KEYTAKEAWAYS

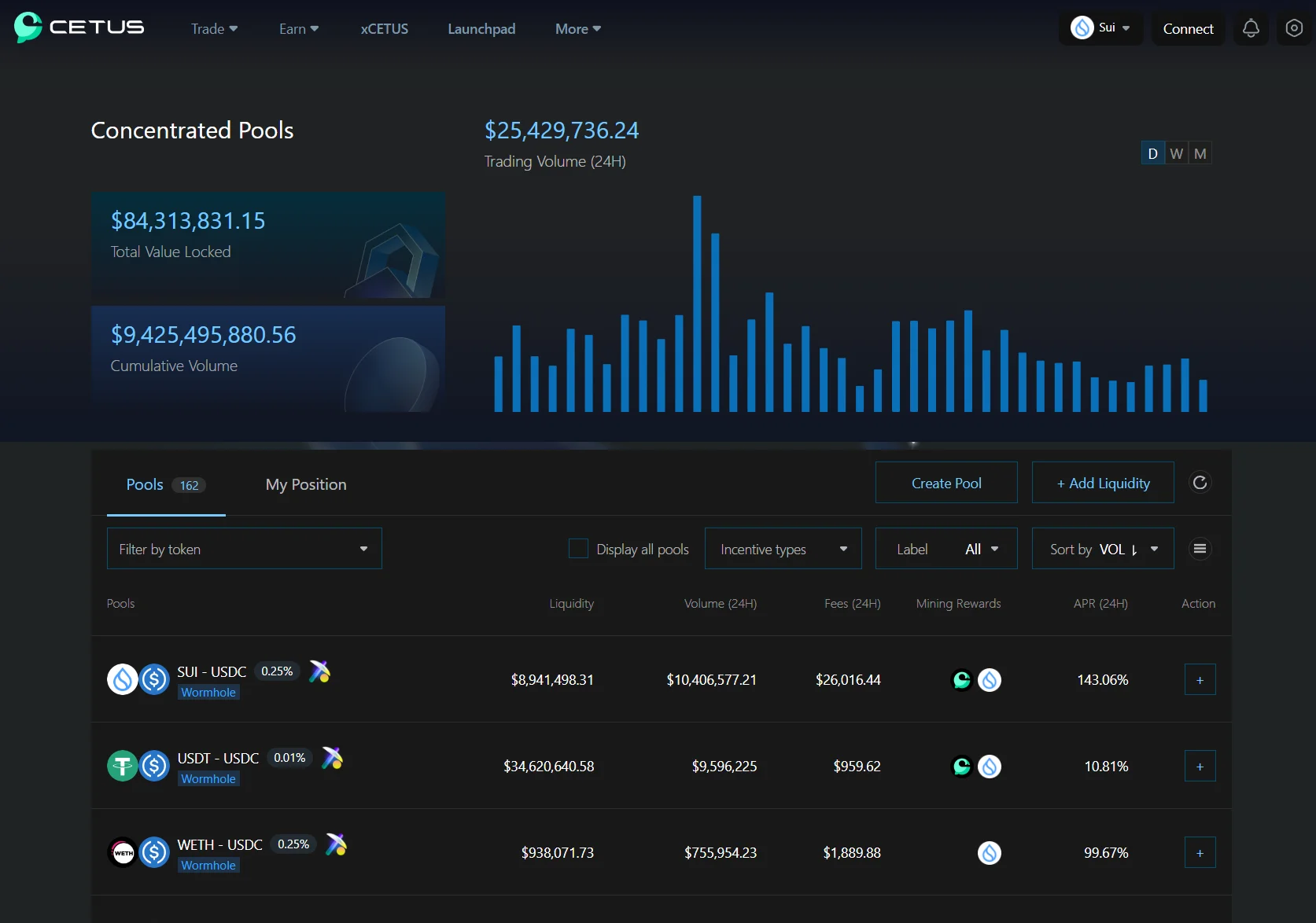

- Cetus uses a Concentrated Liquidity Market Maker model, optimizing capital efficiency and offering strategic liquidity management for providers.

- Built on Sui and Aptos, Cetus offers faster transaction times and enhanced scalability compared to Ethereum, benefiting traders with lower slippage rates.

