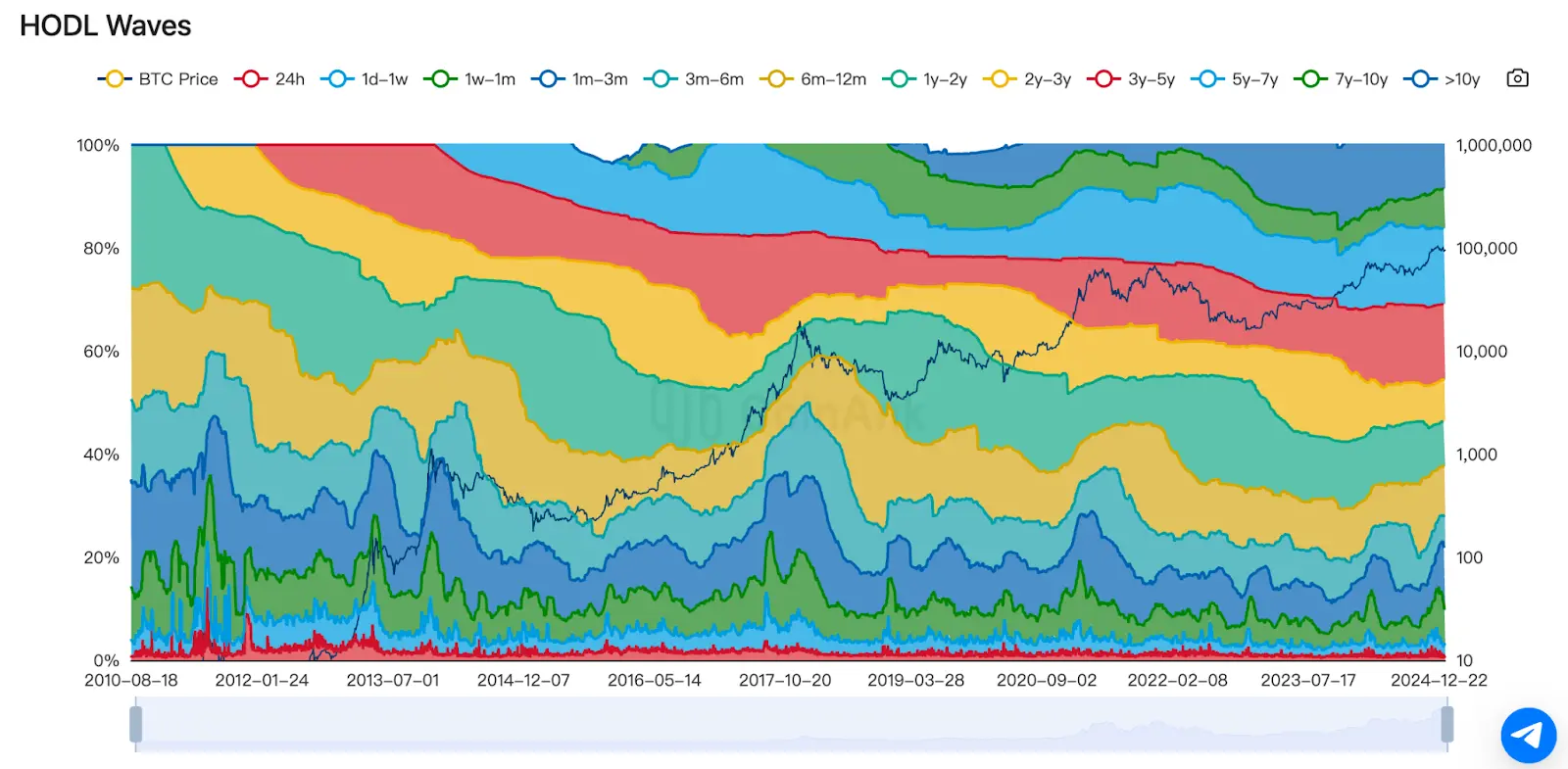

Market position structure data further demonstrates this trend, showing a marked decline in short-term Bitcoin holdings, which clearly indicates a significant reduction in retail investor participation and position sizes.

Bitcoin HODL Wave

(Source: CoinAnk)

From market information, discussion volume on platforms like X (Twitter), Google Trends, and Reddit has notably decreased, with bearish voices growing louder and bears clearly overwhelming bulls, indicating retail investor confidence has been nearly exhausted.

During Bitcoin’s four 10,000-point drops, trading volume continued to increase, indicating retail investors were selling in panic. However, after prices bottomed, trading volume gradually shrank, suggesting reduced selling pressure and market positions gradually concentrating in the hands of major players.

After these four major drops, whether looking at market sentiment, on-chain data, trading volume, or retail investor behavior and metrics (mass exits, decrease in small addresses, market entering low volatility consolidation), the current shakeout appears quite thorough, laying a good foundation for the next upward wave. Particularly as January 20th approaches, with Trump’s presidential inauguration drawing near, the market’s anticipated rally seems to be on the horizon.

WILL TRUMP’S INAUGURATION CEREMONY DEFINITELY BRING A MAJOR RALLY?

