- In 2024, XRP overtook SOL as the third-largest cryptocurrency, with market caps of $139.4B and $109.2B, respectively, both showing strong growth.

- XRP excels in cross-border payments for traditional finance, while SOL drives DeFi and NFT innovation with high performance.

- XRP’s global community focuses on financial institutions, while SOL attracts Web3 developers with active ecosystem support.

TABLE OF CONTENTS

XRP and SOL have shown robust growth in the 2024 cryptocurrency market, leveraging their strengths in cross-border payments and decentralized applications, respectively. XRP addresses the demand for efficient settlements in traditional finance, while SOL leads the Web3 sector with cutting-edge technology and an active ecosystem. Both offer unique value propositions for investors with varying preferences.

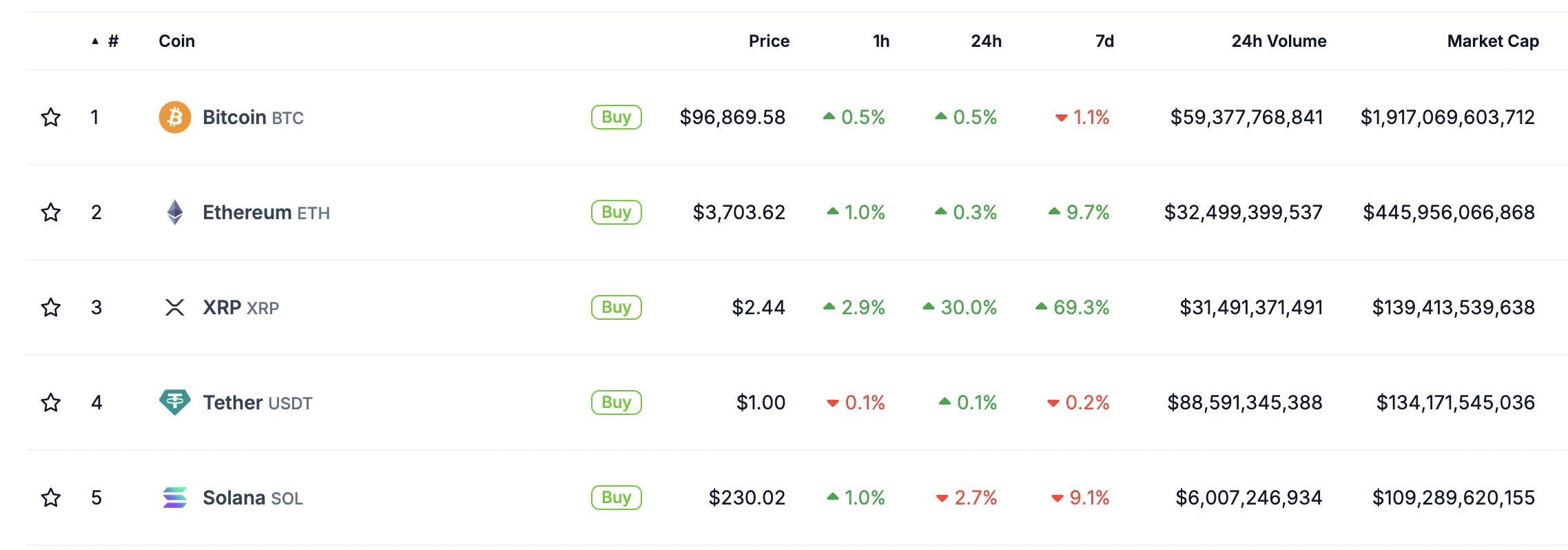

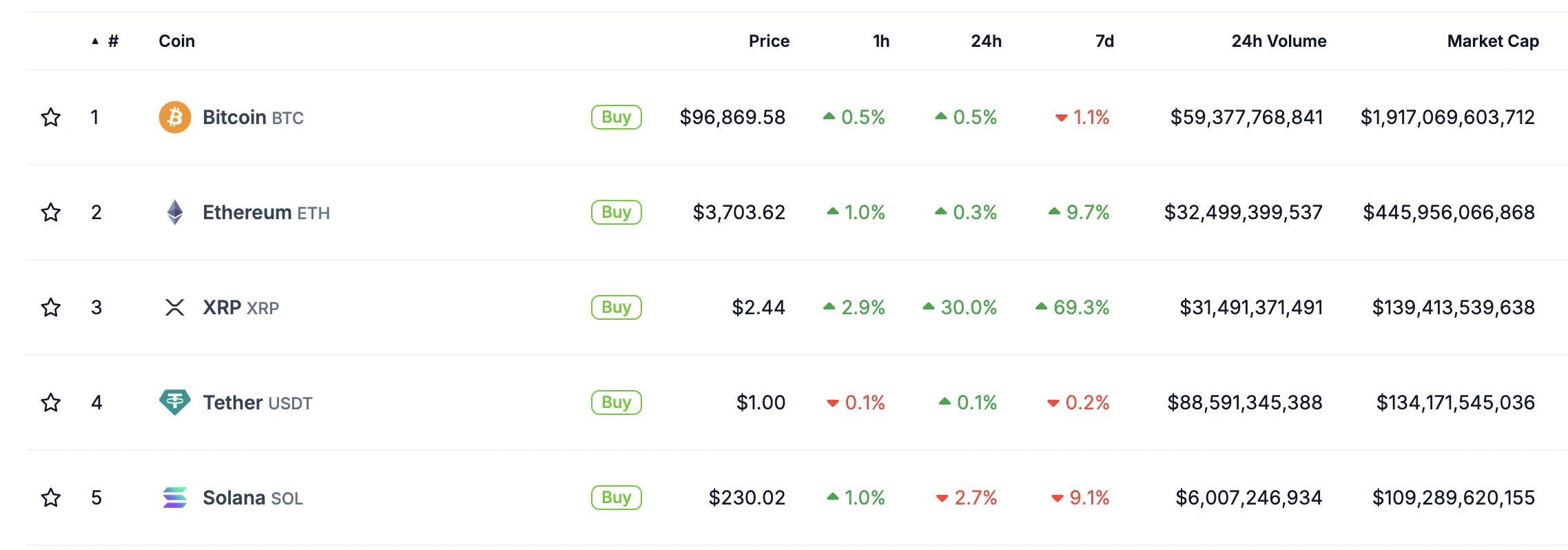

The cryptocurrency market experienced significant turbulence in the second half of 2024. Amidst the volatility, XRP and SOL have stood out with impressive performances, sparking widespread discussion. As of December 2, 2024, XRP’s market capitalization has reached approximately $139.4 billion, surpassing SOL to become the third-largest cryptocurrency. Meanwhile, SOL follows closely with a market cap of around $109.2 billion, holding its position despite a slight recent decline.

(Source:CoinGecko)

XRP’s growth in market capitalization is primarily driven by increasing demand in cross-border payments and optimistic market expectations for its potential. On the other hand, SOL continues to attract developers and users with its widespread applications in decentralized finance (DeFi) and non-fungible tokens (NFTs). Below, we provide an in-depth comparison of these two projects from the perspectives of use cases, technical architecture, and community ecosystems.

I. USE CASES: PAYMENTS VS. SMART CONTRACTS

1. Primary Use Cases of XRP

XRP focuses on cross-border payment solutions, aiming to provide fast and low-cost methods for transferring funds. Traditional cross-border payment systems often require several days to process transactions and come with high fees. XRP leverages RippleNet to enable second-level settlement and transparency using blockchain technology, significantly reducing transaction costs.

Key applications of XRP include:

Liquidity Management for Financial Institutions: XRP facilitates rapid currency conversion to reduce forex risks. Notable institutions like Santander Bank and Standard Chartered have adopted Ripple technology to optimize payment processes.

Corporate Partnerships: Ripple collaborates with companies like MoneyGram, leveraging XRP as a payment gateway to offer customers faster, lower-cost remittance services.

Global Trade Support: XRP is becoming a vital liquidity tool in global trade, particularly in scenarios requiring rapid fund transfers.

2. Primary Use Cases of SOL

Solana is renowned for its ultra-high throughput and low latency, making it a preferred platform for decentralized application (dApp) development. It is widely used in DeFi and NFT markets.

Key strengths of Solana include:

DeFi Applications: Solana supports various financial services, including lending, decentralized exchanges (DEXs), and liquidity pools. Its low transaction costs and fast confirmation times enable users to engage in complex financial activities at minimal expense.

