KEYTAKEAWAYS

- Warren Buffett makes a significant investment in US Treasuries amid easing inflation and nearing interest rate hikes.

- Bonds and bond ETFs are emerging as attractive investment options, offering stability and potential returns.

CONTENT

With inflation easing and the interest rate hike cycle nearing its end, Warren Buffett just bought $10 billion worth of US Treasuries this month. In 2023, with investors enthusiastically seeking stable yields and price differentials, bonds have emerged as a popular investment. But what exactly are bonds? How can one invest in them? ETFs are among the most popular options when investors seek to invest in bonds. Today, our financial editor will explore what bonds and bond ETFs are and also recommend popular American bond ETFs, helping investors make wise choices in the bond markets via ETFs.

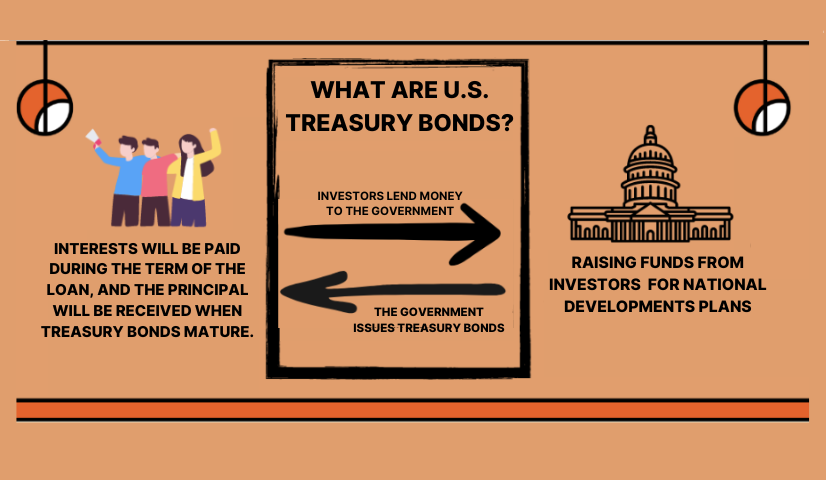

WHAT IS A BOND?

A bond is a tradable security that an organization issues to raise money. The issuer and bondholders agree that the issuer will pay a fixed interest rate to the bondholders over a specified period and repay the borrowed amount at maturity. The purchaser of the bond becomes the creditor, while the issuer becomes the debtor. The bond represents the creditor’s claim against the issuer. For example, when an investor buys US Treasury bonds, it means they are lending money to the issuer, the US government. Similarly, purchasing corporate bonds means lending money to a company.

Generally, a bond contains the following information:

- Face value: The amount that the issuer borrows and promises to repay to the bondholders at the maturity date.

- Coupon rate: The annualized interest rate paid by the issuer to the bondholders.

- Interest payment period: How often the interest is paid.

- Maturity date: The date when the principal will be repaid.

For instance, investing in a 20-year government bond with a face value of $10,000, a coupon rate of 5%, and a 6-month interest payment period. The government will pay $250 (2.5% of $10,000) as interest to the investor once every 6 months and return the full borrowed amount 20 years after the issuance date.

TYPES OF BONDS

Bonds can be categorized in several ways. The following are common classification methods:

1. Issuer-based classification:

-

- Government Bonds: Issued by the government

- Corporate Bonds: Issued by companies

2. Risk-based classification:

-

- Investment-grade Bonds: Bonds with investment-grade ratings (e.g., AAA S&P rating, etc.)

- Junk Bonds: Bonds with lower credit ratings (e.g., CCC S&P rating, etc.)

3. Regional classification:

-

- Emerging Market Bonds: Issued by developing economies

- Developed Market Bonds: Issued by economically advanced and stable countries

DIFFERENCES BETWEEN SHORT-TERM AND LONG-TERM BONDS

The difference between a short-term and a long-term bond lies in their respective maturity periods. This may sound like an obvious statement, but the maturity date of a bond profoundly affects its characteristics. In simple terms, the longer the duration, the higher the risk exposure, leading to both higher price volatility and coupon rates. Let’s highlight the characteristics of each type:

Short-Term Bond Features:

- Relatively Stable: With a shorter time to maturity, the price volatility tends to be more stable, making it suitable for conservative investors.