- Cetus Plus integrates enhanced features, offering access to Sui ecosystem liquidity, optimized swap results, and seamless user experiences for token exchanges.

CONTENT

Cetus Protocol is a DEX using concentrated liquidity on Sui and Aptos blockchains, enhancing trading efficiency and liquidity management for DeFi users with innovative features and models.

WHAT IS CETUS PROTOCOL?

Cetus Protocol is a pioneering decentralized exchange (DEX) and concentrated liquidity protocol built on the Sui and Aptos blockchains. It is designed to facilitate efficient trading between various assets.

Its mission is to create a robust and flexible underlying liquidity network that makes trading easier for any user and asset. Unlike traditional automated market maker (AMM) protocols, Cetus introduces the concept of concentrated liquidity. This allows liquidity providers to strategically allocate their assets within customized price ranges.

This innovation not only significantly reduces the underutilization of liquidity in traditional AMM pools but also enhances trading efficiency, providing liquidity providers with higher fee returns. Additionally, Cetus is committed to delivering the best trading experience and superior liquidity efficiency for DeFi users by establishing concentrated liquidity protocols and a series of interoperable functional modules.

▶ Cetus Official Website: https://www.cetus.zone/

-

Cetus Features

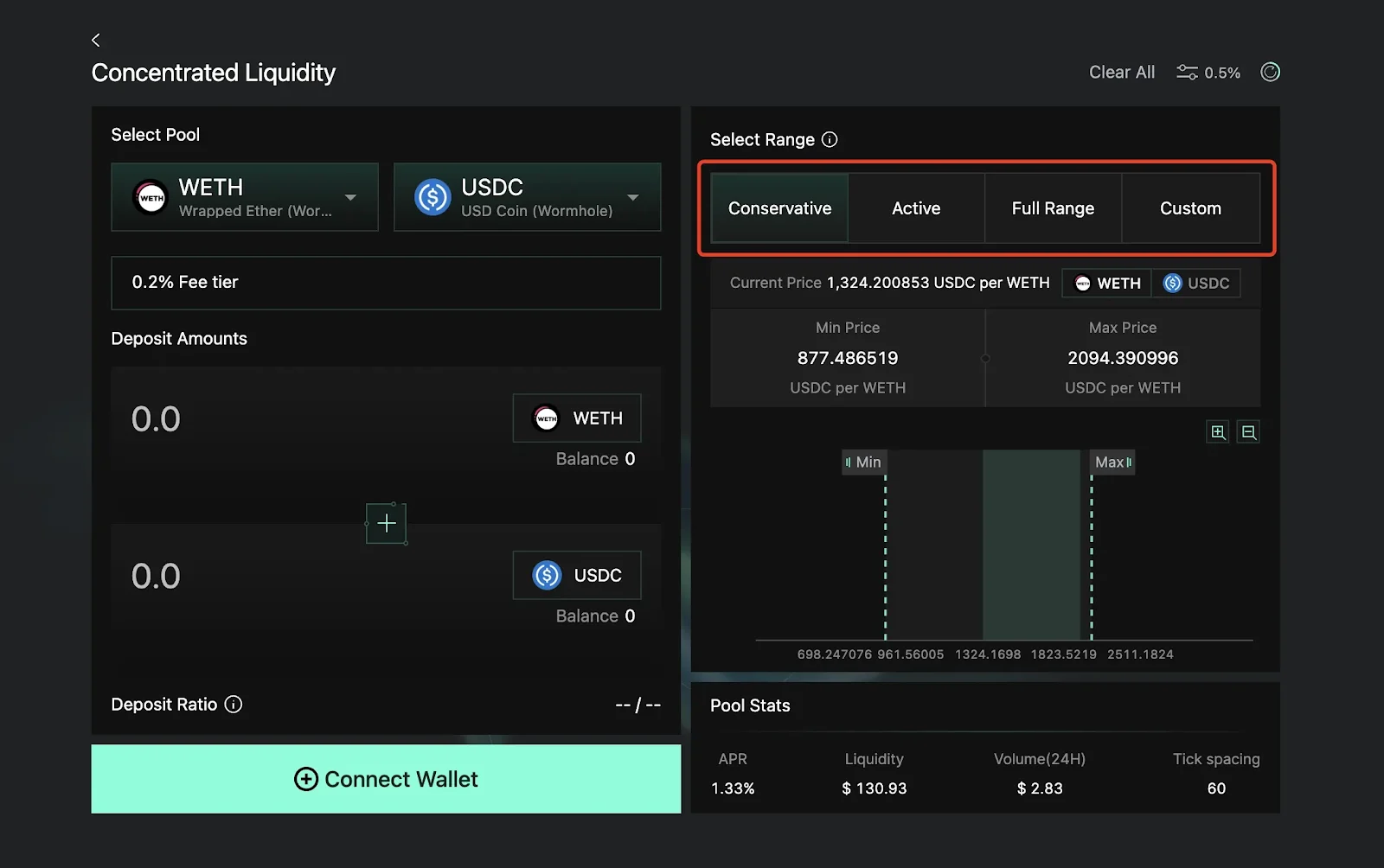

Concentrated Liquidity: As a trading platform, Cetus offers features similar to Uniswap V3 with its concentrated liquidity model. Users can choose specific price ranges when providing liquidity to maximize their capital efficiency. Cetus provides users with four options for setting their liquidity ranges:

1. Conservative Range: Suitable for users who prefer lower risk and stable returns.

2. Active Range: For users seeking higher returns with potentially greater risk.

3. Full Range: Covers the entire price spectrum, allowing for broad market exposure.

4. Custom Range: Users can define their own specific range according to their strategies and risk tolerance.

-

Cetus Token Model

The current token distribution for Cetus is as follows:

➢ 50% to the Community: Primarily for liquidity incentive programs.

➢ 20% to the Team and Advisors: With a 12-month lock-up period, followed by linear vesting over the next 24 months.

➢ 15% to Investors: With a 6-month lock-up period, followed by linear release over the next 12 months.

➢ 15% for Initial Liquidity, Long-term Community Incentives, and Insurance Fund.

