KEYTAKEAWAYS

-

QQQ is a well-established ETF tracking the Nasdaq-100 Index, featuring large-cap growth stocks. With over 25 years of history and a size exceeding $100 billion, it offers investors excellent liquidity.

-

QQQ's top holdings include tech giants like Apple, NVIDIA, Meta, Amazon, and Google. While heavily weighted in technology (57.05%), it also diversifies into consumer industries (18.67%) and healthcare (7.07%).

-

QQQ provides diversification, liquidity, and growth potential at a relatively low cost. However, its performance is highly tied to a few tech companies, posing concentration and market risk. Long-term holding is recommended for potential explosive gains.

CONTENT

In recent times, the global markets have shaken off the specter of interest rate hikes as we enter the radiant month of October. The Nasdaq Index, after consolidating for several days, has managed to cross the 120-day moving average and the monthly trendline at the juncture of long and short positions. Faced with the late-stage economic cycle, how should investors diversify their risk and position themselves for future trends? Today, we’ll introduce one of the most established and popular US stock ETFs that tracks the Nasdaq 100 Index – “QQQ.”

In this article, we will discuss the following questions deeply: What exactly is “QQQ”? What index does it follow, and which stocks are included in it? Who are the suitable investors for it? Let’s get all the answers today.

WHAT IS QQQ?

QQQ is an ETF established in 1999, with a history of over 25 years. Its investment objective is to track the performance of the Nasdaq-100 index, selecting large-cap growth stocks from the Nasdaq 100 index as its constituent components. The fund has a size of over $100 billion and offers excellent liquidity.

QQQ TRACKING INDEX

QQQ tracks the “Nasdaq-100 Index,” where the “100” in the name refers to the top 100 companies in terms of market capitalization on the Nasdaq exchange. The Nasdaq Index is known for its heavy weighting in technology stocks, but it’s essential to note that it isn’t solely composed of tech companies. It also includes various public enterprises, healthcare stocks, and even retailers such as Amazon and Costco. However, one thing is certain – the index excludes financial stocks. QQQ functions more like a package of large-cap growth stocks, representing a diverse range of industries, not just technology.

QQQ CONSTITUENT STOCKS

Looking at the major holdings of QQQ provides a clearer understanding of the concept of “large-cap growth stocks.” Here are the top 10 holdings by weight in QQQ.

(Source:invesco.com)

From the chart above, it’s evident that QQQ comprises many well-known American large corporations, such as APPLE, NVIDIA, META, AMAZON, and GOOGLE. In a way, investing in QQQ is akin to purchasing a basket of stocks from the most elite American companies, becoming their shareholders and sharing in the benefits of the global tech wave.

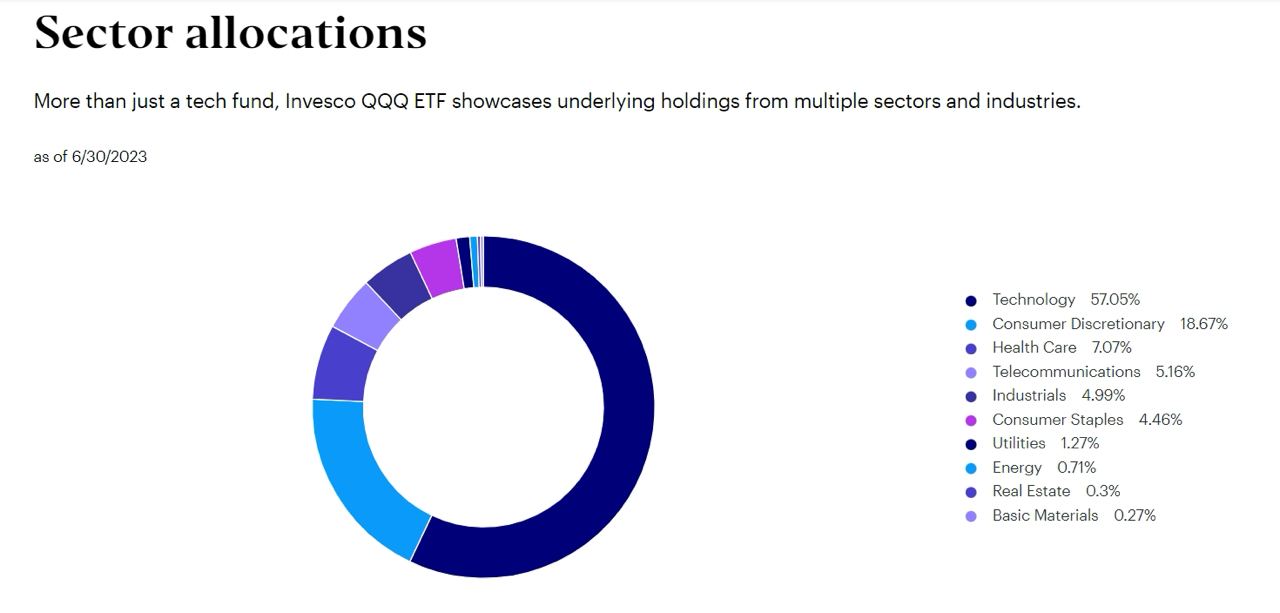

(Source:invesco.com)

