KEYTAKEAWAYS

- Suipad offers a tiered staking system with 6 levels, rewarding higher tiers based on SUIP staked.

- The Lock Multiplier allows stakers to boost their tiers without staking extra tokens by locking SUIP for set periods.

- SuiPad Shield provides protection for principal investments in IDOs, compensating losses within 7 days.

CONTENT

Suipad is an IDO launchpad offering staking tiers, Lock Multiplier, and SuiTank, helping users protect their investments and participate in project development within the Sui ecosystem.

WHAT IS SUIPAD?

▶ Official Site: https://suipad.xyz/

Suipad is a community-driven project launch platform within the Sui ecosystem. As a launchpad for Tier 1 projects on the Sui blockchain, through its official partnership with Mysten Labs, provides an all-in-one solution for launching projects on the Sui blockchain. Its flagship product, Suipad Launchpad, is an IDO platform that offers users the best new projects on the Sui blockchain, thanks to its rigorous vetting process and industry access. Suipad aims to drive innovation and development within the Sui ecosystem.

🔥 Our CEO is heading to #Token2049 in Singapore! 🔥

🤝🏻 Don’t miss the chance to connect and chat about the future of #SuiPad and #Web3.

💥 If you’re around, say hi and let’s make some magic happen! 🪄 pic.twitter.com/TxSQwAjmaX

— SuiPad 🌊 – Launchpad on Sui (@SuiPadxyz) September 13, 2024

SUIPAD TOKEN | $SUIP

The native token of Suipad, $SUIP, serves as the core asset within the platform’s ecosystem. It is primarily used to participate in curated Initial DEX Offerings (IDOs) on Suipad. This utility token also grants governance rights to its holders, allowing them to take part in key decision-making processes that shape the future of the Suipad ecosystem. Additionally, $SUIP plays a crucial role in educational initiatives, such as SuiPad Academy, which offers a 16-week Web3 coding bootcamp designed to train future Web3 developers, further expanding the token’s use within the ecosystem.

SUIPAD (SUIP) PROS AND CONS

As a relatively new blockchain project, Suipad has distinct advantages and challenges. Its advantages include offering top-tier projects on the Sui blockchain and integrating features like wallets, vesting markets, and transaction management. Additionally, Suipad supports decentralized project launches, token staking, and governance voting. However, its challenges include being in the early stages of development, making it less well-known, and facing the same volatility and uncertainty that the broader cryptocurrency market experiences. The success of Suipad will largely depend on its future market performance and its ability to attract more users and investors.

