KEYTAKEAWAYS

- Scallop offers high-interest lending and low-fee borrowing with robust security.

- $SCA token rewards and staking provide additional incentives for users.

- Future innovations include RWA, cross-chain lending, and leveraged lending.

CONTENT

Scallop, a leading DeFi project on the Sui blockchain, offers high-interest lending, low-fee borrowing, and innovative solutions. Learn about its unique features, $SCA tokenomics, and future plans.

WHAT IS SCALLOP?

Scallop (SCA) is a leading decentralized money market on the Sui blockchain. It focuses on institutional-grade quality, enhanced composability, and robust security, offering users dynamic money markets with high-interest lending and low-fee borrowing. As the first DeFi project to receive official funding from Sui in 2022, Scallop is renowned for its innovative solutions.

Scallop‘s smart contracts have been thoroughly audited by reputable firms like OtterSec and MoveBit, ensuring the protocol’s integrity and reliability. The platform is committed to transparency and trust, providing users with a secure environment for lending and other financial activities.

Users can easily transfer digital assets to the Sui network using Scallop‘s bridging solutions, which include Wormhole Connect, Portal Bridge, and Celer Bridge. The protocol also offers comprehensive institutional-grade features, such as tools for creating Sui Programmable Transaction Blocks (PTx), the Scallop SDK for interacting with the platform, the Sui Kit for integrating with Sui using TypeScript SDK, and free flash loans with sCoins (Scallop‘s liquid derivative tokens).

Moreover, using Scallop can significantly reduce costs in DeFi transactions.

With its high lending rates, low borrowing fees, self-managed crypto tools, and SDKs for professional traders, Scallop stands out among its peers, becoming one of the largest and fastest-growing money markets in the Move ecosystem.

▶ Scallop Official Website: https://scallop.io/

💧Scallop Overview – All In One Guide💧

GM Scallopers!

The past few months have been exciting for Scallop as we achieve many new milestones and introduced new integrations!🔥

This thread will serve as an All-In-One overview of all you will need to know for Scallop!✨

Let's… pic.twitter.com/ldW0Fas6ug

— Scallop (@Scallop_io) May 14, 2024

$SCA Tokenomics

$SCA is the native token of the Scallop platform, designed to be distributed as rewards to users who actively contribute to its ecosystem. Scallop also allows token holders to stake their $SCA to receive veSCA, which grants voting rights.

Upon the token’s launch, users engaging in lending on the platform will receive free $SCA tokens as an incentive.

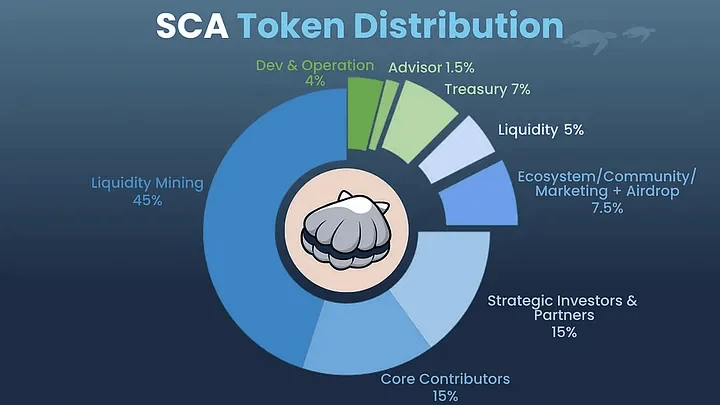

The total supply of $SCA tokens is 250 million, allocated as follows:

- Liquidity Mining: 45%

- Scallop Core Contributors: 15%

- Development and Operations: 4%

- Advisors: 1.5%

- Investors and Strategic Partners: 15%

- Ecosystem/Community/Marketing/Airdrops: 7.5%

- Liquidity: 5%

- Treasury: 7%

>>> More to read : Exploring SUI: A Revolutionary Cryptocurrency on the Rise

FEATURES OF SCALLOP

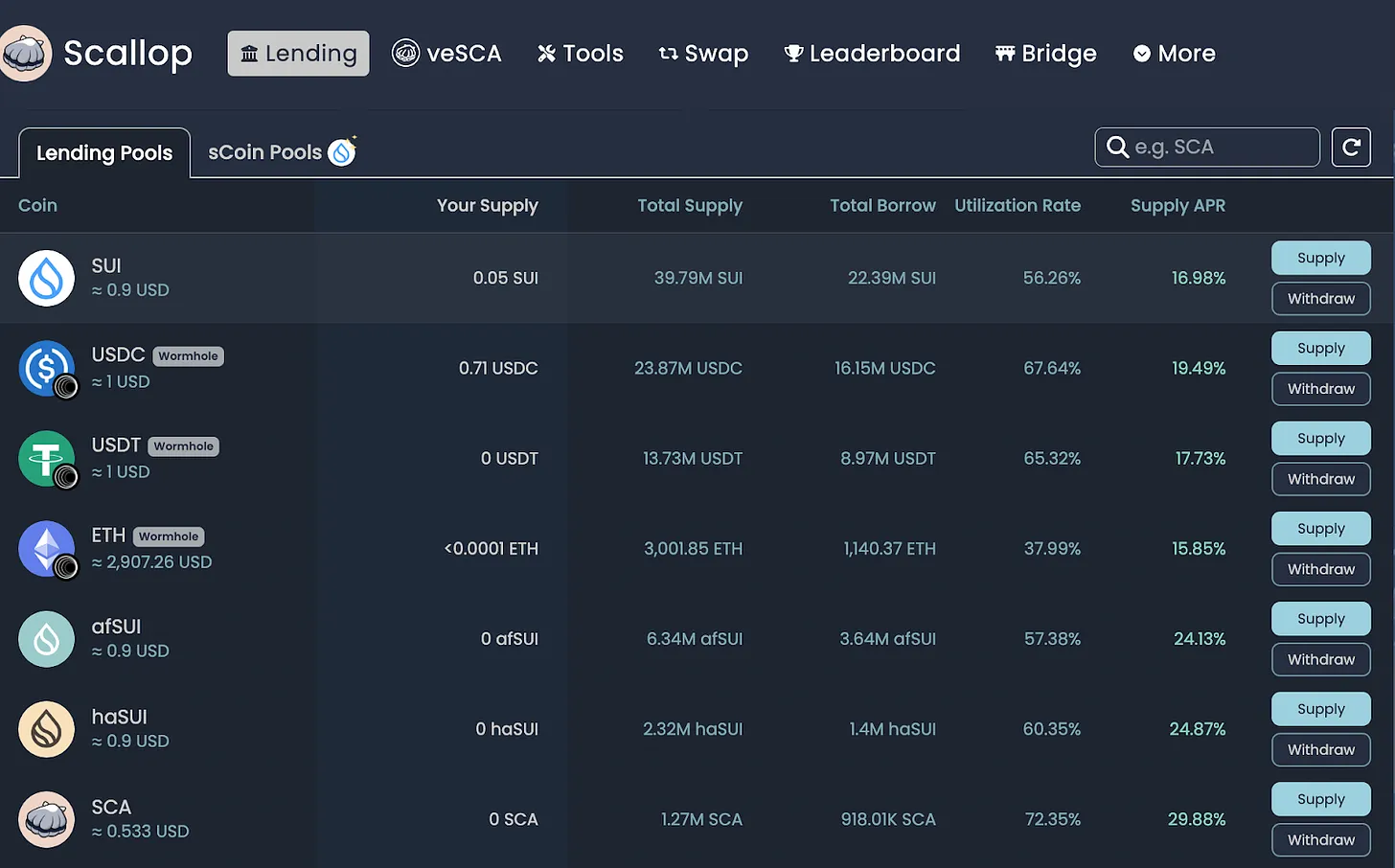

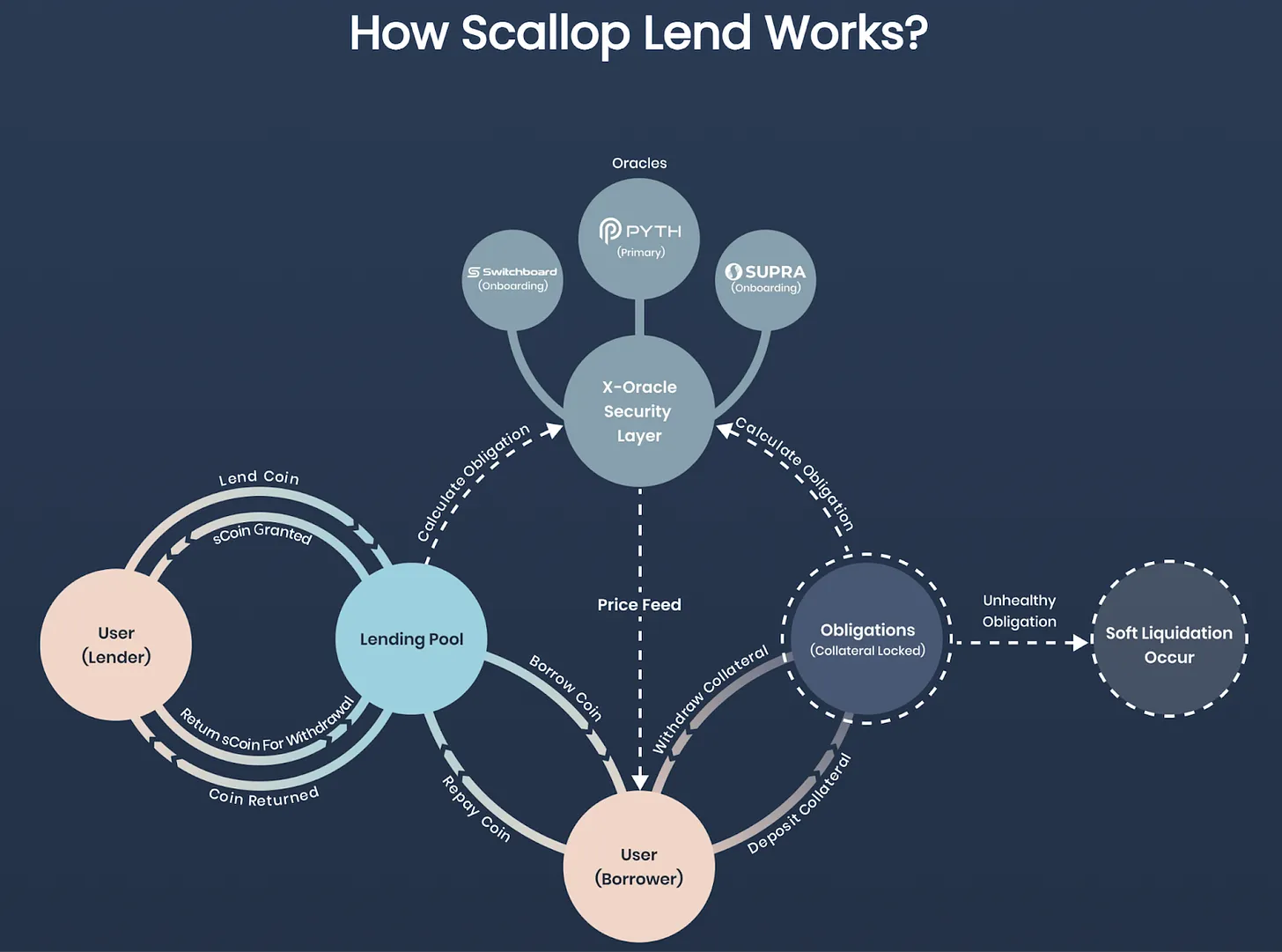

