KEYTAKEAWAYS

- ETF Performance Review as a Key Investment Tool: Analyzing the annual performance of ETFs is crucial for investors to understand market trends and make informed decisions. This review includes data on returns, risks, and holdings composition, helping to identify high-potential sectors and adjust investment strategies.

- Significance of Major Economic Events: Events like the Federal Reserve's rate hikes, fluctuations in government bond yields, and the emergence of AI technology in 2023 have significant impacts on the capital market. Understanding these events helps investors anticipate market trends and tailor their investment approaches accordingly.

- Effective ETF Selection and Asset Allocation: For successful ETF investing, thorough research, understanding market dynamics, and proper valuation are essential. Diversifying across industries, regions, and asset types, while regularly reviewing and adjusting asset allocation strategies, can enhance portfolio performance and mitigate risks.

CONTENT

The ETF annual performance review is one of the crucial topics that investors must closely monitor. As investors, we all aspire to achieve the best returns in the market. As an investment tool, exchange-traded funds (ETFs) directly impact our investment outcomes based on their performance.

Through the annual performance review of ETFs, we can understand how the fund has performed in the past year. The study consists of relevant data such as its returns, risks, and the composition of its holdings. By analyzing these data in depth, we can grasp more information about market trends and make wiser investment decisions.

This passage will discuss why an annual review of ETF performance is crucial for investors. We aim to gain a deeper understanding of this topic by exploring key factors influencing market trends.

Additionally, we will keep an eye on the latest developments regarding the upcoming cryptocurrency ETFs.

THREE MAJOR ECONOMIC EVENTS OF 2023

Looking back at the capital market this year, it has been quite eventful.

Three significant economic events have occurred in the international market, which are expected to continue influencing the capital market in 2024.

1. The Federal Reserve Pauses Hawkish Rate Hikes:

The U.S. Federal Reserve started raising interest rates from March 2022, and the rising trend continued until September 2023, bringing the federal funds rate to 5.5%. The further rate adjustments hinge on how well the inflation rate will be controlled for the following months.

However, despite successfully curbing inflation through rate hikes, there is now a looming concern about a series of corporate bankruptcies. As of the end of October, a total of 516 companies in the U.S. have filed for bankruptcy, with 17 of them having debts exceeding $10 billion. Corporate closures will reduce market supply, directly impacting the real economy and indirectly affecting the stock market. Therefore, stopping rate hikes timely by the U.S. Federal Reserve is seen as a supportive measure for the stock market. The future market trend in 2024 will depend on whether the U.S. economy keeps stable or heads towards a recession.”

2. Fluctuation of Government Bond Yields:

Closely related to the monetary policy of the U.S. Federal Reserve is the bond market. This year, government bond yields once approached 5%. This seemingly low-risk investment product offered historically high returns, drawing many investors to enter the market when yields were around 4%. However, they did not anticipate the continuous decline in bond prices, resulting in earning interest but losing on the price differential. Many people were puzzled about why bond prices kept falling. The underlying reason is the increasing fiscal deficit in the United States, necessitating borrowing to overcome the current crisis.

Additionally, after years of quantitative easing (QE) by various governments, they have started to reduce their balance sheets, meaning they are not renewing bonds upon maturity. These factors led to an oversupply of government bonds compared to demand, causing bond prices to fall and yields to rise.

Fortunately, in the last Federal Reserve interest rate decision meeting on December 13th, Chairman Powell maintained the interest rate again, leading the market to interpret that a rate cut may likely occur in Q1 of the coming year. With this expectation, the capital market, driven by positive sentiment, demonstrated a bullish trend.

3. AI Emerges, Triggering a Technological Revolution:

Describing the emergence of AI may not be entirely accurate, as the rise of AI is attributed to big data cooperation, hardware upgrades, and the maturation of 5G networks. In other words, the development of AI is a natural progression, and it is safe to say that there is no turning back. With Nvidia successfully leading the charge in AI server chip technology, AMD followed suit with the MI300 series Accelerated Processing Unit (APU) chips that boast superior specifications to Nvidia’s H100 and cost half as much as Nvidia’s H100. AMD is determined to capture a significant share of the AI server and data center chip market. It’s not just AMD expressing interest in this lucrative chip market; even Intel, traditionally focusing on CPUs, plans to launch Gaudi 3 in 2024 to enter the AI chip arena. Therefore, with a substantial increase in computing power, AI applications are expected to reach general users sooner than anticipated, creating more opportunities for edge computing. The day artificial intelligence becomes a part of our daily lives is drawing closer.

