KEYTAKEAWAYS

- Bitcoin Strategic Reserve links national assets to Bitcoin’s volatility, raising financial risks and policy constraints.

- The U.S. Treasury’s Bitcoin holdings could resemble a Sovereign Wealth Fund rather than a true reserve asset.

- Bitcoin’s long-term viability as a strategic reserve depends on sustained value appreciation—an uncertain bet.

CONTENT

Bitcoin Strategic Reserve proposes integrating Bitcoin into national reserves. While promising, it poses financial risks, policy conflicts, and uncertain long-term economic impact.

WHAT IS BITCOIN STRATEGIC RESERVE?

Bitcoin Strategic Reserve refers to the concept of nations or institutions incorporating Bitcoin into their official reserve assets to enhance financial stability and hedge against economic uncertainties.

The core idea is based on Bitcoin’s “digital gold” properties—scarcity, decentralization, and censorship resistance—making it a potential tool for mitigating inflation and market volatility.

Recently, U.S. Senator Cynthia Lummis from Wyoming introduced a bill proposing that the U.S. government establish a Bitcoin Strategic Reserve.

The plan suggests purchasing 1 million Bitcoins over the next five years and holding them for at least 20 years to strengthen the nation’s long-term financial resilience.

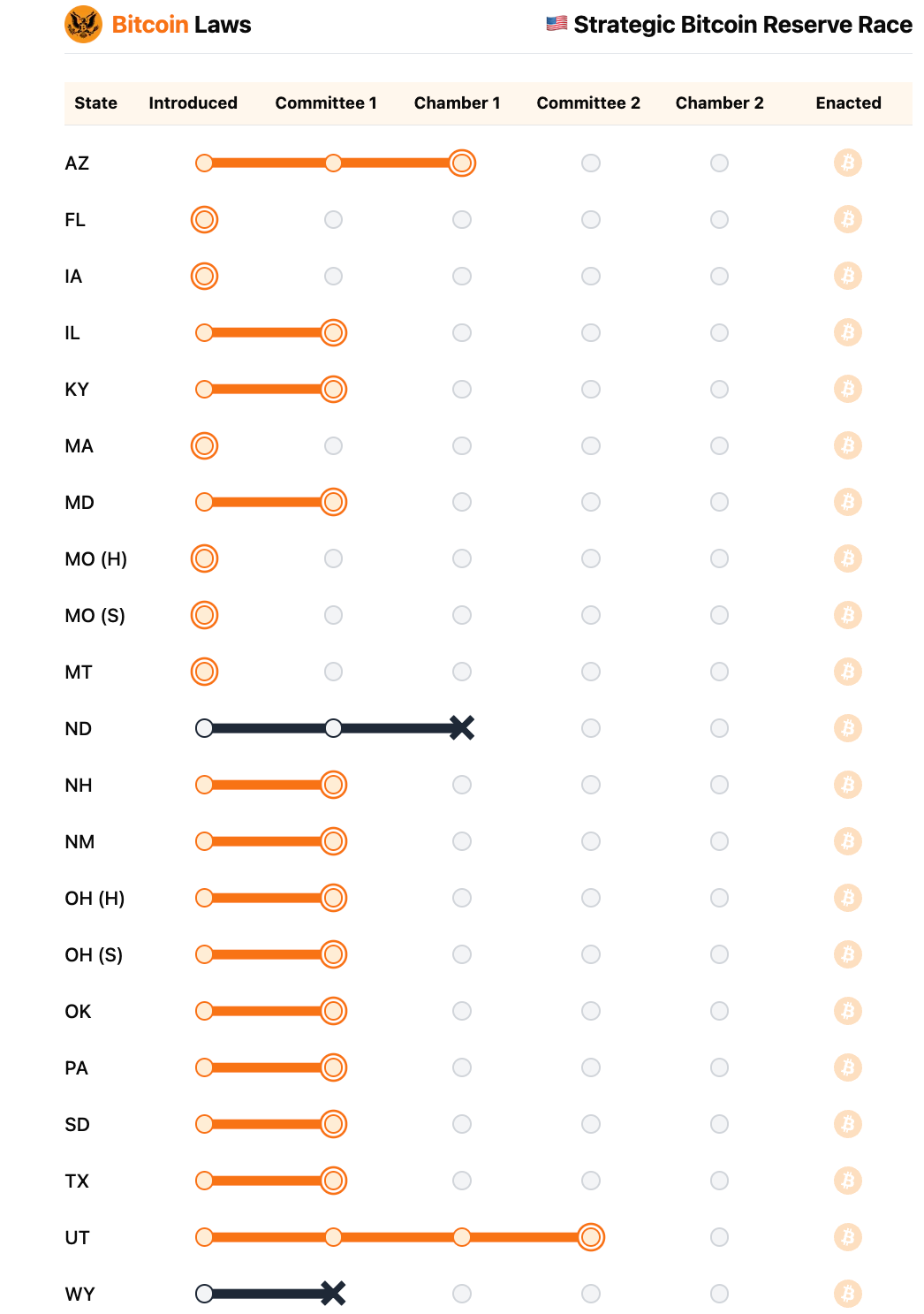

📌 States Push for Bitcoin Reserves

Although the U.S. Presidential Cryptocurrency Committee is still debating whether to establish a Bitcoin Strategic Reserve that includes multiple U.S.-based crypto tokens or solely Bitcoin, state governments have already taken a clear stance.

As of February 10, 2025, more than 23 U.S. states have introduced bills advocating for the creation of a Bitcoin Strategic Reserve. Most proposals suggest allocating 10% of state funds to Bitcoin reserves.

Wyoming has taken a more cautious approach, proposing to allocate only 3% of public funds to BTC, while other states are considering increasing this ratio to 10%.

Meanwhile, North Dakota lawmakers have introduced a resolution to allocate state funds to digital assets.

While the resolution does not explicitly state whether Bitcoin will be the sole digital asset in the reserve, it indicates that policymakers are exploring a broader strategy for integrating digital assets.

Bitcoin reserve bill progress. (Source: Bitcoin Laws)

📌 Why is Bitcoin Strategic Reserve Becoming More Likely?

As the U.S. presidential election concludes, Trump’s victory has strengthened support for the Bitcoin Strategic Reserve plan. During his campaign, Trump expressed an open stance toward Bitcoin and cryptocurrencies, emphasizing that the U.S. should take a leading role in the global crypto market.

