KEYTAKEAWAYS

-

Federal Reserve officials suggest the rate-hiking cycle may be over, impacting U.S. Treasury yields.

-

Observing the "term premium" can help gauge bond market sentiment and potential returns.

-

Despite recent declines, bonds may offer a compelling investment opportunity, with ETF options like SHY, IEI, IEF, TLT, and USIG.

CONTENT

Recently, Federal Reserve officials have released dovish signals indicating that the rate-hiking cycle of the U.S. central bank may have come to an end, resulting in an 8.4 basis point drop in the 2-year Treasury yield to 4.995% and an 11.9 basis point drop in the 10-year Treasury yield to 4.663%.

Several Federal Reserve officials have made consecutive mild statements. Raphael Bostic, President of the Federal Reserve Bank of Atlanta, and Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, both expressed that ‘the Federal Reserve has completed its rate-hiking mission.’ The U.S. economy is soft-landing, which means that based on the current overall economic situation, inflation will likely follow the Federal Reserve’s script and fall back to the 2% target, and unemployment rates will not rise significantly.

However, with slowing inflation and signals from the FOMC that the rate hikes are nearing an end, the most critical question for investors may be, ‘Has the investment opportunity in bonds arrived?’

WATCHING THIS INDICATOR FOR THE BOTTOM OF U.S. TREASURY YIELDS: TERM PREMIUM

In the investment world, analysts often discuss the U.S. 10-year Treasury yield, and the reason is quite simple: The 10-year Treasury yield is frequently used as the threshold for setting risk-free rates. In simple terms, any investment product’s expected returns should be higher than the yield on this bond. Otherwise, the risk-return ratio is relatively unfavorable, making it a benchmark for market returns.

However, since the rapid interest rate hikes by the Federal Reserve began in March 2022, investors have experienced the period of prolonged declines in bond prices, with the second-longest and most significant drop in history. Various bond yields continued to surge, expanding investors’ horizons.

As we approach the end of 2023, investors are naturally wondering: ‘After such a prolonged decline, is it finally a good time to invest in bonds?’ and ‘Is there an indicator for observing the halt in U.S. Treasury yields?’

Investing in bonds should be understood from a long-term perspective. In addition to understanding the overall economic trends regarding interest rate direction, investors can also observe an indicator called ‘term premium.’

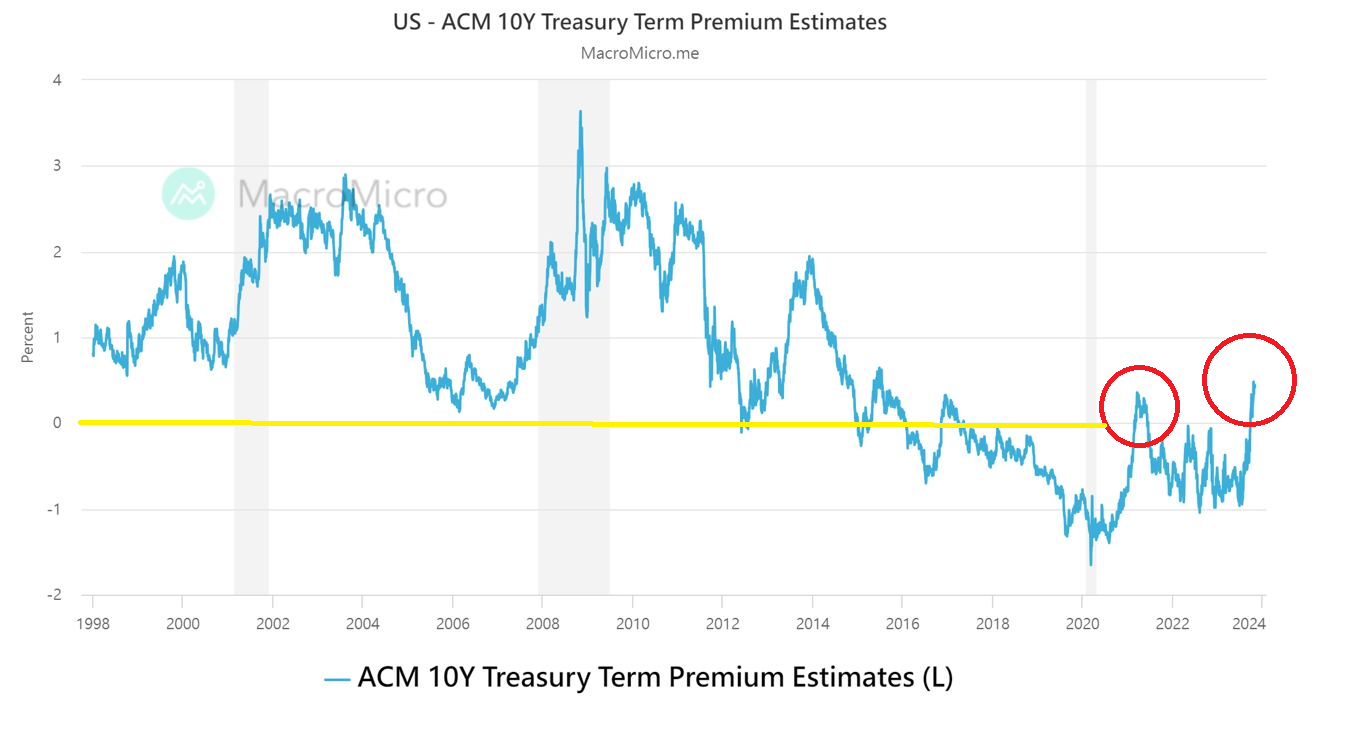

Investors can regard ‘term premium’ as an indicator for gauging market sentiment and demand. According to the chart below, a simple approach is to watch whether the term premium of the 10-year Treasury is above the zero axis. When the term premium is negative, U.S. Treasury yields will likely continue declining with negative returns*.

