KEYTAKEAWAYS

- Suiswap distributes 60% of its revenue every 14 days to SSWP token stakers, offering regular dividend earnings.

- Longer staking periods increase your Boost value, leading to higher dividend shares and greater rewards.

- Staking SSWP on Suiswap allows you to earn both platform dividends and additional yield farming rewards.

CONTENT

Suiswap offers platform revenue sharing, staking, and yield farming with SSWP tokens. Learn how to maximize your earnings through staking, Boost value, and rewards.

Suiswap offers a variety of benefits to its users, such as platform revenue sharing, staking, yield farming, and more. In this guide, we’ll explain how SSWP token holders can make the most of these features.

>>> More to read : What is Suiswap? Leading Token Swap Platform

SUISWAP| PLATFORM REVENUE SHARING

Suiswap collects approximately 60% of the platform’s revenue every 14 days and distributes it as dividends to users on the 15th day. Each 14-day period is called an “earning cycle,” with cycles set to 14 days on the mainnet and one day on the testnet.

Users who stake their tokens before the start of a new earning cycle are eligible to receive dividends for that cycle. The dividend share you receive is based on:

- The amount of SSWP you have staked

- Your Boost Value (multiplier)

For example, if the first earning cycle runs from March 1 to March 14 and the second cycle from March 15 to March 28, the revenue generated from March 1 to March 14 will be distributed to users who staked before March 15.

SUISWAP| STAKING PROCESS AND BOOST VALUE

When staking SSWP tokens on Suiswap, users choose a lockup period during which their tokens are secured in a smart contract. During this time, the locked tokens provide two main benefits:

- Earning platform dividends: Receive a share of the platform’s revenue

- Yield Farming: Earn additional SSWP rewards after the lockup period ends

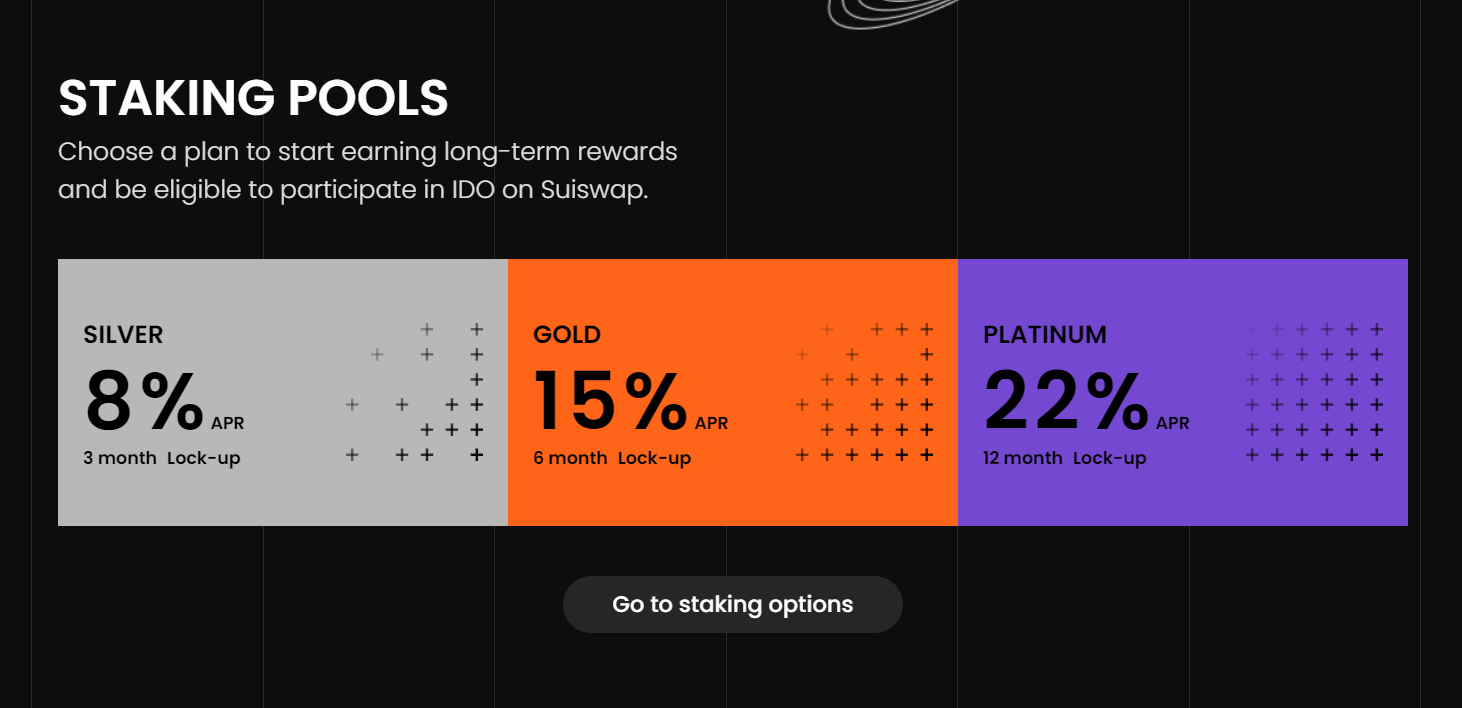

The Boost Value is a multiplier that determines your share of platform dividends, ranging from 1.0 to 7.0, depending on the length of your staking period. The longer you stake, the higher your Boost value, and the greater your share of dividends. For example:

ꚰ Staking 1,000 SSWP with a Boost value of 2.0 yields the same dividend as staking 2,000 SSWP with a Boost value of 1.0.

SUISWAP|YIELD FARMING AND REWARD DISTRIBUTION

By staking SSWP tokens, users can earn additional SSWP rewards. The rewards are based on:

- The amount of SSWP staked

- The length of the staking period

The longer you stake, the higher your Annual Percentage Rate (APR), resulting in greater rewards when you unlock your tokens. It’s important to note that Suiswap has a fixed supply of SSWP, with a portion pre-allocated for staking rewards. Once this allocation is exhausted, no additional staking rewards will be available, but you can still extend your staking period to increase your Boost value.

HOW TO STAKE ON SUISWAP

To start staking on Suiswap:

