KEYTAKEAWAYS

- APR reflects a flat interest rate without compounding, while APY includes compounding effects.

- Knowing the difference helps investors make informed decisions in crypto investments.

CONTENT

Understanding the difference between APR (Annual Percentage Rate) and APY (Annual Percentage Yield) is crucial in the crypto market, as it can significantly impact your investment returns and strategies.

INTRODUCTION

In the dynamic and rapidly evolving world of cryptocurrency, investors are constantly seeking ways to maximize their returns while minimizing risks. Two fundamental financial metrics often encountered in this journey are APR (Annual Percentage Rate) and APY (Annual Percentage Yield). Although these terms are frequently used interchangeably, they represent distinct concepts that can significantly impact investment outcomes.

Understanding the difference between APR and APY is crucial for making informed decisions in the crypto space, whether you’re engaging in lending, staking, or yield farming. This article delves into the definitions of APR and APY, explores their key differences, and provides guidance on which metric to prioritize based on your investment goals.

UNDERSTANDING APR (ANNUAL PERCENTAGE RATE)

Definition of APR

APR, or Annual Percentage Rate, is a financial metric that represents the annual cost of borrowing or the annual return on an investment, excluding the effects of compounding interest. Essentially, APR provides a straightforward percentage that indicates the nominal rate without considering how interest is applied over time. In traditional finance, APR is commonly associated with loans, credit cards, and mortgages, serving as a standard measure for comparing different borrowing options. In the cryptocurrency industry, APR is utilized to describe the interest rates on crypto loans, lending platforms, and some staking rewards. For example, a crypto lending platform might offer a 5% APR, meaning you earn a 5% return on your investment annually without any compounding.

How APR is Calculated

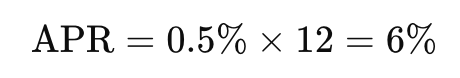

Calculating APR is relatively straightforward. The formula for APR is:

![]()

For instance, if a crypto lending platform offers a monthly interest rate of 0.5%, the APR would be:

This calculation assumes that interest is not compounded, providing a clear and simple representation of the annual interest rate. However, this simplicity can sometimes be misleading, as it does not account for the effects of compounding, which can significantly impact the actual returns or costs associated with an investment or loan.

Pros and Cons of APR in Crypto

Pros:

- Simplicity: APR offers a straightforward and easy-to-understand percentage, making it simple to compare different investment or borrowing options.

- Transparency: By excluding compounding, APR provides a clear view of the nominal interest rate without additional complexities.

Cons:

- Lack of Compounding Consideration: APR does not account for compounding interest, which can lead to underestimating the actual returns or costs.

- Potential Misleading Representation: In scenarios where interest is compounded, APR might not accurately reflect the true financial impact, making it less reliable for long-term investments.

Scenarios:

- Beneficial Use: APR is useful for short-term investments or loans where compounding is minimal or non-existent.

- Less Favorable Use: For long-term investments or loans with frequent compounding, APR may underestimate the true returns or costs, making it less favorable for accurate financial planning.

UNDERSTANDING APY (ANNUAL PERCENTAGE YIELD)

Definition of APY

APY, or Annual Percentage Yield, extends the concept of APR by incorporating the effects of compounding interest. APY represents the real rate of return on an investment, taking into account how often interest is applied and reinvested over a year. In the cryptocurrency sector, APY is frequently used to describe returns on activities such as staking, yield farming, and crypto savings accounts. For example, if a staking platform advertises a 7% APY, it means that with compounding, you will effectively earn a 7% return on your investment over the course of a year.