-

xCETUS Governance Incentive Model

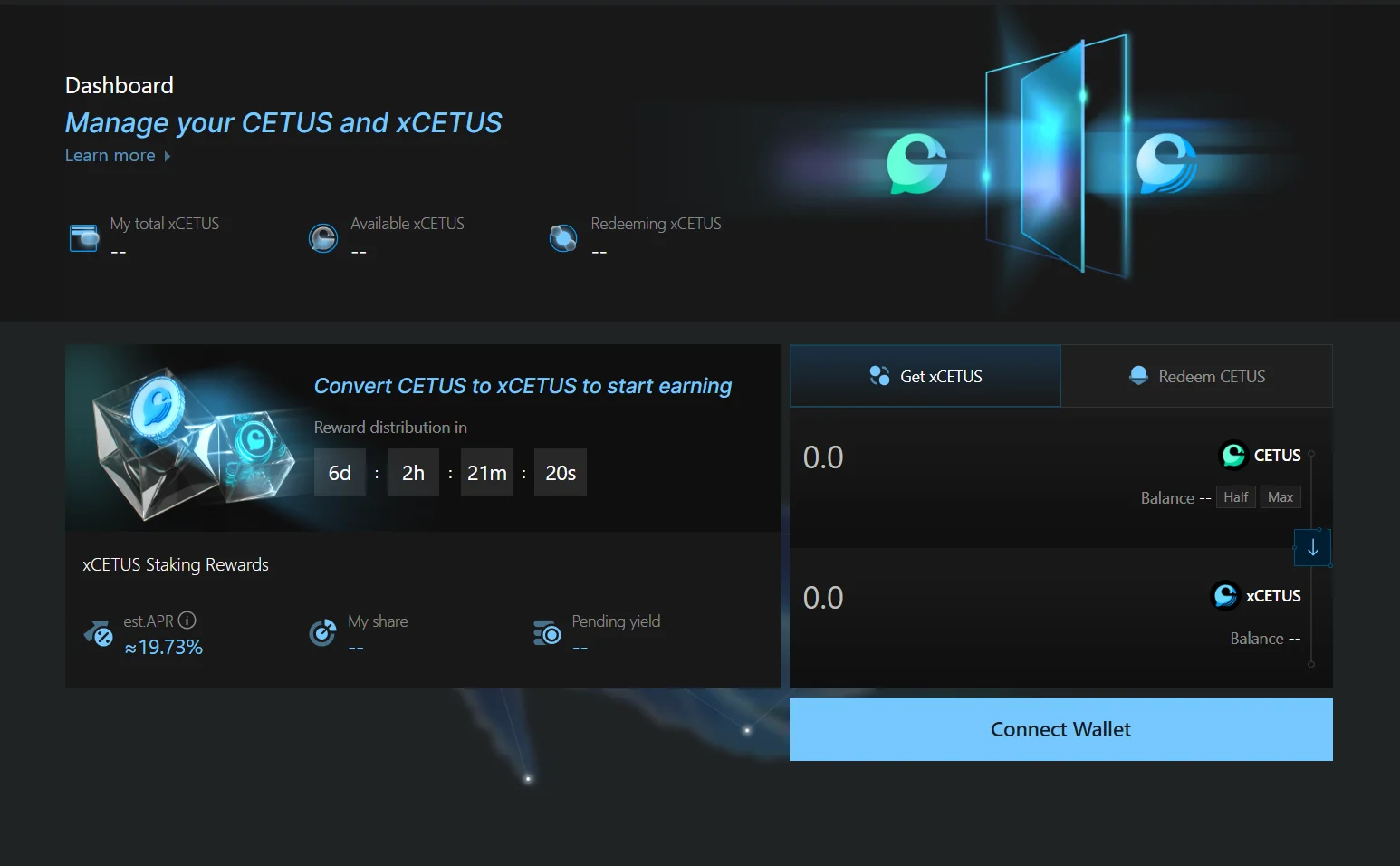

To better promote protocol governance and development, Cetus has designed a token mechanism for $CETUS and $xCETUS.

Key features include:

- CETUS can be converted to xCETUS at a 1:1 ratio at any time.

- The conversion ratio of xCETUS back to CETUS varies between 1:0.5 and 1:1, depending on the lock-up period.

- A higher xCETUS balance equates to greater voting power.

- xCETUS balances will be used in the future to calculate allocation weights in the Launchpool.

- Liquidity miners locking xCETUS can receive additional rewards, with reward multipliers ranging from 1.25x to 2.5x.

