- MicroStrategy has acquired an additional 15,400 BTC, bringing its total holdings to over 402,000 BTC.

- More companies, including MicroStrategy and Tesla, are investing in Bitcoin as a hedge against inflation and currency devaluation.

- Tech giants like Apple and Amazon remain cautious about directly investing in Bitcoin, focusing instead on blockchain technology.

TABLE OF CONTENTS

MicroStrategy has significantly increased its Bitcoin holdings to over 402,000 BTC, positioning it as a hedge against inflation. Other companies like Tesla have followed suit, while major tech firms such as Apple, Amazon, and Meta remain cautious but explore blockchain technologies, showing an interest in digital assets despite market uncertainties.

According to an 8-K filing with the SEC on Monday, business intelligence firm and major Bitcoin holder MicroStrategy acquired an additional 15,400 BTC between November 25 and December 1, at an average price of $95,976 per Bitcoin, totaling about $1.5 billion. The company had previously sold 3,728,507 shares of MicroStrategy stock in the same period.

As of December 1, MicroStrategy still has about $11.3 billion worth of stock for sale, aiming to raise $42 billion over the next three years for further Bitcoin acquisitions.

The company currently holds 402,100 BTC, worth over $38 billion, at an average price of $58,263 per Bitcoin, including fees and expenses, totaling approximately $23.4 billion.