How APY is Calculated

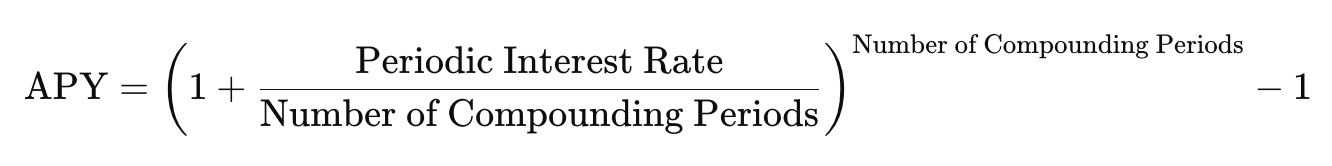

The calculation of APY is more complex than APR because it factors in the frequency of compounding. The formula for APY is:

For example, if a platform offers a monthly interest rate of 0.5%, the APY would be calculated as:

This calculation demonstrates how the frequency of compounding can lead to a higher effective yield compared to the nominal APR. The more frequently interest is compounded, the greater the APY will be, reflecting the true growth of the investment over time.

Pros and Cons of APY in Crypto

Pros:

- Accurate Reflection of Returns: APY accounts for compounding, providing a more precise measure of the actual returns on an investment.

- Better for Long-Term Investments: APY is particularly beneficial for long-term investments where interest is compounded regularly, offering a clearer picture of potential gains.

Cons:

- Complexity: The calculation of APY is more complex than APR, which can make it harder for some investors to understand.

- Potential for Overestimation: In some cases, high compounding frequencies can lead to an overestimation of returns, especially if the underlying investment is volatile.

Scenarios:

- Beneficial Use: APY is ideal for long-term investments, staking, and yield farming in the crypto space where interest is compounded frequently.

- Less Favorable Use: For short-term investments or loans where compounding is minimal, APY might provide unnecessary complexity without significant added value.

KEY DIFFERENCES BETWEEN APR AND APY IN CRYPTO

Compounding Interest

The primary difference between APR and APY lies in the treatment of compounding interest. APR does not account for compounding, presenting a straightforward annual rate. In contrast, APY includes the effects of compounding, which can significantly increase the effective yield over time.

Example: Consider a crypto investment with a nominal interest rate of 6%. If the interest is compounded monthly, the APR would be 6%, while the APY would be approximately 6.17%. This difference arises because APY factors in the additional interest earned from compounding each month.

Impact on Crypto Investments

The choice between APR and APY can greatly influence the returns on various crypto investment products such as staking, lending, and yield farming. Understanding which metric is being used can help investors make more informed decisions based on their investment strategies.

Staking:

- APR: Provides a clear view of the nominal return without considering reinvested rewards.

- APY: Offers a more accurate representation of returns by including the compounding of staking rewards, making it more relevant for long-term staking strategies.

>> Also read: What Is Crypto Staking?: Overview, How It Works, & Future

Lending:

- APR: Useful for understanding the cost of borrowing or the nominal return on lent assets.

- APY: Better for evaluating the actual returns when interest is reinvested or compounded over time.

Yield Farming:

- APR: May underestimate the true returns if yields are reinvested frequently.

- APY: Provides a comprehensive view of potential returns by accounting for the compounding of yields, making it essential for yield farmers aiming to maximize their gains.