>>> More to read : What Is NAVI Protocol: Leading DeFi on Sui Network

CETUS PROTOCOL | CETUS PLUS

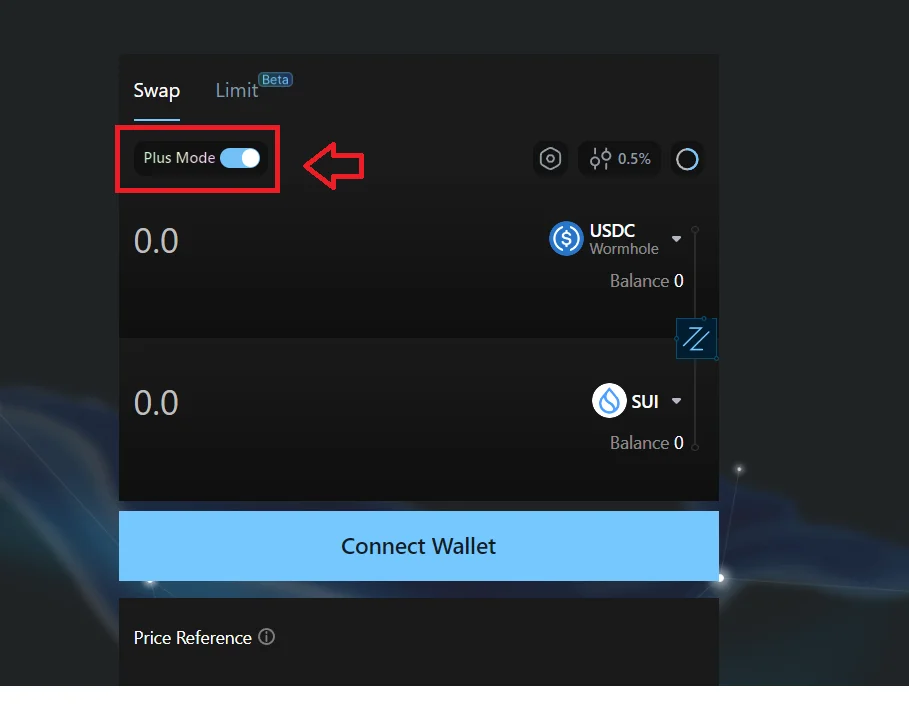

1. Enhanced Features and Optimized Swapping

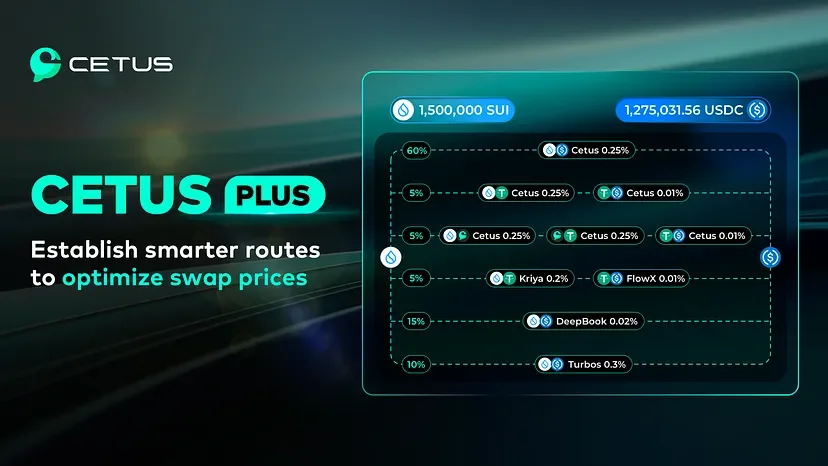

The Cetus Plus Aggregator has undergone major upgrades to its original swap router module. It now boasts enhanced order jumping and splitting capabilities, with faster response times during the swapping process. Powered by a smarter routing system, Cetus Plus offers optimized swap results and better slippage control, significantly enhancing the overall on-chain trading experience for all users.

2. Access to the Entire Sui Ecosystem’s Liquidity

With Cetus Plus, the liquidity of the entire Sui ecosystem is now within reach. In addition to leveraging native liquidity on the Cetus protocol, the Cetus Plus Aggregator seamlessly integrates liquidity from all major sources on the Sui network, including DeepBook, Kriya, FlowX, Aftermath, and Turbos. As the Sui ecosystem continues to grow, more valuable liquidity venues will be integrated in the future.

3. Integrated, One-Stop User Experience

Cetus Plus Aggregator is fully integrated into the Cetus front-end interface, eliminating the need for users to visit other sites. Regardless of where the pools and liquidity are located across the ecosystem, users can easily swap any token through the Cetus front end in a one-stop manner. Simply activate the “Plus Mode” on the swap page, and the swap aggregator will be enabled to fulfill swap requests.

Benefits of Cetus Plus

With Cetus Plus, users can expect:

