- Market capitalization, calculated by multiplying price and circulating supply, serves as a crucial barometer for crypto market health and investor sentiment.

- Major factors influencing crypto market cap include macroeconomic conditions, regulatory changes, technological innovations, and significant industry events or developments.

- Long-term trend analysis and volatility monitoring of market cap charts help investors identify opportunities while managing risks in cryptocurrency investments.

TABLE OF CONTENTS

Explore how the crypto market cap chart serves as essential tools for investors, revealing market trends, sentiment, and opportunities. Learn to interpret crypto market cap charts for better-informed crypto investment decisions.

The cryptocurrency market is filled with opportunities and challenges, but its complex price fluctuations often leave investors puzzled. In such a dynamic market, the crypto market cap chart serves as a vital tool for gauging market health and trends.

A deeper understanding of the crypto market cap chart not only helps investors see the bigger picture but also aids in crafting more forward-looking investment strategies. This article delves into the significance, functions, and applications of the crypto market cap chart, empowering investors to gain a competitive edge in this evolving space.

WHAT IS THE CRYPTO MARKET CAP CHART?

1.1 Definition: What is Market Cap?

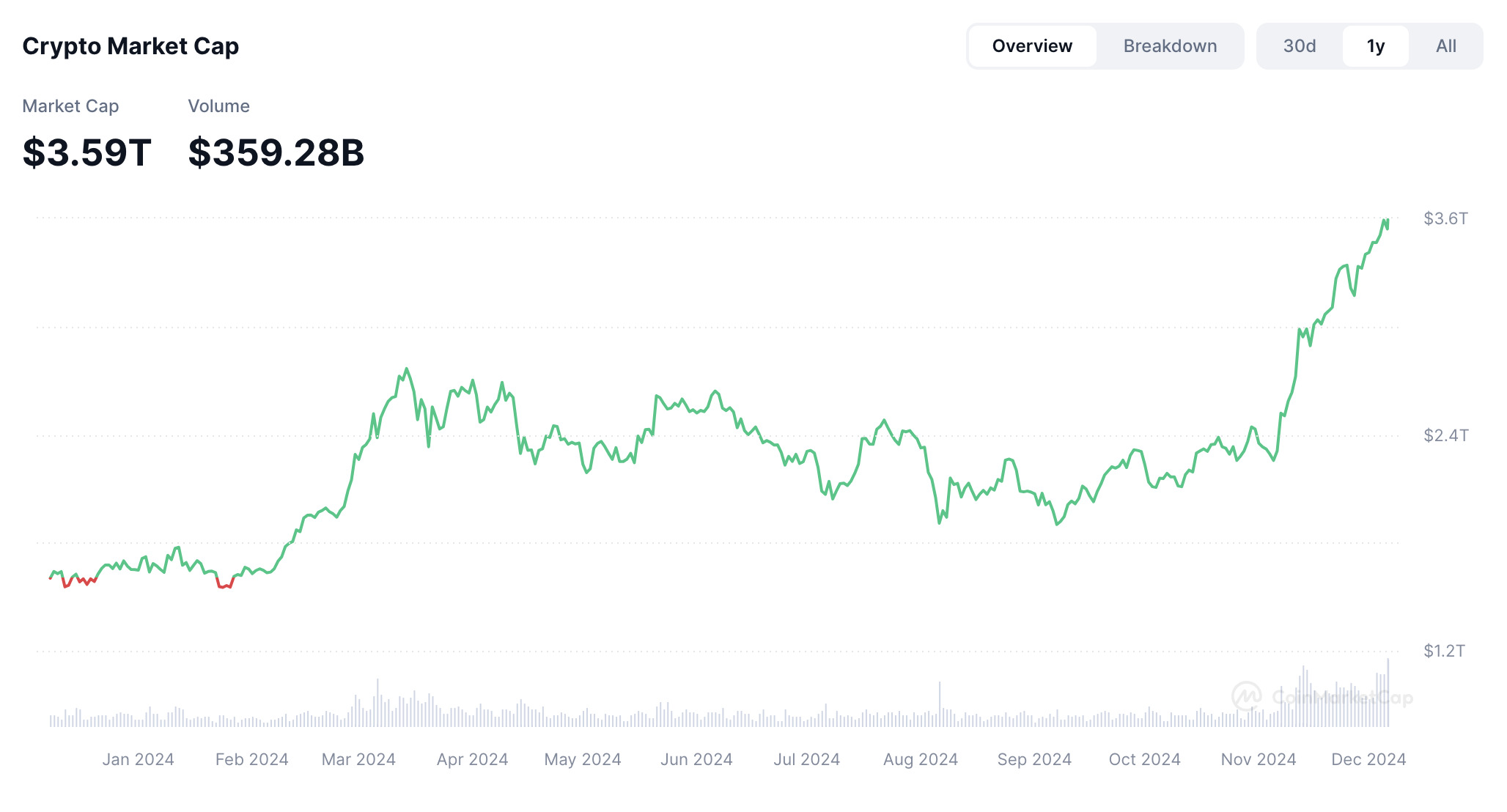

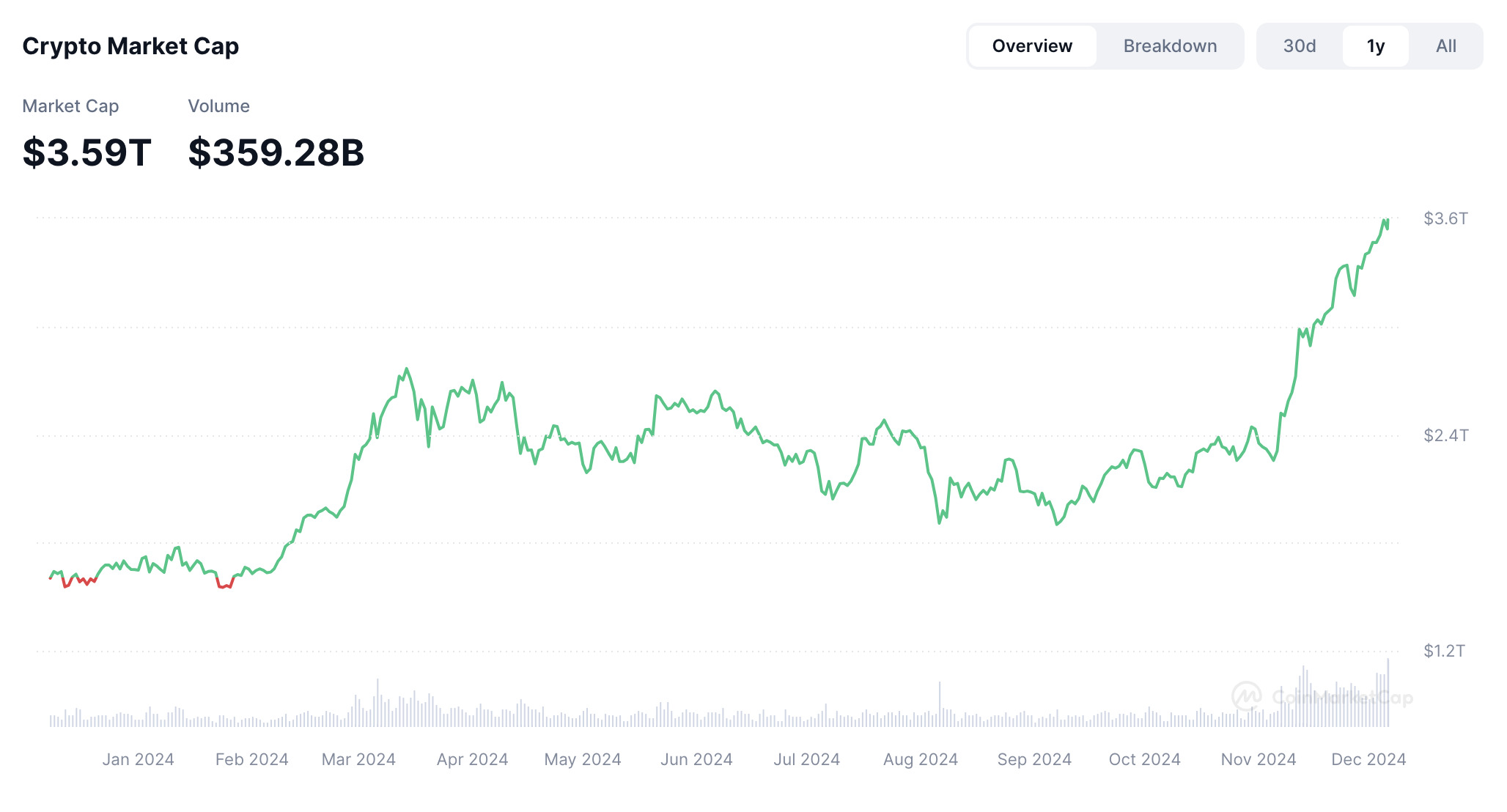

The cryptocurrency market cap refers to the total value of all cryptocurrencies, a key metric for measuring the market’s overall size. It is calculated using the formula: Market Cap = Current Price × Circulating Supply

(Source: CoinGecko)

(Source: CoinGecko)

This metric aggregates the value of all major coins and smaller tokens, providing a straightforward view of the market’s scale.