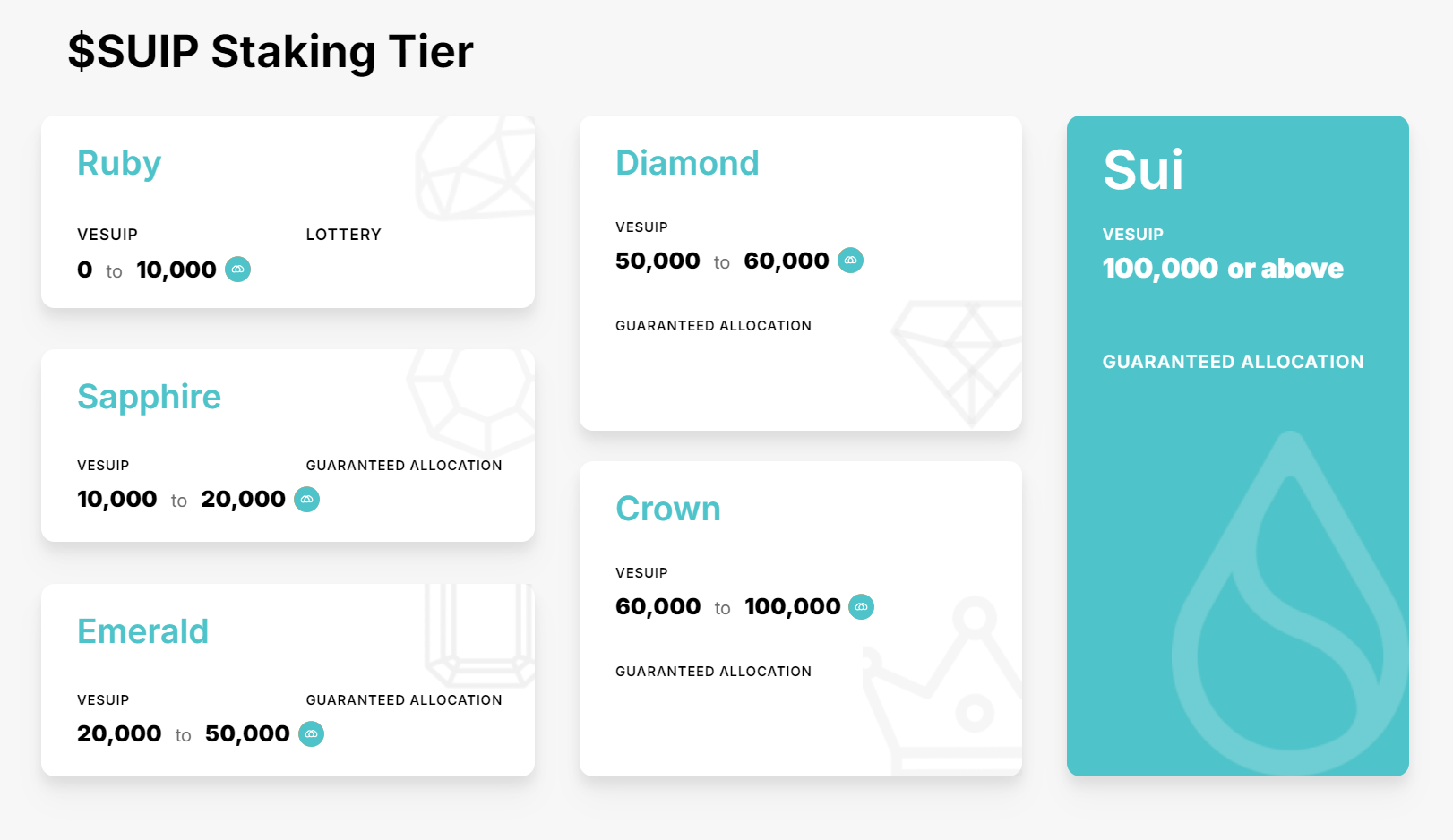

SUIPAD STAKING & TIER SYSTEM

The tier system is a key component of the SuiPad platform, ensuring commitment from users and allowing stakers to participate in project IDOs. Staking and tier levels go hand-in-hand on SuiPad. To qualify for a specific tier, users must stake $SUIP tokens on the platform.

There are six tiers based on the amount of $SUIP staked

★ Ruby: 10,000 SUIP

★ Sapphire: 20,000 SUIP

★ Emerald: 50,000 SUIP

★ Diamond: 60,000 SUIP

★ Crown: 100,000 SUIP

★ Sui: 100,000+ SUIP

The more $SUIP you stake, the higher your tier, and the larger your allocation in project IDOs.

(Note: There is a 15-day cooling-off period after staking.)

SUIPAD SHIELD: HOW IT WORKS

In the current market, most Launchpad or IDO platforms do not offer protection against volatility for users’ principal investments when investing in new crypto projects, making IDO participation a highly risky activity. SuiPad addresses this by introducing an insurance feature designed to safeguard users’ principal. For instance, when a user purchases tokens during an IDO round on the SuiPad launchpad, they can opt to add 15% of their investment amount to buy insurance. The insurance fee is then transferred to the SuiPad Shield Pool.

The SuiPad Shield Pool compensates for any potential loss in the user’s principal within the first 7 days after the IDO goes live. If the average peak price during this period is below the IDO price, the Shield Pool covers the difference, ensuring users’ principal is well-protected. On the other hand, if the project performs well, the user’s return remains unlimited, while the 15% paid serves as the insurance cost for peace of mind.

-

SuiPad Shield Insurance Mechanism

Optional Purchase: Launchpad participants can decide whether to buy SuiPad Shield.

Insurance Fees: All fees are directed into the Shield Pool.

Loss Coverage: Funds in the pool are used to repay IDO investment losses.

Price Protection: If the average peak price is below the IDO price, the Shield Pool covers the difference.

Additional Funds: If the Shield Pool is insufficient, funds raised from the IDO project will be used.

Fund Rollover: Unused pool funds accumulate for future projects.

SUITANK: THE WEB3 REALITY SHOW

SuiTank is a reality show series where Web3 startup founders pitch their projects to a panel of venture capital (VC) investors, similar to a “Web3 Shark Tank.” The show features experienced VC investors, known as “sharks,” who evaluate the business models and products of the startups before deciding whether to invest. Participants include founders, product designers, and service operators from Web3 startups, presenting live on the show.

Before the show begins, the project team must state the amount they wish to raise in a private funding round, as well as the token allocation for investors. According to the rules, if the sharks’ total investment offers do not meet or exceed the project’s initial target, the funding attempt is deemed a failure, and no funds are raised.

SuiTank aims to educate the community on how to analyze projects by learning from experienced VCs while providing a platform for Web3 startups to showcase their products and secure funding. With a panel of six professional VC members from SuiPad, the show offers in-depth questioning and detailed evaluations of each project, giving retail investors a transparent understanding of the projects, beyond typical promotional events like AMAs. This format eliminates the common issue of biased or misleading project representations.

SUIPAD LOCK MULTIPLIER

The Suipad Lock Multiplier is a mechanism that allows SUIP stakers to achieve higher tier levels without staking additional tokens. By locking their staked SUIP for a predefined period, users can benefit from multipliers applied to their staked tokens. There are three locking options, each with a corresponding multiplier:

➢ 3 months: 1.3x multiplier

➢ 6 months: 1.5x multiplier

➢ 12 months: 2x multiplier

>>> More Sui Projects :

- Cetus on Sui : The Future of DEX

- Turbos Finance: Ultra-Efficient DEX on the Sui Blockchain

- Scallop: The Future of DeFi on Sui

▶ Buy Crypto at Bitget