- Robust Liquidity Aggregation: Access to a wide range of liquidity sources for optimal trading conditions.

- Optimized Pricing and Slippage Management: Ensures the best swap prices and minimal price slippage, with fine-grained order splitting and routing for large swap orders.

- Seamless Cross-Platform Swapping: Completes swaps across multiple platforms within the Sui ecosystem through a seamless user experience.

- Expanded Asset Selection: An increasing variety of supported assets, enhancing trading flexibility.

>>> More to read : Sui Ecosystem in 2024: Stunning Evolution, Rapid Growth, and Upcoming Projects Unveiled

HIGHLIGHTS AND RISKS OF CETUS PROTOCOL

Highlights

- Strong Financial Backing: Cetus Protocol benefits from substantial financial support, providing a solid foundation for growth and development.

- Well-Designed Products and Models: The protocol offers well-structured products and models that ensure an excellent user experience.

- First-Mover Advantage: Cetus has the advantage of being an early entrant in the market, allowing it to establish itself ahead of competitors.

- Launchpad Integration: The DEX includes a launchpad feature, which enhances the token’s use cases and broadens its application scenarios.

Risks

- Early Stage of the Sui Ecosystem: The Sui ecosystem is currently in its early stages, which may limit the development of the DEX to some extent.

- Competition for Market Share: Future competitors may pose a threat by competing for market share, which could impact Cetus Protocol’s position in the market.