1. Lending

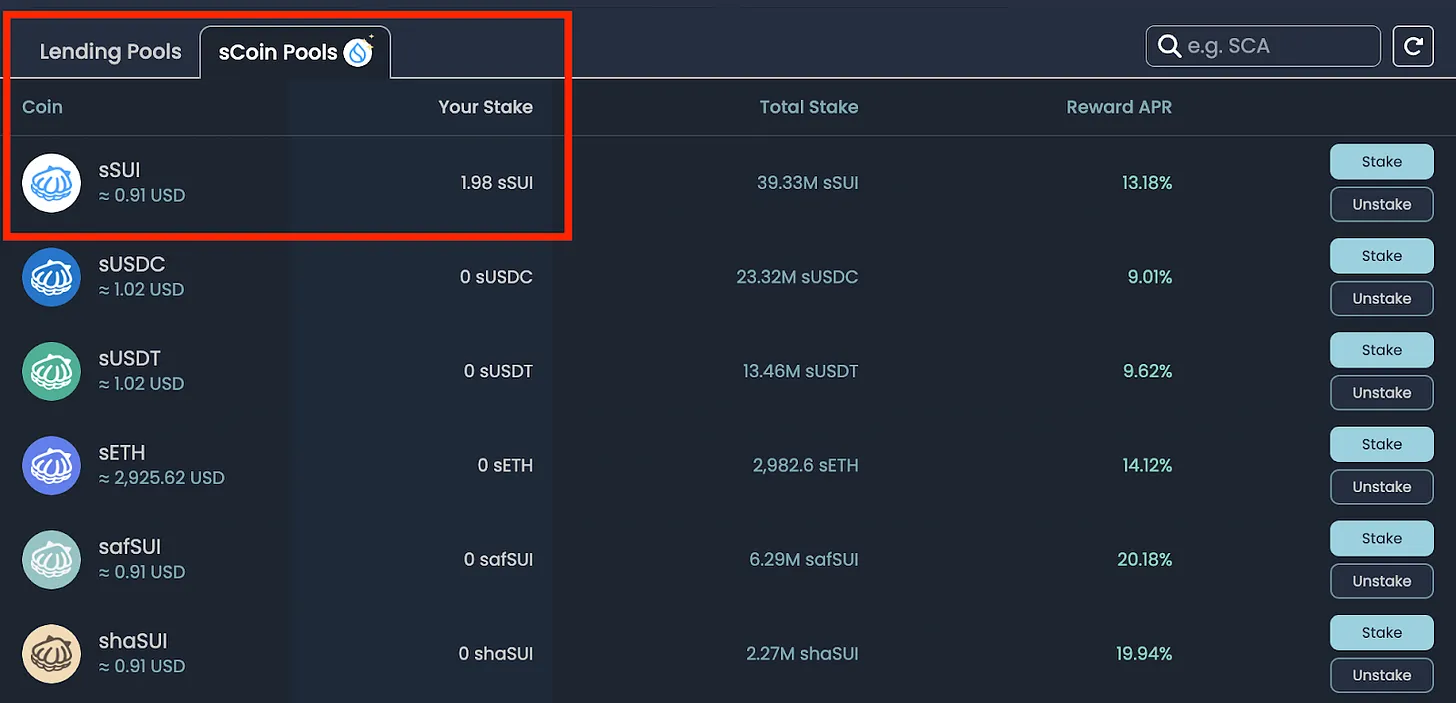

If you have extra cryptocurrencies and want to earn passive income, you can join one of Scallop‘s asset pools and participate in high-interest lending. During the lending period, your cryptocurrencies will be converted into sCoin, which gradually accrues interest. Due to the continuously increasing exchange rate of sCoin, it offers high-interest lending. When you redeem sCoin for the original asset, you will receive more tokens than you initially deposited.

By clicking “Supply,” you can lend your assets, with an option to directly stake them in the sCoin pool, thus increasing capital efficiency. After selecting this option and completing the transaction, you will see your staked assets in the sCoin Pools.