MORE AND MORE PUBLICLY LISTED COMPANIES ARE CHOOSING TO HOLD BITCOIN

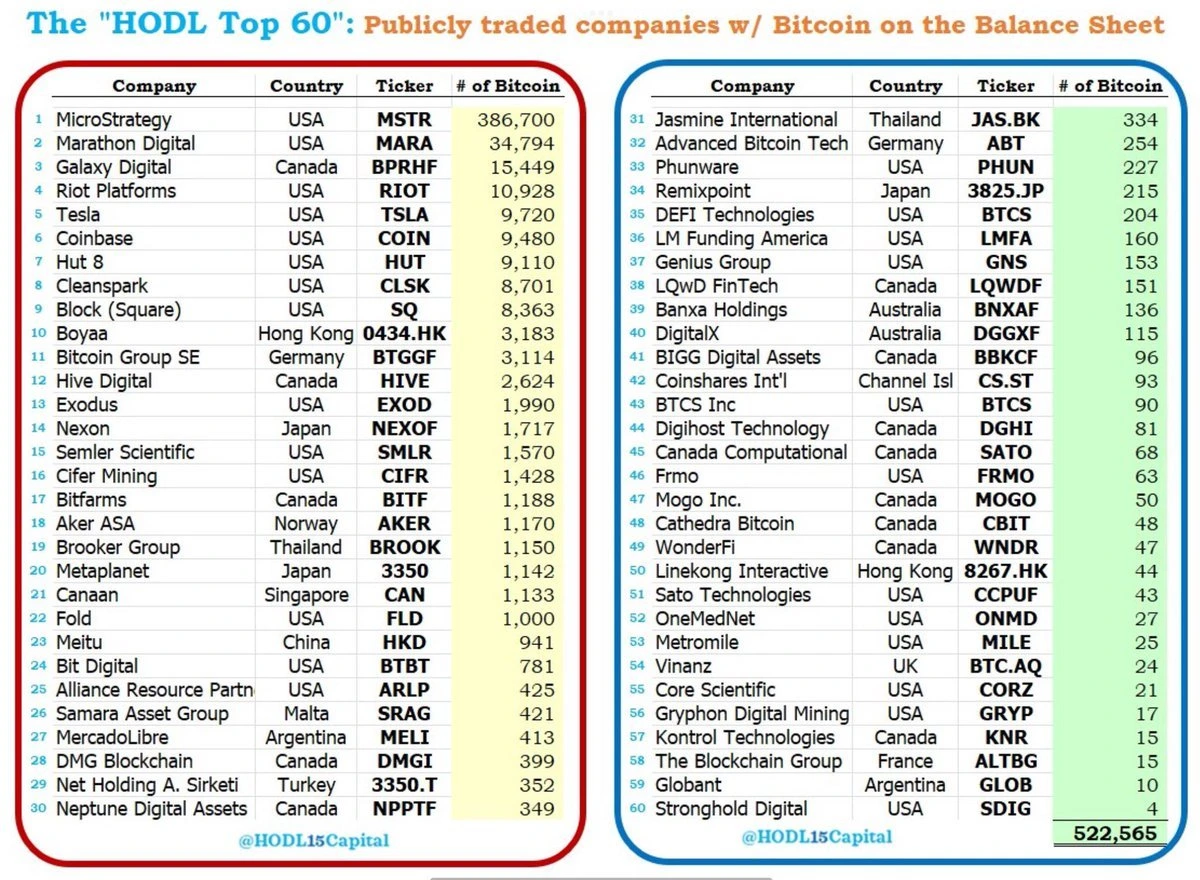

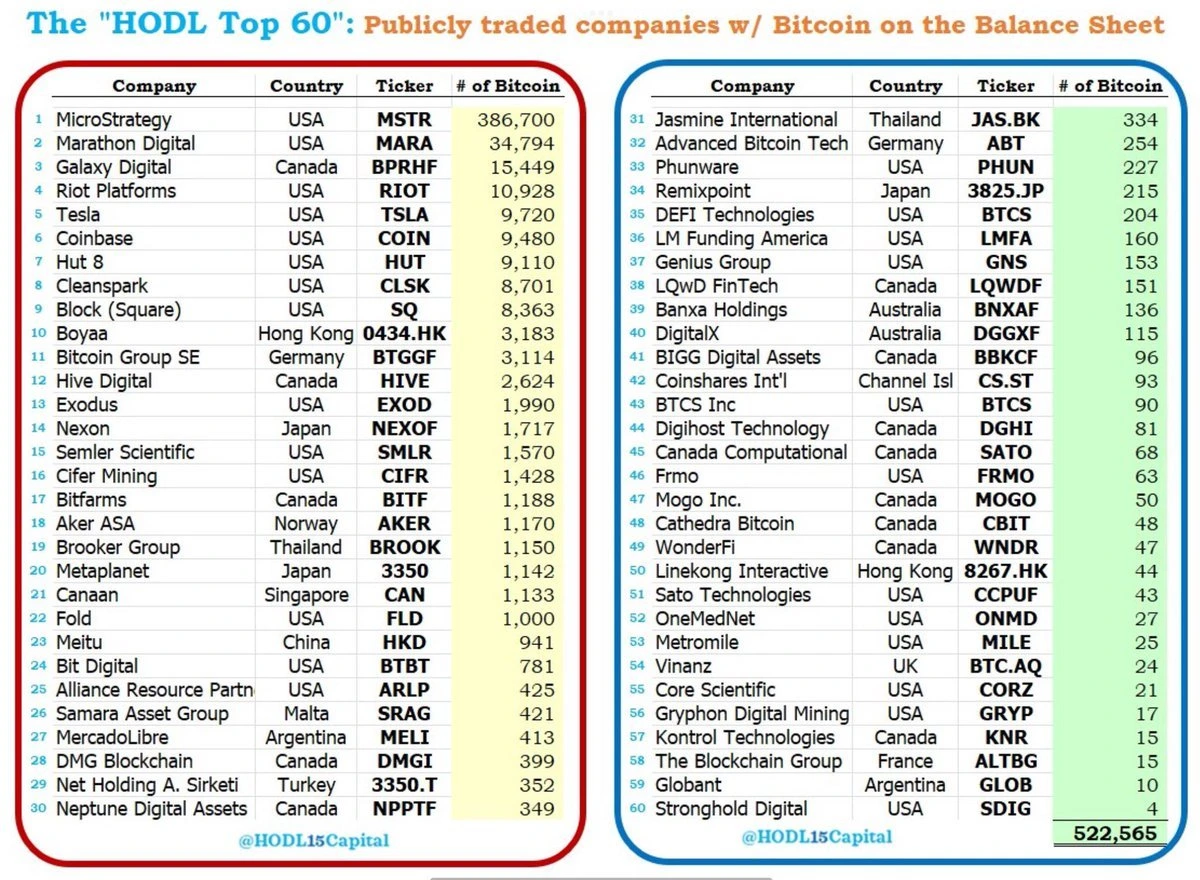

In recent years, more public companies have started buying Bitcoin, especially amid global economic uncertainty and rising inflation. Bitcoin is seen as a hedge against inflation and the devaluation of fiat currencies. Data shows that 60 global companies have used stock issuance to acquire Bitcoin.

Here are six major companies holding Bitcoin:

1. MicroStrategy

Main Business: A leading provider of business intelligence and analytics software, primarily serving enterprise data analysis needs.

Bitcoin Journey: In August 2020, MicroStrategy announced Bitcoin as a primary reserve asset and began increasing its holdings. The company now holds over 402,000 BTC, worth over $38 billion. CEO Michael Saylor views Bitcoin as “digital gold” and a strategic asset to counter the devaluation of the dollar.