PERFORMANCE ANALYSIS AND ASSET ALLOCATION STRATEGY

As an investor, understanding the market dynamics is crucial for selecting suitable investment tools. The ETFs annual performance review not only provides performance data for the past year but reveals trends and performances in different investment sectors. These insights are vital for evaluating portfolio performance and making further adjustments to asset allocation strategies.

Assisting in Identifying the Right Industries:

Firstly, the ETFs annual performance review can showcase how the performance of different investment sectors influences the overall market. ETFs in various industries and regions have varying investment risks and return characteristics. By analyzing the performance of different sectors, we can better understand the hotspots and trends in the market. For example, technology-oriented ETFs may have shown strong performance in the past year, while energy and traditional manufacturing sectors might have performed weaker. This information can help us choose investment opportunities with potential.

It is essential to consider industry-specific ETFs that suit your investment goals. During the annual review of ETF performance, differences in the performance of various industries become evident, allowing us to identify sectors with clear advantages and higher long-term growth potential in the market.

The practical strategy for choosing winning industry ETFs involves several key elements. Firstly, a thorough examination of the fundamentals of different industries is necessary. Understanding the long-term trends, relevant policies, and competitive environments within an industry is crucial. For example, as renewable energy develops and environmental concerns rise, the clean energy sector may exhibit significant long-term growth potential.

Secondly, the industry should focus on technological innovation and transformation. If an industry experiences rapid technological advancements that enhance efficiency and reduce costs, it may emerge as a leading industry in the future. For instance, the widespread application prospects of artificial intelligence and big data analytics technology across various industries are widely acknowledged.

Additionally, one needs to consider market opportunities and risks within the industry. An industry with substantial market demand and relatively low competition may have more potential. However, investors should pay attention to the risks faced by the industry, such as regulatory changes, manufacturing challenges, and market cyclicality as well. We can select industry ETFs with stable growth and lower risks through thorough research and analysis.

Evaluating Portfolio Performance:

Investors often combine different ETFs to create a diversified portfolio to mitigate risks and enhance returns. However, ETFs may perform differently under various market conditions. By observing the annual performance of different ETFs, we can better assess the portfolio’s overall performance. If certain ETFs outperform others, we may consider increasing their weight to enhance the portfolio’s returns further.

Performance analysis may include the following aspects:

- Annual return rate: Observe the performance of the ETF over the past year to assess its investment returns.

- Volatility: Understand the level of volatility of the ETF, assessing risk tolerance.

- Benchmark comparison: Compare the performance of the ETF with relevant market indices to evaluate its tracking ability.

- Investor returns: Observe the investor return rate of the ETF, understanding the overall performance of market participants.

Through performance analysis, we can understand the investment returns and risk characteristics of the ETF, comparing them with the market environment. This information helps us evaluate the strengths and weaknesses of the ETF, enabling us to make more informed investment decisions.

Adjusting Asset Allocation Strategies:

Market trends may change over time, and certain sectors may benefit from economic and policy changes. By studying the past-year performance of various sectors, we can better predict future market trends and adjust our asset allocation strategies accordingly. For example, in the year of technological prosperity, we might increase the allocation of technology ETFs to pursue better returns.

Here are some potential asset allocation strategies:

- Industry diversification: Choose different industry ETFs based on market trends and the performance of various industries to achieve better diversification benefits.

- Regional diversification: Invest in corresponding regional ETFs based on different regions’ economic conditions and growth prospects to diversify risk.

- Asset diversification: Diversify the portfolio into different asset categories, such as stocks, bonds, commodities, etc., to reduce specific asset risks.

- Time diversification: Periodically rebalance the investment portfolio, adjusting the allocation based on market conditions.

Asset allocation strategy aims to build a balanced portfolio that adapts to different market environments. Through regular reviews of ETF performance, we can better understand market trends and make wise decisions in asset allocation.