1.2 The Importance of Market Cap

The crypto market cap chart is a “barometer” for participants in the financial market, significant in the following ways:

Market Overview: The size and changes in the total market cap quickly convey the growth and trends in the cryptocurrency market.

(Source: CMC)

A continuous increase in market cap typically signals a bull market, while a decline indicates a bear market. Investors can adjust their positions accordingly to mitigate risks or seize profits.

Investor Behavior Insight: Market cap fluctuations often correlate with investor sentiment, reflecting shifts in market confidence.

(Source: CMC)

Rapid market cap growth usually indicates optimism, with investors willing to take on more risks. Conversely, sharp declines often reflect panic and capital flight.

>> Also read:How to Read Crypto Charts: A Beginner’s Guide to Market Analysis

KEY INSIGHTS FROM THE CRYPTO MARKET CAP CHART

2.1 The Market Position of Individual Cryptocurrencies

Market Cap Rankings and Competitive Landscape:

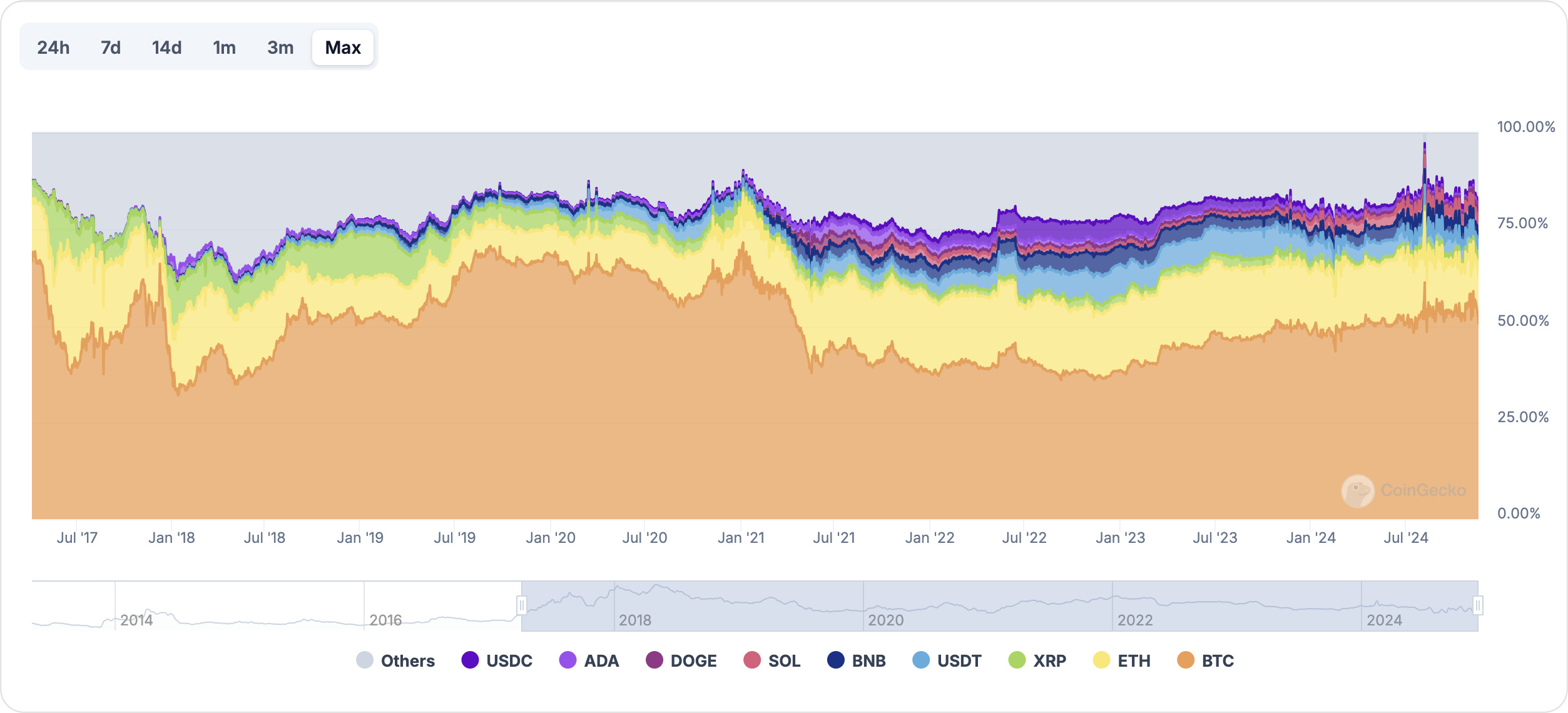

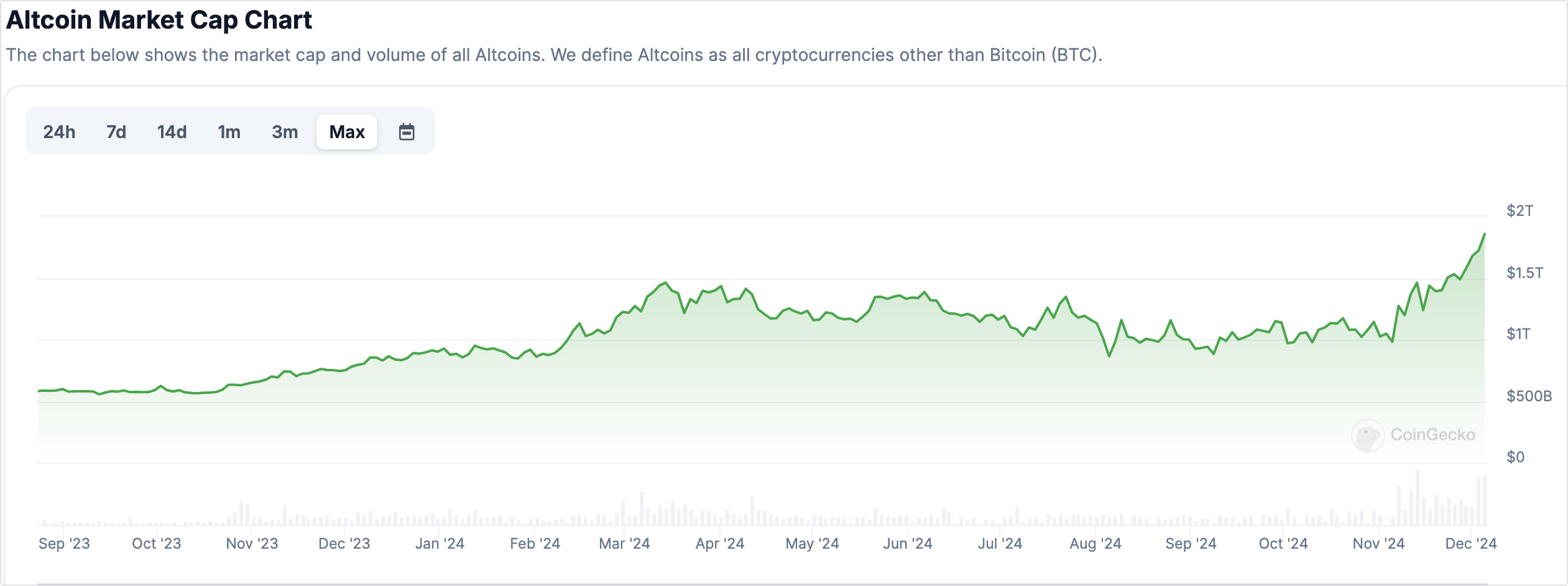