2. Marathon Digital

Main Business: A major Bitcoin mining company in North America, focusing on operating high-performance mining facilities.

Bitcoin Journey: Marathon has accumulated approximately 34,794 BTC through efficient Bitcoin mining and direct purchases. The company is also committed to using carbon-neutral energy to reduce environmental impact.

3. Galaxy Digital

Main Business: A cryptocurrency-focused financial services company offering asset management, investment banking, and trading services.

Bitcoin Journey: Galaxy Digital holds 15,449 BTC, with founder and CEO Mike Novogratz being a strong supporter of Bitcoin. He believes Bitcoin will become a crucial pillar of the future financial system.

4. Riot Platforms

Main Business: One of the largest Bitcoin mining companies in the U.S., focusing on efficient and sustainable blockchain mining.

Bitcoin Journey: Riot Platforms has accumulated 10,928 BTC through self-operated mining and by expanding its mining infrastructure. The company also focuses on using green energy to improve energy efficiency and achieve carbon neutrality.

5. Tesla

Main Business: A globally known electric vehicle manufacturer, also involved in clean energy.

Bitcoin Journey: In early 2021, Tesla bought $1.5 billion worth of Bitcoin and briefly accepted Bitcoin as a payment method. Despite suspending Bitcoin payments due to environmental concerns, Tesla still holds around 9,720 BTC, showing trust in cryptocurrency.

6. Coinbase

Main Business: One of the largest cryptocurrency exchanges globally, providing services for buying, storing, and investing in crypto assets.

Bitcoin Journey: Coinbase has accumulated 9,480 BTC through its platform, not only for liquidity optimization but also to demonstrate the company’s confidence in Bitcoin’s long-term value.

WHY SOME TECH GIANTS HAVE NOT ENTERED THE CRYPTOCURRENCY MARKET

Despite many companies embracing Bitcoin, some tech giants remain cautious about entering the cryptocurrency market. The main reasons for this include differences in core business, risk management strategies, and their stance on the crypto market.

1. Apple

Apple’s stance is relatively conservative. CEO Tim Cook has publicly stated that he personally owns Bitcoin, but the company has not made Bitcoin a strategic asset. Apple has made it clear it will not directly invest in cryptocurrencies and has no plans to incorporate them into its business, although it allows crypto wallet apps on the App Store, showing a more open attitude toward the crypto industry.

2. Microsoft

Microsoft briefly accepted Bitcoin payments on its Xbox platform but has not expanded this model to other areas. The company now focuses more on blockchain technology, launching Azure Blockchain Services to help businesses manage and deploy blockchain networks. While Microsoft does not directly engage in the Bitcoin market, its involvement in blockchain technology could allow it to capture related opportunities in the future.

Microsoft briefly accepted Bitcoin payments on its Xbox platform but has not expanded this model to other areas. The company now focuses more on blockchain technology, launching Azure Blockchain Services to help businesses manage and deploy blockchain networks. While Microsoft does not directly engage in the Bitcoin market, its involvement in blockchain technology could allow it to capture related opportunities in the future.

3. Amazon

Amazon has not yet accepted Bitcoin or other cryptocurrencies as payment, but many believe the company may consider entering the space in the future. Amazon continues to focus on its e-commerce business, but its reluctance to enter the cryptocurrency market does not completely rule it out. This cautious approach might be a preparation for future cryptocurrency developments.

4. Meta (formerly Facebook)

Meta launched the Libra (later renamed Diem) stablecoin project but faced regulatory challenges, causing the project to fail. Despite this, Meta is still actively exploring blockchain and cryptocurrency technology, hoping to find breakthroughs that can drive future innovation. While the Libra project failed, Meta has not abandoned its exploration of crypto assets.

CONCLUSION

The hesitation of major tech companies to engage in cryptocurrency is driven by various factors. The volatility of the crypto market can impact financial stability, and many companies prefer to focus on their core business rather than investing in high-risk areas.

Additionally, the uncertain regulatory environment makes companies more cautious, especially under an unclear legal framework. Furthermore, the environmental impact of cryptocurrency mining, such as energy consumption, may conflict with these companies’ sustainability goals.

Tech companies’ attitudes toward cryptocurrency could evolve positively in the future. While some remain cautious now, as market conditions change, more companies may reassess their strategies in the crypto space. Bitcoin is increasingly seen not only as a tool against inflation but also as part of global asset allocation.

With the gradual improvement of the regulatory framework and technological advancements, we can expect more companies to join this trend, contributing to the further development of the cryptocurrency market.

CoinRank x Bitget – Sign up & Trade to get $20!