KEYTAKEAWAYS

- Leveraged tokens magnify market gains and losses, making them ideal for short-term traders seeking quick returns.

- Daily rebalancing prevents liquidation but can lead to value erosion over time, impacting long-term holders.

- Costs include transaction fees, management fees, and rebalancing decay, which can erode profits, especially with frequent trades.

CONTENT

Leveraged tokens amplify market returns but come with risks like value decay and management fees. Discover how they work, their costs, and if they suit your trading strategy.

WHAT ARE LEVERAGED TOKENS?

Leveraged tokens are specially designed cryptocurrencies that come with built-in leverage, allowing you to amplify your returns during market movements.

However, this also increases the potential risks. Simply put, leveraged tokens act as a “magnifier” of price fluctuations, enhancing the price changes of the underlying cryptocurrency they track.

For example, if you purchase a 3x leveraged Bitcoin token, a 10% increase in Bitcoin’s price could result in a 30% gain for the token.

Conversely, if Bitcoin’s price drops by 10%, your loss would also be magnified to 30%.

-

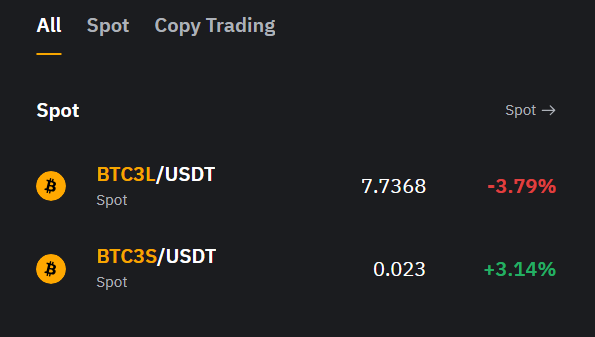

Naming Conventions for Leveraged Tokens

Exchanges typically name leveraged tokens using the following format:

ꚰ Underlying Asset Code + Leverage Multiplier + Long/Short Direction.

Examples:

- BTC3L: Represents a 3x long leveraged Bitcoin.

- BTC3S: Represents a 3x short leveraged Bitcoin.

(Examples: Leveraged tokens in BYBIT exchange)

In BTC3L, each letter and number represents the following:

✎ BTC: Indicates that the underlying asset of this leveraged token is Bitcoin.

✎ 3: Denotes the leverage multiplier, which is 3x.

✎ L: Stands for “Long,” meaning a bullish position; similarly, S stands for “Short,” meaning a bearish position.

-

Do Leveraged Tokens Really Avoid Liquidation?

The primary design of leveraged tokens is to prevent liquidation.

In traditional leveraged or futures trading, significant market fluctuations can cause your margin to become insufficient, leading to forced liquidation, commonly known as a margin call.

Leveraged tokens avoid this scenario by automatically adjusting their positions to mitigate the risk of liquidation.

-

Are Leveraged Tokens Risk-Free?

While leveraged tokens are immune to liquidation, they are not without risks. These tokens manage risk by rebalancing their leverage ratios daily, adjusting positions based on the day’s market conditions.

Although this mechanism prevents liquidation, it can reduce returns or even result in losses during highly volatile markets, especially if held over a long period.

As a result, leveraged tokens are better suited for short-term trading strategies focused on high-risk, high-reward opportunities.

They are not ideal for long-term investments, as frequent rebalancing can erode potential gains.

>>> More to read: How to Get Crypto Passive Income Easily?

REBALANCING & VALUE DECAY IN LEVERAGED TOKENS

Leveraged tokens perform periodic or daily rebalancing (Rebalance) to maintain a fixed leverage ratio.

However, this rebalancing mechanism can lead to value decay (Volatility Decay) over the long term.

Even if the market price eventually returns to or slightly exceeds the starting point, the price of a leveraged token may be lower than its initial value due to the effects of rebalancing, failing to meet expected returns.

-

Example of Leveraged Token Rebalancing

Using BTC as an example, we can illustrate the rebalancing process of leveraged tokens:

Assume BTC’s price increases from 10 to 100, a 10x increase overall. Theoretically, BTC3L (3x leveraged token) should rise 30x, from 1 to 30.

If you sell BTC3L at this point, you could achieve a 30x return.

However, real market fluctuations are usually more complex, and the actual outcome may differ significantly from expectations.

-

Step-by-Step Explanation of Value Changes

Assume BTC experiences the following price movements:

- Increases from 10 to 40 (+4x),

- Drops from 40 to 20 (-50%),

- Finally rises from 20 to 100 (+5x).

ꚰ Stage 1: BTC rises from 10 to 40

BTC’s price increases 4x, and BTC3L’s price should increase 12x (3x leverage), from 1 to 12.