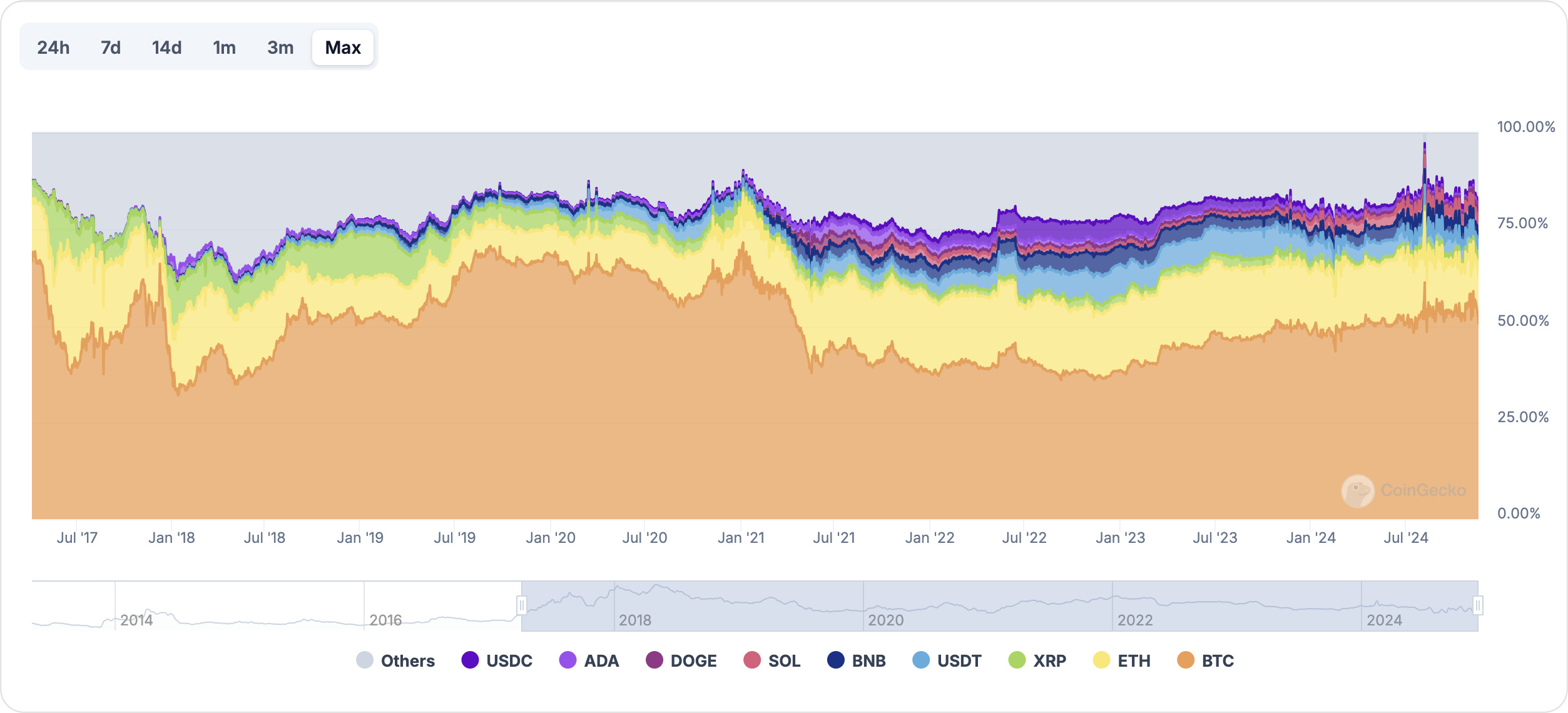

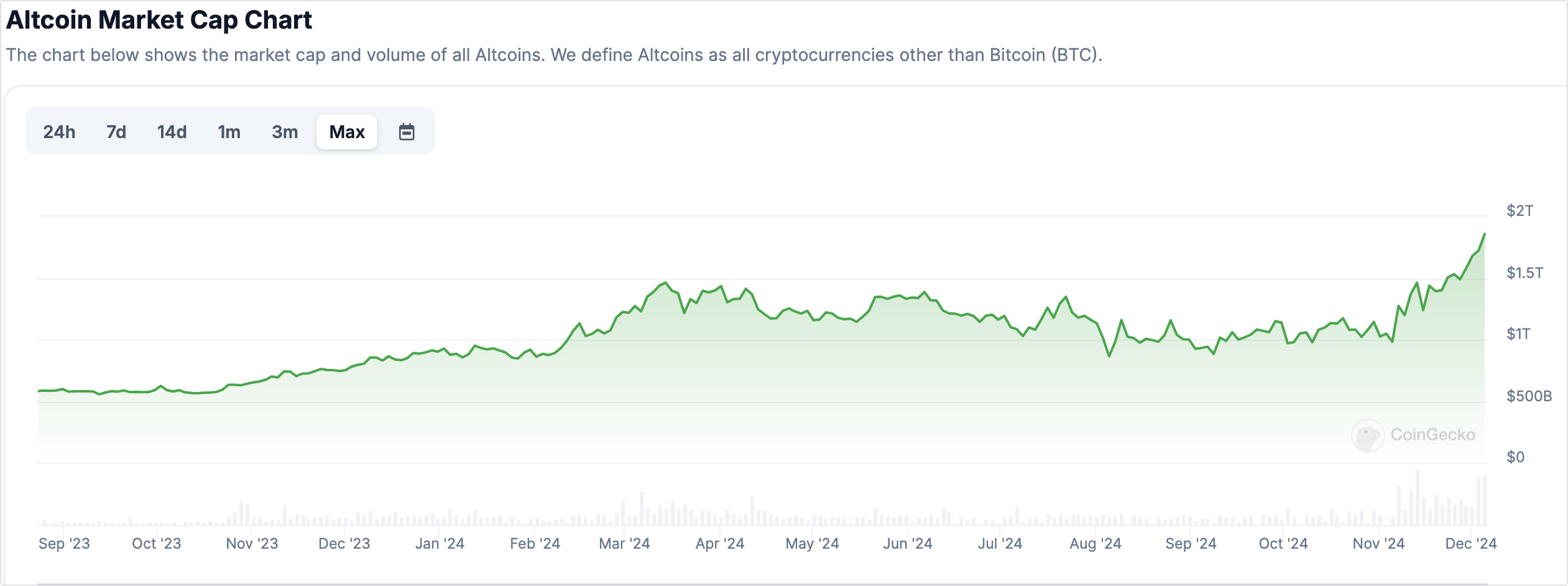

Changes in the market cap of individual cryptocurrencies can be used to analyze their market share and position. For example, Bitcoin and Ethereum often dominate, and shifts in their market share may indicate a change in market focus.

(Source: CoinGecko)

Market Cap Proportion Analysis:

The market cap proportion of a cryptocurrency reflects its importance within the broader market. A higher proportion often signifies greater market stability and investor confidence.