This has excited Bitcoin holders—imagine owning a collection of Picasso paintings, and the government announces the creation of a “National Picasso Reserve.” Naturally, this would boost the asset’s value and legitimacy.

>>> More to read: What is $TRUMP|OFFICIAL TRUMP

📌 How Will Bitcoin Strategic Reserve Be Funded?

Lummis’ bill proposes a unique mechanism to fund the Bitcoin Strategic Reserve, aiming for compatibility with the existing financial system:

1. Adjusting the Federal Reserve’s Surplus Distribution

Under current regulations, the Federal Reserve (Fed) returns its annual surplus to the U.S. Treasury. The bill suggests redirecting this surplus toward Bitcoin purchases, integrating it into national reserves.

2. Revaluing Gold Certificates

The bill also proposes that the Fed revalue its gold certificates based on current market prices. The gains from this revaluation would be transferred to the Treasury and used to acquire Bitcoin.

Essentially, this approach converts a portion of the nation’s gold reserve value into Bitcoin, adding diversification and flexibility to U.S. strategic reserves.

📌 Will Bitcoin Strategic Reserve Actually Impact the Economy?

While these proposals are technically feasible, they fail to answer a crucial question:

✎ How will these measures improve the lives of American citizens and impact the broader economy?

Historically, shifts in reserve assets take time for markets to adapt to, and Bitcoin’s price volatility remains a major concern for policymakers.

Furthermore, if the U.S. moves forward with a Bitcoin Strategic Reserve, it could spark monetary policy competition with other global economies, such as the EU or China—adding another layer of complexity to the geopolitical landscape.

Regardless of whether the bill passes, one thing is clear: Bitcoin is evolving from a hedge asset to a national-level strategic reserve, and its influence can no longer be ignored.

>>> More to read: Crypto Beginner’s Guide | What, Why, Where, When, Who

BITCOIN STRATEGIC RESERVE | FREEDOM, TRUST, MONEY, AND THE FINANCIAL SYSTEM

1. The Irony of Bitcoin’s Freedom Being Backed by State Policy

For long-time Bitcoin supporters (Hodlers), the idea of a national Bitcoin Strategic Reserve is both thrilling and ironic.

On the one hand, it marks a significant acknowledgment of Bitcoin as a “free currency” by a sovereign state. On the other hand, it paradoxically relies on government policies to sustain its value.

Senator Cynthia Lummis’ proposal argues that reserving 1 million Bitcoins could help the U.S. diversify its assets and strengthen its financial and monetary system.

However, unlike traditional banking reserves, these Bitcoins would be held by the U.S. Treasury and could not be sold before 2045.