- Lower Yield: Due to their shorter term, short-term bonds usually offer relatively lower interest rates, resulting in limited investment returns.

Long-Term Bond Features:

- Higher Yield: With a longer time to maturity, long-term bonds typically offer higher interest rates, making the investment returns more attractive.

- Higher Price Volatility: Due to the longer term, long-term bonds may be more susceptible to significant market fluctuations, resulting in higher risk.

RISKS OF BONDS

After exploring various bonds, one might wonder if bonds are truly without risks. All financial instruments inherently carry risks, which vary in degree. International economic and political conditions also have an impact on bonds, and there are a number of risks to take into account:

- Interest Rate Risk: Interest rate risk refers to the risk of bond prices declining due to rising market interest rates. When investors hold fixed-rate bonds, an increase in market interest rates makes newly issued bonds more attractive with higher rates. Consequently, the existing fixed-rate bonds may lose appeal in the market, leading to price declines.

- Credit Risk: Also known as default risk, credit risk pertains to the possibility that the bond issuer may not be able to make timely interest payments or fully repay the debt. If the issuer encounters financial difficulties or goes bankrupt, investors may not receive the full or partial principal and interest of the bond.

- Liquidity Risk: Liquidity risk refers to the possibility that certain bonds in the market may be challenging to buy or sell quickly due to a high bid/ask spread. This may hinder investors from transacting at expected prices when needed.

- Inflation Risk: Inflation risk involves the impact of inflation on bond investments. When inflation rates rise, the real purchasing power of fixed-rate bonds held by investors may decrease, resulting in reduced actual returns.

WHAT ARE BOND CREDIT RATINGS?

Investing in a bond ETF is akin to holding a basket of bonds. Owning bonds is akin to lending money to others, and the biggest fear is the risk of default. However, as long as the bond’s credit rating is in the investment-grade category, the risk of default is rather minor.

So, what is a credit rating? It’s quite simple. Bond credit ratings are assigned by professional credit rating agencies, with the most well-known international agencies being Moody’s, Standard & Poor’s (S&P), and Fitch Ratings (recently gaining prominence).

Investment-grade bonds include the highest ratings, from AAA to BBB-. Ratings starting from BB+ and below are considered junk bonds, with D being the worst rating. The higher the rating, the lower the risk of default.

Generally, bonds issued by governments are considered safer than corporate bonds, but there are exceptions, such as during times of war or major government crises.

WHAT ARE BOND ETFS?

Regarding Bond ETFs, they are exchange-traded funds that track the performance of specific bond market indices. Which means, generally, you will make profits or take losses as if you were holding a bag of bonds when holding bond ETF shares.

Bond ETFs operate similarly to stock ETFs, as they are listed on the stock exchange for purchasing and selling in a much smaller quantity. They offer liquidity and trading convenience, making it easier for investors to participate in the bond market without directly owning individual bonds.

HOW TO BUY BOND ETFS

The process of purchasing a bond ETF is relatively straightforward and similar to buying stocks:

- Choose a suitable brokerage or trading platform: Select a reliable brokerage or online trading platform that offers the bond ETF products you are interested in.

- Open a trading account: Complete the account opening process based on your chosen brokerage or platform, which typically requires providing identification and relevant bank account information.

- Search and select the bond ETF: Once your trading account is successfully set up, you can search for and choose the bond ETF products that pique your interest through the platform.

- Place an order to buy the bond ETF: After selecting the appropriate bond ETF, make the purchase through the trading platform. Enter the desired number of shares or amount and confirm the transaction.

- Monitor your investment: After buying the bond ETF, regularly monitor the performance and market trends of the fund, and make adjustments as needed.

Note: Any investment requires planning and research, and bond ETF investments are no exception. Investors can start by researching the fund size, fees, liquidity, and types to help make informed investment decisions.