2. Borrowing

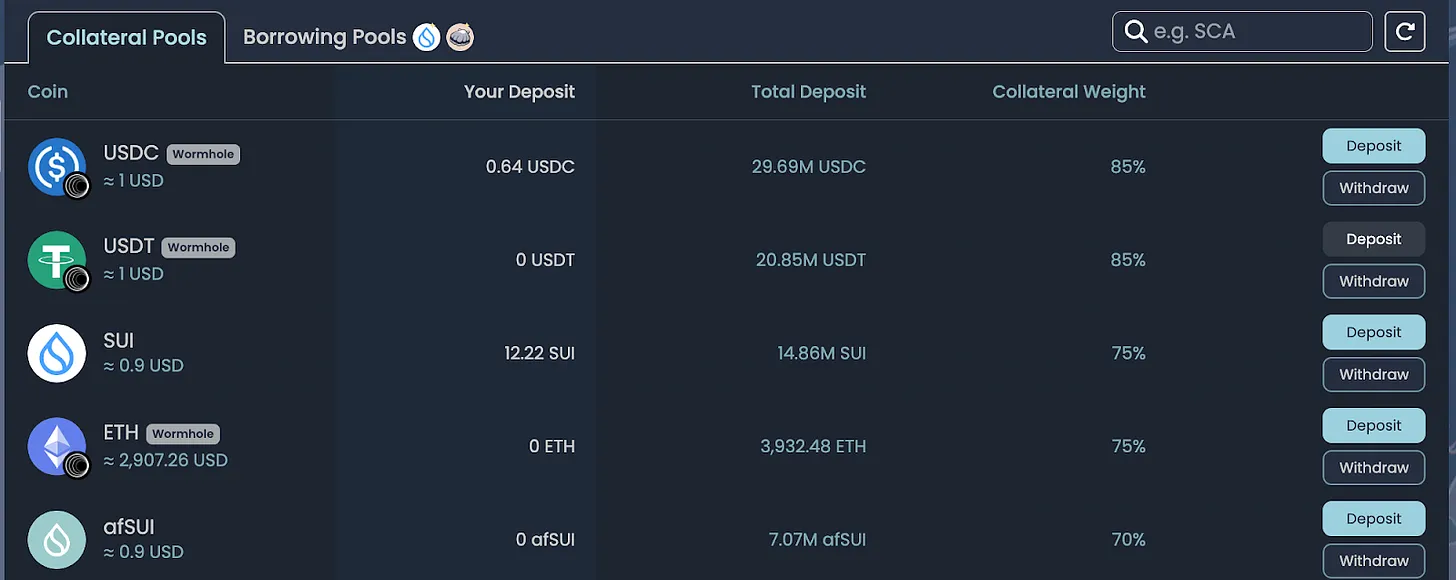

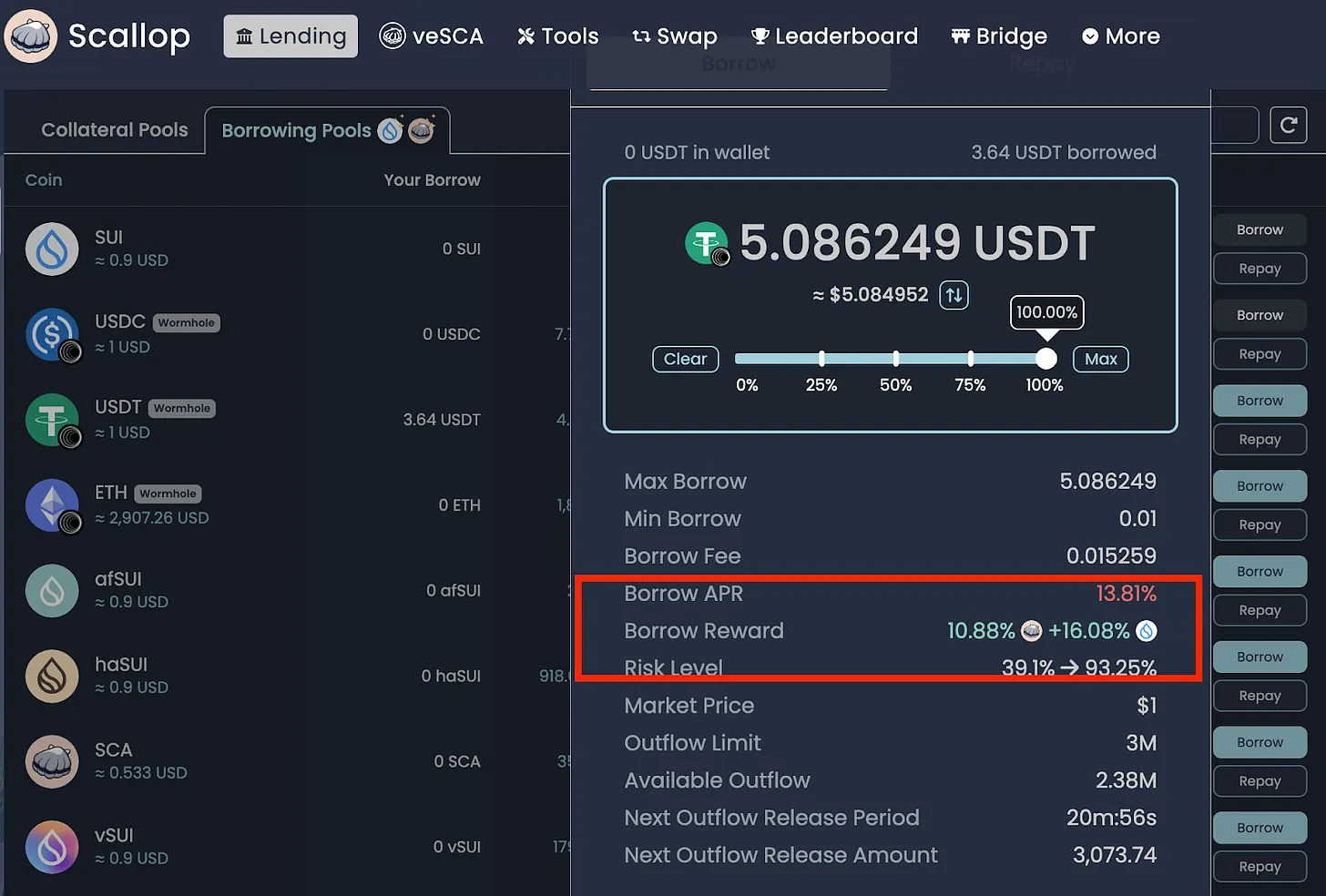

This DeFi protocol also offers significant advantages for borrowers. Scallop emphasizes institutional-grade quality borrowing, ensuring users can easily and quickly obtain additional cryptocurrencies. After depositing collateral tokens, you can borrow a certain percentage of the collateral’s value. Interest rates vary based on supply and demand, and risk levels change with the price of the collateral. Before each loan, you will see clear and detailed terms, including the interest you will pay and the conditions under which your loan may be liquidated.

1. Borrowers must first deposit their assets into the Collateral Pools and then select the assets and interest rates they wish to borrow from the lending pool.

2. Next, in the “Borrowing Pools” section, borrowers can see the borrowing interest rates and reward interest rates next to each asset.

3. Airdrops

To promote its robust security and high-quality lending, Scallop conducts several airdrops. For instance, users who borrow on Scallop or participate in Scallop events. Participants can redeem Mystery Pearls, which can be exchanged for Scallop tokens.

- Eligibility for $SCA Airdrops:

If you participate in any phase of the activities, including lending, social engagement, Zealy tasks, etc., you are eligible for $SCA airdrops.

▶ Scallop Airdrop Page: https://airdrop.scallop.io/

4. Swapping

Professional traders can also use Scallop‘s oracles and bridges for swapping. Supported by Aftermath Finance, Scallop‘s swapping feature allows exchanges across all chains supported by Scallop.

5. Bridging