Next Monday, Trump will officially become President of the United States. Since Trump’s election victory in November, the crypto market has been full of expectations for his presidency, which to some extent contributed to Bitcoin’s multiple record highs in December.

But will Trump’s presidency definitely bring a major rally?

The crypto market’s expectations for Trump mainly stem from his numerous crypto-related policy promises during the campaign. The main “new policies” currently circulating in the market include:

- Making America the global crypto capital and supporting the development of cryptocurrencies, AI, and other emerging industries

- Stopping crypto industry suppression within one hour of taking office and protecting Bitcoin mining and trading rights

- Blocking further U.S. government CBDC development, viewing it as a limitation on individual freedom

- Establishing strategic Bitcoin reserves, making Bitcoin one of America’s strategic assets

- Firing SEC Chairman Gary Gensler to relax crypto industry regulation

- Proposing cryptocurrency solutions for U.S. debt issues

- Blocking U.S. sales of held Bitcoin

- Proposing comprehensive crypto policies covering stablecoin regulation and user self-custody rights

- Establishing a cryptocurrency advisory committee

- Reducing Silk Road founder Ross Ulbricht’s sentence

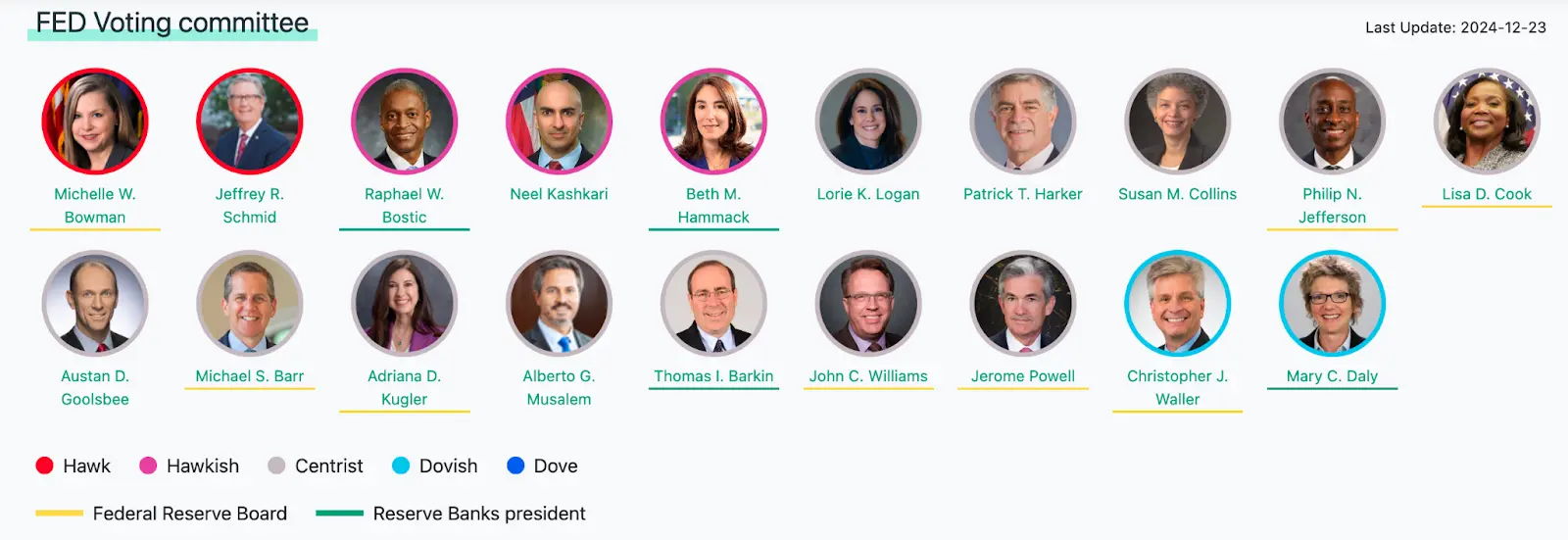

Federal Reserve FED Voting Members and Their Attitudes

(Source: MacroMicro)

We can analyze the feasibility of these “new policies” from easiest to most difficult. The simplest is reducing Silk Road founder Ross Ulbricht’s sentence, which is easily achievable for a U.S. President with pardoning powers. Firing SEC Chairman Gary Gensler isn’t difficult either, but relaxing crypto industry regulations isn’t as simple as just saying it – it involves many interests and won’t be smooth sailing.

The moderately difficult “new policies” include preventing U.S. Bitcoin sales, comprehensive crypto policies, and using cryptocurrency to address U.S. debt. With Trump’s current prestige and advantageous control of both House and Senate, these policies might be partially realized, but complete implementation is almost impossible.

The most challenging policies are “making America the global cryptocurrency capital” and “stopping crypto industry suppression within one hour of taking office.” These are more like campaign slogans because implementation would require challenging traditional financial institutions and global economic policies, along with establishing various policies involving tax incentives, simplified regulatory processes, and other aspects. Given America’s current political ecosystem, this would be an arduous and lengthy process.