SUMMARY OF 3 STOCK SELECTION RECOMMENDATIONS FOR ETF INVESTORS

- Before Buying, Research the ETF Thoroughly

In recent years, ETFs have gained significant popularity, with various financial institutions introducing a multitude of ETFs with different names and characteristics. Without in-depth understanding, investors may not know the reasons behind the price movements—why they rise or fall. Investors must thoroughly understand what they are investing in before buying an ETF.

- Understand the Intricacies of ETFs, Don’t Fear Buying at High Prices

If the premium or discount is too large, it means that the ETF’s market price deviates significantly from its net asset value (NAV). Therefore, investors should avoid buying when a high premium exists, as it means buying at an expensive price. Generally, when the premium exceeds 3%, caution is advised.

- Conduct Proper Valuation, Patiently Wait for Suitable Entry Points

By calculating cheap and fair valuations, investors can buy with peace of mind and patience, waiting for suitable entry points.

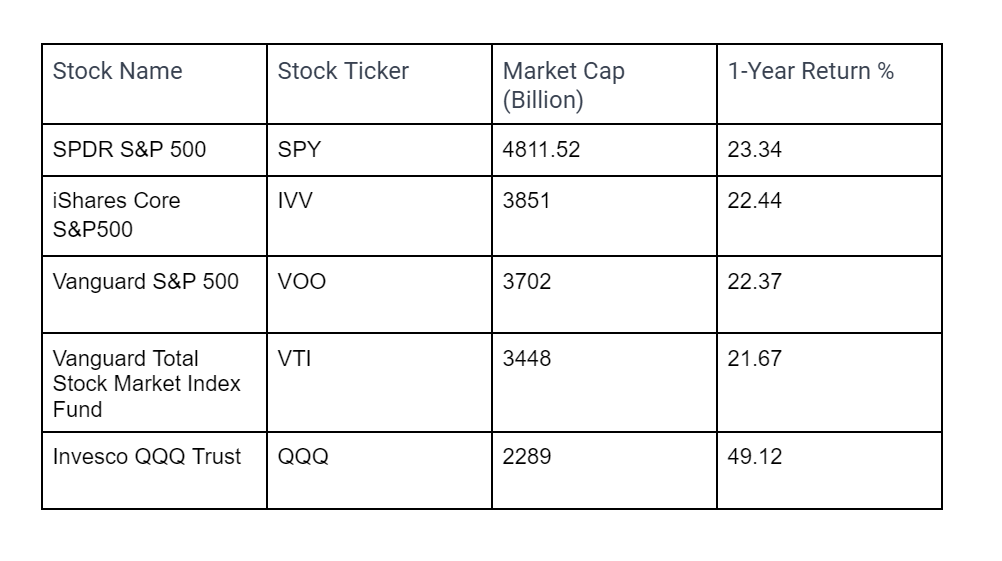

TOP 5 U.S. STOCK ETFS BY MARKET CAPITILIZATION

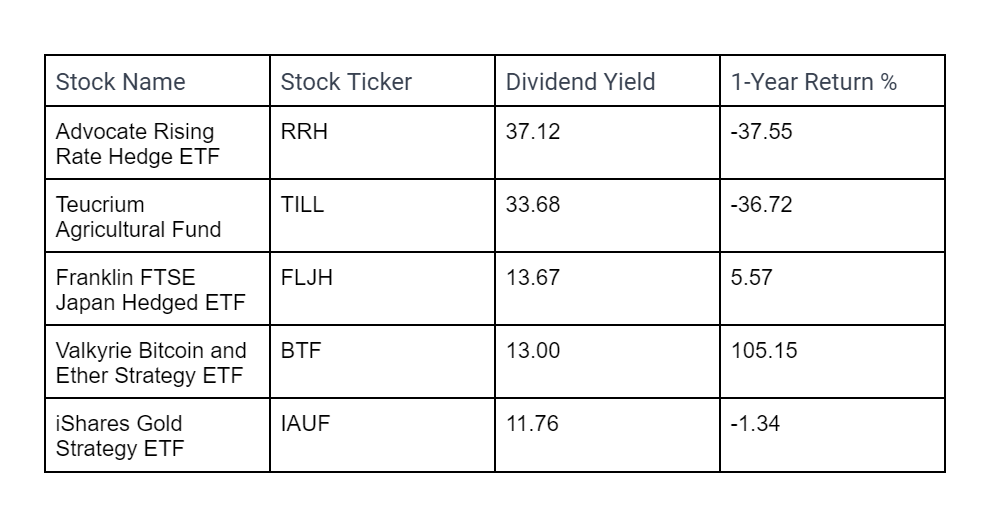

Top 5 High Dividend Yield ETFs:

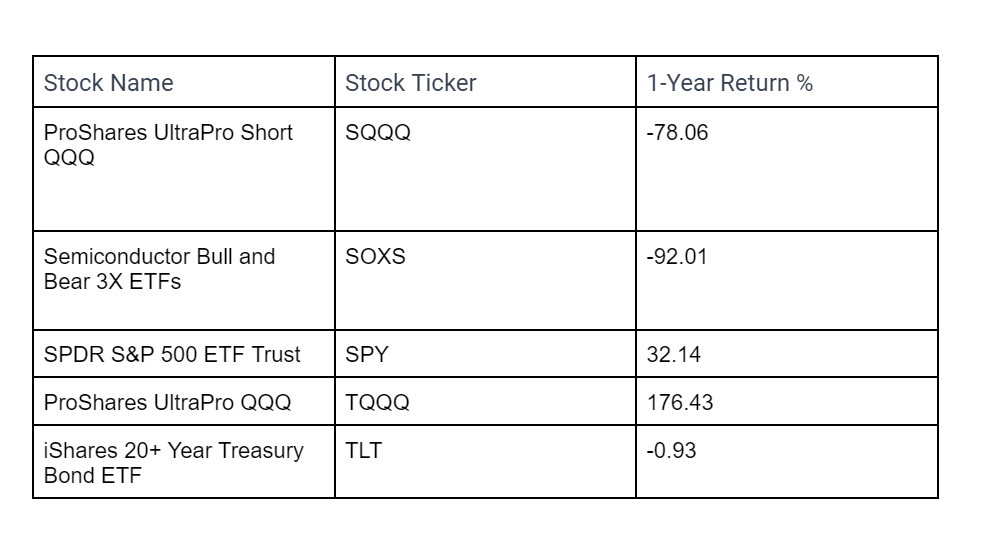

Top 5 ETFs by Trading Volume:

POSSIBLE NEW ETFS IN 2024

ETFs represent the current paradigm shift in the stock market. Even in the more established United States, the total assets of ETFs have grown 2.8 times in the past decade, reaching $6.5 trillion. The amount is expected to be doubledin the next 5 years. However, in theyear of 2024, ETFs may no longer be limited to traditional stock combinations but could venture into the blockchain domain, particularly by tokenizing cryptocurrencies.

Investors may have noticed the recent focus on the impending ETFization of cryptocurrencies, with major asset companies actively applying for Bitcoin ETFs. Market optimism suggests that the U.S. Securities and Exchange Commission (SEC) is likely to approve a Bitcoin spot ETF soon, possibly before January 10, 2024. This anticipation has fueled several recent surges in the virtual currency market.

Since 2023, Bitcoin has surged approximately 152%, reaching a 19-month high on December 4th at $42,144, the highest price since April 2022. While it has retraced to around $41,000, there are expectations that 2023 might surpass the records set in 2020, marking a definitive end to the bear market.

Reports indicate that the SEC is currently reviewing more than 10 applications for Bitcoin spot ETFs, including major asset management giants such as Grayscale, BlackRock, and Fidelity, which seek to convert their Bitcoin trust funds into Bitcoin spot ETFs.

According to FOXBusiness reporters Charles Gasparino and Eleanor Terrett, the SEC is holding a rare joint conference call with potential Bitcoin spot ETF applicants. Insiders revealed that this is to ensure that everyone is on board with creating Bitcoin ETFs using cash. Simultaneously, the SEC requests issuers to remove all indications of physical redemption from their application documents.

Yet shortly after, Bloomberg analyst Eric Balchunas clarified that it is not a large-scale conference call between the SEC and all Bitcoin spot ETF issuers but multiple meetings with exchanges/issuers. The SEC is urging applicants to opt for cash creation or be patient.

Regardless, this is seen as a positive sign for advancing the issuance of Bitcoin ETFs, indicating they are entering a substantive discussion phase. Investors are believed to soon witness the listing and issuance of Bitcoin ETFs.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!