NFT Market: Many artists and creators choose Solana as their platform for issuing and trading NFTs, taking advantage of its efficient performance to avoid high gas fees.

Ecosystem Expansion: The Solana Foundation provides funding and technical support for developers, attracting numerous new projects and enhancing the ecosystem’s diversity and competitiveness.

II. TECHNICAL ARCHITECTURE: EFFICIENCY VS. INNOVATION

1. XRP’s Technical Features

XRP employs a unique Federated Consensus mechanism, where transactions are verified by network nodes to ensure efficiency and security.

Efficiency: Transactions are confirmed within seconds, offering high-speed processing.

Low Costs: Minimal transaction fees make XRP suitable for large-scale microtransactions.

Security: A decentralized network of nodes reduces the risk of 51% attacks.

Despite its technological maturity, XRP faces criticisms regarding its decentralization, as Ripple retains a degree of influence over its validation nodes.

2. SOL’s Technical Features

Solana combines an innovative Proof of History (PoH) consensus mechanism with Proof of Stake (PoS).

High Throughput: The network can process thousands of transactions per second (TPS), significantly reducing congestion risks.

Innovation: The introduction of timestamp technology optimizes transaction sequencing, enhancing network efficiency.

Scalability: Solana supports high-performance dApp development, meeting the demands of large-scale applications.

However, Solana has faced network outages in the past, highlighting vulnerabilities in its high-performance architecture under extreme conditions. The team continues to address these issues through ongoing technical improvements.

III.COMMUNITY AND ECOSYSTEM: TRADITIONAL FINANCE VS. WEB3 INNOVATION

1. XRP’s Community and Ecosystem

XRP has a global and loyal user base, primarily composed of financial institutions and payment service providers. Ripple strengthens market confidence through legal compliance initiatives and partnerships with banks. Additionally, the XRP community is optimistic about its potential role in central bank digital currencies (CBDCs), which could become a key development area in the future.

2. SOL’s Community and Ecosystem

Solana’s community is developer-centric, attracting numerous Web3 projects and innovative teams. The Solana Foundation supports development activities by providing resources and encouraging collaboration within the ecosystem. Prominent projects like the Phantom wallet and Serum are integral to Solana’s ecosystem. Compared to XRP, Solana’s community focuses more on building a decentralized economy, with a younger and more tech-oriented user demographic.

CONCLUSION

XRP and SOL each showcase distinct strengths in the payment and smart contract domains, respectively. XRP leverages its efficiency and integration with traditional finance to expand its use cases, making it a suitable choice for conservative investors. SOL, with its technological innovation and active ecosystem, is well-positioned in the emerging decentralized economy, appealing to risk-tolerant investors.

For investors, the choice between these two assets should align with individual risk preferences and investment strategies. Regardless, both projects are poised to play significant roles in the future of the cryptocurrency market.

Read More:

OpenEden:a New Force in the Tokenized U.S. Treasury Market

XRP VS SOL: A Deep Dive into the Two Rising Stars in the Crypto Market

CoinRank x Bitget – Sign up & Trade to get $20!