Real-World Examples in Crypto

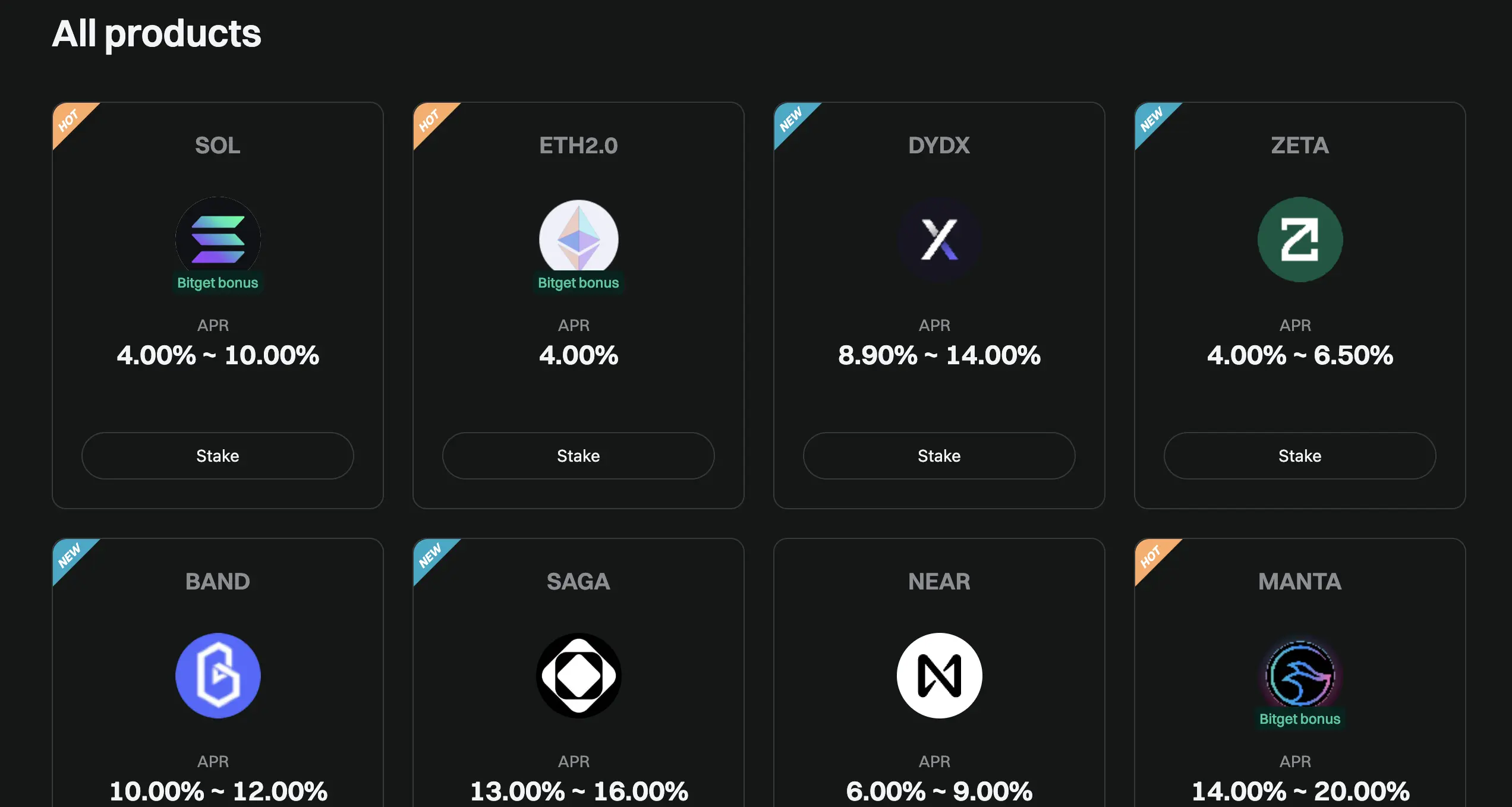

Several crypto platforms offer returns based on APR and APY, providing investors with different perspectives on potential earnings.

Platforms Offering APR:

- Crypto Loans: Platforms like BlockFi and Nexo offer crypto-backed loans with interest rates quoted as APR. Investors can see the nominal interest they need to pay or earn without the complexity of compounding.

Platforms Offering APY:

- Staking Platforms: Platforms such as Binance and Bitget offer staking services with returns quoted as APY, reflecting the compounded rewards over time.

- Yield Farming Platforms: DeFi platforms like Aave and Compound present yields as APY, giving a more accurate picture of the potential returns from reinvested yields.