Rather than increasing financial resilience, such a reserve could introduce additional storage costs and asset management burdens—an aspect often overlooked in the broader discussion.

2. Bitcoin’s Appreciation vs. The Trust Dilemma

The core argument for a Bitcoin Strategic Reserve is its long-term appreciation potential. In 20 years, the U.S. could control around 5% of the world’s most valuable digital asset.

However, this proposal resembles more of a Sovereign Wealth Fund, where the U.S. Treasury could use Bitcoin for future debt repayments or other financial needs.

The biggest challenge? Convincing people that Bitcoin’s value will inevitably continue rising.

While Bitcoin’s track record suggests long-term appreciation, treating it as a certainty is a leap of faith that policymakers may struggle to justify.

>>> More to read: Crypto vs Stocks: Which is the Better Investment?

3. Can Bitcoin Truly Function as Money?

Bitcoin has already demonstrated its real-world functionality as a monetary instrument.

A study published in the Journal of Empirical Finance analyzed Bitcoin’s open ledger and found that it serves as an efficient medium for capital transfers, especially in certain economic conditions:

📌 Offshore Transactions – Bitcoin is commonly used to move capital to offshore financial havens like Seychelles, bypassing financial restrictions or seeking tax advantages.

📌 Inflation Hedge – In Brazil, Bitcoin transaction activity surged during periods of high inflation, as locals sought a hedge against currency devaluation.

📌 Sanction Evasion – In Venezuela, Bitcoin was widely used to bypass international financial sanctions and maintain economic transactions.

📌 Regulatory Suppression – In contrast, Bitcoin-related activity dropped sharply in China following the government’s crackdown on mining and trading.

While Bitcoin is often treated as a speculative asset in developed economies, it has already proven to be a reliable store of value and cross-border financial tool in regions with unstable financial systems.

4. Can Bitcoin Disrupt a 50-Year-Old Financial System?

With Trump’s return to office, Bitcoin’s price surge has triggered a circular narrative:

📈 Bitcoin is more valuable because Trump will support it; Trump must support Bitcoin because its value is rising.

However, let’s put things into perspective—the U.S. dollar has operated as the world’s dominant financial instrument for over 50 years.

The way Americans and foreigners use dollars has zero connection to how much gold the Treasury stores in Fort Knox.

Similarly, if the U.S. Treasury uses Federal Reserve surplus funds to buy Bitcoin, it will not fundamentally alter how the dollar is used worldwide.

💡 The Dollar’s Value Is Not Arbitrary

The strength of the U.S. dollar is backed by multiple mechanisms:

✅ Federal Deposit Insurance (FDIC) – A safety net that ensures depositors’ confidence in the banking system.

✅ Banking Regulations – Imperfect but functional safeguards that maintain financial stability.

✅ Central Bank Cooperation – A global framework where central banks collaborate to support offshore dollar liquidity during crises.

Yes, the dollar system is opaque and unfair, and it’s far from perfect for American consumers. But it works.

5. Bitcoin’s Bold and Radical Assumption

Bitcoin supporters often argue, using engineer-like logic, that inefficient social systems will inevitably collapse—just like a poorly constructed bridge.

However, history has shown that after every crisis, the monetary system recovers and adapts rather than crumbling entirely.

We use dollars not because we are foolish, but because banks have the legal authority to issue money, and no government has been able to strip this privilege away from the powerful.

A bet on Bitcoin’s long-term success is a bold and radical value proposition.

It assumes that the current fiat system will eventually fail, and that the world will need to rebuild a completely decentralized value storage system.

That assumption, while revolutionary, is an extreme one.

>>> More to read: How to Start Trading in Crypto: A Beginner’s Guide

BITCOIN STRATEGIC RESERVE CONCLUSION

The idea of establishing a Bitcoin Strategic Reserve may seem like a bold move, but its actual impact could be highly uncertain.

If the U.S. Treasury holds 1 million Bitcoins, its assets would be directly linked to Bitcoin Strategic Reserve market fluctuations, introducing significant financial risks.

For instance, if Congress enacts policies restricting Bitcoin mining for environmental reasons, market confidence in Bitcoin Strategic Reserve could plummet, leading to a sharp decline in its value.

This not only weakens the effectiveness of the Bitcoin Strategic Reserve but also creates a scenario where government policy becomes constrained by its own investments.

Instead of strengthening economic resilience, a Bitcoin Strategic Reserve might function more as a government-backed safety net for Bitcoin holders (Hodlers), raising concerns about its practicality and long-term stability.