ꚰ Stage 2: BTC drops from 40 to 20

BTC’s price drops 50%, and BTC3L theoretically decreases by 150%. At this point, the token’s price would significantly decline, possibly close to zero.

However, to avoid liquidation, the rebalancing mechanism adjusts the token’s price to a lower but positive value, say 0.2.

ꚰ Stage 3: BTC rises from 20 to 100

BTC’s price increases 5x, and BTC3L’s price should increase 15x, from 0.2 to 3.

-

Impact of Rebalancing on Leveraged Token Returns

In this example, BTC’s spot price increased from 10 to 100, yielding a 10x return for spot investors.

However, for BTC3L holders, the price only increased from 1 to 3 after multiple rebalancing events, resulting in a return far below that of spot holdings.

Additionally, since most exchanges charge daily management fees for leveraged tokens, these fees could further erode returns, potentially leading to losses.

Leveraged tokens are more suitable for short-term high-risk trading rather than long-term holding.

Holding leveraged tokens for an extended period may result in diminished returns due to rebalancing mechanisms and value decay.

Caution is necessary to avoid unnecessary losses.

>>> More to read: Will Bitcoin Mining Make Money After 2024?

COSTS OF TRADING LEVERAGED TOKENS

In addition to the rebalancing costs mentioned earlier, the costs of trading leveraged tokens primarily consist of the following two components:

- Transaction Fees:

Every time you buy or sell leveraged tokens, you incur transaction fees charged by the trading platform.

These fees are similar to regular cryptocurrency trading fees and are typically calculated as a percentage of the transaction amount.

Frequent trading of leveraged tokens can significantly increase these costs.

- Management Fees:

Leveraged tokens are usually managed by fund companies or trading platforms, which charge a management fee.

These fees are calculated daily and deducted from the net asset value of the token, reflected in its price.

While management fees may seem small, they can accumulate over time and significantly impact investment returns, especially for long-term holdings.

The total cost of trading leveraged tokens can be summarized as:

ꚰ Transaction Fees + Management Fees + Rebalancing Decay.

>>> More to read: Bitcoin’s $100K Near-Miss: Why the Recent Pullback Signals a Healthy Bull Market

LEVERAGED TOKENS PROS & CONS & CONCLUSION

▶ Advantages of Leveraged Tokens

1. No Risk of Liquidation

Leveraged tokens are designed to eliminate the risk of liquidation, so investors don’t need to worry about their assets being forcefully closed due to extreme market volatility.

2. Ease of Use

Trading leveraged tokens is as simple as trading regular cryptocurrencies. There’s no need to learn complex contract mechanisms or manage leverage adjustments, making them suitable for beginners.

3. No Additional Margin Required

Investors don’t need to provide additional margin to maintain leveraged positions, reducing the complexity of managing funds.

4. Controlled Risk

The leverage multiplier is fixed, such as 2x or 3x, unlike contract trading, which can offer extremely high leverage. This makes the risk relatively manageable.

5. Ideal for Short-Term Trading

Leveraged tokens magnify short-term market movements, making them a great tool for traders seeking quick returns.

▶ Disadvantages of Leveraged Tokens

1. Value Decay (Rebalancing Erosion)

Leveraged tokens rebalance daily, which can lead to value erosion during periods of significant market volatility. Long-term holders may find that the token’s value is lower than expected.

2. Management Fees

Daily management fees gradually erode the token’s value, posing a hidden cost for long-term holders.

3. Lower Market Liquidity

Leveraged tokens often have lower liquidity compared to mainstream cryptocurrencies, which can result in slippage during large transactions, increasing trading costs.

4. Unsuitable for Long-Term Holding

Leveraged tokens are more suitable for short-term trades.

Long-term holding may fail to achieve expected returns, and the automatic rebalancing mechanism may not adequately protect investors’ interests during extreme market fluctuations, potentially leading to significant losses.

5. Limited Leverage Multipliers

Leverage multipliers are fixed (e.g., 2x or 3x), offering less flexibility compared to contract trading, which may not meet the needs of aggressive investors.

-

Leveraged Tokens Conclusion

In summary, leveraged tokens are simple and easy-to-use trading instruments that allow investors to amplify returns during market fluctuations while avoiding the liquidation risks of traditional contract trading.

While they offer some risk control, their daily rebalancing mechanism and management fees make them unsuitable for long-term holding.

When choosing leveraged tokens, it’s crucial to be aware of the impact of market volatility on value erosion and the potential losses from frequent rebalancing.

In conclusion, leveraged tokens are better suited for short-term, high-risk investors, while long-term investors should approach them with caution.

>>> More to read: Crypto vs Stocks: Which is the Better Investment?