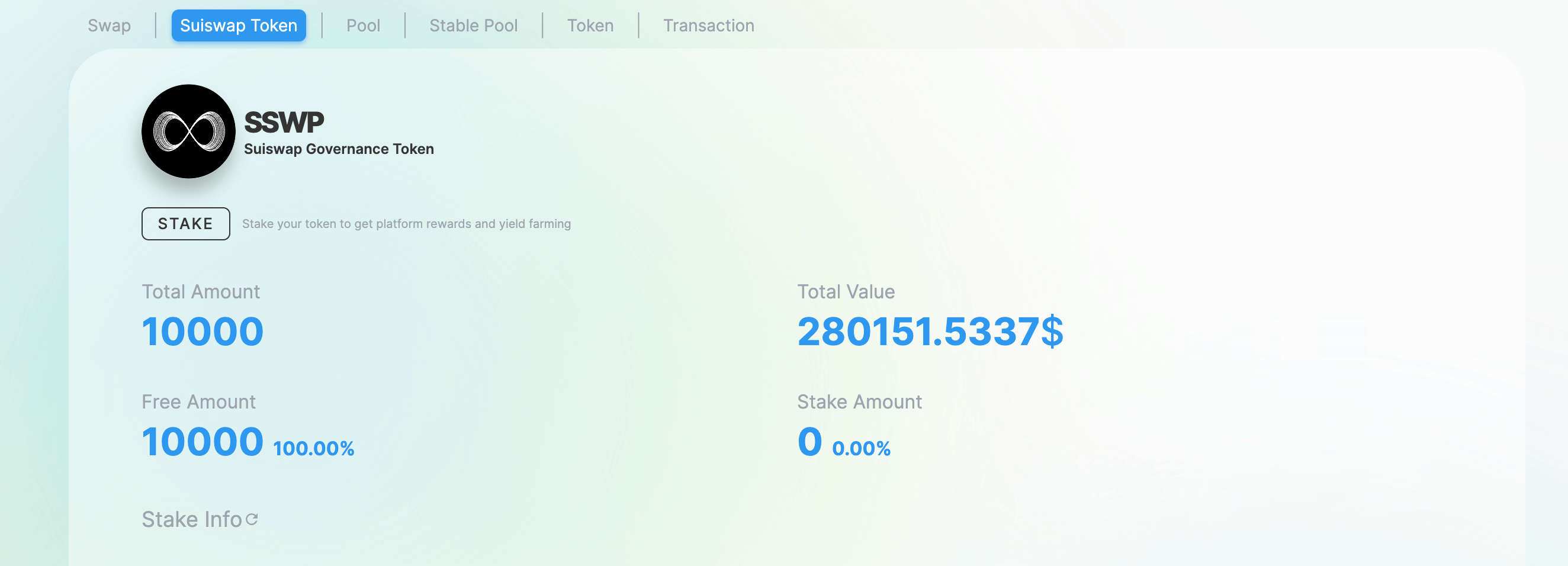

1. Access the Suiswap app and go to the “Suiswap Token” tab.

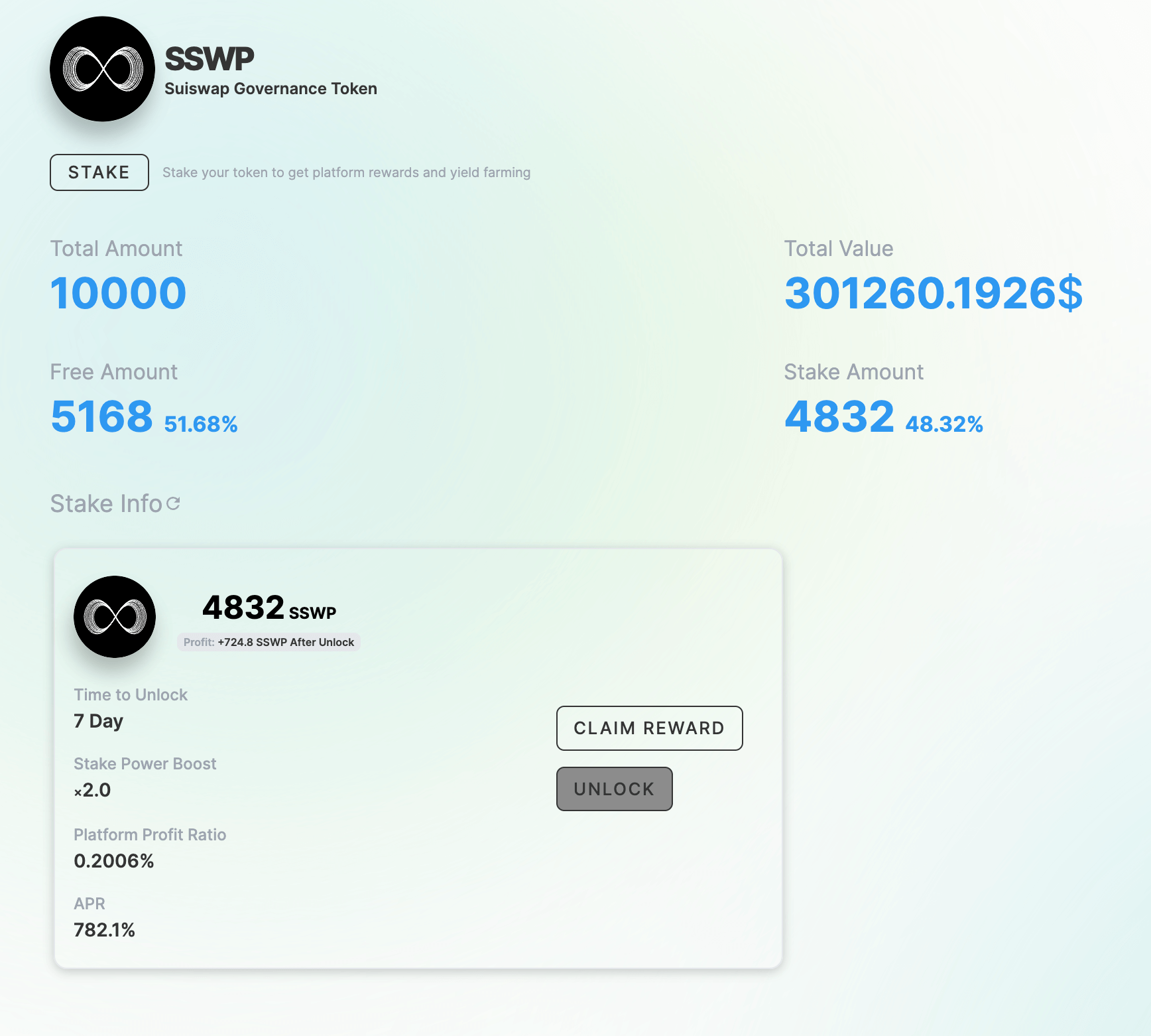

2. Check your holdings: View your total SSWP balance, market value, and currently staked amount.

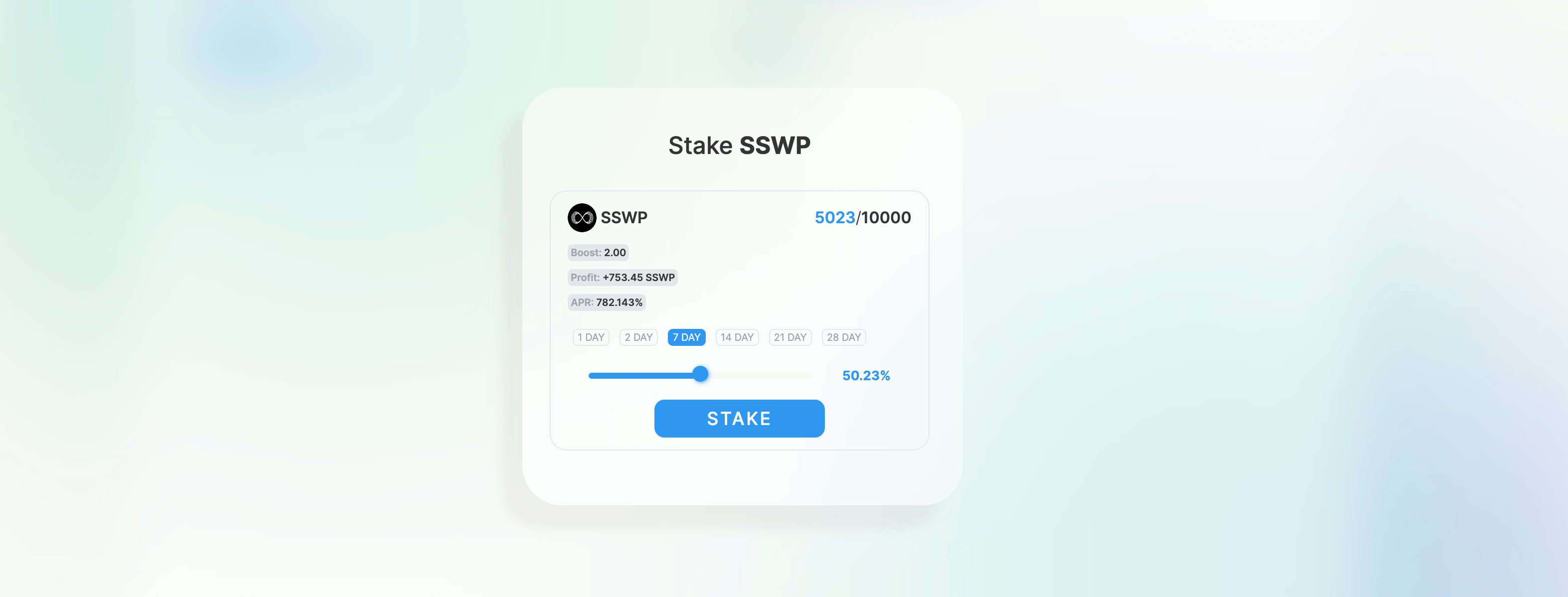

3. Start staking: Click the “Stake” button, then select your desired amount and lockup period in the popup panel.

4. Confirm staking: The system will display your Boost value, estimated rewards, and APR based on your chosen lockup period.

5. You can select one of the staking information panels and then click the “Claim Reward” button to collect platform revenue or the “Unlock” button to unlock your staked SSWP.