Investor Decision-Making: By understanding whether a platform uses APR or APY, investors can better assess the true potential of their investments. For instance, a higher APY generally indicates a more lucrative investment due to the compounding effect, whereas APR provides clarity on the nominal interest rate without additional factors.

WHICH ONE SHOULD YOU USE: APR OR APY?

Choosing Based on Investment Goals

Selecting between APR and APY depends largely on your investment objectives and the nature of the crypto product you’re engaging with.

Short-Term vs. Long-Term Goals:

- Short-Term Investments: For short-term investments where interest is not compounded frequently, APR might be sufficient as it provides a clear and simple view of the returns.

- Long-Term Investments: For long-term investments, APY is generally more advantageous as it accounts for the compounding effect, giving a more accurate representation of potential earnings.

Investment Strategies:

- Passive Income Strategies: If you’re seeking passive income through staking or yield farming, APY is more relevant as it reflects the compounded returns over time.

- Active Trading or Lending: For active trading or lending strategies where interest may be periodically withdrawn or reinvested, understanding both APR and APY can help in assessing the true cost or return.

Evaluating Crypto Products

When evaluating crypto financial products, it’s essential to consider both APR and APY to gain a comprehensive understanding of potential returns and costs.

Guidelines:

- Read the Fine Print: Always check whether the platform quotes returns as APR or APY. This will help you understand whether the returns include compounding.

- Understand Compounding Frequency: If APY is provided, understand how frequently the interest is compounded, as this can significantly affect the overall returns.

- Compare Similar Metrics: When comparing different platforms, ensure you’re comparing the same metrics (APR vs. APR or APY vs. APY) to make an accurate assessment.

Importance: Understanding these metrics ensures that you’re not misled by seemingly attractive rates that may not account for the true growth or cost of your investments. It also helps in aligning your investment choices with your financial goals and risk tolerance.

COMMON MISCONCEPTIONS ABOUT APR AND APY IN CRYPTO

APR Always Less Than APY

A common misconception is that APR is always lower than APY because APY includes the effects of compounding. While generally true, there are scenarios where APR can be higher than APY, particularly when the compounding frequency is minimal or non-existent.

Example: If a platform offers an APR of 10% with no compounding and another offers an APY of 9.5% with monthly compounding, in this case, the APR is higher than the APY. This can occur in specific financial products where the compounding effect is not strong enough to make APY exceed APR.

Compounding Frequency Doesn’t Matter

Another misconception is that the frequency of compounding has little to no impact on the returns. In reality, the compounding frequency plays a crucial role in determining the APY.

Impact:

- Higher Compounding Frequency: Leads to a higher APY, as interest is calculated and added to the principal more frequently, allowing for exponential growth.

- Lower Compounding Frequency: Results in a lower APY, as interest is compounded less often, reducing the overall yield.

Clarification: Understanding the compounding frequency is essential for accurately assessing the potential returns on your investments. Even small differences in compounding frequency can lead to significant variations in APY over time.

CONCLUSION

Navigating the complexities of cryptocurrency investments requires a solid understanding of key financial metrics like APR and APY. While APR provides a straightforward view of the nominal interest rate, APY offers a more comprehensive picture by accounting for the compounding of interest. For investors aiming to maximize their returns in the crypto space, especially through long-term strategies like staking and yield farming, APY is often the more relevant metric. However, for short-term investments or loans where compounding is minimal, APR remains a useful and clear indicator.

By distinguishing between APR and APY, investors can make more informed decisions, aligning their investment choices with their financial goals and risk tolerance. Always consider both metrics when evaluating crypto financial products, and pay close attention to the compounding frequency to fully grasp the potential returns or costs. As the cryptocurrency market continues to grow and evolve, staying informed about these fundamental concepts will empower you to navigate the landscape with greater confidence and success.

>> Also read:

- Crypto Trading Strategies for Beginners: Your First Step to Earning Millions

- 8 Promising DeFi Protocols You Should Know With Potential Airdrops, Yield, and Points Programs