2.2 Market Hotspots and Industry Trends

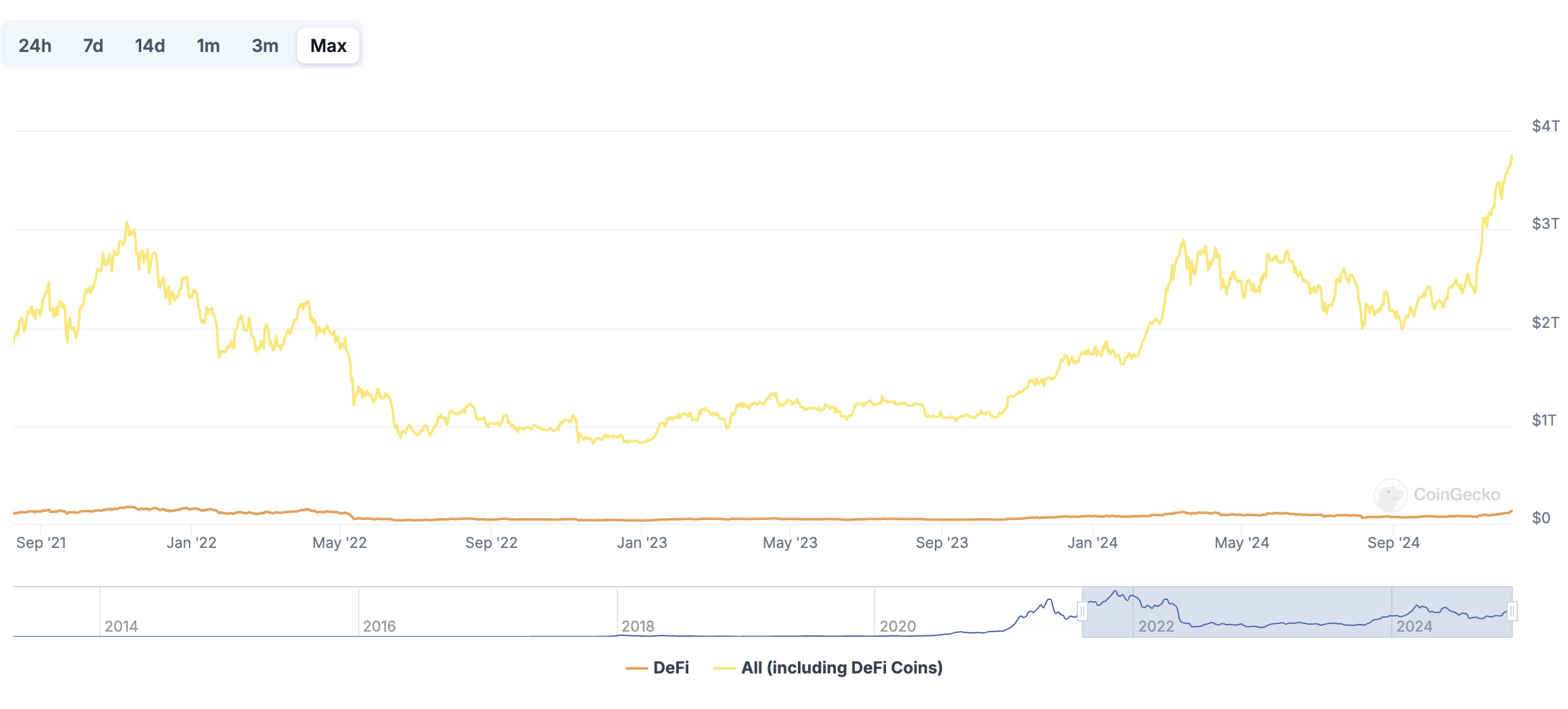

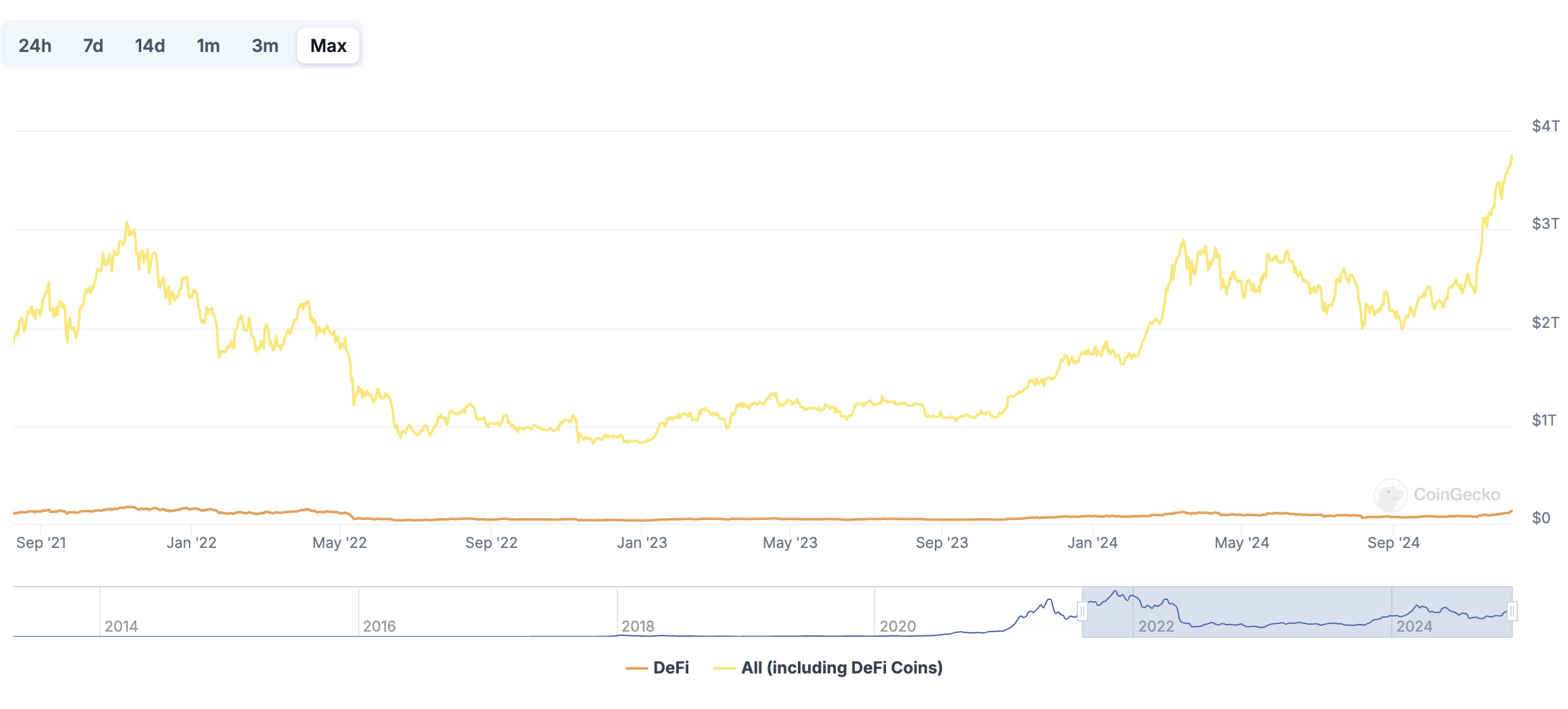

Emerging Projects:

Observing the rapid growth of small-cap projects can reveal promising sectors such as decentralized finance (DeFi), NFTs, or Layer 2 technologies.

(Source: CoinGecko)

Shifts in Industry Direction:

If a specific sector (e.g., privacy coins or payment tokens) sees a rapid rise in market cap, it may indicate increasing technological demand or market attention.

(Source: CoinGecko)

>> Also read:What is NFT and How Does It Work?

FACTORS INFLUENCING THE MARKET CAP

3.1 Macro-Economic Environment

Monetary Policy:

When central banks globally adopt loose monetary policies (e.g., interest rate cuts or quantitative easing), excess liquidity often flows into risk assets, including cryptocurrencies, boosting market cap.

(Source: TradingView)

Economic Uncertainty:

During global economic instability or heightened demand for safe-haven assets, cryptocurrencies like Bitcoin—dubbed “digital gold”—may attract more investors, driving up the market cap.

(Source: TradingView)

3.2 Regulation and Policies

Government regulations significantly impact the market cap. For instance, the approval of the first Bitcoin spot ETF in the U.S. could trigger massive inflows, while strict regulatory crackdowns may lead to capital outflows.

(Source: CMC)