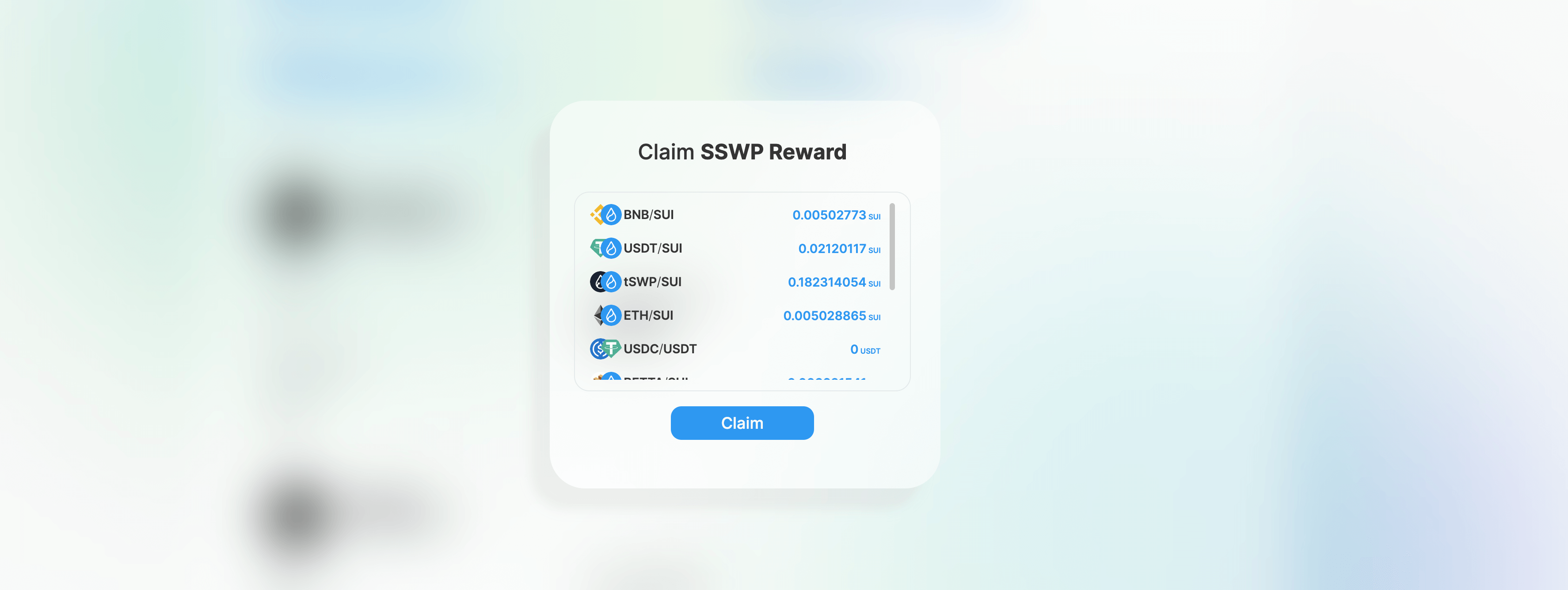

6. When you choose “Claim Reward,” a “Claim-Reward” interaction panel will pop up, displaying your dividend earnings for each liquidity pool in the current earning cycle.

7. Click the “Claim” button to collect all dividend earnings, completing the dividend collection for the current earning cycle.

Once the staking request is submitted, you can monitor your staking information, claim dividends, or unlock your staked SSWP tokens when needed.

➤➤➤ Stake $SSWP Now!

SUISWAP STAKING CONCLUSION

Staking SSWP tokens on the Suiswap platform allows users to participate in platform revenue sharing and enjoy additional yield farming rewards. By carefully selecting your staking period and amount, you can maximize your potential earnings and make the most of Suiswap’s benefits.

>>> More Sui Projects :

- Suipad: The Premier Launchpad for Tier 1 Projects on Sui

- SuiNS | The Future of Digital Identity on Sui

- What Is NAVI Protocol: Leading DeFi on Sui Network

- Cetus on Sui : The Future of DEX

- Scallop: The Future of DeFi on Sui

▶ Buy Crypto at Bitget