>>> More to read : Scallop: The Future of DeFi on Sui

CETUS PROTOCOL (CETUS) FEATURES

1. Concentrated Liquidity

Cetus uses a concentrated liquidity market-making algorithm similar to Uniswap V3. A liquidity provider (LP) can establish multiple positions within the same pool by setting different price ranges, allowing them to simulate various price curves and implement custom strategies. As prices change with each new swap execution, smart contracts consume all available liquidity within the current price range until reaching the next price tick. At this point, the contract automatically switches to the new tick, activating any dormant liquidity within the newly enabled tick interval. The spacing of ticks is related to transaction fee levels; higher fees result in closer tick points.

Through concentrated liquidity, LPs can earn more transaction fees with higher capital efficiency.

2. Flexible Trading Fees

Cetus allows teams and users to choose custom trading fee levels. The same token can have multiple pools with different trading fees, with four fee tiers currently available: 0.01%, 0.05%, 0.25%, and 1%. This design encourages the market to find the most suitable liquidity distribution, providing greater flexibility for LPs and traders. Low-volatility assets like stablecoin pairs may concentrate in the lowest-fee pools, while high-volatility or low-volume assets may opt for higher-fee pools to offset risk.

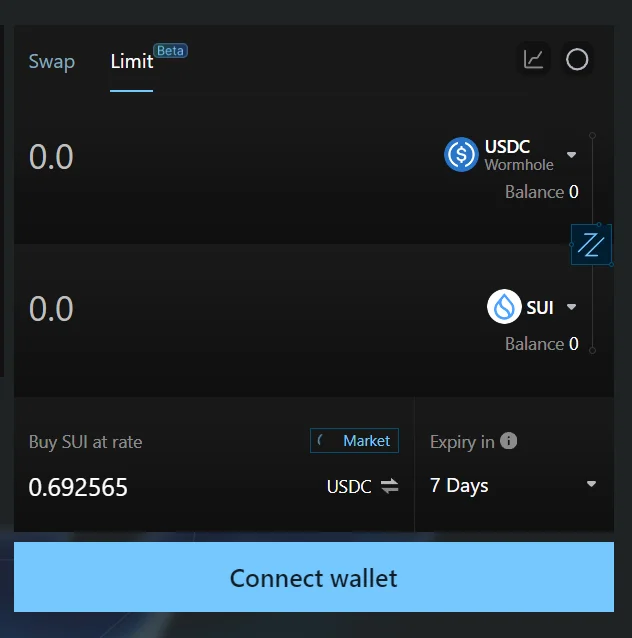

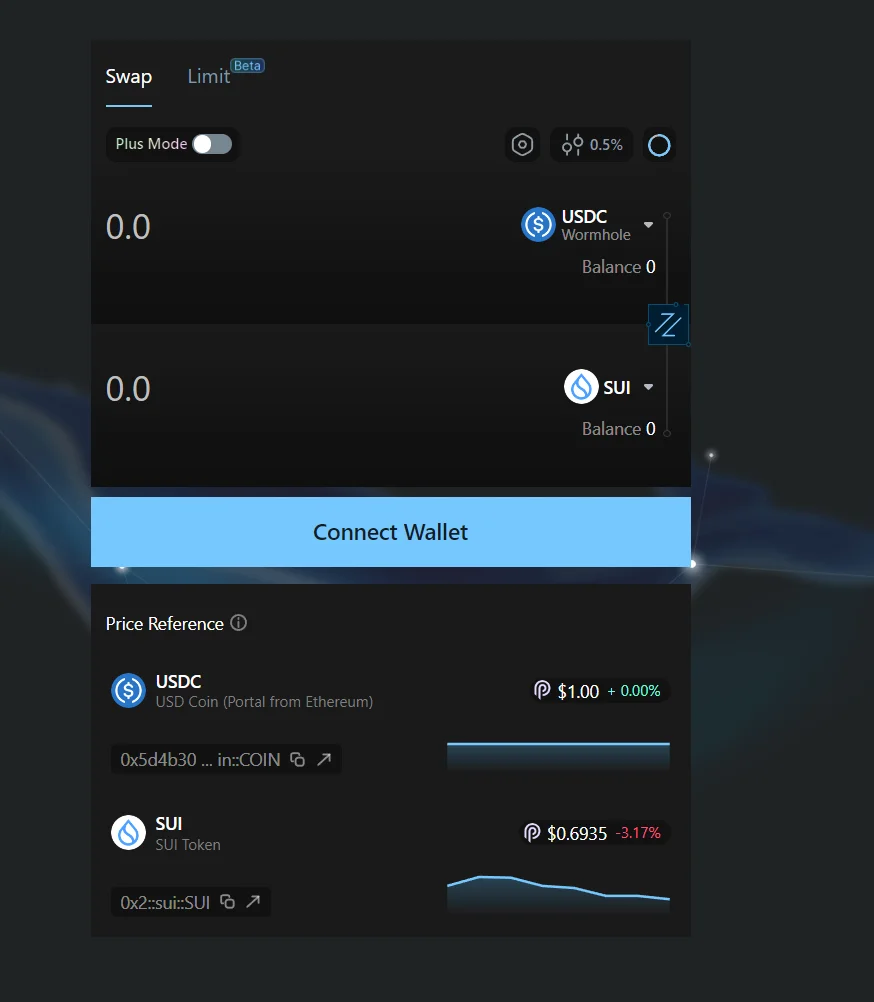

3. Swap

Swapping is one of the most common interactions with decentralized exchanges. The token swap mechanism is easy to understand: users sell the tokens they currently own in exchange for a proportion of the target tokens. A small swap fee is deducted in this process, incentivizing liquidity providers.