3.3 Technological Innovation and Adoption

New technologies (e.g., zero-knowledge proofs or cross-chain applications of smart contracts) and enhanced utility often attract more users and capital into the crypto market, driving market cap growth.

3.4 Market Sentiment and Major Events

Market Sentiment: Improved market confidence generally attracts more capital, while a decline in sentiment has the opposite effect.

Significant Events: Events like Bitcoin halving, protocol upgrades (e.g., Ethereum Merge), or global incidents (e.g., geopolitical crises) can have a pronounced impact on market cap fluctuations.

(Source: TradingView)

>> Also read:Choosing the Right Cryptocurrency Exchange: CEX vs DEX

HOW TO READ THE CRYPTO MARKET CAP CHART?

Identify Trends:

A long-term upward trend in market capitalization is often a sign of a healthy and growing market. This trend suggests increasing investor confidence, adoption, and possibly greater liquidity in the ecosystem. For long-term holders, such trends can signal potential for steady returns and reduced risk over time.

However, it’s crucial to assess whether the growth is organic or driven by speculative bubbles, as these could lead to eventual corrections. Evaluating trends in the broader context of macroeconomic conditions and industry developments can provide deeper insights.

Monitor Volatility:

Volatility is a double-edged sword in financial markets. High volatility can indicate active investor participation and the potential for significant short-term gains. However, it also brings heightened risks, including rapid price fluctuations that could result in significant losses.

For traders, monitoring periods of elevated volatility can help identify opportunities for profitable trades, but it requires a disciplined strategy and risk management. Long-term investors, on the other hand, may use volatility as an entry or exit signal, waiting for price dips or avoiding overly exuberant markets.

>> Also read:What Is Memecoin And Why Are They Popular?

CONCLUSION AND INVESTMENT ADVICE

The crypto market cap chart is not just a tool for measuring market size; it’s also a key reference point for identifying opportunities. It reveals trends, sentiment, and industry shifts, empowering investors to make informed decisions in a complex market.

However, it’s crucial to remember that the cryptocurrency market is highly volatile and influenced by various factors. Investors should base their decisions on thorough analysis and align their strategies with their risk tolerance.

By mastering the crypto market cap chart, you’ll gain not only a comprehensive understanding of the cryptocurrency market but also a sharper edge in your investment journey.

ꚰ CoinRank x Bitget – Sign up & Trade to get $20!

(Source: CoinGecko)

(Source: CoinGecko)