Wormhole Connect is Scallop‘s service for bridging tokens. This bridge allows users to transfer assets across all chains supported by Scallop. The service is entirely free (except for Sui miner fees) and typically results in nearly instant transfers.

>>> More to read : What Is Sui Wallet & How To Use It?

FUTURE OF SCALLOP

Scallop, a rising star in the Sui ecosystem, plans to continue expanding its influence in the DeFi sector. By exploring new collaboration opportunities and launching more innovative products, Scallop is swiftly transforming the DeFi market landscape with its technological innovations and robust operations. Its unique triple-linear interest rate model, multi-oracle consensus strategy, and powerful SDK provide unparalleled security and flexibility for users. Each of Scallop‘s innovations redefines the possibilities of blockchain finance.

Looking ahead, Scallop will continue to lead the DeFi market transformation by introducing more cutting-edge products, deepening its collaboration with the Sui network, and expanding its ecosystem influence. With the introduction of RWA (Real-World Assets), cross-chain deployments, cross-chain lending, and leveraged lending, Scallop will unlock even more potential. We look forward to Scallop‘s continuous breakthroughs, setting the benchmark in the global DeFi market, and bringing endless possibilities to the future of blockchain finance.

>>> More to read : Sui Ecosystem in 2024: Stunning Evolution, Rapid Growth, and Upcoming Projects Unveiled

FAQ

- What is SCALLOP ?

Scallop is the leading lending project on the SUI chain, providing users with high-interest lending and low-fee borrowing.