Swap execution in the Cetus protocol (or most DEX platforms) differs from order books. Order books usually follow a first-in, first-out policy, where the order time is crucial. In contrast, swaps on Cetus are executed against passive liquidity pools, with liquidity providers earning trading fees proportional to the active liquidity they contribute.

4. Liquidity Mining

In a concentrated liquidity protocol, only liquidity with an active price range can be used for trading, thus generating trading fees. The trading fee performance of a liquidity position reflects its effectiveness and contribution to the protocol. Therefore, one of the key features of Cetus liquidity mining is that mining rewards are allocated based on users’ actual fee performance rather than liquidity amounts. To earn more fees and mining rewards, liquidity providers need to participate more actively.

As mining rewards are released linearly, contracts are called each time a new transaction is executed to calculate the proportion of fees generated by each position since the last call. The released rewards are distributed proportionally based on the fees generated by each position.

This fee-based mining mechanism ensures that mining rewards are not diluted by inactive LPs or users who deliberately allocate liquidity in ineffective price ranges just to share mining incentives. It significantly saves on the cost of incentivizing liquidity for the protocol and third-party projects, making Cetus‘s TVL more efficient than other DEXs.

5. Composability

CETUS supports high composability, allowing other project teams to integrate Cetus SDKs and easily establish a swap interface on their front end, providing quick access to Cetus‘s liquidity. For example, the options project Typus integrated CETUS to enable one-click hedging of long-tail assets, improving the liquidity and coverage of its options.