Conversely, it may indicate the potential for positive returns when it turns positive. In early October this year, the term premium turned positive for the first time since the Federal Reserve began raising interest rates. This sign hints at the inflection point between positive and negative bond returns. However, this doesn’t necessarily mean bonds will take off explosively; further declines may not come by quickly. Remember that holding bonds is a multi-year consideration, and seeing a significant recovery in the short term is still challenging.

(Source: Macromicro)

* Generally, short-term bonds, such as U.S. bonds with maturities of less than two years, directly reflect the Federal Reserve’s interest rate decisions. However, for long-term bonds, such as those with maturities of 10 years or more, due to their extended time horizon and increased uncertainty factors, they not only respond to interest rates but also incorporate an “additional return expected by investors” (sometimes referred to as compensation for investors), which is known as the term premium.

IS BUYING BOND ETFS COST-EFFECTIVE FOR RETURNS NOW?

Next, let’s delve into the returns that investors are most concerned about. Suppose an investor puts money into bond investments today. How should returns be calculated regarding the prevailing U.S. bond yields?

Today, we will take the example of Taipei, Taiwan, a prominent semiconductor hub ranked fourth in the global rankings according to the 2023 NUMBEO global database. Let’s assume an investment in a 12-square-meter property in Taipei, with each square meter priced at 700,000 New Taiwan Dollars, resulting in a total price of 8.4 million New Taiwan Dollars. Data shows that the average rental yield in Taipei is approximately 1.1%, which translates to an average annualized rate of return of around 1.1%. This is equivalent to an annual rental income of 92,400 New Taiwan Dollars.

Yes, you read that right. These numbers are calculated based on the database. Rental income from real estate has significantly declined recently, and this calculation does not even consider tax implications. Investors can use the database to see how rental yields in their countries compare to bond investments.

Returning to the topic of bonds, if an investor puts money into bonds today, what kind of return can they expect? Let’s consider well-known U.S. bonds such as ‘TLT’ (U.S. Treasuries) and ‘USIG’ (U.S. Corporate Bonds). The yield levels for these two U.S. bonds are 3.86% and 3.72%, respectively, which imply higher returns compared to investing in rental properties.

Note: ‘TLT’ and ‘USIG’ are well-known exchange-traded funds (ETFs) representing U.S. Treasuries and U.S. Corporate Bonds, respectively.

(Source: INVESTING)

(Source: INVESTING)

While looking back at the prices of long-term bonds from 2018 to the present, the yields appear to be in the negative range. However, this represents the lowest bond prices in five years for prospective investors.

It’s essential to remember the relationship between the overall economic cycle and bonds. In a high-interest rate environment, bond prices tend to be unfavorable. However, it’s this environment that can create attractive yields. Have investors considered the decades ago when savings insurance policies offered interest rates of 8-9%? The current bond market may give investors a golden opportunity to secure a stable income.

With the high interest rates still available, it’s advisable to gradually enter the bond market and build a portfolio, ensuring a foundation of high-yield assets for a more secure retirement in the future.

INTERNATIONAL BOND ETFS

Here we introduce four US government bond ETFs and one corporate bond ETF:

1. SHY (iShares 1-3 Year Treasury Bond ETF)

-

- Key Features: Primarily invests in 1 to 3-year US Treasury bonds, falls into the short-term bond category, characterized by relatively stable prices due to the shorter maturity.

- Average five-year yield: 1.99%

- Bond Type: US government bonds

- Tracking Index: ICE US Treasury 1-3 Year Index

- Risk Level: RR2

2. IEI (iShares 3-7 Year Treasury Bond ETF)

-

- Key Features: Has an average duration of 4.56 years, considered medium-term bonds, with holdings comprising the highest credit-rated bonds, rated AAA by S&P. It provides diversified exposure to about 65 bond holdings with a low net expense ratio of around 0.15%.

- Average five-year yield: 1.73%

- Bond Type: US government bonds

- Tracking Index: ICE U.S. Treasury 3-7 Year Bond Index

- Risk Level: RR2

3. IEF (iShares 7-10 Year Treasury Bond ETF)

-

- Key Features: Classified as medium to long-term bond ETF, paying monthly dividends and balanced risk and return, IEF is suitable for investors seeking moderate risk and returns. Note that its price is affected by changes in market interest rates, but it is generally considered not to default.

- Average five-year yield: 2.31%

- Bond Type: US government bonds

- Tracking Index: ICE U.S. Treasury 7-10 Year Bond Index

- Risk Level: RR2

4. TLT (iShares 20+ Year Treasury Bond ETF)

-

- Key Features: TLT focuses on long-term bonds with maturities of over 20 years, which are more sensitive to interest rate changes. However, it offers higher yields compared to most government bonds.

- Average five-year yield: 2.77%

- Bond Type: US government bonds

- Tracking Index: ICE U.S. Treasury 20+ Year Bond Index

- Risk Level: RR2

5. USIG (iShares Broad USD Investment Grade Corporate Bond ETF)

-

- Key Features: USIG primarily invests in investment-grade corporate bonds in the US with maturities ranging from 3 to 10 years. It is suitable for investors looking for stable income, with around 20% of its holdings in financial industry bonds.

- Average five-year yield: 3%

- Bond Type: Corporate bonds

- Tracking Index: Bloomberg Barclays U.S. Intermediate Corporate Bond Index

- Risk Level: RR2

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!