Of course, when considering QQQ constituents, it’s essential to not only look at the proportions but also the industry sectors. From the chart above, it’s evident that QQQ’s major holdings are concentrated in the technology sector (57.05%), followed by consumer industries (18.67%) and healthcare (7.07%). Clearly, QQQ can be described as an ETF closely intertwined with the technology industry.

QQQ DIVIDENDS AND EXPENSES

Two of the most critical aspects of an ETF are its costs and dividends, which investors closely monitor. QQQ has an expense ratio of 0.2%, which, in comparison to various ETFs worldwide or similar ones, isn’t particularly high. However, it’s crucial not to underestimate these expenses because they can significantly erode an investor’s returns over the long term. Both returns and expenses compound over time, so investors must be vigilant.

Now, let’s talk about dividends. QQQ distributes dividends on a quarterly basis, as of October 6, 2023, with a yield of approximately 0.59%. Although it manages to provide annual distributions, the dividend yield may not be particularly attractive from a yield perspective. Nevertheless, investors should be aware that there is an unspoken consensus among U.S. companies, especially in the tech sector, that they tend to avoid distributing profits to investors. They prioritize reinvesting their earnings into research and development and capital expenditures to maintain a competitive edge in their respective industries, ultimately leading to better corporate and profit growth. Investors may want to consider this perspective when evaluating whether the lower dividend yield of QQQ is acceptable to them.

QQQ PROS AND CONS:

1. Pros:

- Diversification: QQQ includes companies from various industries, such as technology, the internet, biotechnology, and more, allowing investors to achieve industry diversification.

- Liquidity: QQQ is a highly liquid trading instrument with significant daily trading volume, making it easy for investors to buy and sell shares.

- High Growth Potential: As QQQ’s constituent stocks are primarily from the technology and internet sectors, which often have high growth potential, QQQ may achieve long-term capital appreciation.

- Low Costs: QQQ typically has a relatively low expense ratio, enabling investors to participate in the market at a lower cost.

2. Cons:

- High Concentration: QQQ’s performance is highly reliant on a few large technology companies, and if these companies encounter issues, QQQ may be adversely affected.

- Risk: While QQQ offers high growth potential, it also comes with higher market risks, especially during periods of significant market volatility.

- Limited Industry Representation: QQQ includes only 100 companies and is heavily concentrated in the technology sector, which may not fully represent the entire market.

- Nasdaq Market Volatility: As QQQ represents the Nasdaq market, it is directly impacted by the market’s volatility, potentially leading to uncertainty for investors.

THE IMPORTANT STRATEGY FOR INVESTING IN QQQ: LONG-TERM HOLDING

(Source:tradingview)

Of course, for investors, the most important aspect of being in the market is profitability, and this is an enduring truth. But can investing in QQQ achieve this goal? We can evaluate this based on past performance. As seen in the chart above, you can clearly observe the performance over the past 20 years. Compared to investing in a global market ETF (VT), QQQ is an asset that has withstood the dot-com bubble, the financial crisis, the US-China trade war, and even the current pandemic and historically aggressive interest rate hikes, while still maintaining positive returns. Despite significant pullbacks during major events, holding QQQ for the long term has seen remarkable gains, with returns soaring to an astounding 520%. Therefore, if you’re interested in the growth potential of tech stocks, it’s advisable to consider adding gradually during market pullbacks or using a dollar-cost averaging approach. In the long run, explosive performance is likely to be achieved.

WHO IS SUITABLE FOR QQQ?

(Source:tradingview)

From the stock selection approach of QQQ, it’s evident that it primarily focuses on industries such as technology and communications, resulting in a concentration in these sectors. Therefore, before investing in QQQ, investors should first ask themselves whether they can accept a concentration of assets in tech stocks and the price fluctuations that come with significant market volatility. If they can, then QQQ can be an excellent choice.

However, if investors are looking to diversify across different regions, they might consider VT (a global stock ETF). Alternatively, if they want to diversify across various sectors within the United States, they can choose SPY (S&P 500 Index ETF). Of course, investors can also easily allocate their assets across different strategy ETFs to achieve true risk diversification.

In summary, QQQ is suitable for those who are interested in diversifying their investments in tech stocks and for individuals who are actively seeking growth opportunities and have the risk tolerance to handle market fluctuations.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!