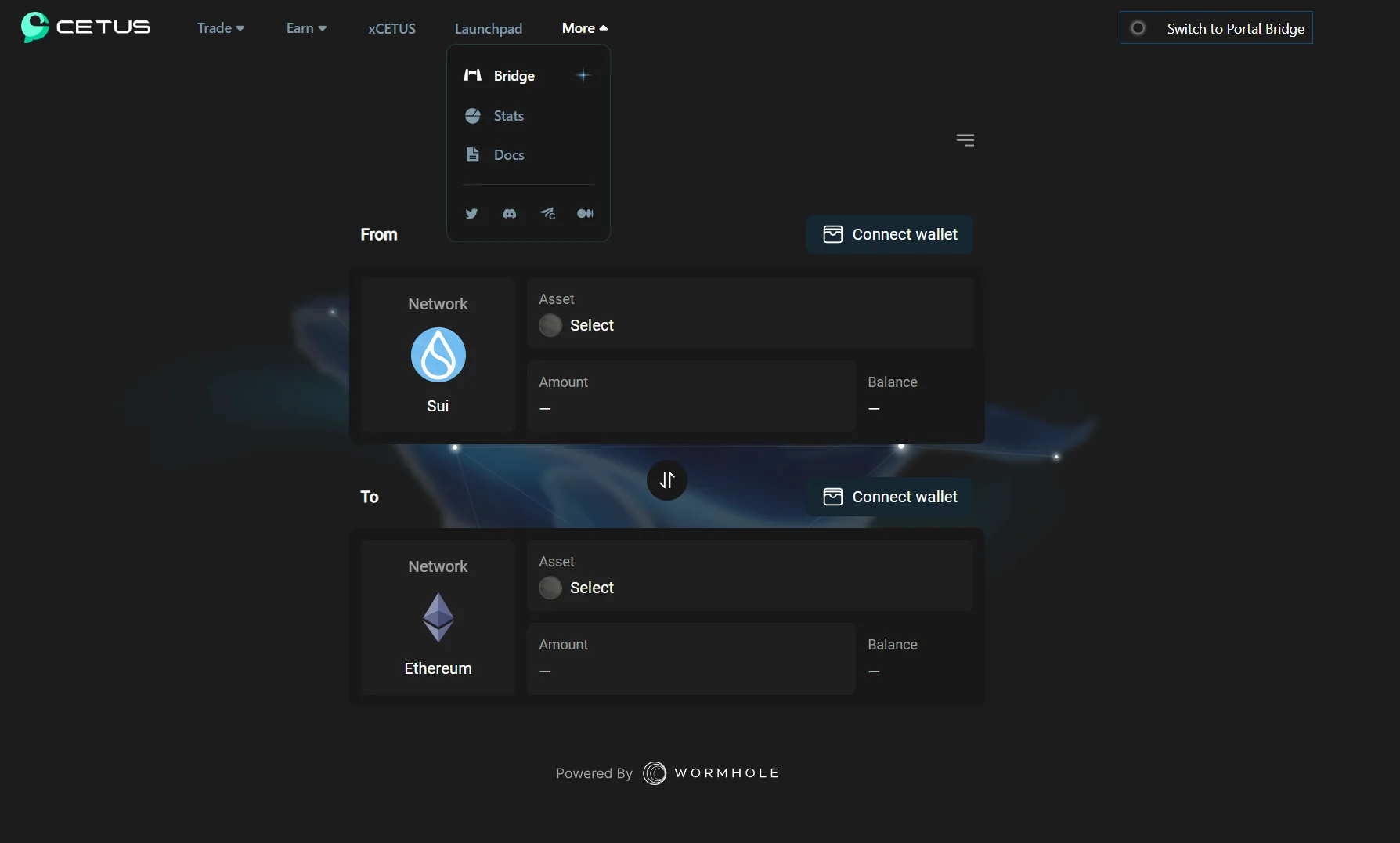

6. Secure Cross-Chain Bridge

The cross-chain bridge built on Wormhole was launched in November last year, allowing users to securely and conveniently transfer assets across nearly 20 blockchains.

7. Permissionless

All major tools and features on Cetus are built according to permissionless standards. It allows users or other applications to use its protocol for their use cases anytime. This includes creating new trading pools or allocating incentives to rent liquidity to the public.

>>> More to read : What Is Sui Wallet & How To Use It?

IS CETUS PROTOCOL A GOOD INVESTMENT?

Investing in CETUS tokens may be worth considering for the following reasons:

- Efficient Liquidity Mining and Token Trading Model

Cetus Protocol offers an efficient liquidity mining and token trading model based on the Concentrated Liquidity Market Maker (CLMM) model. CLMM’s advantages over Automated Market Makers (AMMs) may gradually lead to the growth of CLMM-based DEXs at the expense of AMM-based platforms. The concept of concentrated liquidity first emerged in 2021 and is still relatively young, with untapped growth potential. CLMMs, including Cetus, could experience rapid growth in the coming years.

- Use of Efficient Blockchains

Cetus utilizes two technologically advanced blockchains, Aptos and Sui. Compared to Ethereum, which hosts most CLMM and AMM DEXs, these two chains offer greater scalability, throughput, finality, and transaction confirmation times. In the world of decentralized token exchanges, faster transaction confirmation times are particularly important as they impact slippage rates, a key consideration for traders.

>>> More to read : What Is Sui Wallet & How To Use It?

FAQ

- What is Cetus ?

Cetus is a decentralized exchange that uses a Concentrated Liquidity Market Maker (CLMM) trading model, developed on the Sui and Aptos blockchains.