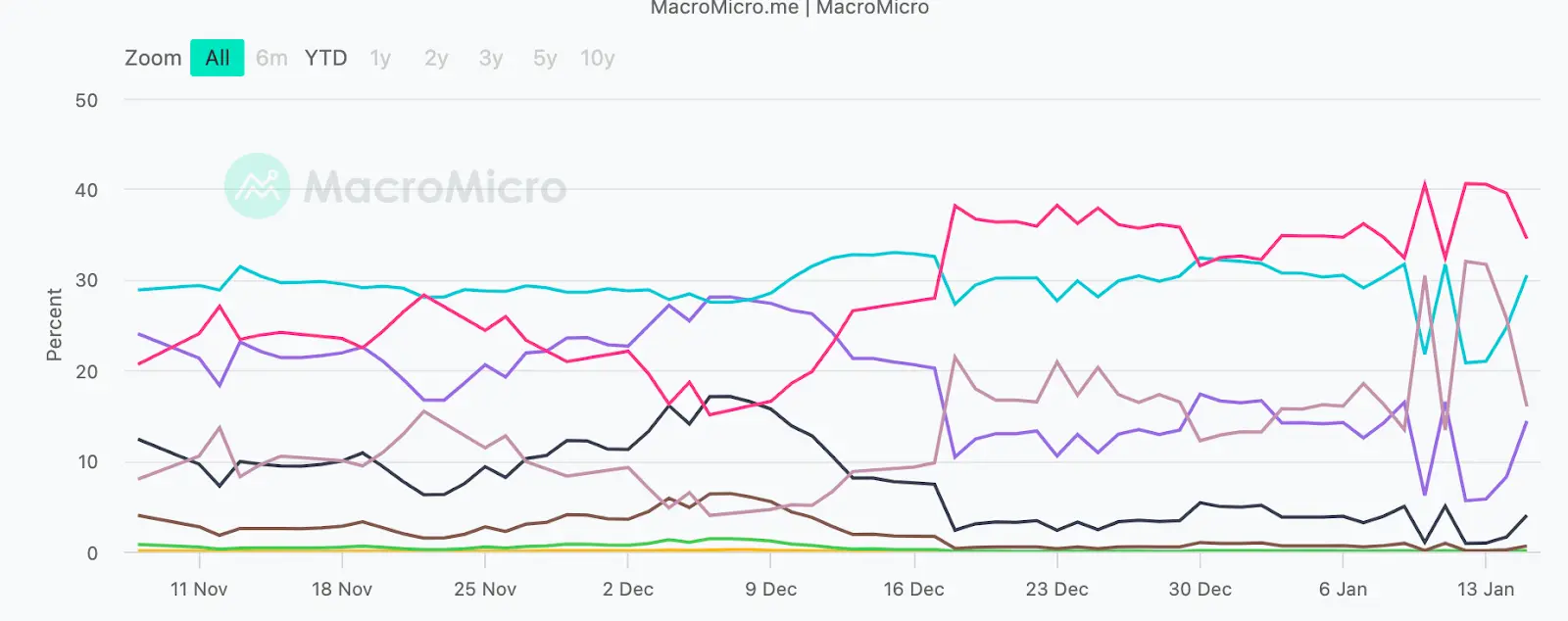

In fact, regarding Trump’s “new policies,” their impact on the current crypto market’s price movements is mainly as a “major financial event.” If there’s partial progress or potential progress, the market will trade on sentiment, undoubtedly causing short-term price fluctuations. However, in the long term, the real impact depends on one thing: how Trump’s presidency will influence the Federal Reserve’s interest rate cut pace and depth.

U.S. – FedWatch Interest Rate Expectations for End of 2025

(Source: MacroMicro)

Currently, the Federal Reserve maintains strong independence, and even as president, Trump would have limited opportunities to influence Fed policy. However, it’s not impossible – for instance, recent news suggests that the Fed’s Vice Chair for Supervision position will soon be vacant, as current Vice Chair Michael Barr has decided to resign on February 28th, allowing Trump to potentially install “his own people” at the Fed.

Overall, Trump’s battle with the Federal Reserve will be a long and complex process. In the short term, it will be difficult to prevent the Fed’s decision to pause rate cuts or reduce the number of cuts planned for 2025. However, in the long run, Trump might use various means to substantively influence Fed monetary policy.

As mentioned before, since Trump’s economic policies require substantial Fed rate cuts for support, this means he will definitely use various methods to accelerate Fed rate cuts after taking office. However, currently, it appears this will take considerable time to achieve.

CONCLUDING THOUGHTS

Currently, following Bitcoin’s drop below $90,000 on the 13th, this round of market shakeout appears largely complete. The sharp drop to this level makes sense from the market makers’ perspective: without it, bulls would remain too stubborn to deleverage, but dropping too far would embolden bears and damage market sentiment, making recovery time-consuming.

The bull market fundamentals remain intact, and the market is expected to continue its upward trend after Trump takes office. However, it’s unlikely to see the kind of explosive bull run witnessed in the previous three halvings. Bitcoin is likely to follow a slower upward trajectory, extending this bull cycle and providing more opportunities for altcoin breakouts. While this benefits the entire industry, it also demands greater patience from investors to truly capitalize on this halving cycle’s benefits.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!