THREE KEY INDICATORS TO CONSIDER FOR BOND ETFS

- Bond Category: Based on historical experience, A-rated investment-grade bonds and US Treasury bonds tend to be more likely to appreciate. It is important to note that bond ratings are classified based on various risks, not necessarily indicating that higher ratings always yield better returns. On the other hand, non-investment-grade bonds, commonly referred to as junk bonds, belong to lower-rated categories and are issued by companies with higher default risks.

- Duration: The longer the duration, the more sensitive the bond is to interest rate changes, which refers to the time it takes for the bond to reach maturity. For example, if interest rates decrease by 1%, bonds with longer durations are more likely to appreciate, and vice versa. However, the duration itself does not determine absolute goodness or badness, as it depends on the prevailing interest rate trend at the time.

- Yield: Extremely high or low bond yields are normally not ideal. High yields often come with higher risks, such as C-rated bonds (high-yield bonds), with default rates potentially exceeding 20%. On the other hand, AAA-rated corporate bonds have very low default rates, but their yields may not be as attractive. However, it is important to remember that bond yields are fixed, while prices are not. Through price fluctuations, investors may sometimes have opportunities to buy bonds that are both secure and offer higher yields.

5 POPULAR US BOND ETFS

If you want to invest directly in US bond ETFs, you can do so through overseas brokerages or domestic commission agents. The most well-known US Treasury ETFs are SHY, IEI, IEF, and TLT, all issued by iShares, which are the largest in their category. Additionally, there is USIG, which focuses on corporate bonds.

SHY

- Highlights: Primarily invests in US Treasury bonds with remaining maturities between 1 and 3 years; it falls under the short-term bond category, and due to its short duration, SHY exhibits stable price fluctuations over the long term.

- Average 5-year yield: 1.99%

- Bond category: US government bonds

- Tracking index: ICE US Treasury 1-3 Year Index

- Risk level: RR2

IEI

- Highlights: The ETF invests in US Treasury bonds with remaining maturities between 3 and 7. It has a weighted average maturity of 4.74 years as of this writing, which makes it fall under the medium-term bond category.

- Average 5-year yield: 1.73%

- Bond category: US government bonds

- Tracking index: ICE U.S. Treasury 3-7 Year Bond Index

- Risk level: RR2

IEF

- Highlights: Falls under the medium- to long-term bond category and strikes a balance between risk and return. It suits investors seeking moderate risk and returns, but it is essential to be cautious about the impact of market interest rate fluctuations on its price. However, it has a significantly lower expense ratio of 0.04%.

- Average 5-year yield: 2.31%

- Bond category: US government bonds

- Tracking index: ICE U.S. Treasury 7-10 Year Bond Index

- Risk level: RR2

TLT

- Highlights: TLT is a long-term Treasury ETF with a duration of 20+ years, making it sensitive to interest rate changes, but at the same time, it offers relatively higher returns more often.

- Average 5-year yield: 2.77%

- Bond category: US government bonds

- Tracking index: ICE U.S. Treasury 20+ Year Bond Index

- Risk level: RR2

USIG

- Highlights: USIG primarily invests in investment-grade corporate bonds with maturities ranging from 1 to 10 years. It is suitable for investors seeking stable income, and approximately 20% of its holdings consist of bonds from the financial sector.

- Average 5-year yield: 3%

- Bond category: Corporate bonds

- Tracking index: ICE BofA US Corporate Index

- Risk level: RR2

FINAL THOUGHTS

In general, bonds possess characteristics of low risk and are considered a fixed-income investment tool that provides stable interest payments. They also tend to exhibit a negative or low correlation with stocks, which could help investors reduce portfolio volatility and hedge risks from the stock market. Looking back over the past 100 years, occurrences of a “double decline” in both stocks and bonds, such as in 2022, have been relatively rare, happening only five times.

The value of bond investments remain relatively stable over time, with interest rates and overall economic trends being the most critical factors. Rising interest rates tend to suppress bond prices, while rate cuts can lead to price increases. To simultaneously enjoy “high dividend yields” and “capital gains,” it is essential to understand the principles of the overall economic cycle. Bond yields are fixed, but dividend yields depend on the purchase price. When the period of rising interest rates comes to an end and shifts towards rate cuts, bond prices may have room for appreciation, offering investors opportunities to benefit from price differentials.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!